Nice Tips About Depreciation Fund In Balance Sheet

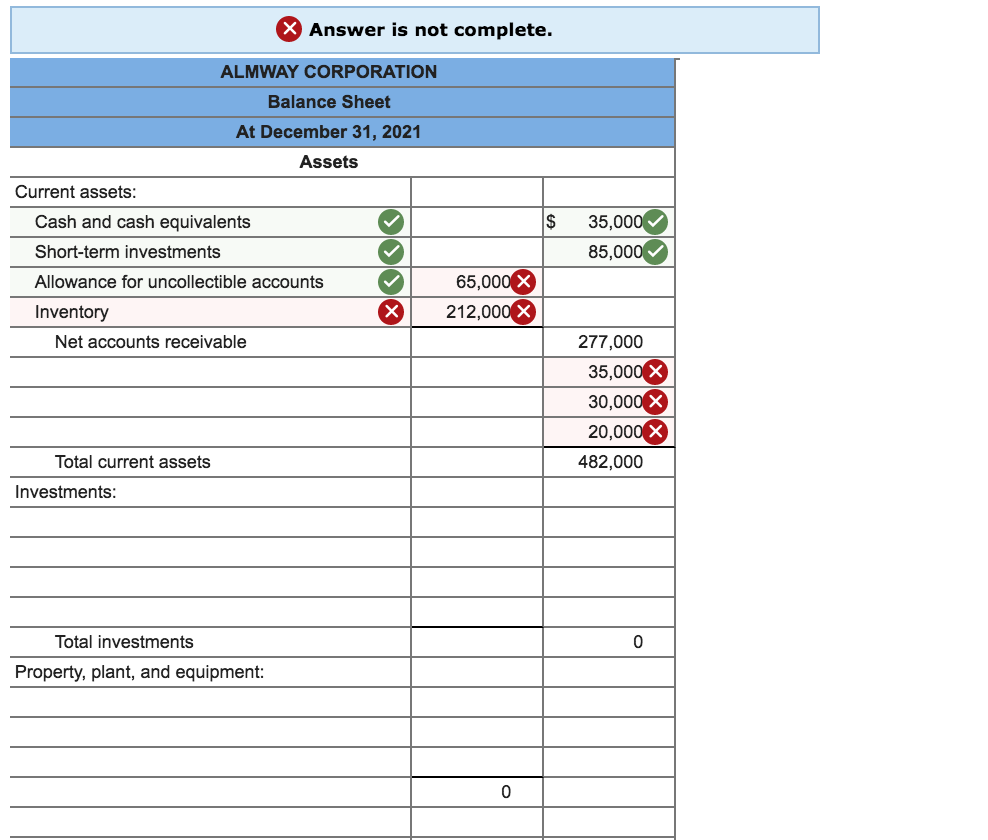

The accumulated depreciation account is a contra asset account on a company's balance sheet.

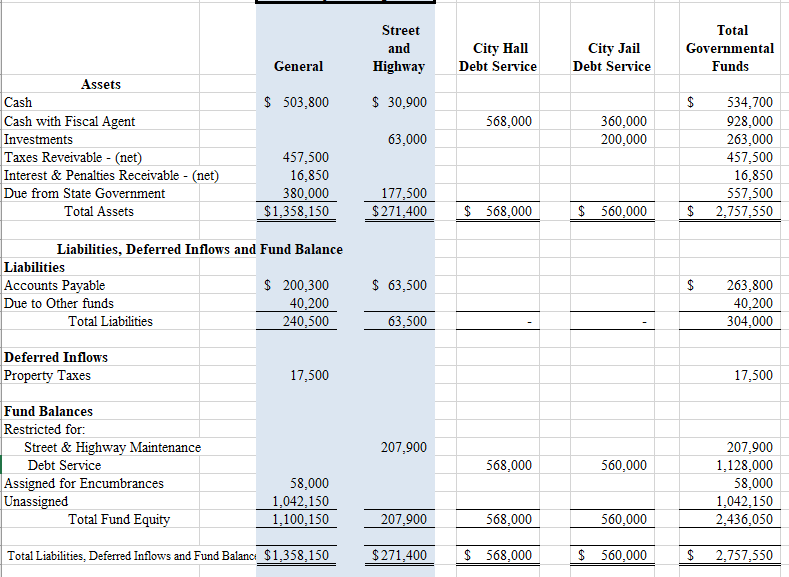

Depreciation fund in balance sheet. The balance sheet is based on the fundamental equation: Capex on the balance sheet capex flows from the cash flow statement to the balance sheet. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

It appears as a reduction from the gross amount of fixed assets. The value of the assets depletes over time, as the assets lose their production capacity due to obsolescence and physical wear and tear. If anything, accumulated depreciation represents the amount.

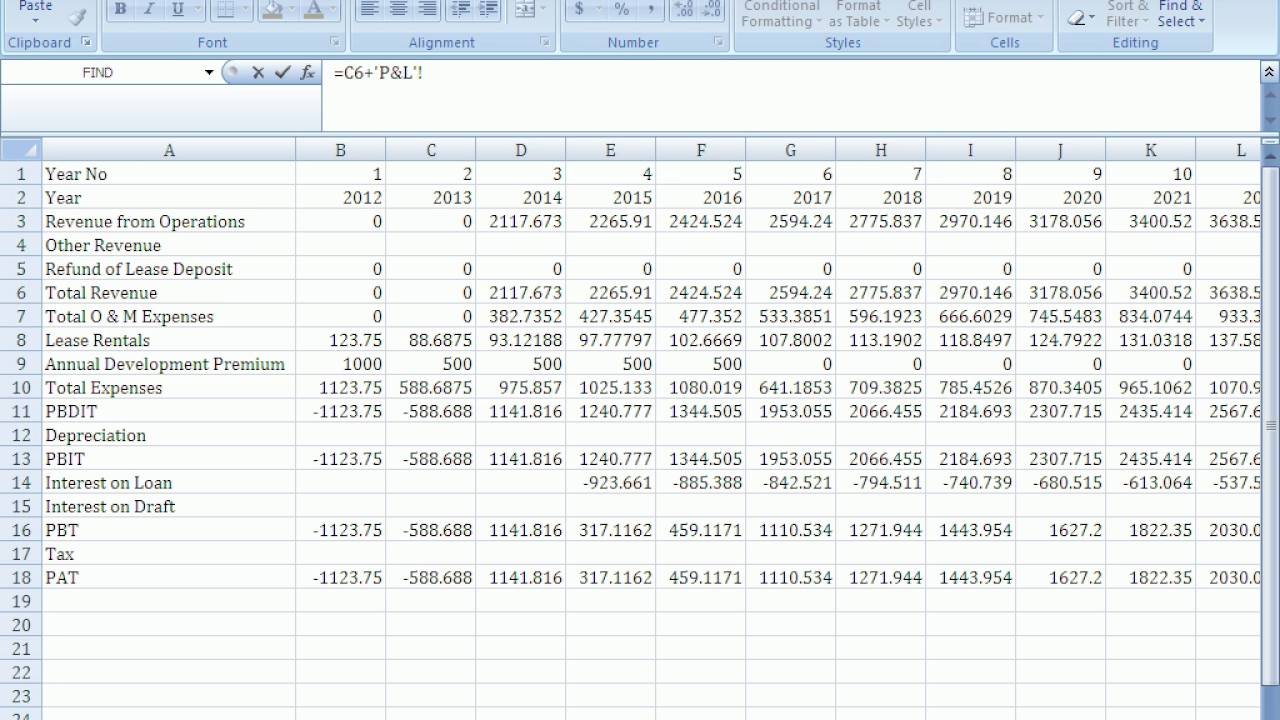

Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. Where does depreciation expense go on a balance sheet modified: Capital and revenue expenditure types of depreciation methods

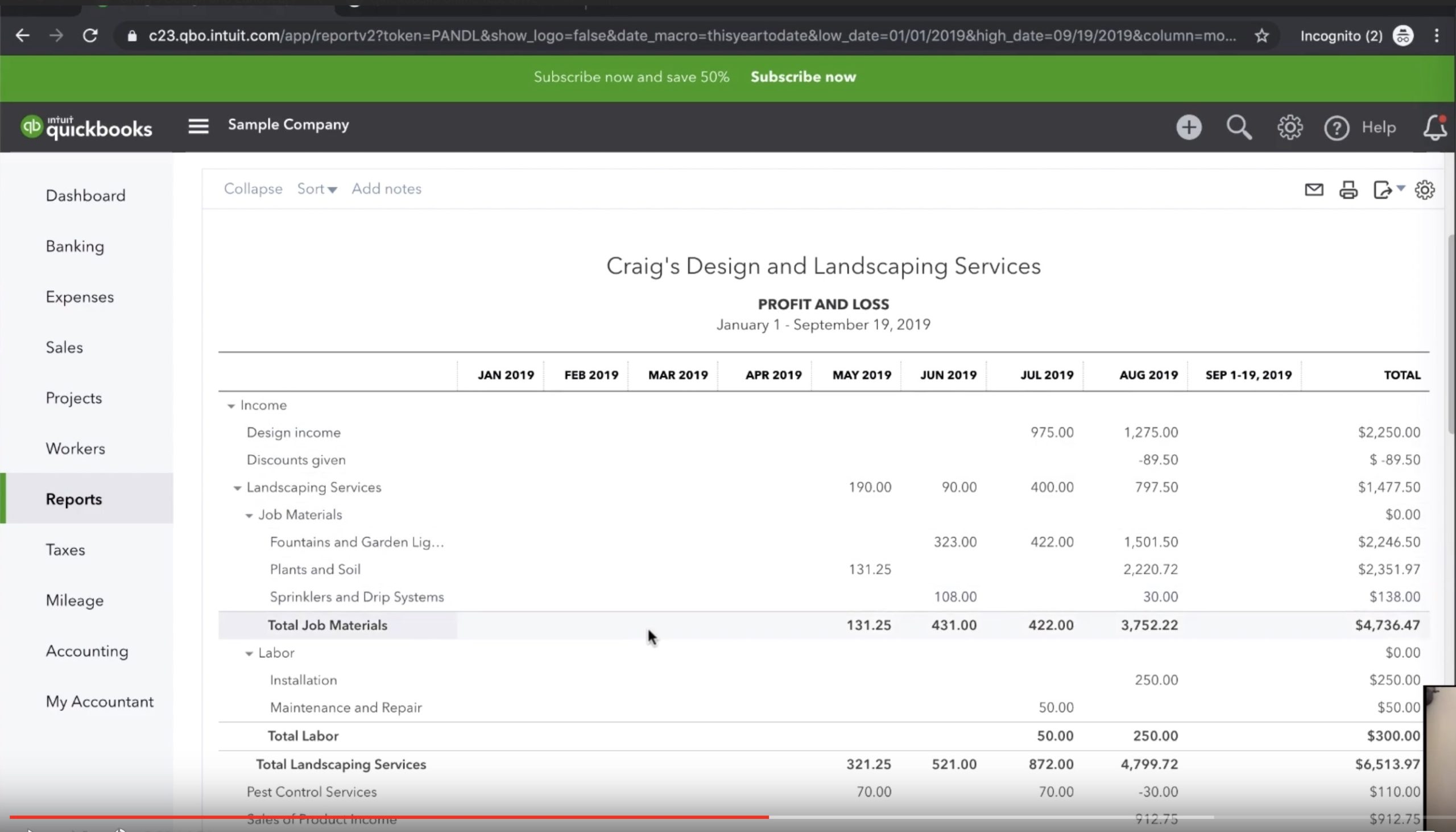

For income statements, depreciation is listed as an expense. On an income statement or balance sheet. It represents a credit balance.

In this example, a $1,000 depreciation expense is recognized annually on your income statement (depreciation decreases net income) even though no cash outlay occurs. Gain insights into where depreciation expense is recorded with our comprehensive guide. Depreciation represents how much of the asset's value has been used up in.

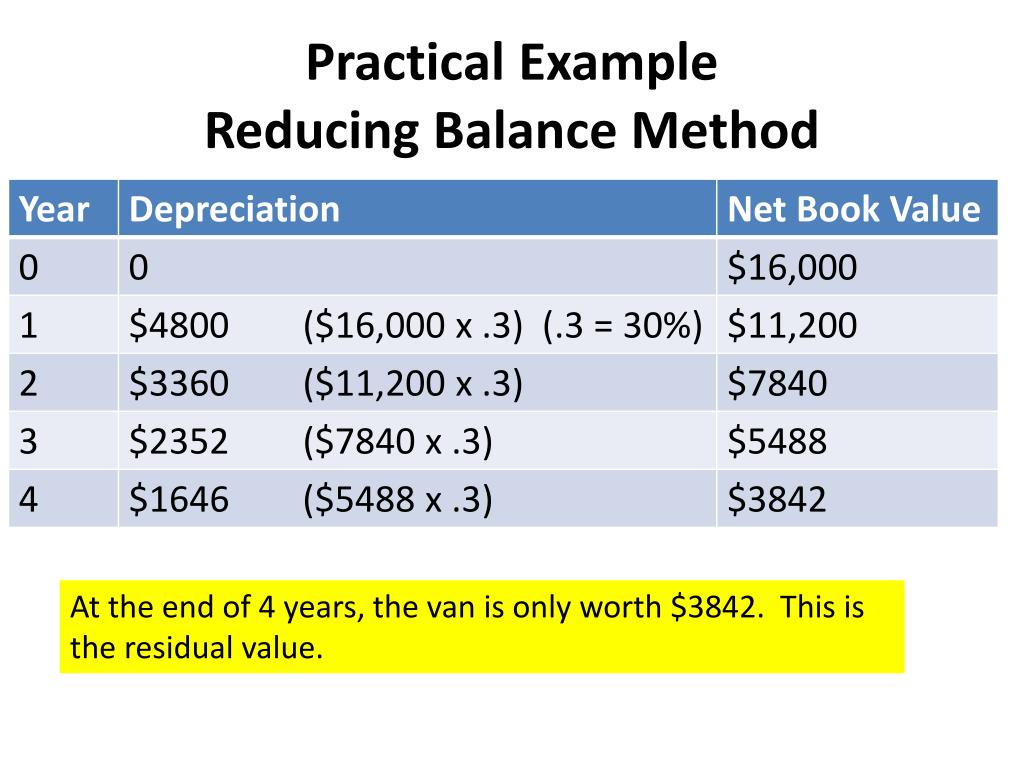

Depreciation is a way of spreading the cost of acquiring the asset over its useful life. Also note that it will. In the example, subtract $80,000 from $100,000 to get $20,000 in accumulated depreciation for the most recent accounting.

Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via depreciation expense. Typically, investments are securities held for more than a year. Accumulated depreciation is the total amount of depreciation applied to an asset throughout its existence.

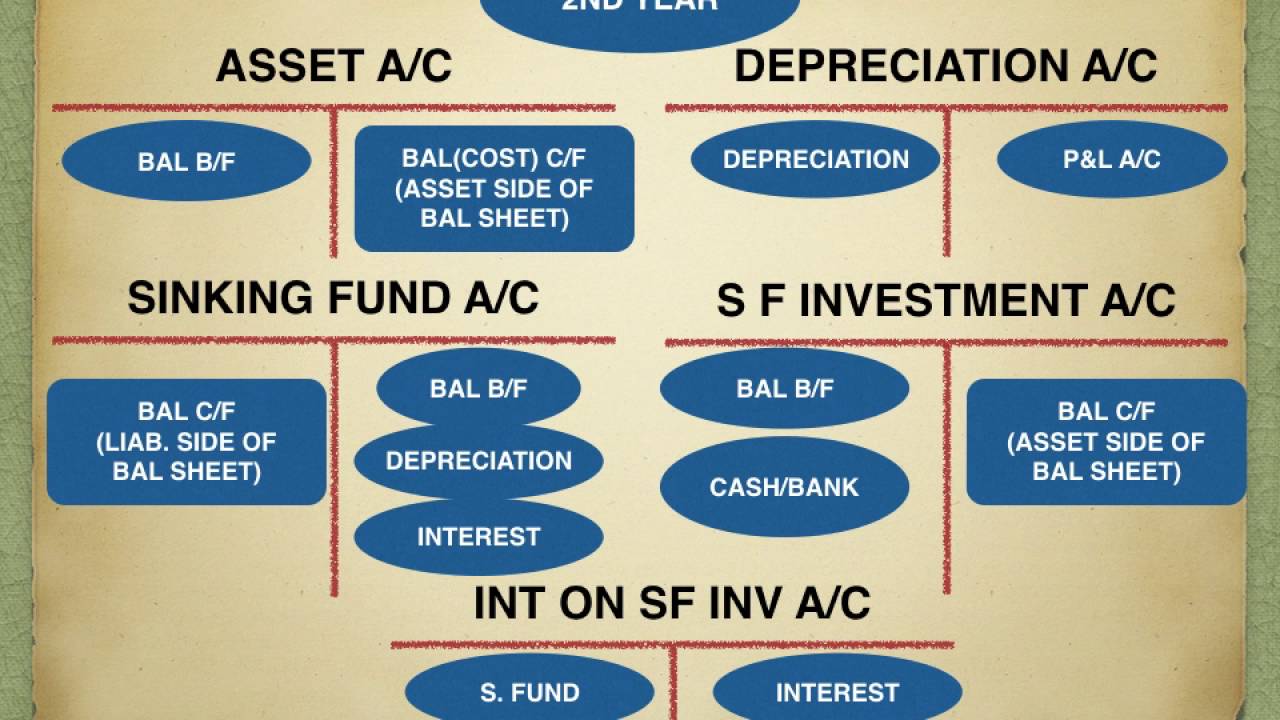

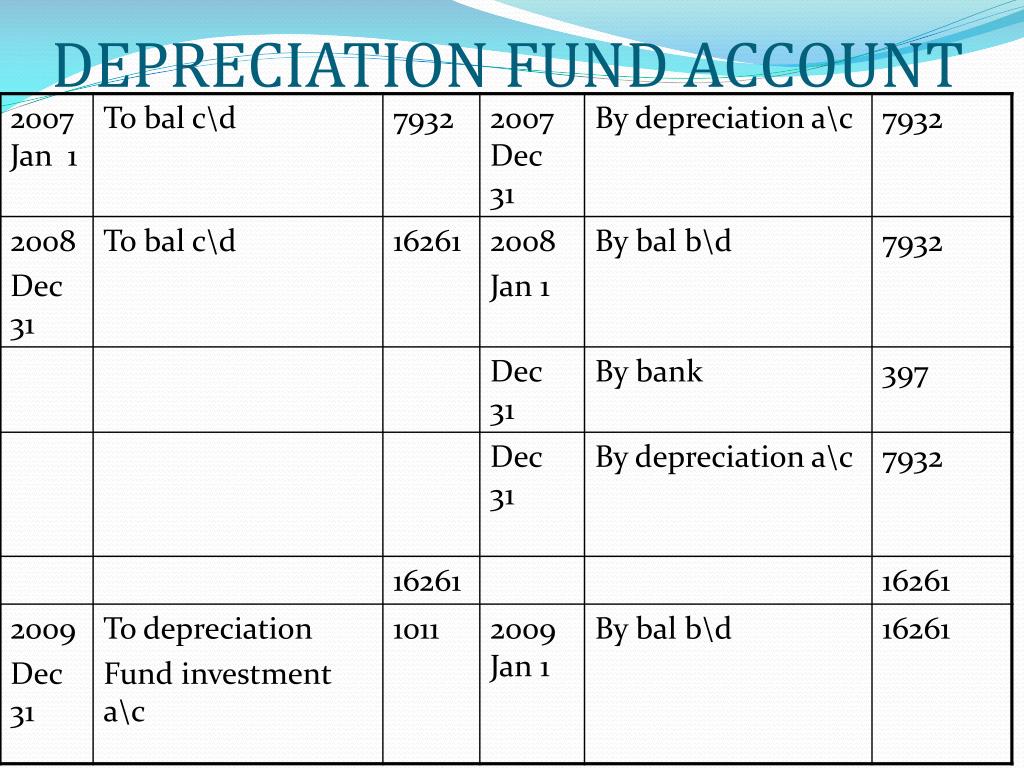

It provides a snapshot of a company's finances (what it owns and owes) as of the date of publication. However, this method is a complex method of accounting. This value is called the depreciation expense, shown in the profit and loss account and the balance sheet.

If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is then called a “marketable security.” Fixed assets are shown net of accumulated depreciation on the balance sheet. This figure appears on the balance sheet as a deduction from the total cost of the asset.

It is not an asset, since the balances stored in the account do not represent something that will produce economic value to the entity over multiple reporting periods. A depreciation reserve offers tax benefits and helps businesses manage their finances effectively. Assets = liabilities + equity.