Impressive Tips About Capital Lease Income Statement

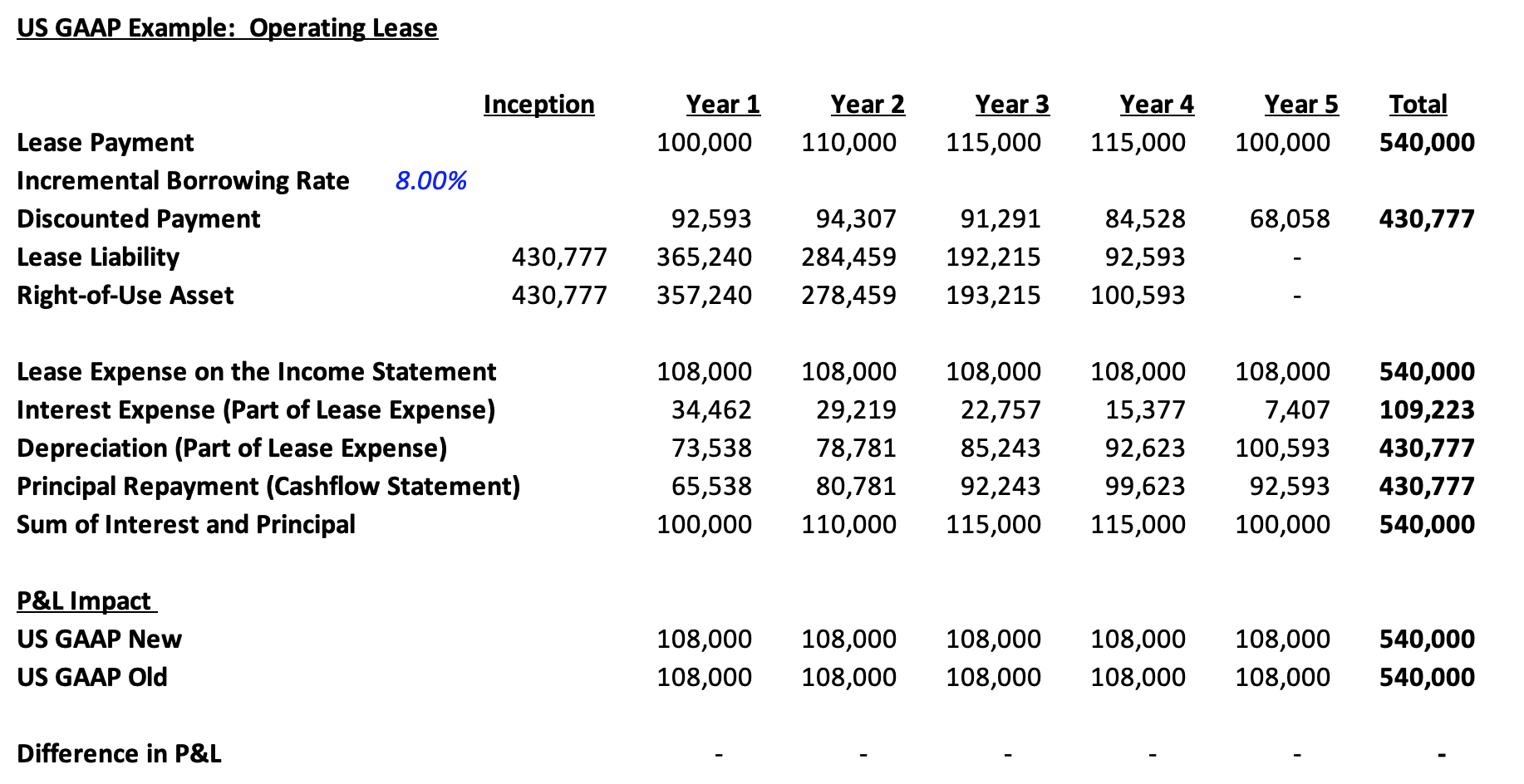

Calculate the present value of the minimum lease payments using the lessee's.

Capital lease income statement. As with all other qualifying operating expenses,. Despite being rental agreements, the gaap views it as an asset of the company. As the income is earned, it will flow through the income.

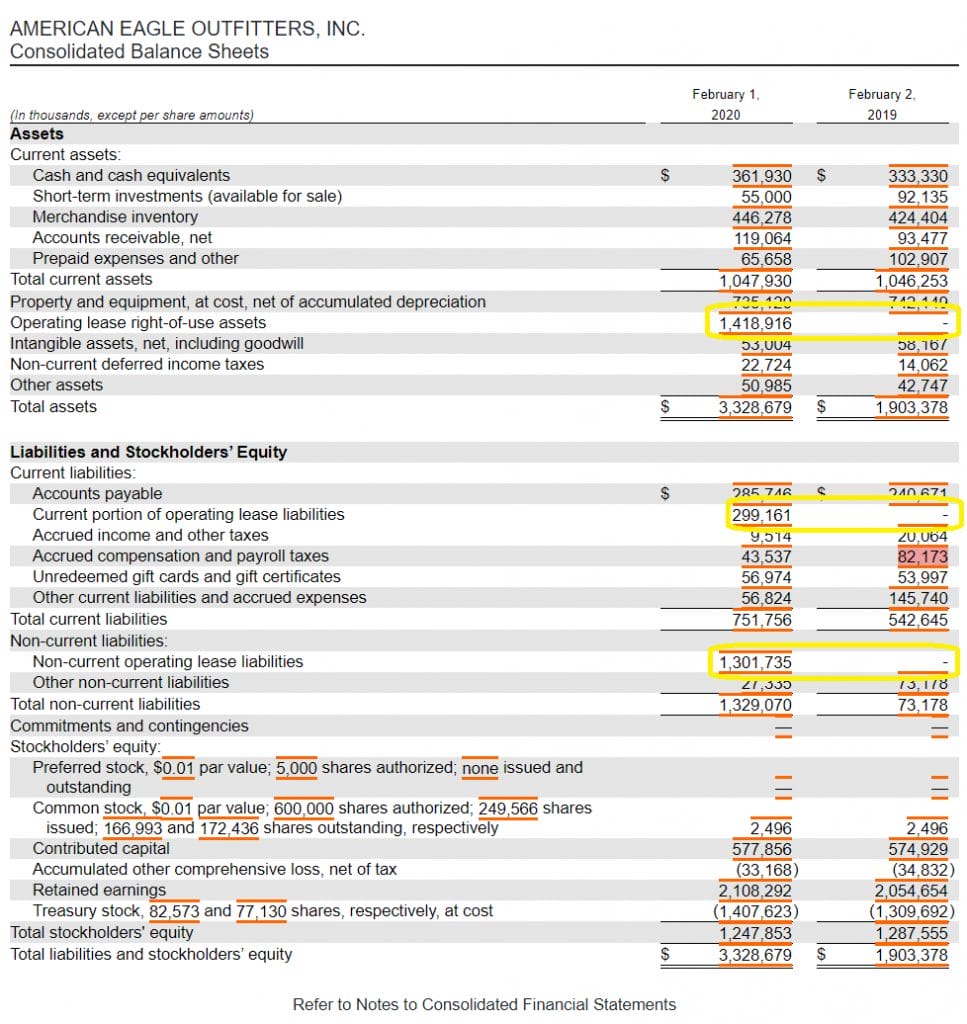

Here are the key steps to calculate and account for a capitalized lease: Full adjustment method step 1: Capital leases affect both the balance sheet and income statement.

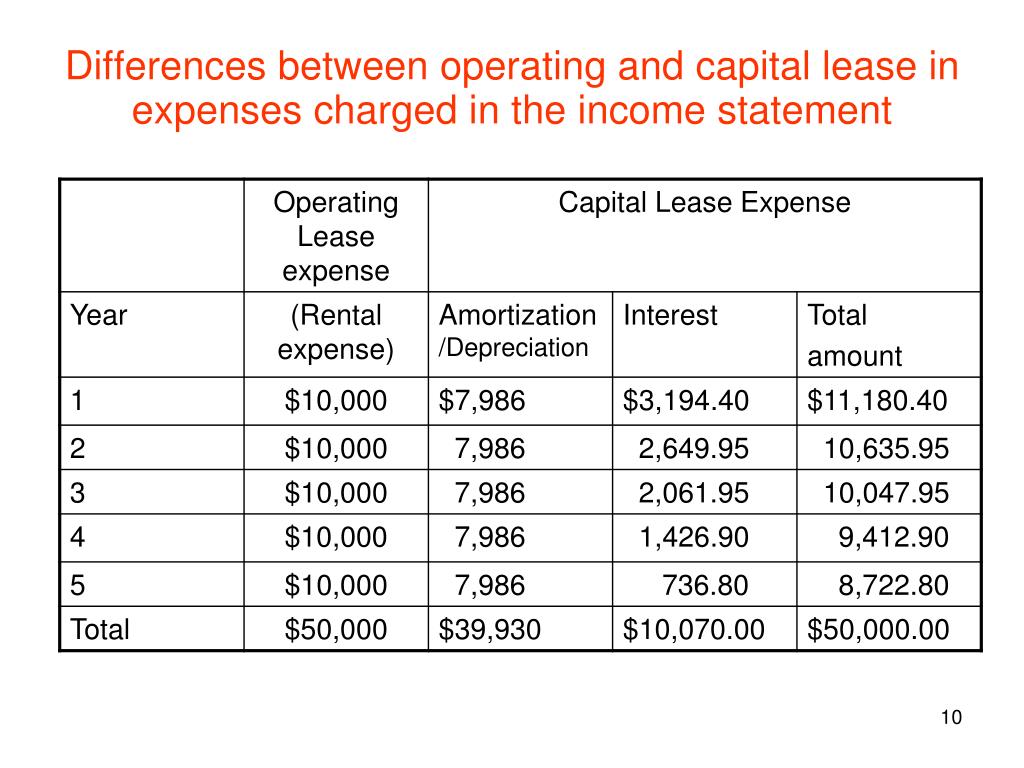

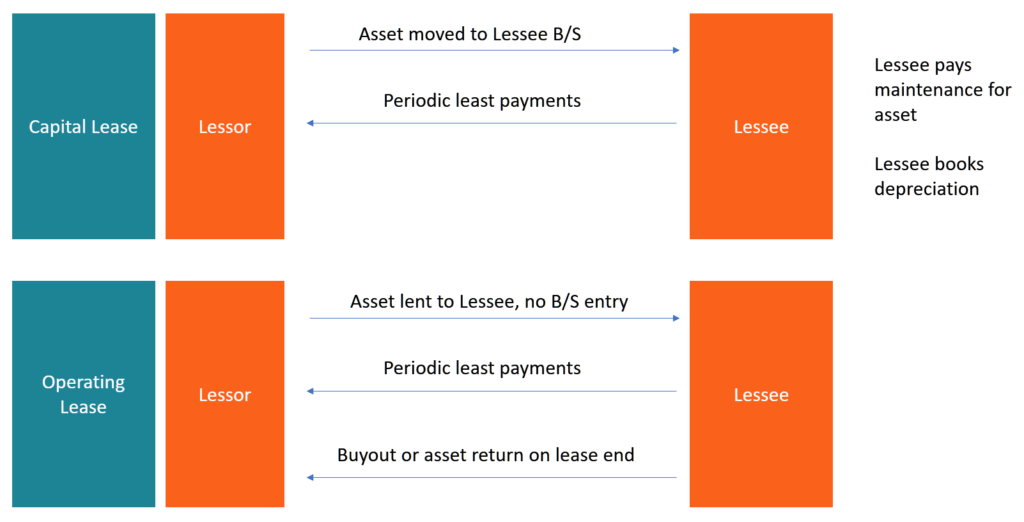

Instead, the rental expense associated with the lease is recognized on the income statement in the period incurred, and each payment is tracked on the cash flow. The lessee will report interest expense on the lease liability and depreciation expense on the leased asset. Otherwise, it is an operating lease, which is similar to a landlord and renter contract.

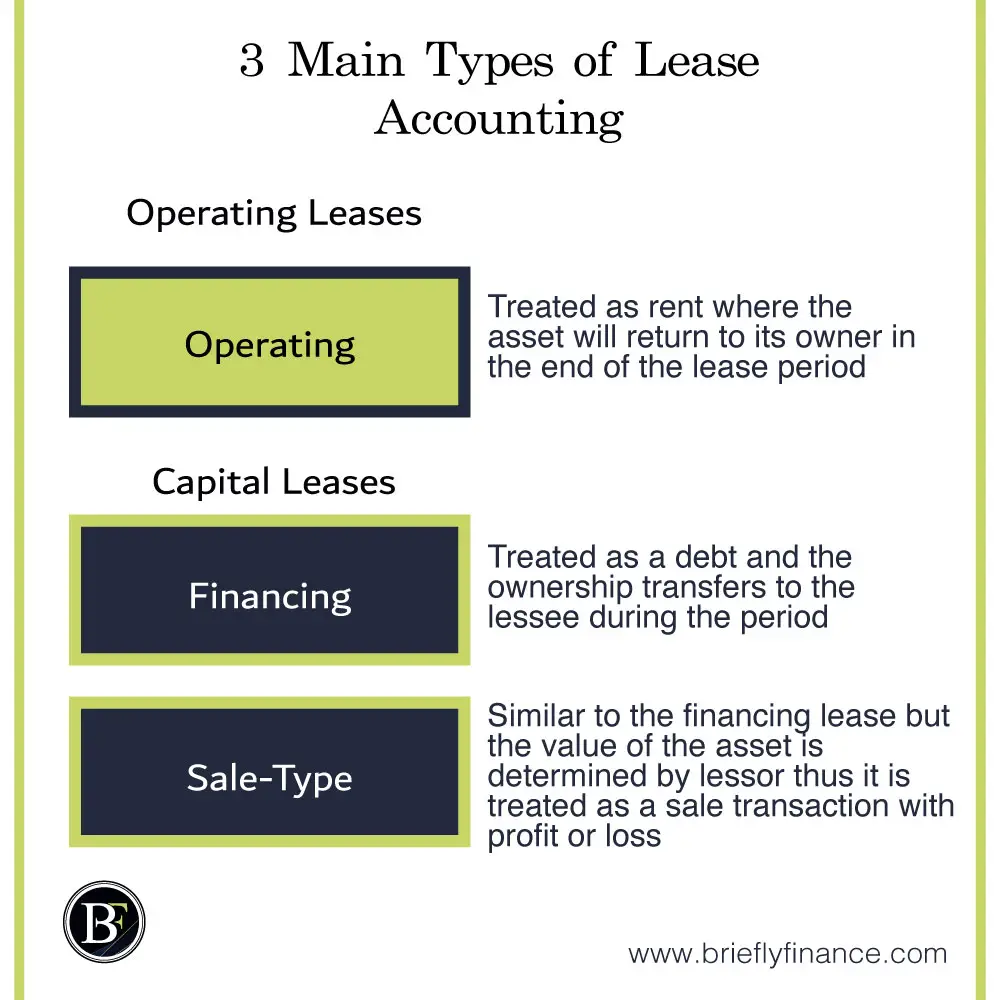

Leases is how the lease is recognized on the income statement. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the. The lessee must pay rent to the lessor, which will be recorded as rent expense on the lessee’s income statement, reducing the lessee's net income /profit.

To income statement (finance costs) to statement of financial position. Operating versus capital leases. In the case of a finance lease, the lessor reports a lease receivable based on the present value of future lease payments, and the lessor also reduces its assets by the.

If you’re a lessee, adopting ifrs 16 eliminates the distinction between capital leases and. As this was leased before 1 july 2024, the previous rules continue to apply for employer b until the earlier of the lease expiry, or 5 april 2028. Collect input data find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses.

You record operating lease payments on your profit and loss income statements. Under ifrs 16, almost all leases must show on your balance sheet. Under aspe and gaap, a finance lease is called a capital lease.

Lendlease holds a 38% economic interest in the military housing asset management income stream and 100% interest in development and construction management rights. The underlying asset is unique and holds no value to the lessor at the end of the lease period.