Simple Info About Interest On Capital In Balance Sheet

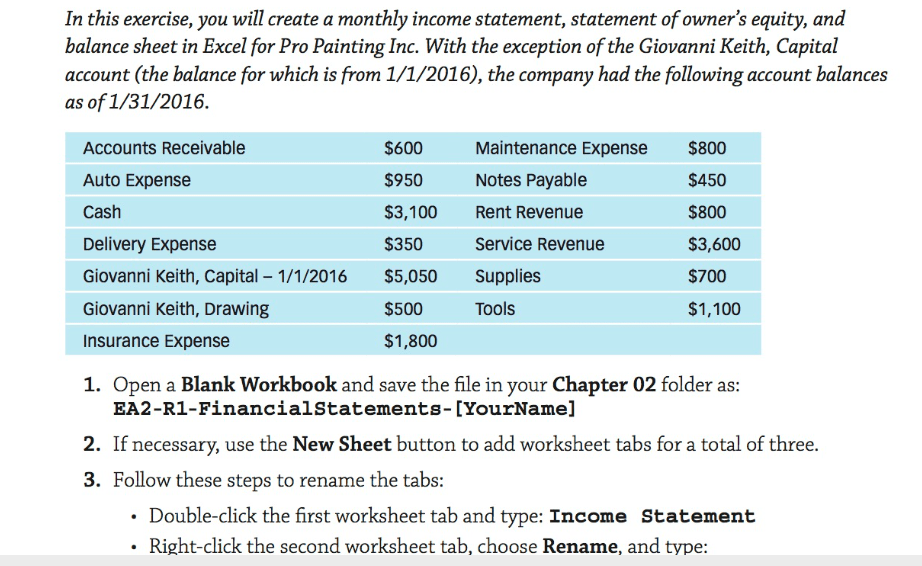

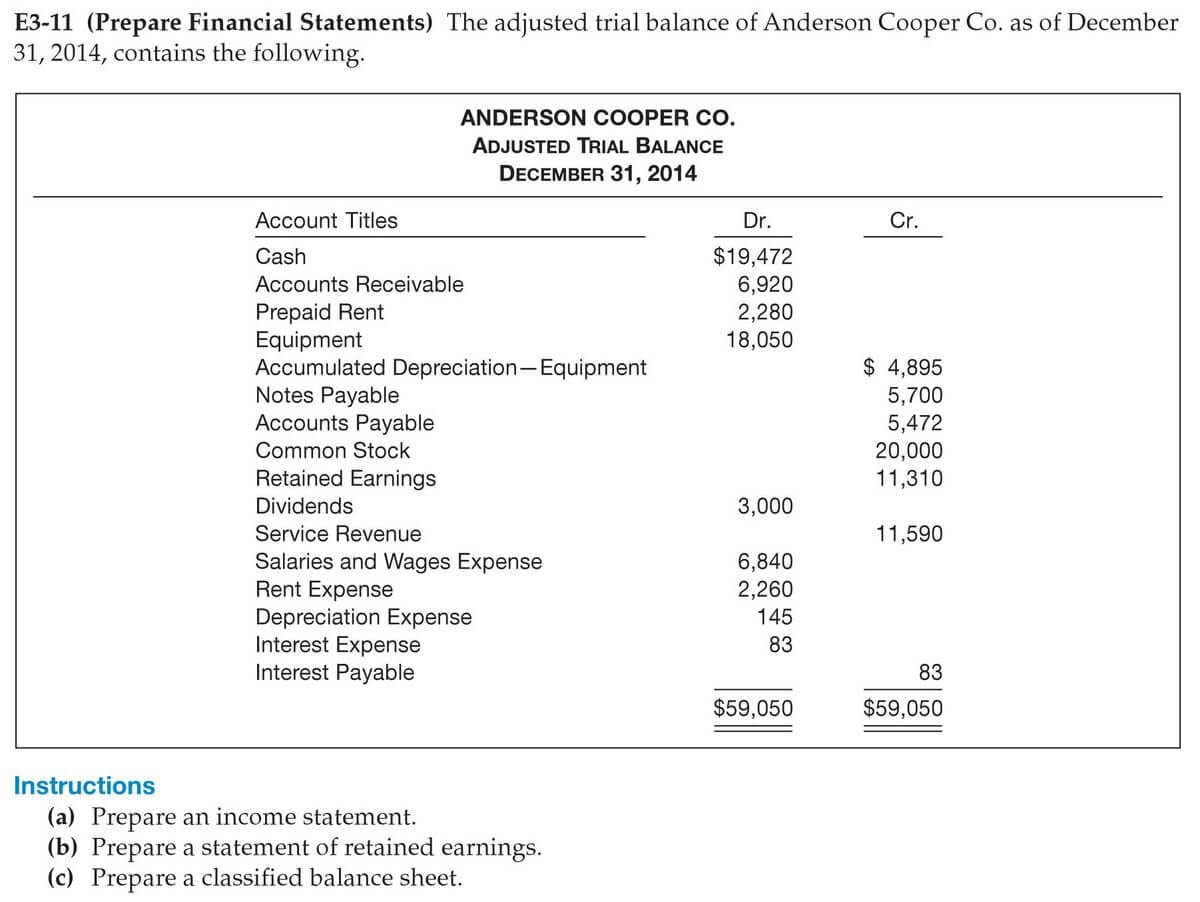

Solution calculation of interest on capital:

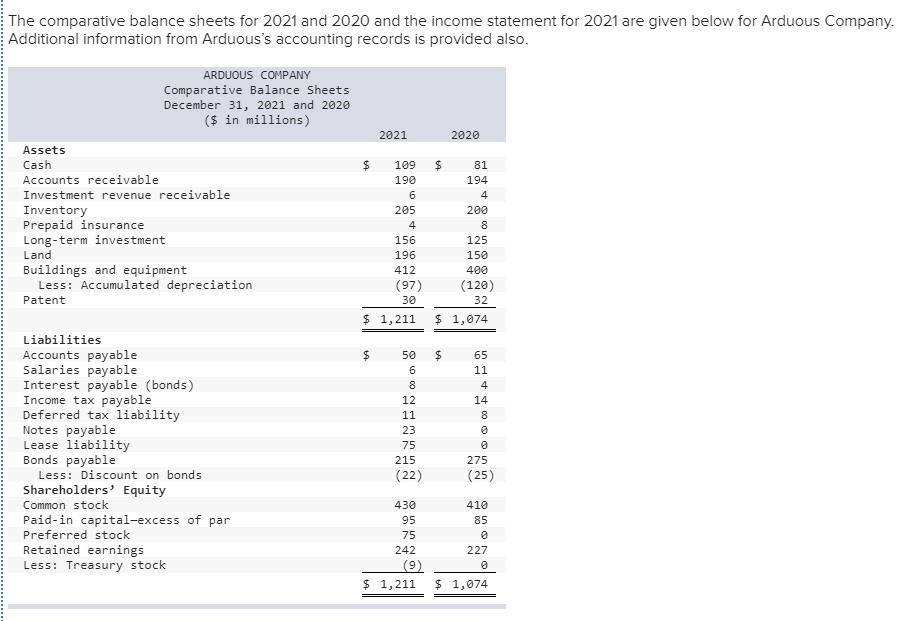

Interest on capital in balance sheet. Interest on capital is an expense for the business and is added to the capital of the proprietor thereby increasing his total capital. Sometimes the manager is also eligible to a commission on profits at a fixed rate. The following adjustments were noted:

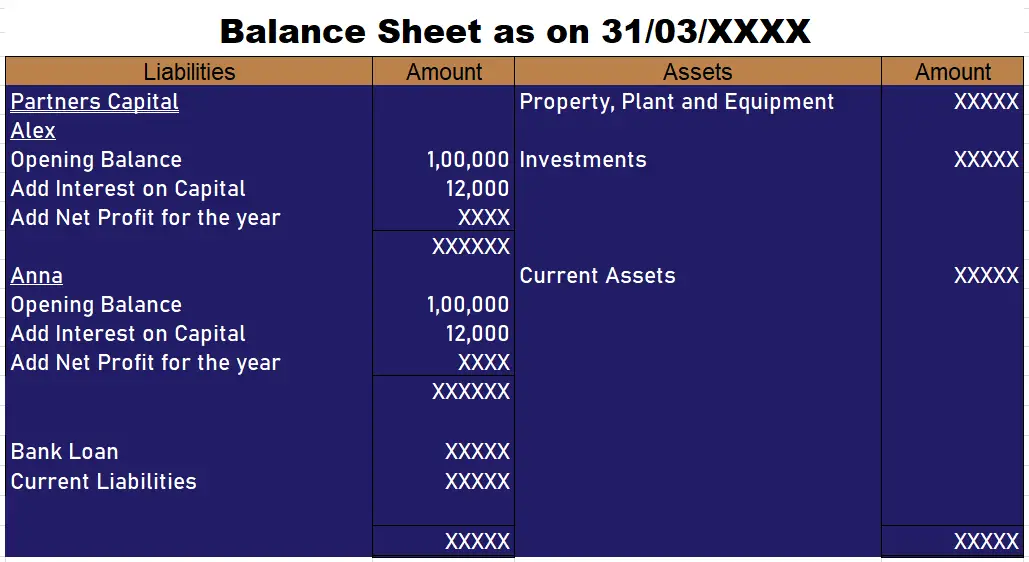

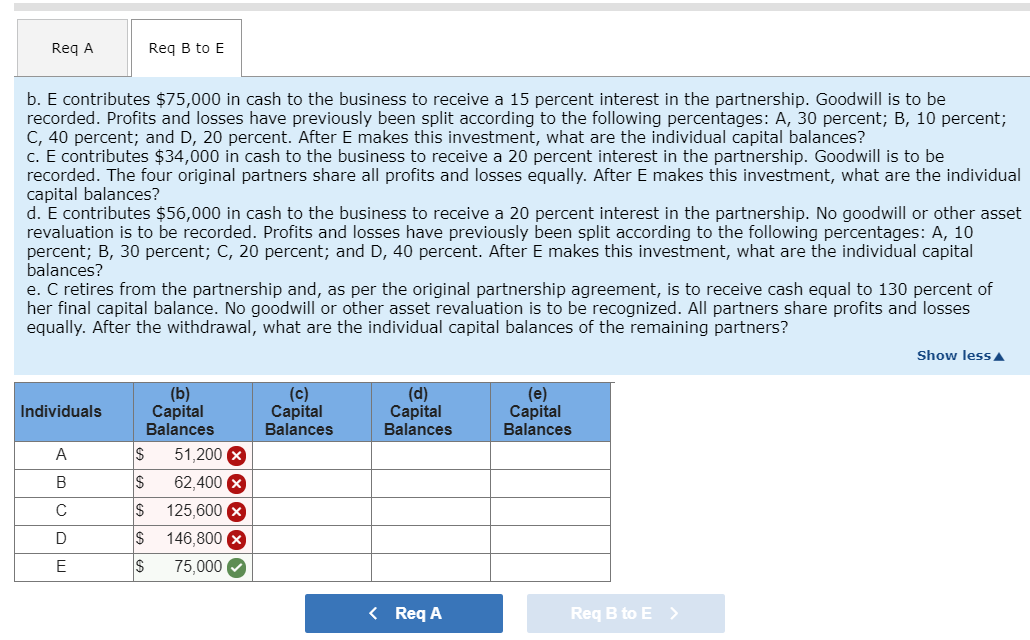

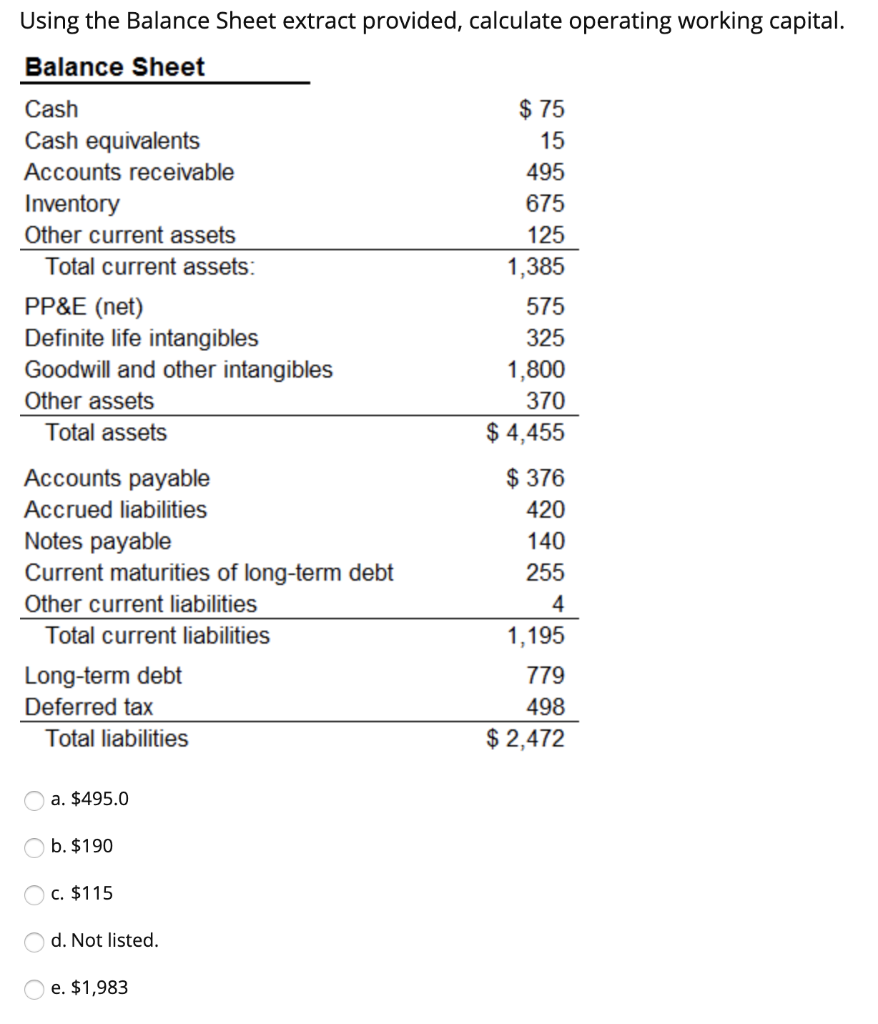

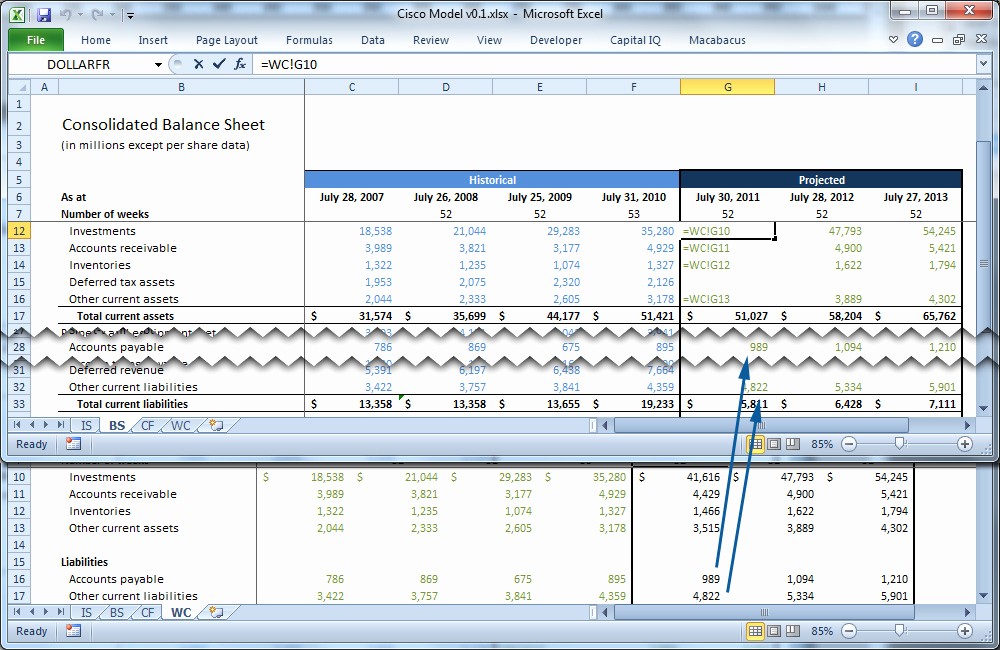

Balance sheet (a) there is a separate capital account for each partner instead of just the one required for a sole trader (b) we often maintain a separate current account for each partner, recording drawings and profit shares. It is the interest on share capital paid to the investor for the amount they agree to invest and start a business. We have transformed the group and delivered consistent execution of our “driving progress 2023” plan, building a strong earnings and capital distribution track record, while maintaining a robust balance sheet.” “today we have an attractive business model, with leading and scaled.

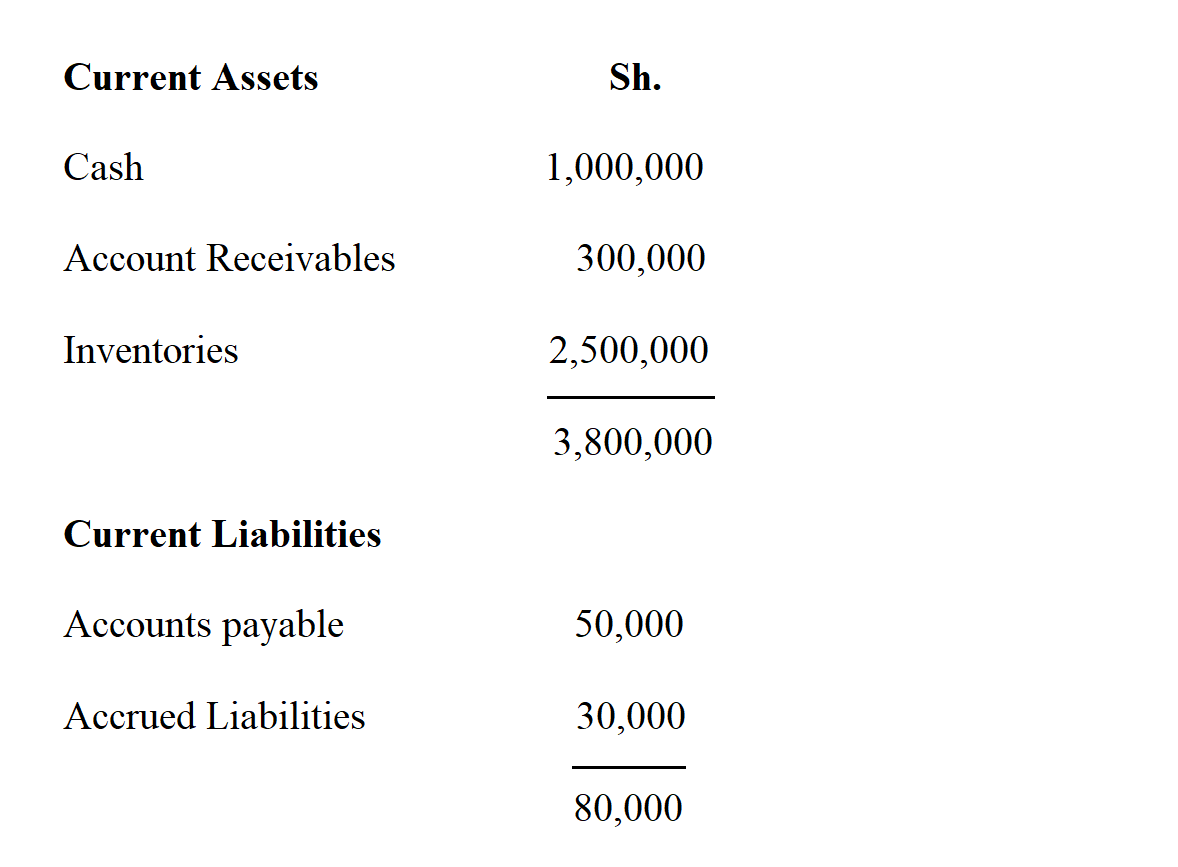

This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. If interest on capital is given inside the trial balance: Hence, the interest of 24,000 (100,000 x 12% p.a x 2 partners) shall be transacted in the balance sheet and profit and loss statement as;

Reduce owner’s equity to keep the sheet in balance. 6 per statement cycle (currently not enforced) monthly service fee. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

To rahul’s capital a/c 10,000. December 30, 2023 learn about interest expense on the balance sheet and its importance in finance. Interest on capital @ 5% to be provided.

Discover where to find interest expense and how it impacts a company's financial statements. It is an expense of the business, so it will be recorded on the debit side of the profit and loss account. In short, the balance sheet is a financial statement that.

Balance of current account will not be considered for calculation of interest on capital. Interest to be paid on the partners’ opening capital balances at a rate of 5% per annum; Capital a/c & interest on capital a/c.

According to the last reported balance sheet, fastenal had liabilities of us$661.3m due within 12 months, and liabilities of us$452.8m due beyond 12 months. Where is interest expense on balance sheet modified: The amount of interest that is charged on capital is an indirect expense of the business.

Further, the interest incurred is determined by the outstanding principal on each debt instrument. Interest on capital = amount of capital * rate of interest per annum * period of interest. It is a similar treatment.

Interest in drawings has the following two effects on final accounts: Interest on capital = (100,000*10*12)/ 12*100. Capital on a balance sheet refers to any financial assets a company has.