Supreme Tips About Revenue In Cash Flow Statement

Key details from the income statement show that while revenue has grown, the cost of revenue also increased to.

Revenue in cash flow statement. Hence the need to present a statement of. Accountants follow the accrual basis in measuring income and expenses. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. La rosa on target to generate $100 million of annualized revenue as a 2024 exit run rate. The accrual method provides more realistic revenues that are reduced by the cost to produce an item and prepare it for sale.

The cfs measures how well a. The business brought in $53.66 billion through its regular operating activities. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

Revenue is essential for measuring a company’s sales performance, while cash flow is crucial for paying wages and bills and investing in growth. From the above example, we can see that the computed cash flow for fy 2018 was $ 2,528,000. The accrual method of accounting is an accurate portrayal of the business transactions and profitability based on the products and services sold.

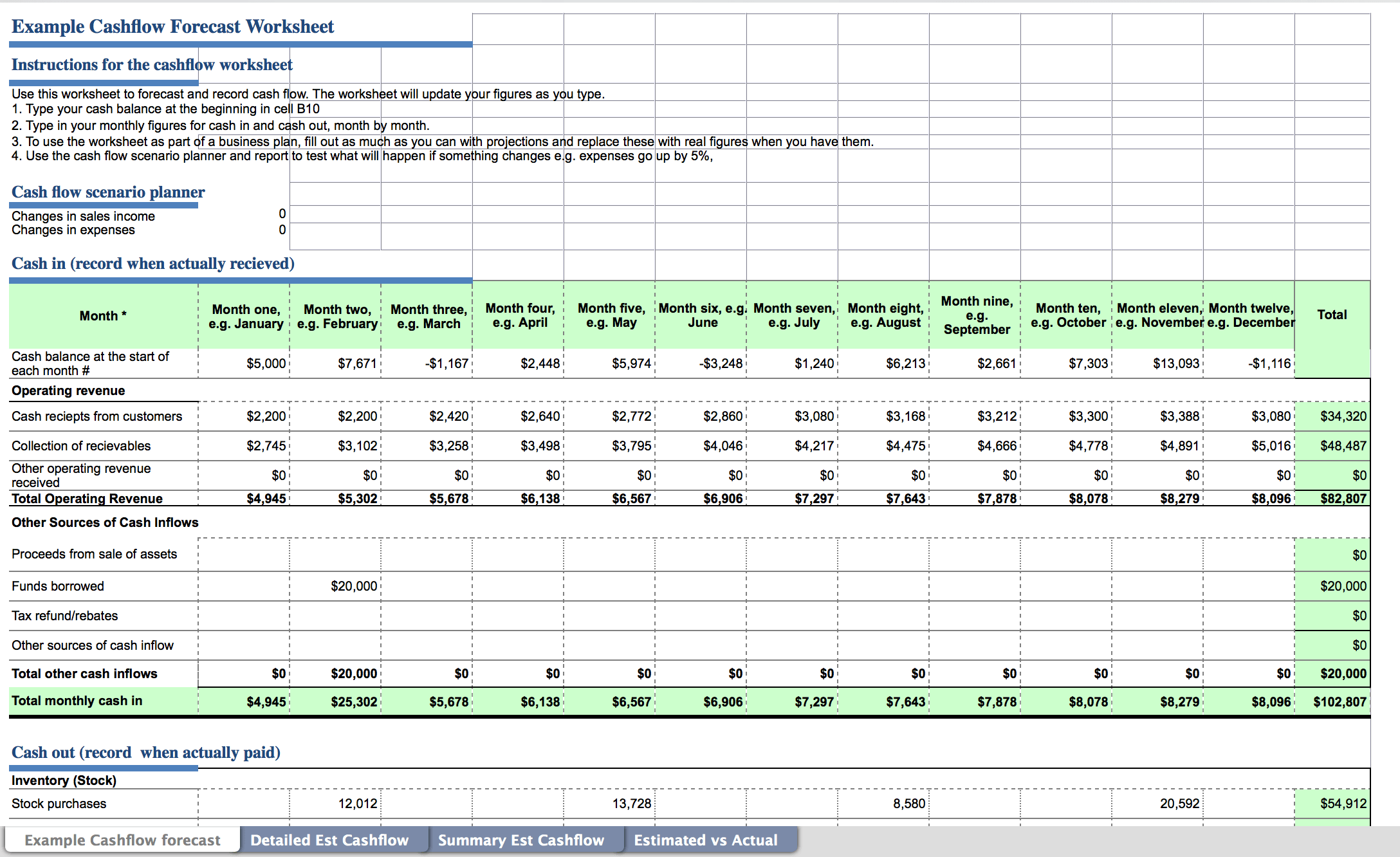

The statement of cash flows is prepared by following these steps:. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. A cash flow statement is a financial statement that presents total data. The money coming in and out of your business:

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Purchase of property and equipment: Activities, products, services, and markets that generate income for your business:

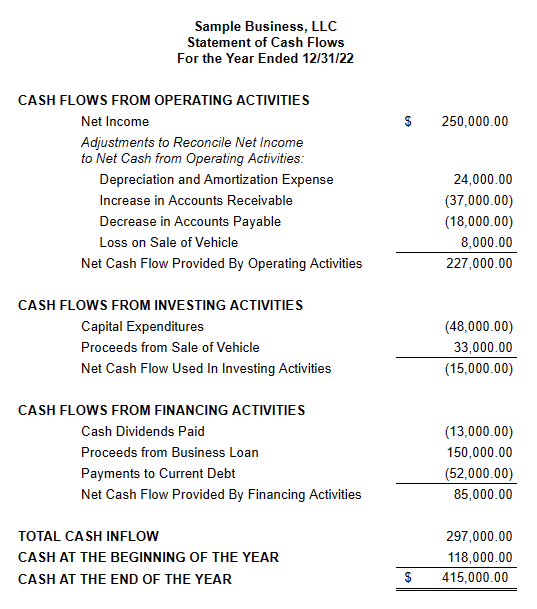

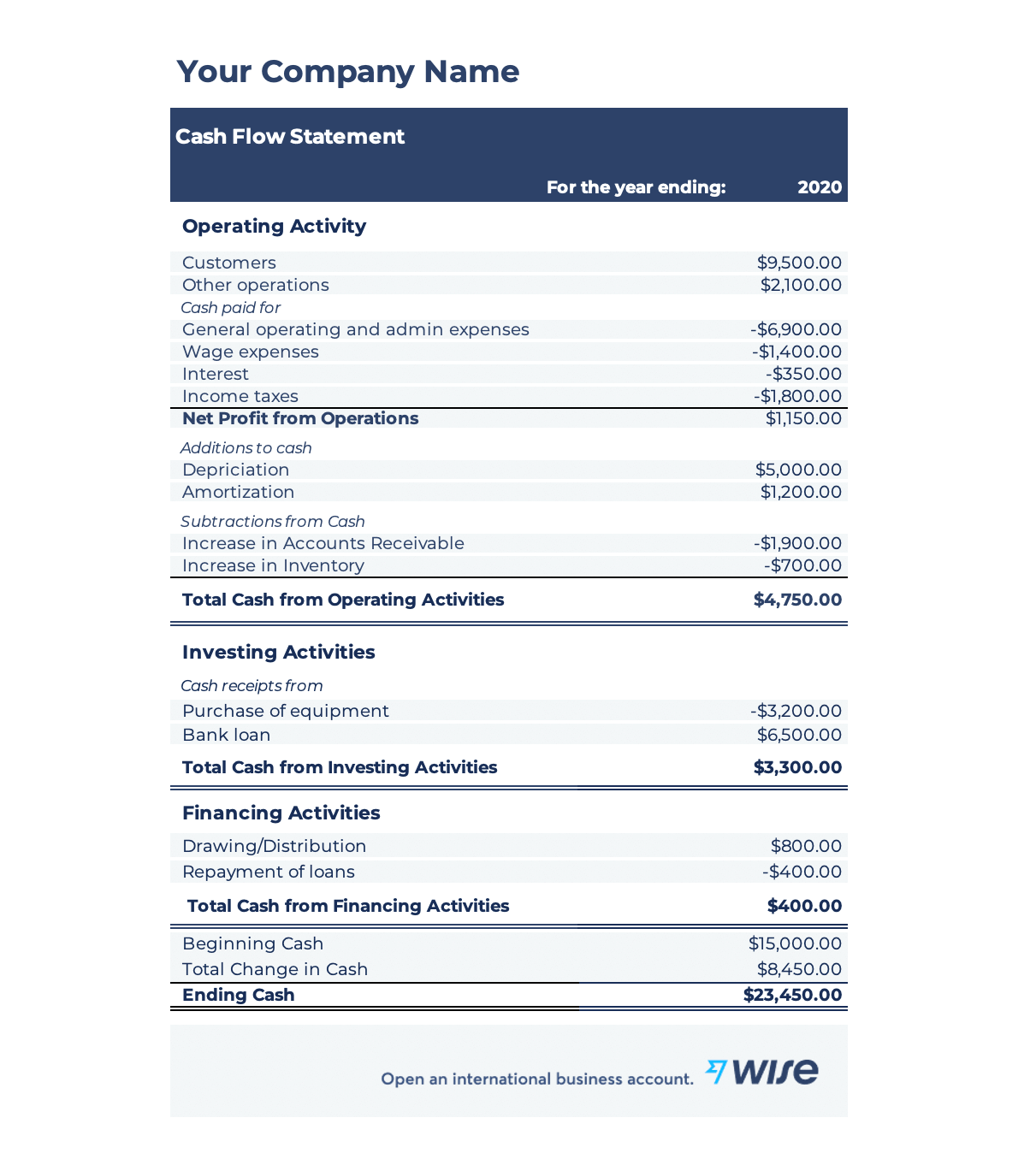

Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. Following is an example of what a cash flow statement looks like.

Cash flow statement example. The bottom line of the cash flow statement is the net increase or decrease in cash during that time period. This cash flow statement shows company a started the year with approximately $10.75 billion in cash and equivalents.

Revenue is also correlated to stock price, and investors and analysts closely monitor revenue on financial statements. Cash flow from operations was $11.6 billion for the full year, up 5%; A cash flow statement is a report that summarizes and calculates your cash flow — the movement of liquid assets into and out of your company.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)