Have A Tips About Provident Fund In Balance Sheet

We have created an employee provident fund calculator in excel with predefined formulas.

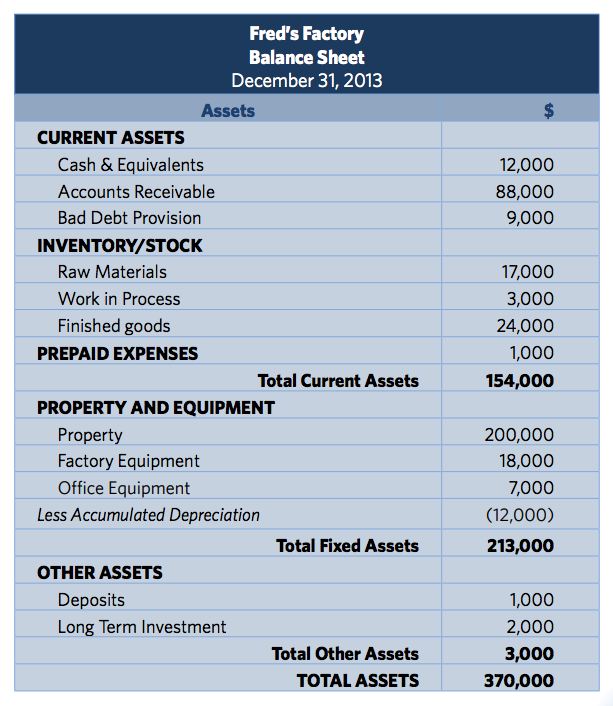

Provident fund in balance sheet. It is an important hr document. The balance sheet size of the reserve bank, nevertheless, increased by 6.99 per cent for the year ended march 31, 2021, mainly reflecting its liquidity and foreign exchange. (a) balance as per last balance sheet (ii) (iii) total other adjustments (b) amount transferred from a/c no.

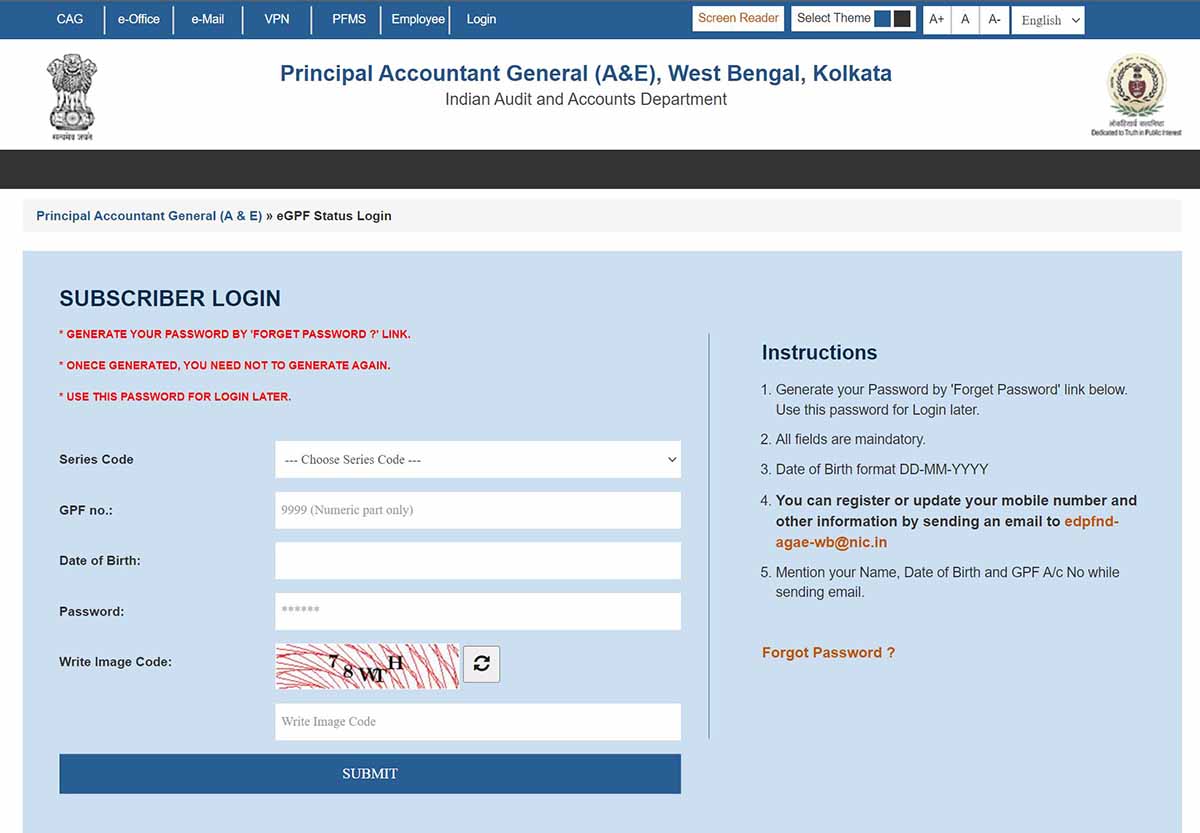

Go to “member balance information”. For epf balance enquiry : S.p.f balance shown in balance sheet be reconciled with broad sheet of staff provident fund.

2 during the year annual. Employees' provident fund organisation, india ministry of labour & employment, government of india. Accounting for provident fund including preparation of pf balance sheet.dear viewers,in this video, i have shown how pf accounting is made in the books.

The amount of money deposited at the start of the accounting period. After all the shareholder’s funds represent the funds belonging to. What are the 4 statements included in the annual report?

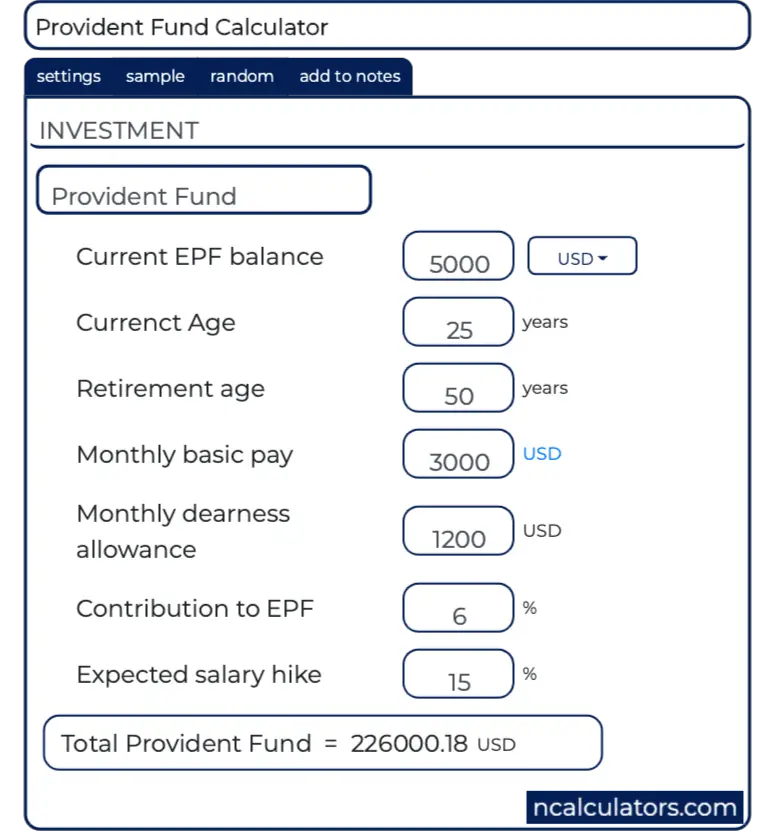

12%*50000 = rs 6000 3. Fill in the retirement age up. Enter the below mentioned input:

You can enter your present age, basic monthly salary and dearness allowance, monthly epf contribution, and retirement age up to 58 years in the epf calculator's formula box. Employees' provident fund organisation (epfo), the nodal body for employees’ provident fund (epf), allows subscribers to view their balance online. The minimum percentage of contribution to your epf is 12%.

Click on 'click here to know your epf balance”. Balance sheet under the head “provisions”. 2 to 8 account no.

All the payable accounts showing negative balances be reconciled. You will be redirected to epfoservices.in/epfo/. For individuals with a salary of ₹15,000 or lower, the epf contributions are distributed as follows:

Employer contribution towards epf = 3.67% of 50000 =. The central board of trustees administers a contributory provident fund, pension scheme and an insurance scheme for the workforce engaged in the organized sector in india. They are listed as follows:

You can increase the percentage by contributing to the voluntary provident fund. Yes , provident fund deducted form employees salary is liability to pay to govt account (p.f dept ) with in due date , therefore you have show under current liability in balance sheet. How can liabilities and shareholders’ funds appear on the ‘liabilities’ side of the balance sheet?