Real Tips About Balance Sheet Adjustment Entries

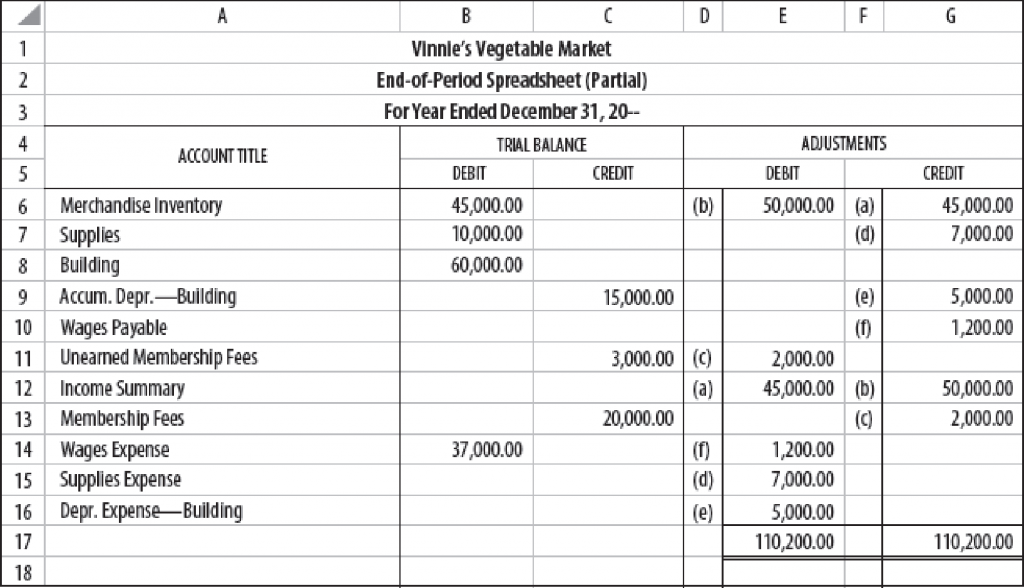

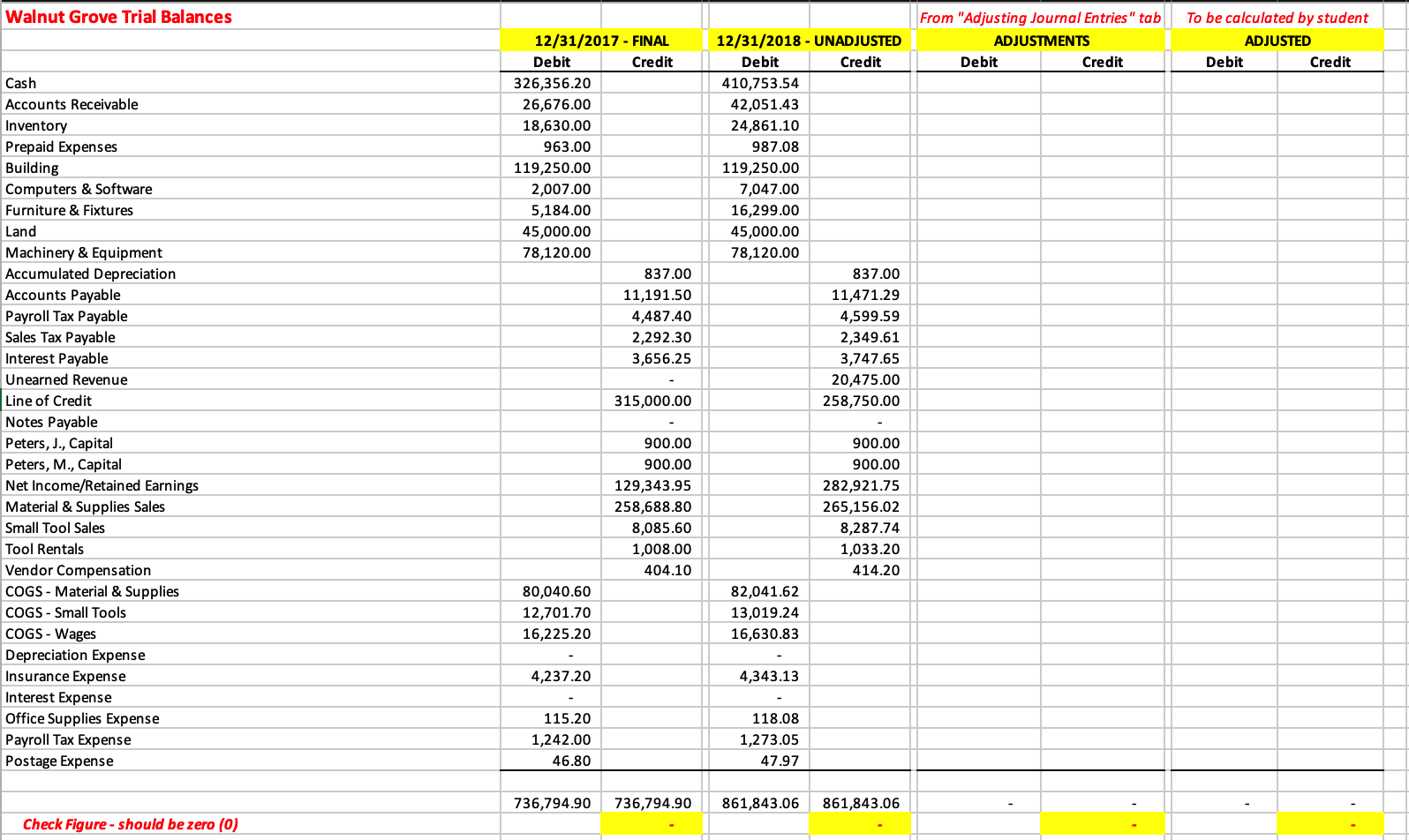

Determine what the ending balance ought to be for the balance sheet figures 5.

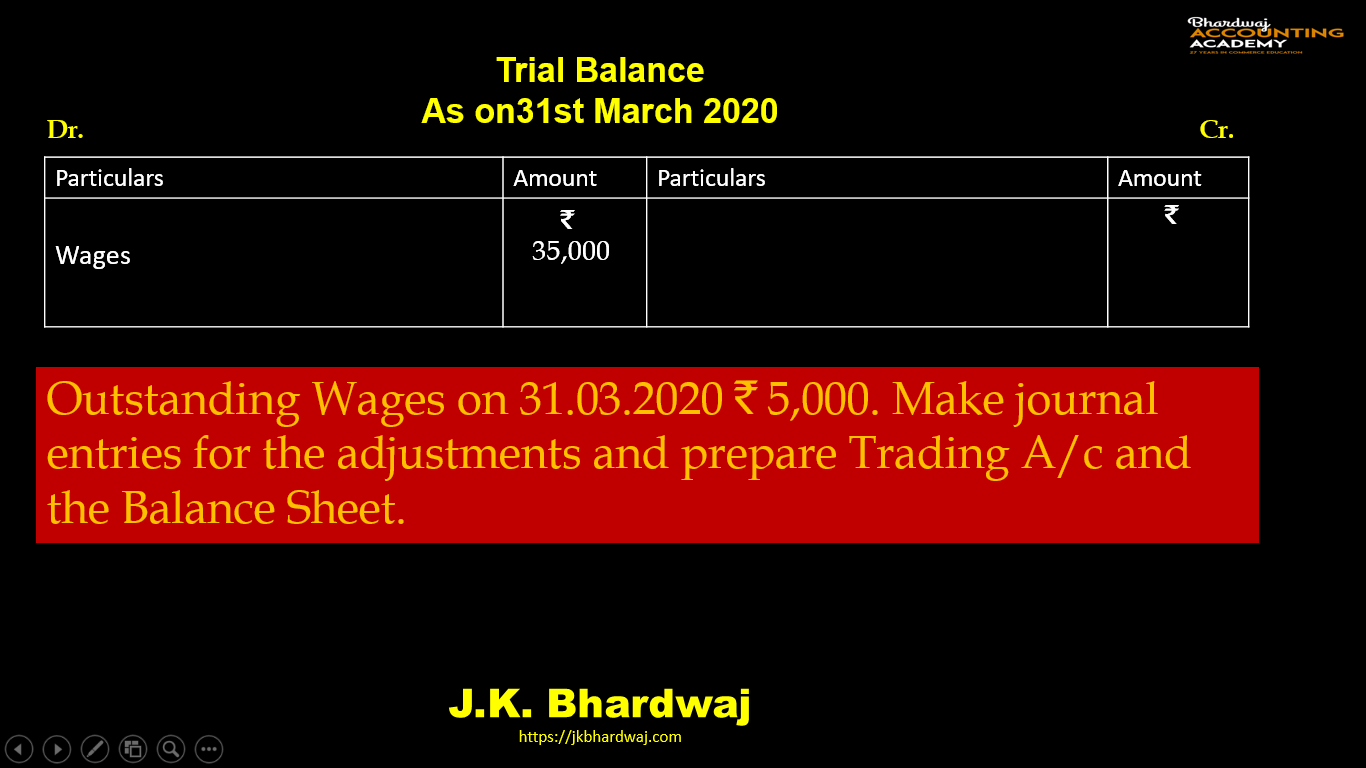

Balance sheet adjustment entries. Adjusting entries are crucial to ensure the correct balance and correct information. Adjusting entries are accounting journal entries that convert a company's accounting records to the accrual basis of accounting. The adjusting entry for accounts payable in general journal format is:

Every adjusting entry will have at least one income statement account and one balance sheet account. Cash will never be in an adjusting entry. The adjusting entry records the change in amount that occurred during the period.

Make an adjustment so that the. We have to make an adjustment entry in. Sometimes ordered goods are dispatched by the supplier but not received till the date of preparing the balance sheet.

Supplies is a balance sheet account, and supplies expense is an income statement account. Similar to an accrual or deferral entry, an adjusting journal entry also consists of an income statement account, which can be a revenue or expense, and a balance sheet account,. Adjusting entries refers to a set of journal entries recorded at the end of the accounting period to have an updated and accurate balances of all the accounts.

Adjusting entries are made at the end of the accounting period to make your financial statements more accurately reflect your income and expenses, usually — but. At the end of the accounting period, ledger requires. Adjusting entries are accounting journal entries in which we adjust the expenses and the company’s revenue and finance.

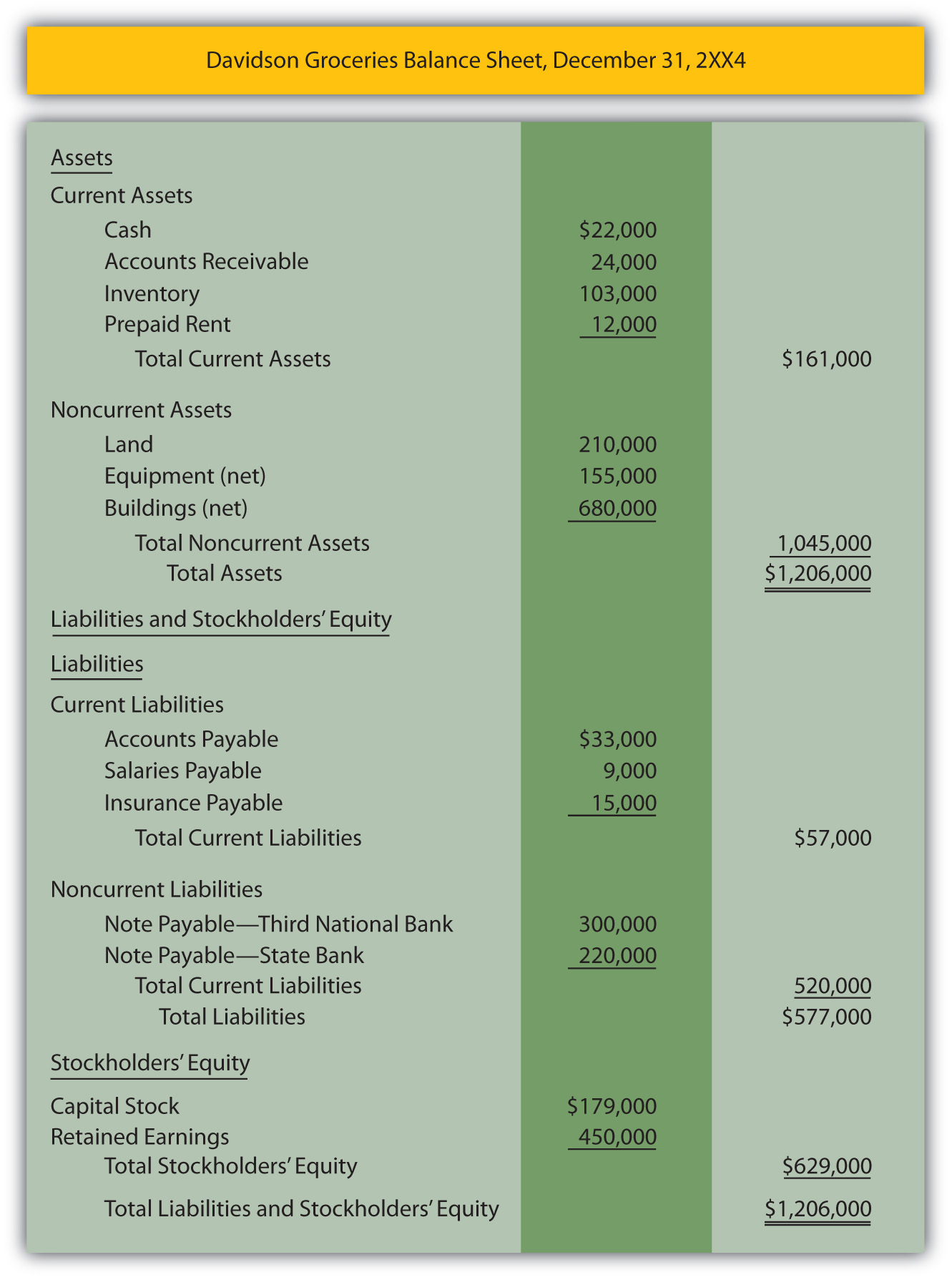

What are “income statement” and “balance sheet” accounts? Balance sheet accounts are assets, liabilities, and. This satisfies the rule that each adjusting.

An adjusting entry is an entry that brings the balance of an account up to date. Impact on the financial statements: Income statement accounts include revenues and expenses.

Adjusting entries are step 5 in the accounting cycle and an important part of accrual accounting.