Have A Info About Proforma Of P&l Account

What does a p&l statement show?

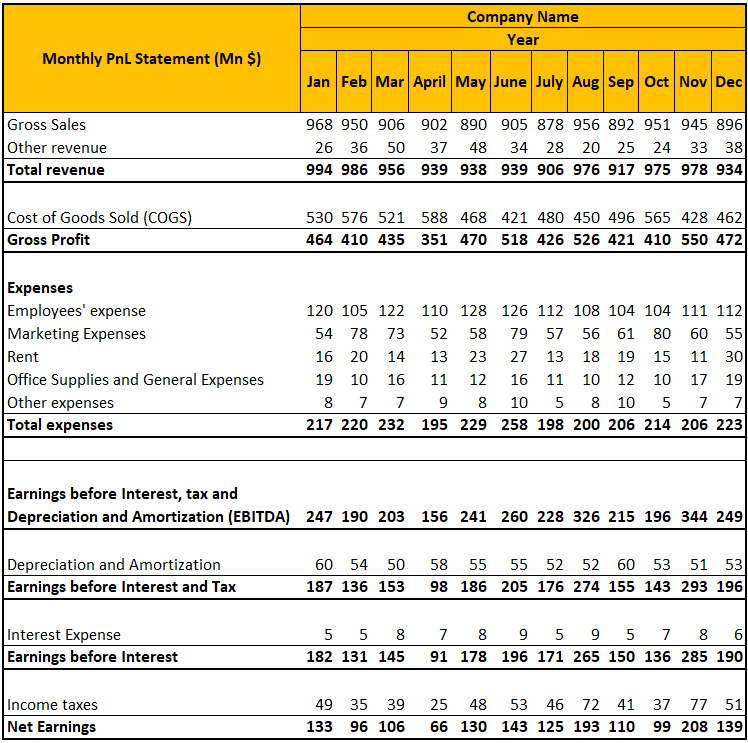

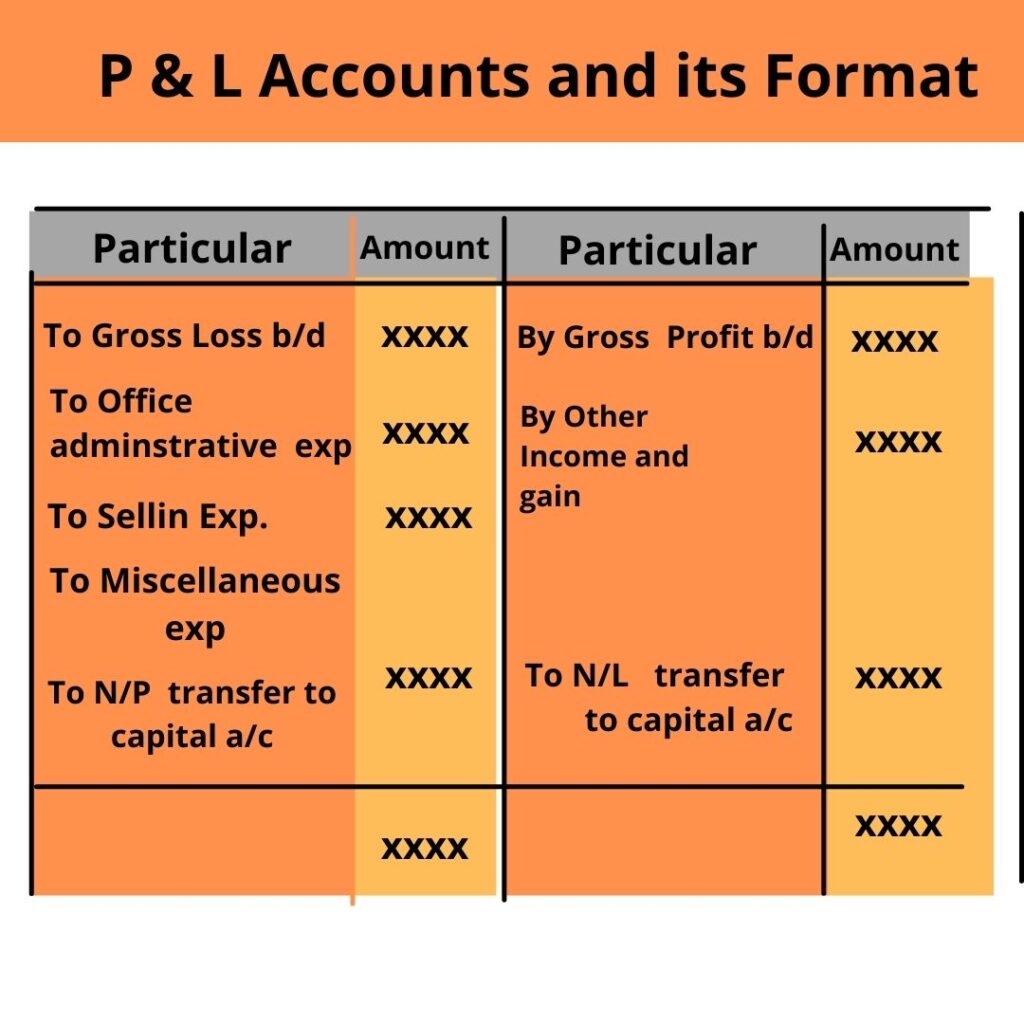

Proforma of p&l account. The spending of the company on the rent was $6,000, on utility was $5,000, and on the salary of one staff working was $7,000. The result is either your final profit (if things went well) or loss. Usually, these entities prefer “t shaped form” for preparing p&l account.

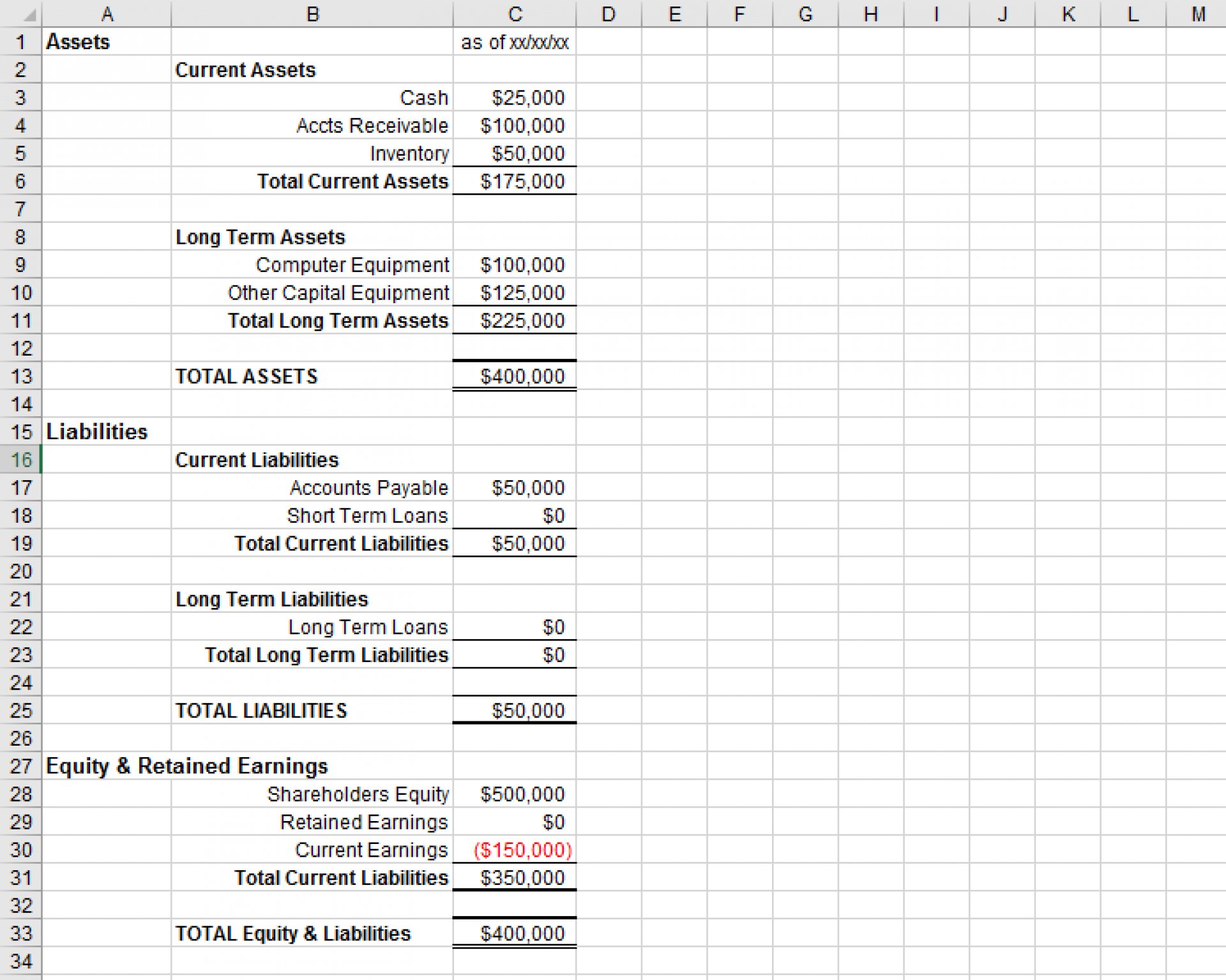

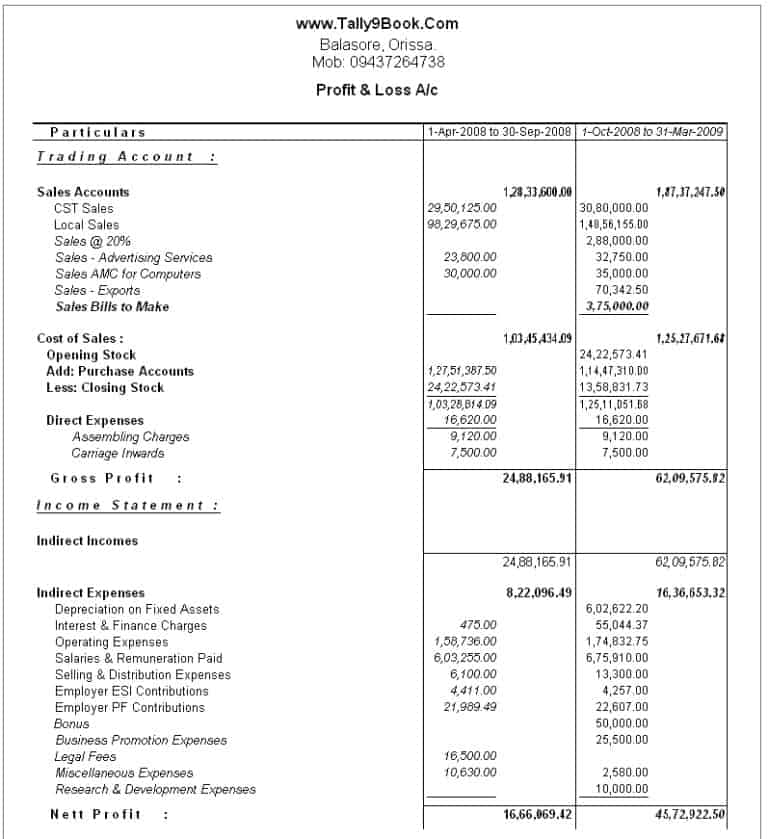

The income statement, often known as the balance sheet, is a window into the heart of a corporation, presenting revenues, costs, and expenses in a comprehensive style. Profit and loss account is made to ascertain annual profit or loss of business. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

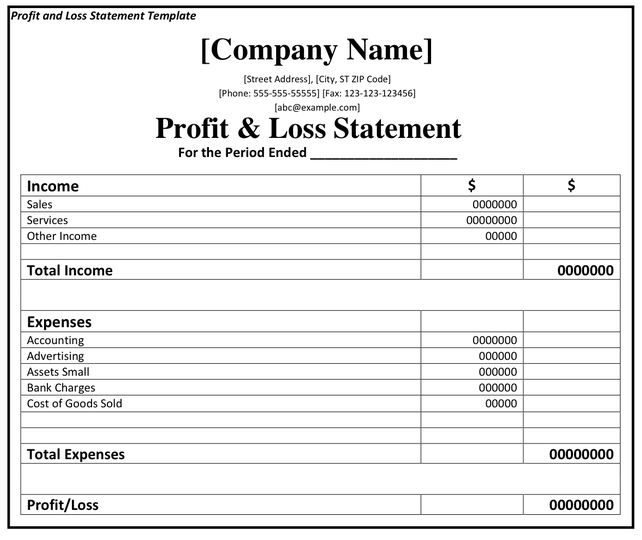

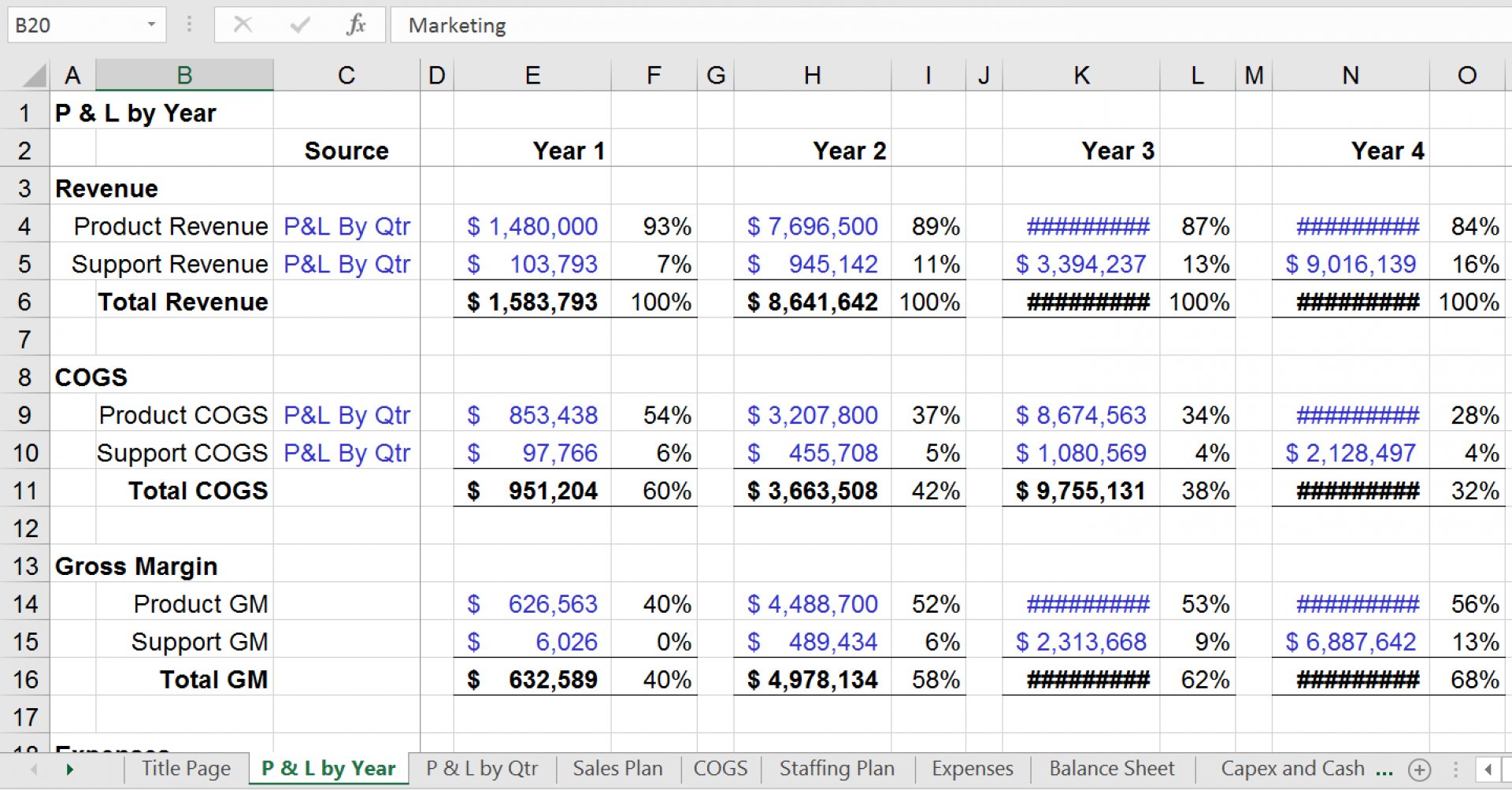

There are three major pro forma statements: As in, “what if my business got a $50,000 loan next year?” #1 monthly profit and loss template

Add up all expenditures made throughout the accounting period. It shows your revenue, minus expenses and losses. But, learning how to read one isn’t always intuitive.

Pro forma income statements pro forma balance sheets pro forma cash flow statements pro forma statements look like regular statements, except they’re based on what ifs, not real financial results. The basic formula for a profit and loss statement is: The p&l account is a component of final accounts.

The p&l statement reveals the company's realized profits or losses for the specified period of time by comparing total revenues to the company's total costs and expenses. However, it should reflect the gross profit & net profit separately. The vertical format of the p&l account;

Balance sheet vs profit & loss account Balance of profit and loss appropriation account. Pro forma income statements, also called pro forma profit and loss (pro forma p&l), are projections based on your past income statements.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Trading account is prepared first followed by profit & loss statement. The pro forma income (p&l) and cash flow statements.

Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. Prepare the profit and loss statement for the year ended december 31, 2018, for the shop. A profit and loss statement (p&l) is an effective tool for managing your business.

The p&l contains details about a company's revenue, or the total amount of income from the sale of goods or services associated with the company's primary. A p & l account or profit and loss account is a crucial financial document. Only indirect expenses are shown in this account.