Brilliant Tips About Most Important Balance Sheet Ratios

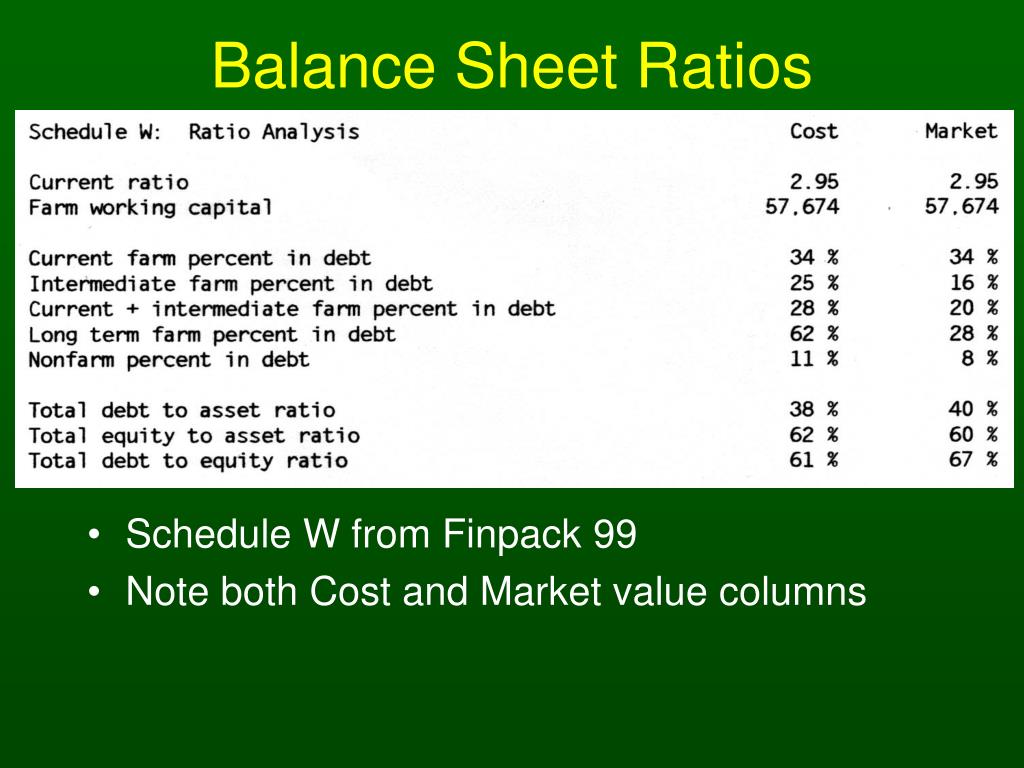

Liquidity ratios show the ability to turn assets into cash quickly.

Most important balance sheet ratios. · have debt no more than 10% of the company’s net worth. Most important financial ratios there are dozens of financial ratios you can track, but the most important financial ratios fall into one of four broad categories: · be based in the united.

· have a market value of $5 billion or more. Most ratios are best used in combination with. The 20 best balance sheet ratios, formulas, and metrics to analyze a company's health and discover undervalued stocks.

Profitability ratios show the ability to generate income. November 21, 2023 by cashflowclick this post covers every important balance sheet ratios. Financial ratios, such as efficiency ratios, liquidity ratios, solvency ratios, quick ratios, and profitability ratios, can be utilized by the managers, stakeholders.

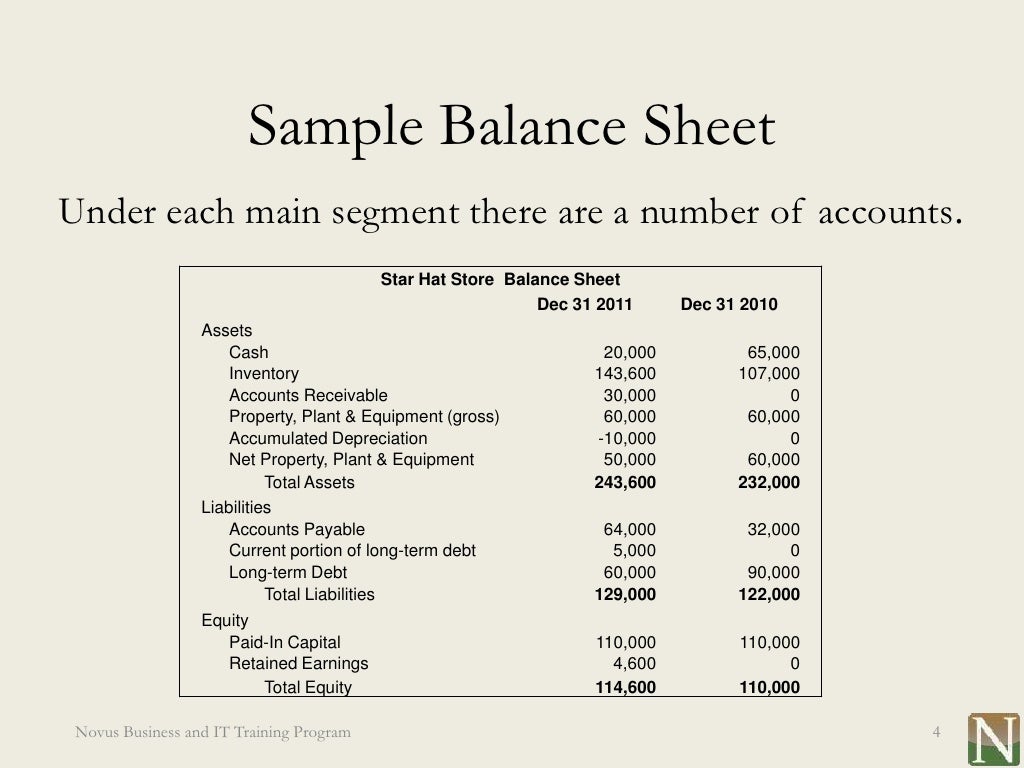

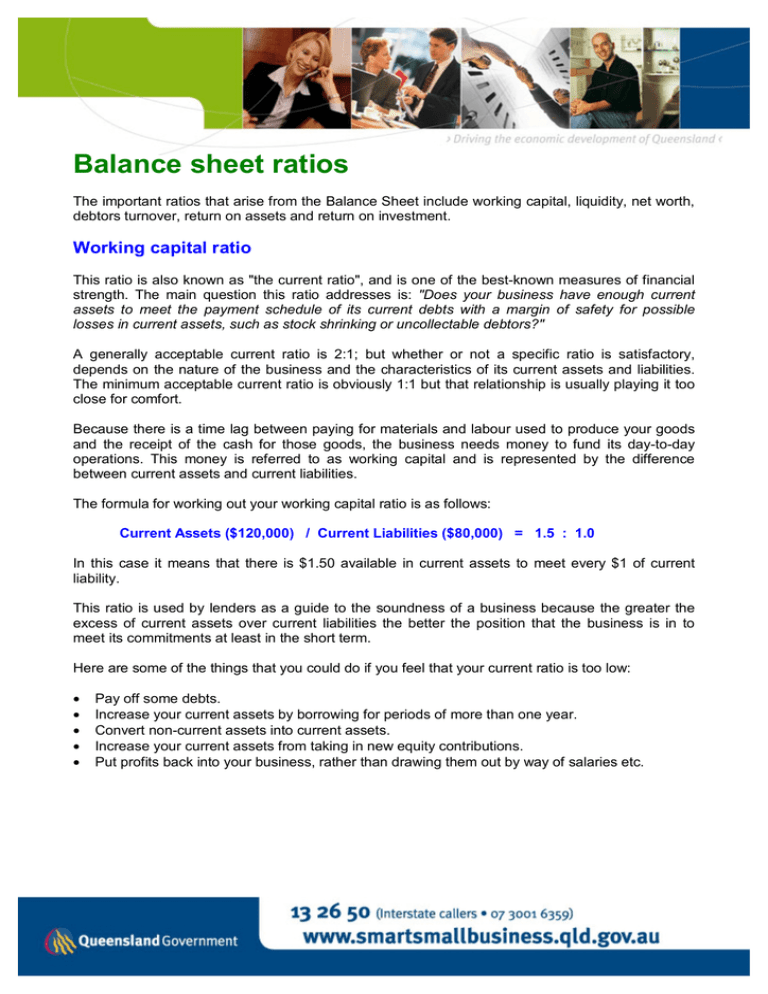

Current ratio measures whether you have enough current assets (defined as anything that can be turned into cash within a year) to meet your current liabilities. Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement. Most analysts prefer would consider a ratio of 1.5 to two or higher as adequate, though how high this ratio depends upon the business in which the company operates.

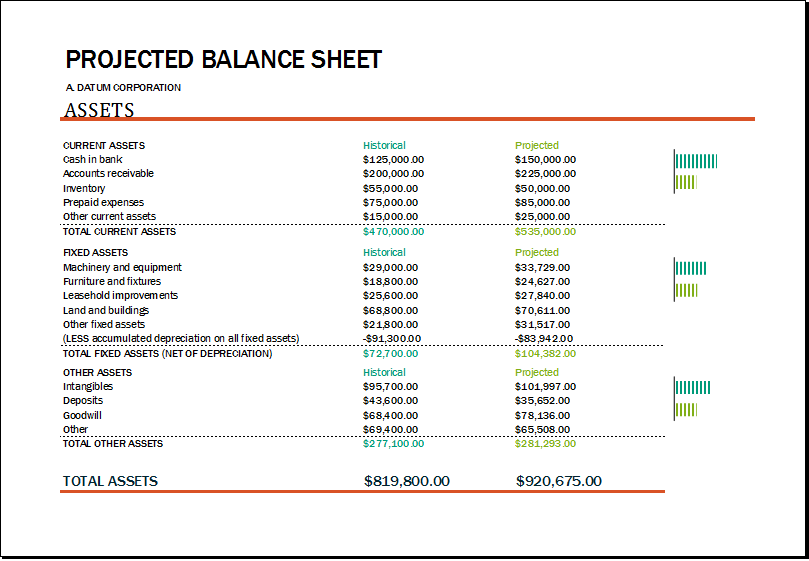

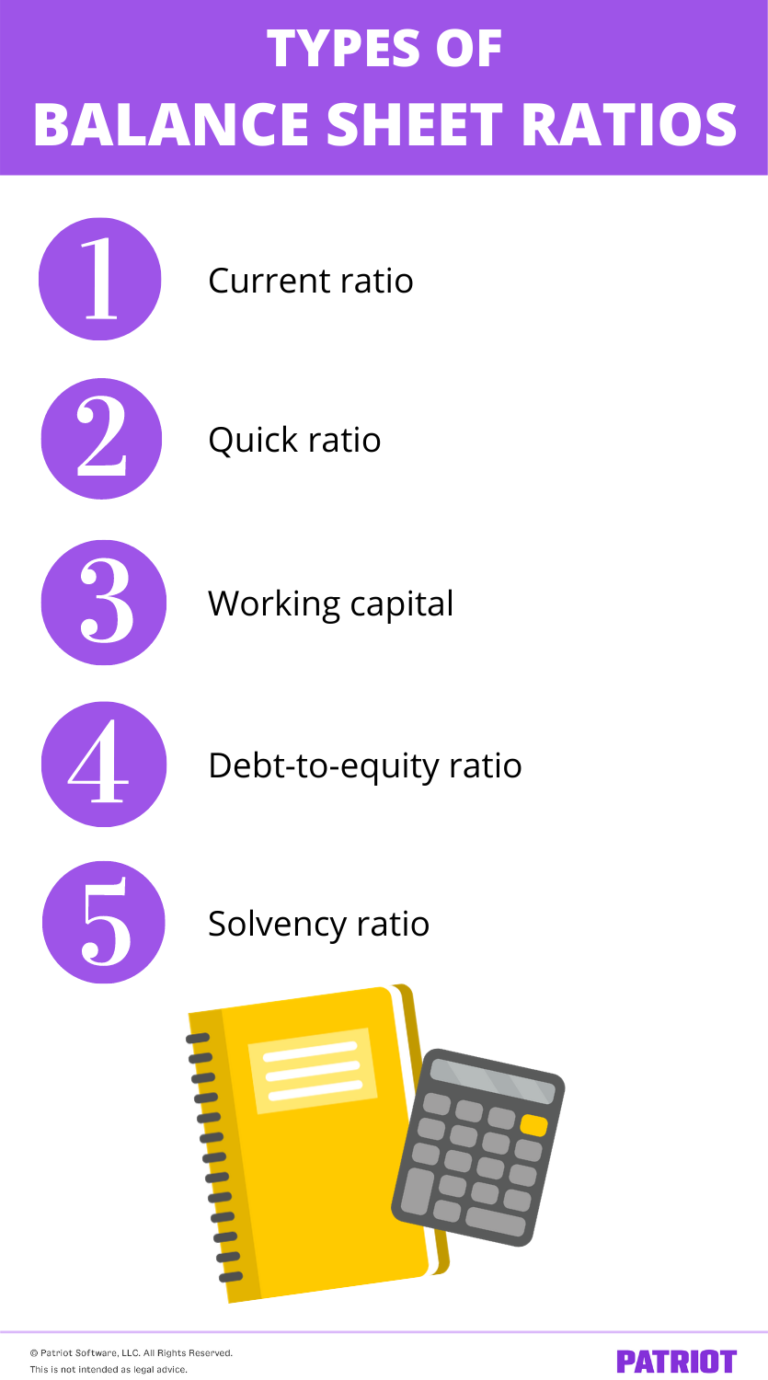

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Types of balance sheet ratios; This type of important balance.

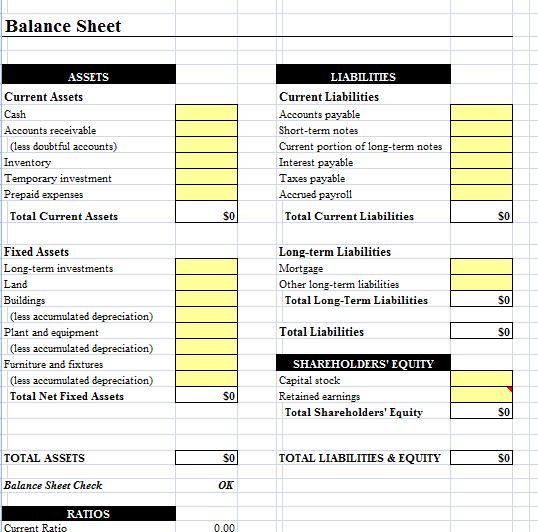

When it comes to your balance sheet, you should follow the accounting equation: The information it contains can be used to derive a number of ratios that can be used to infer the liquidity, efficiency, and financial structure of a business. This type of balance sheet ratio analysis, i.e., efficiency ratio, is used to analyze how.

What are the ratios for analyzing a balance sheet? Liquidity leverage profitability asset management we’ll look at 10 ratios across these four categories and provide a detailed walkthrough for each. This type of balance sheet ratio analysis is also known as the banker’s ratio.

From profitability to liquidity, leverage, market, and activity, these are the 20 most important ratios for financial analysis. The most important financial ratios to consider. This concludes our discussion of the three financial ratios using the current asset and current liability amounts from the balance sheet.

Current assets divided by current liabilities. 20 balance sheet ratios to help you determine the financial health of a company & includes a pdf download. As fixed assets age, they begin to lose their value.

Net working capital is how much money you’d have if you took all of your current. There are three types of ratios derived from the balance sheet: So, let’s dive into this amazing post.