Awe-Inspiring Examples Of Tips About Write A Note On Valuation Balance Sheet

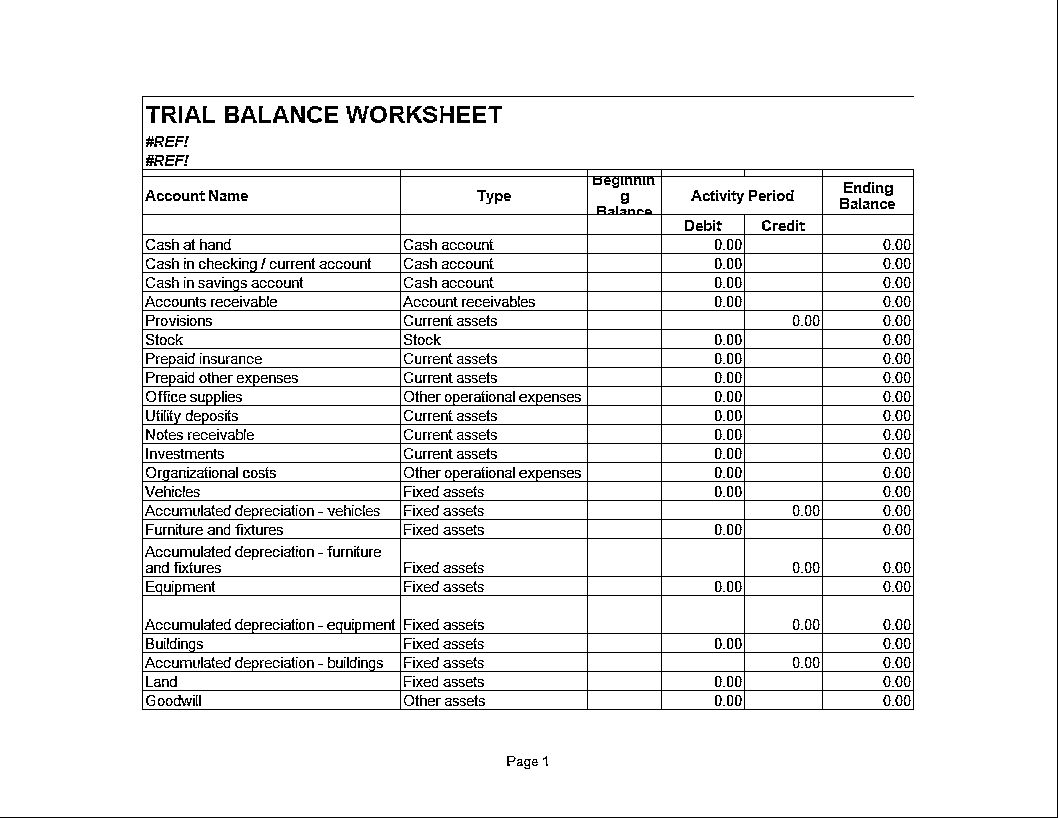

In accounting, a valuation account is usually a balance sheet account that is used in combination with another balance sheet account in order to report the.

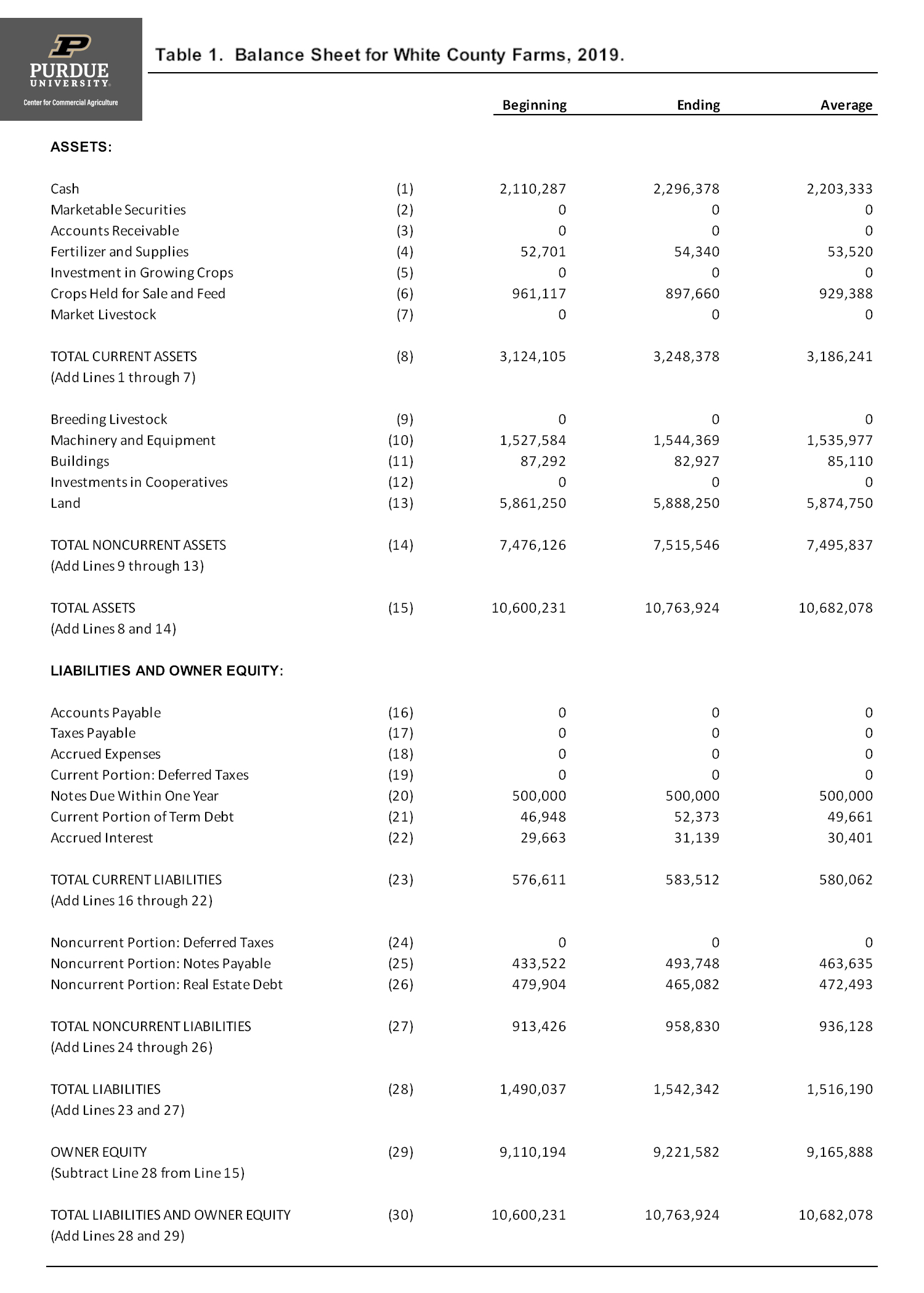

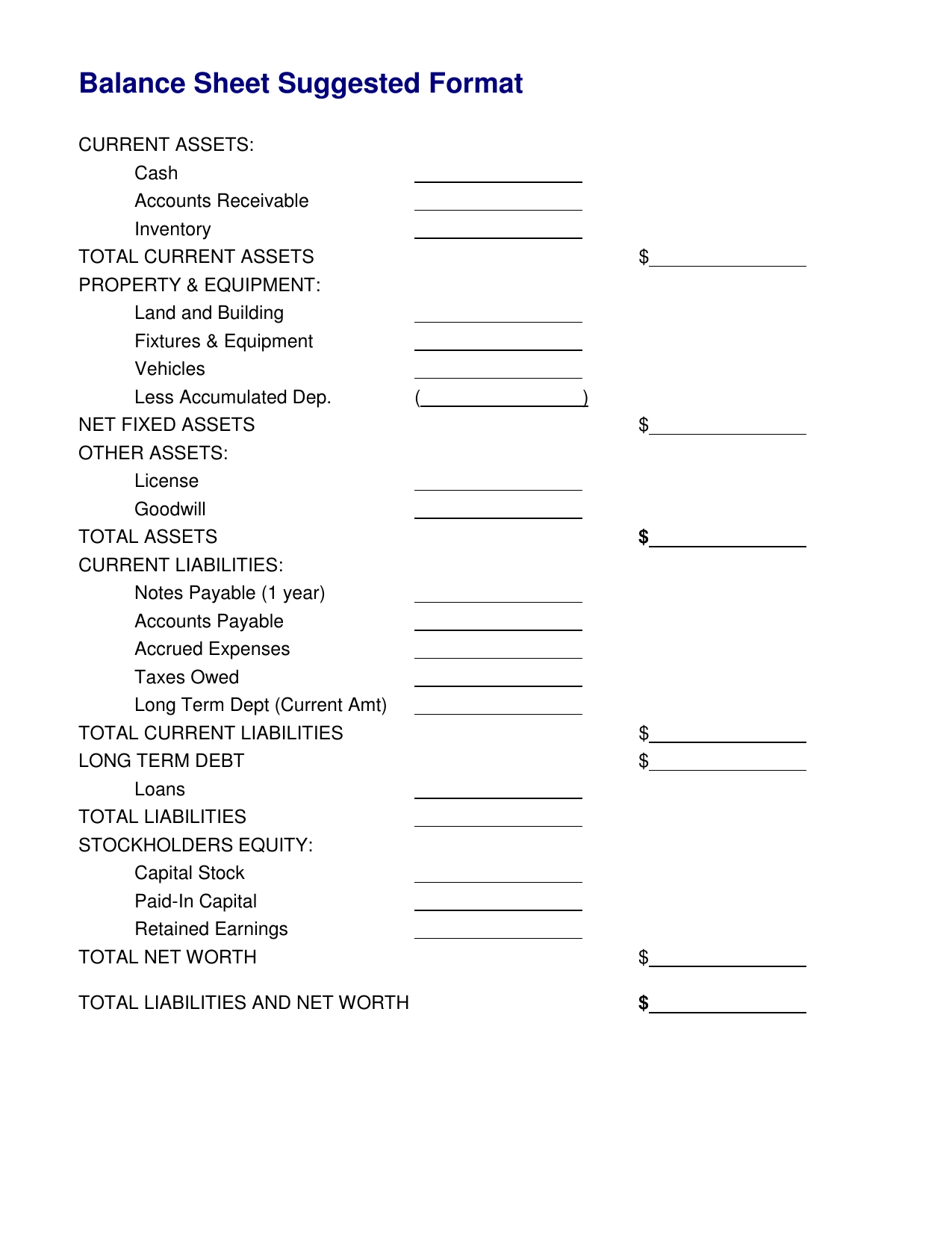

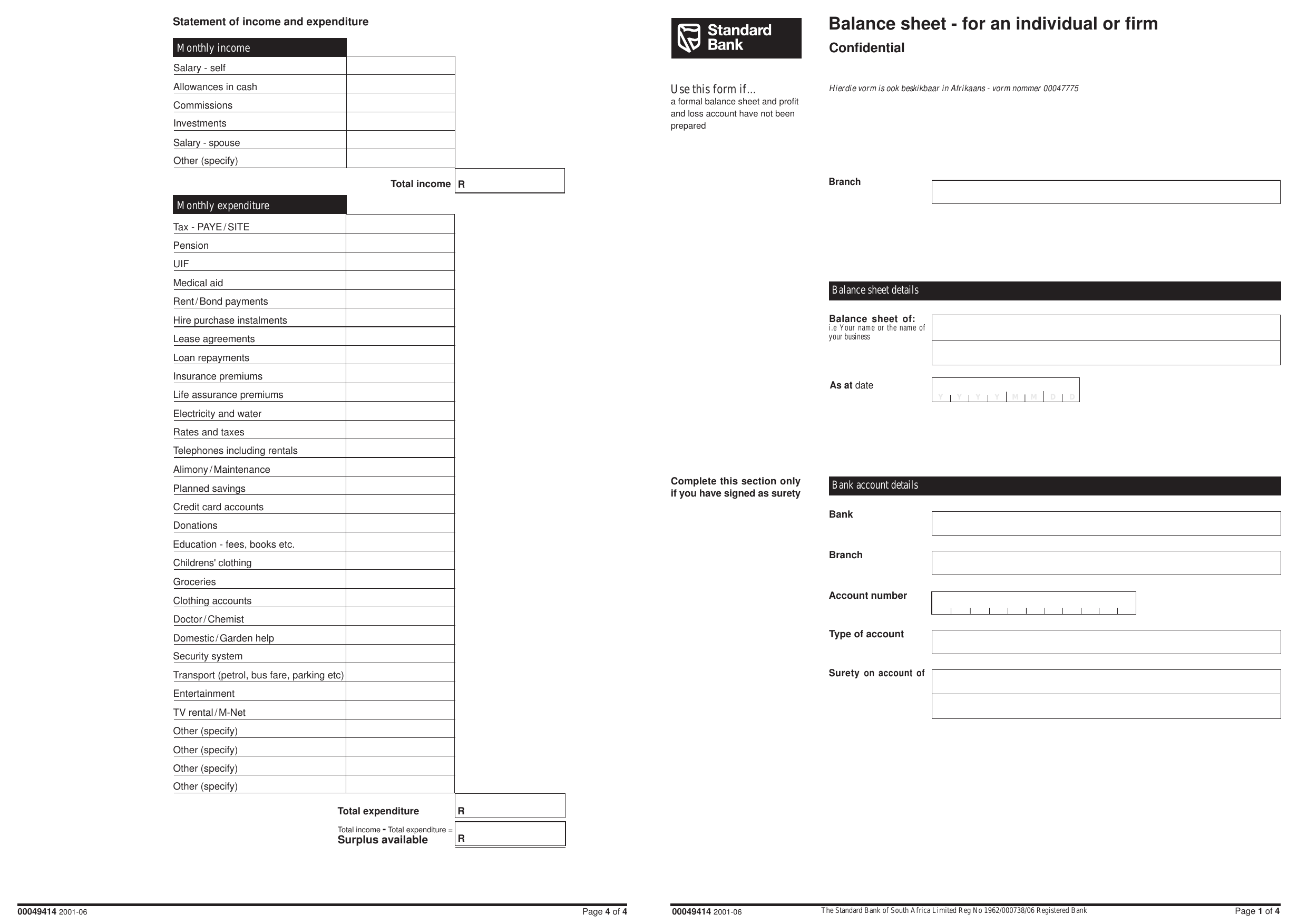

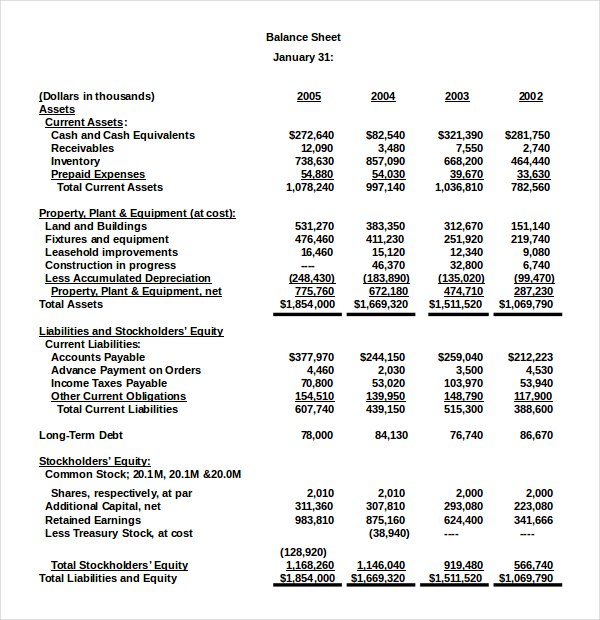

Write a note on valuation balance sheet. A balance sheet, or compilation of stocks, is a statement of the values of the assets owned at a specific time and the financial claims, or liabilities, held by other units. A reporting entity should present assets that are measured at fair value separate from similar assets that are measured at amortized cost basis on the face of the balance. Has the following investments classified as trading securities, an adjustment for $9,000 is necessary to.

The changes are not clearly reflected in the balance sheet. The value of assets on the balance sheet. The valuation account is used to adjust the value in the trading securities account reported on the balance sheet.

The notes to the balance sheet, as well as the cash flow statement, also detail the changes in fixed assets like pp&e. It is often seen as the most. Equity valuation is a blanket term and is used to refer to all tools and techniques used by investors to find out the true value of a company’s equity.

Therefore, the discount or premium shall be reported in the balance sheet as a direct deduction from or addition to the face amount of the note. Valuation landscape, has warranted a greater emphasis on the accurate valuation, as the assets are critical drivers of corporate value. Notes payable are written agreements (promissory notes) in which one party agrees to pay the other party a certain amount of cash.

Asset valuation is the process of determining the fair market or present value of assets, using book values, absolute valuation models like discounted cash flow. What are notes payable? The days inventory outstanding ratio is calculated as inventory divided by the cost of goods sold (cogs) and then multiplied by 365.

This ratio measures the average. By kate christobek. Considering the changes in the regulatory.