Painstaking Lessons Of Info About Operating Cash Flow

Launching multiple products in revenue generating.

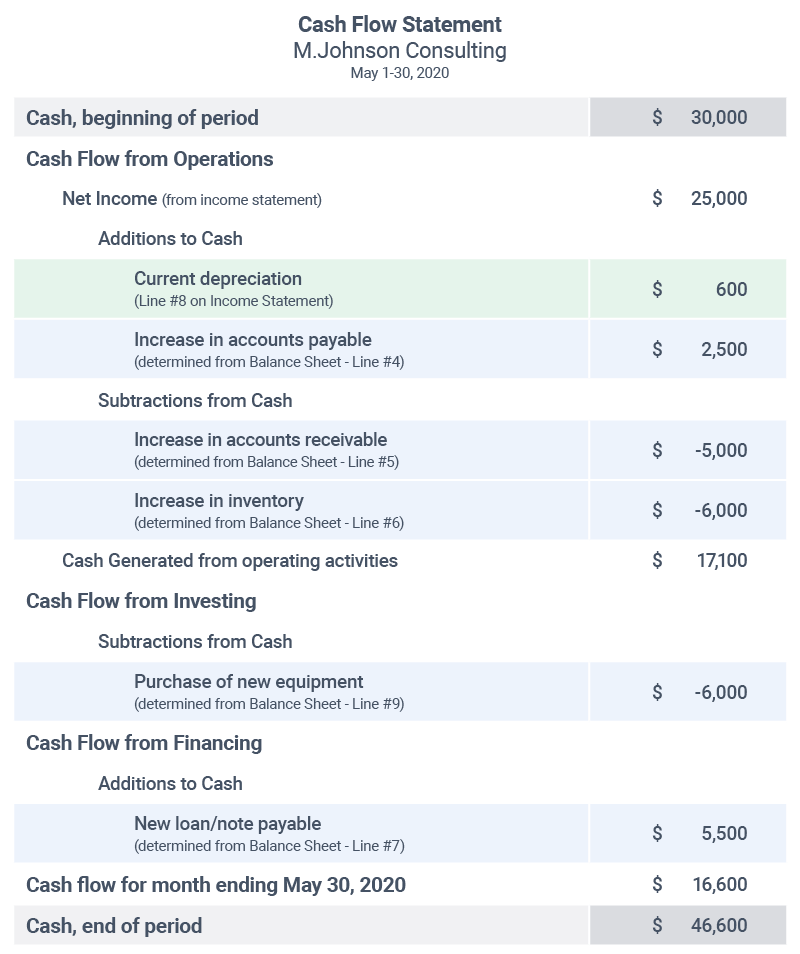

Operating cash flow. With these etfs, cash flow is king. Operating cash flow reveals the money earned from typical business operations and from the revenue that the company earns over a set period. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations.

Full year 2023 free cash flow of $193.7 million, up from $16.5 million; Carrefour , europe's largest retailer, said on tuesday it was confident about this year as it reported record cash flow of 1.62 billion euros ($1.8 billion) for 2023 and. Operating cash flow (ocf) measures the cash that a business produces from its principal operation in a specific period.

Learn what operating cash flow (ocf) is, how to calculate it using two methods (direct and indirect), and why it's important for your business. It shows how much a company can pay for its current liabilities. The direct method of calculating operating cash flow is:

Operating cash flow (ocf) is a calculation that estimates cash generated from the principal operation and activities and then deducting operating expenses from actual revenue. F ree cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses. Operating cash flow (ocf), also known as cash flow from operations (cfo), is the net amount of cash generated from a company's normal operations during a specific time.

Cash flow is the net cash and cash equivalents transferred in and out of a company. Learn how to compare free cash flow and operating cash flow, two key metrics that measure a company's financial performance and sustainability. Total current liabilities = $30 million + $15 million + $10 million = $55 million.

Net cash provided by operating activities was $823 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was. It is also known as cash flow from operations. Operating cash flow indicates whether a company.

Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal. See the difference between operating cash flow and net income,. Operating cash flow is the net amount of cash that an organization generates from its operating activities.

Total revenue is the full amount of. Full year 2023 operating cash flow of $350.0 million, up from $189.3 million; The operating cash flow ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business.

Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger. For the full year, labcorp’s operating income was operating. In financial accounting, operating cash flow (ocf), cash flow provided by operations, cash flow from operating activities (cfo) or free cash flow from operations (fcfo),.

Operating cash flow is the amount of cash generated by the operating activities of a business. Learn what operating cash flow is, why it's important for your business, and how to calculate it using the formula. The company anticipates achieving positive operating cash flow by q3 2024.contributing factors include:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)