Supreme Tips About Acquisition Of Subsidiary Cash Flow Statement Simple Bank Balance Sheet

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

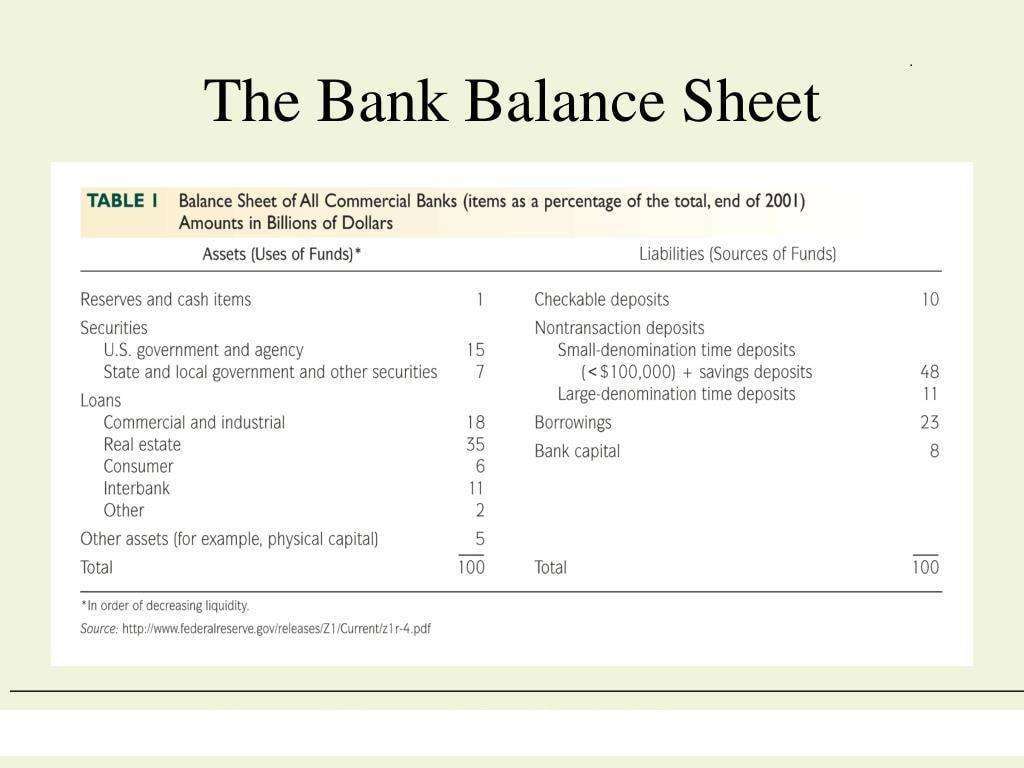

Acquisition of subsidiary cash flow statement simple bank balance sheet. An entity can present its statement of cash flows using the direct or indirect method; This value can be found on the income statement of the same accounting period. Why would an acquirer be willing to pay $100 million for a company whose balance sheet tells us it’s only worth $50 million?

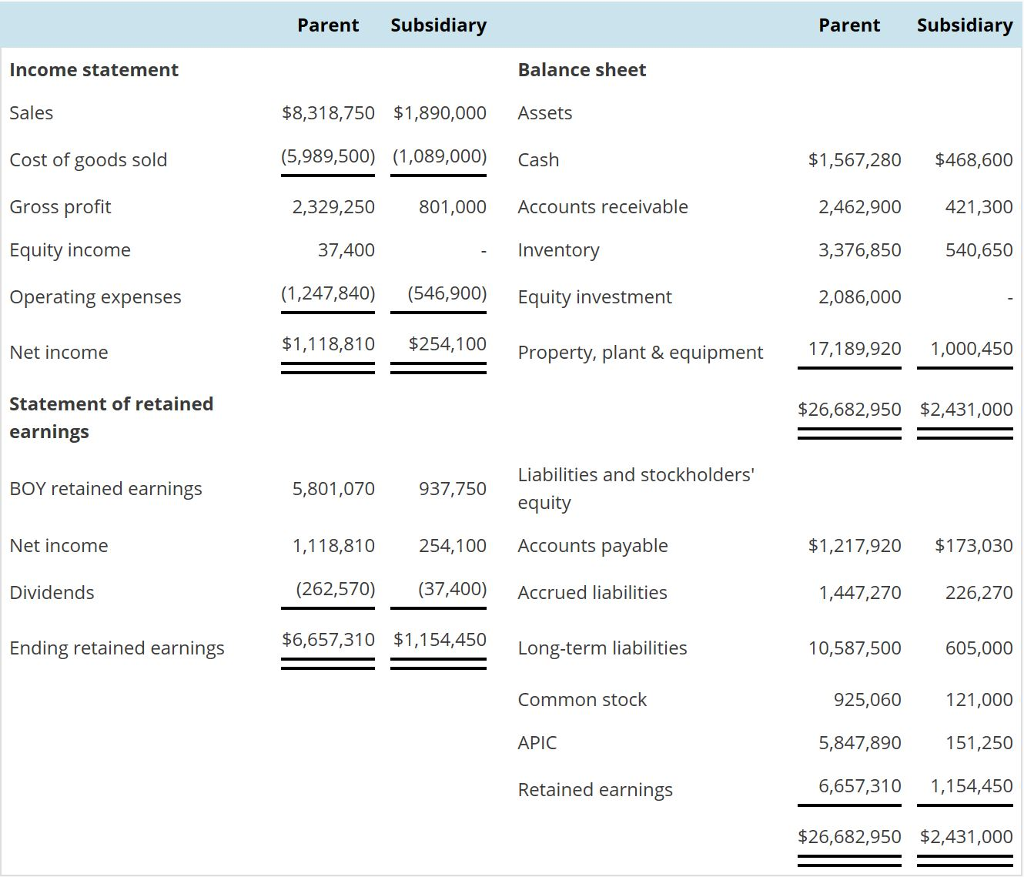

In simple terms, the consolidation method involves the parent and subsidiary’s financial statements being (wait for it…) consolidated in one set of financial statements, which includes consolidated balance sheets and income statements. A cash flow statement is divided into five parts: A balance sheet shows what a company owns in the form of assets, what it owes in the form of liabilities, and the amount of money invested by shareholders listed under shareholders' equity.

Net cash used in investing activities ( 480) cash flows from. Bigco is willing to pay $100 million. 95 requires that any adjustments from changes in operating balance sheet accounts (accounts receivable, inventory, accounts payable, etc.) reflect the amounts acquired in the.

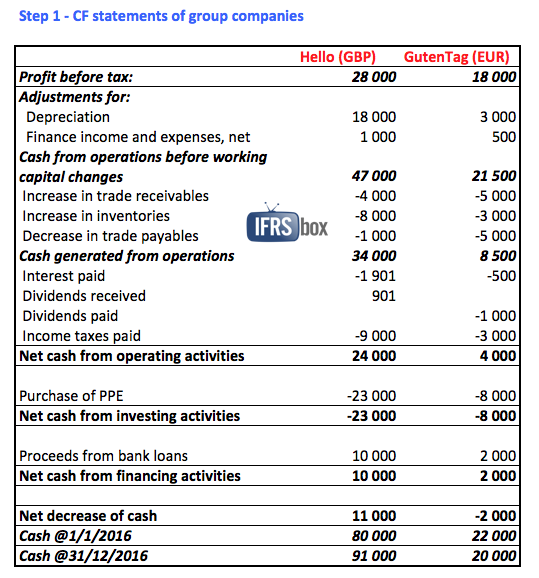

What the ifrs text says, how the business use case is handled in financial consolidation, and what impact the cfo should expect on her/his company’s financial statements. Net cash from operating activities. Acquisition of subsidiary x, net of cash acquired ( 550) purchase of property, plant and equipment ( 350) proceeds from sale of equipment.

Because it allows you to identify patterns and problems. Purchase of subsidiary (10,000) overdraft acquired on acquisition (2,352) (5,182 less 2,830) notes to the group statement of cash flows (extract) $,000.

The fair values of assets acquired and liabilities assumed were as follows: For example, the cash, trade receivables and prepayments of the parent and each subsidiary are © the institute of chartered accountants of india 2.3 prepare an income statement, statement of.

The latter is illustrated in this publication. Explain the flow of net income and dividends when a parent company owns 20% or 30% of a subsidiary company. The chapter covers companies act 2006 requirements, control relationships, accounting policies, accounting reference dates, overview of the consolidation process, consolidated balance sheet, consolidated profit and loss account and.

For example, suppose a company’s cash flow statement shows $500 million for “acquisitions, net of cash acquired”. For companies, the cash flow statement may fall under two formats. For intraperiod acquisitions, sfas no.

The cash flow statement shows the sources and uses of a companys cash. A cash flow statement is a summary of the cash transactions of your business, over a certain period of time. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in.

An example of bank of america's income statement is shown below with the following highlights: Cash flows from investing activities. This means the company used $500 million of.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)