Simple Info About Operating Expenses Formula Income Statement

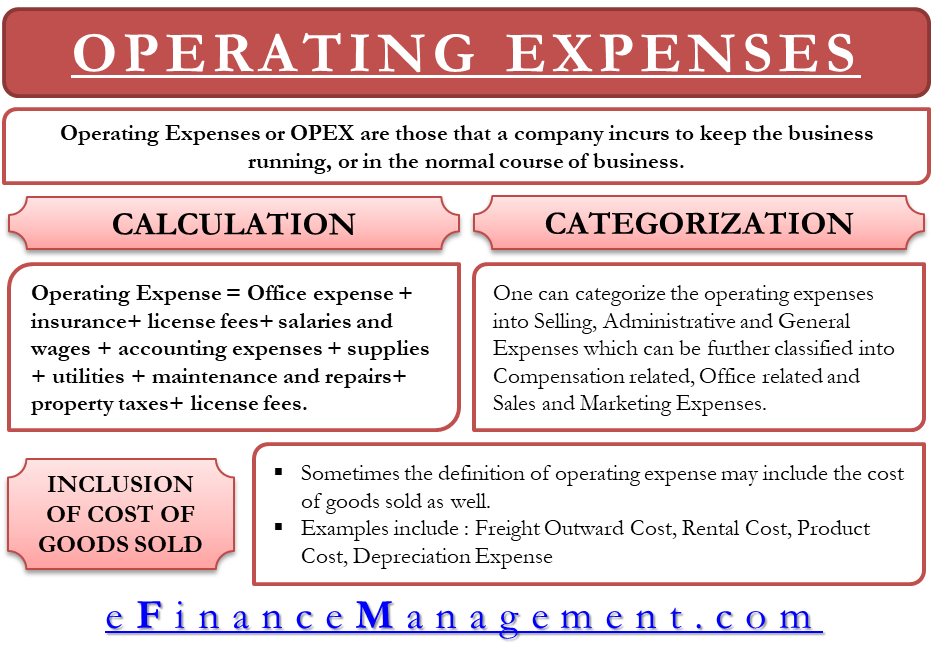

Operating expenses are the expenses incurred in the entity for its normal operational purposes and activities that generally include both the cost of products or.

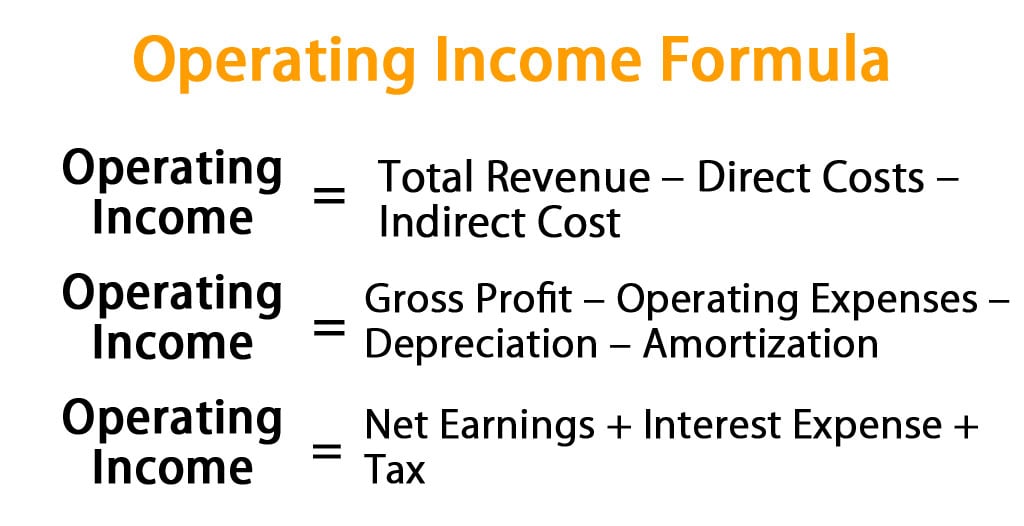

Operating expenses formula income statement. Let’s try presenting facebook, inc.’s income statement (up to operating income) in formula form: These are different and apart from the expenses that happen. Operating income formula.

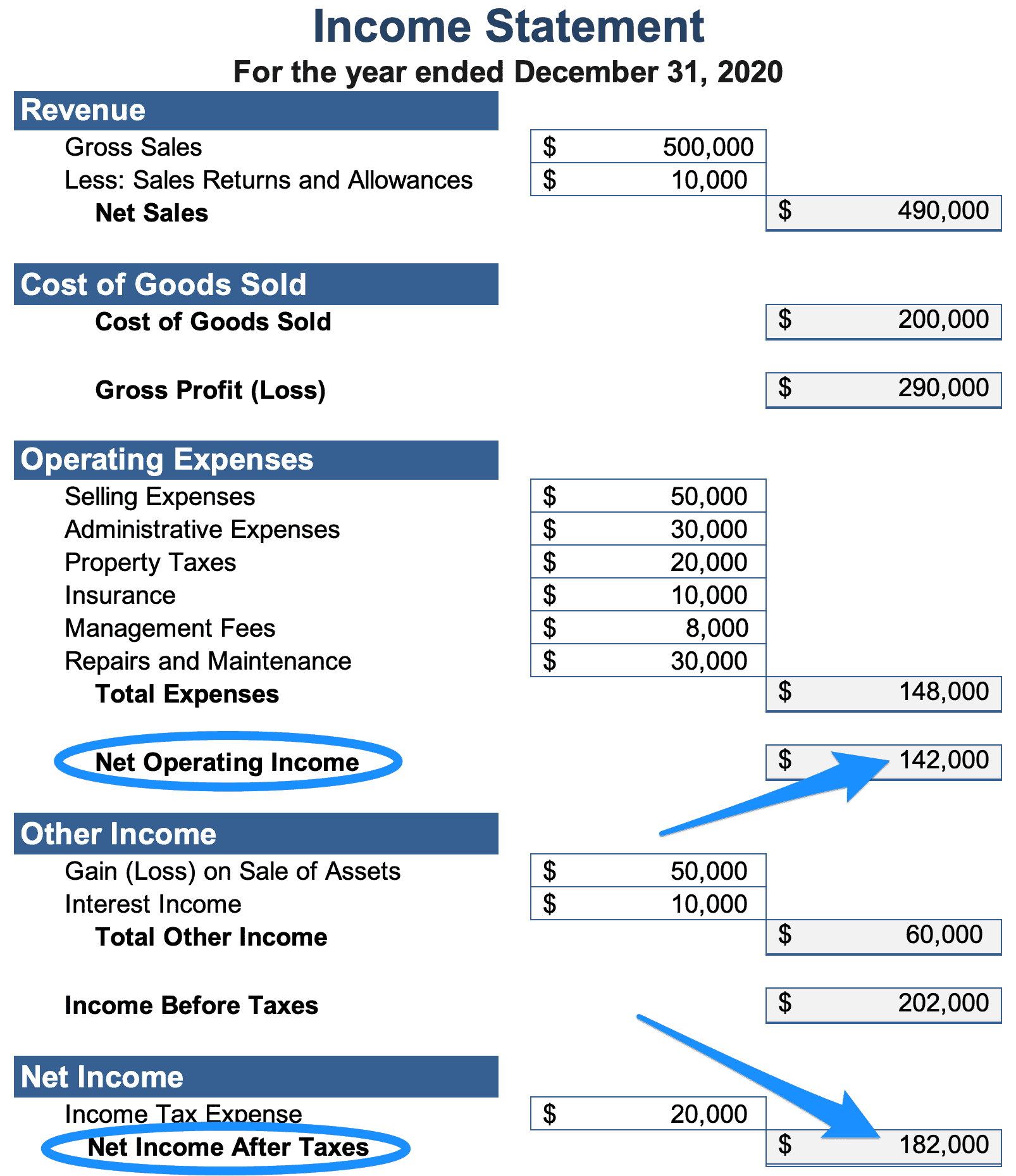

How to find operating expenses on income statement. Operating expenses are the operating costs that occurred by an entity as the result of its daily operating activities and are recording the. Some people refer to net income as net earnings, net profit, or.

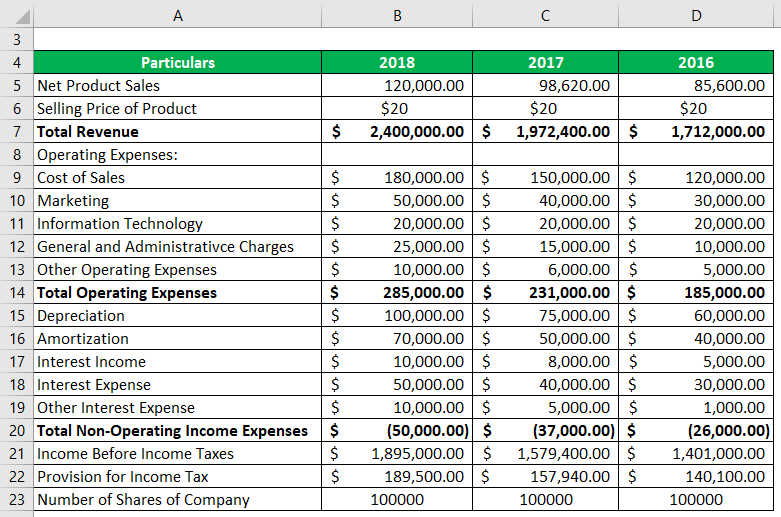

The very reason is to allow you to assess the core operations of. The formula to calculate a company’s operating income is as follows. All the amounts shown in the table below are in millions.

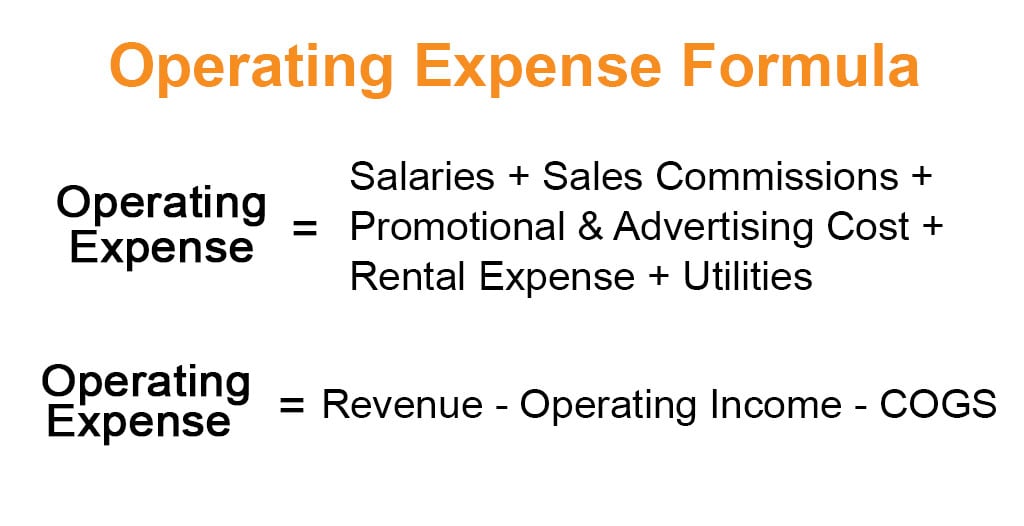

Calculate the operating expense of the company based on the above information. The formula to calculate operating expense is as below: Net income is the profit that remains after all.

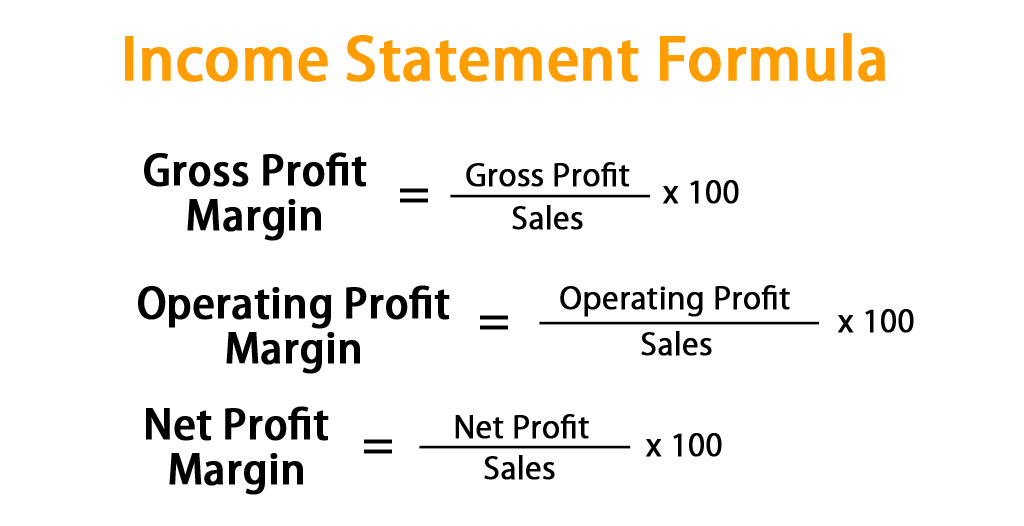

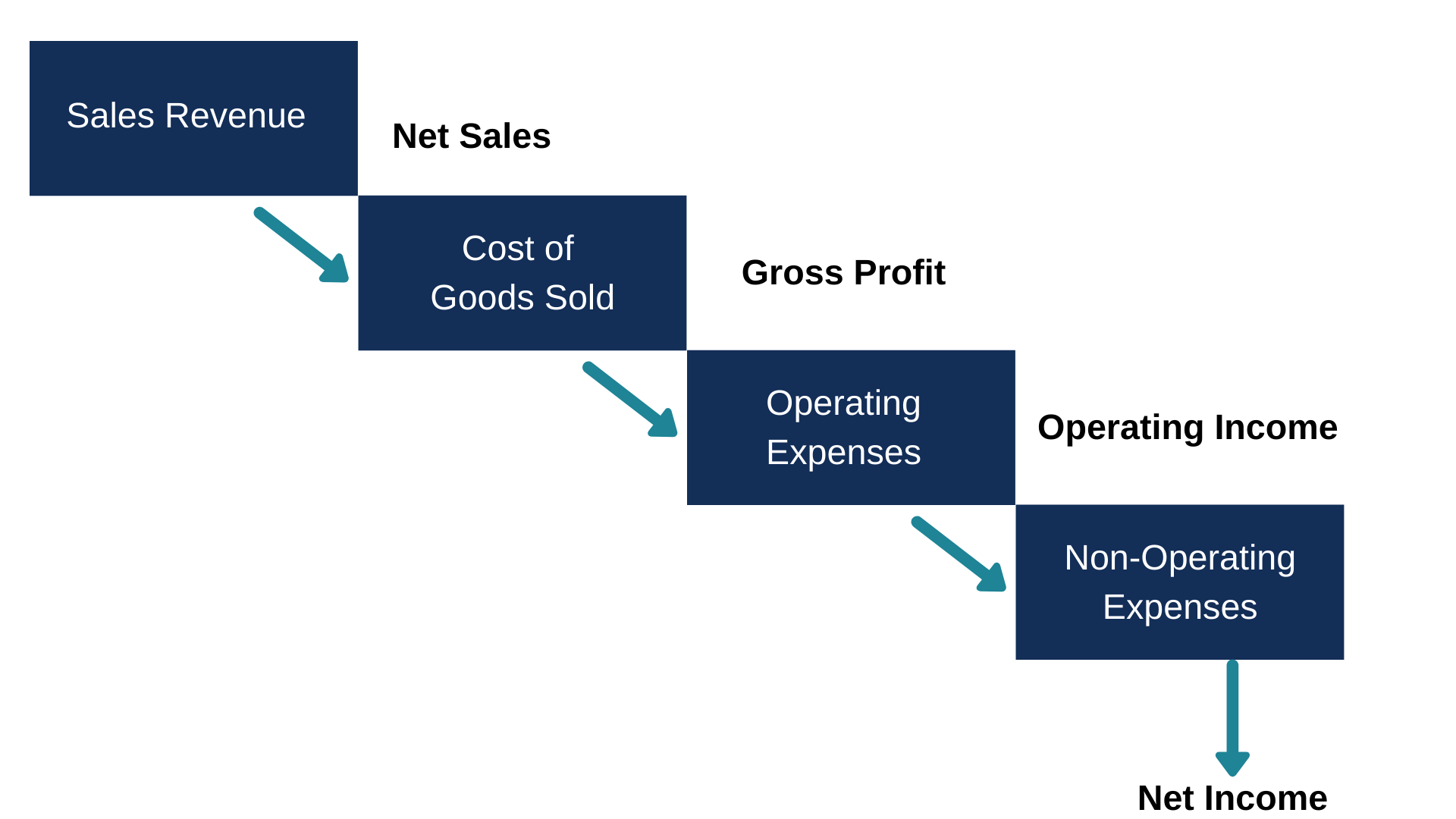

Updated june 24, 2022 operating expenses are those expenses incurred during regular business operations. There are three formulas to calculate income from operations:

Here’s the formula of operating expenses: To calculate income from operations, just take a company's gross income and subtract the operating expenses. On the income statement, the section for operating expenses can be found below gross profit and.

The operating costs are deducted from the gross income to. Operating income = gross profit. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

For the calculation of net profit first, we will calculate the following values.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)