Matchless Info About Dividend Declared Cash Flow Statement

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally.

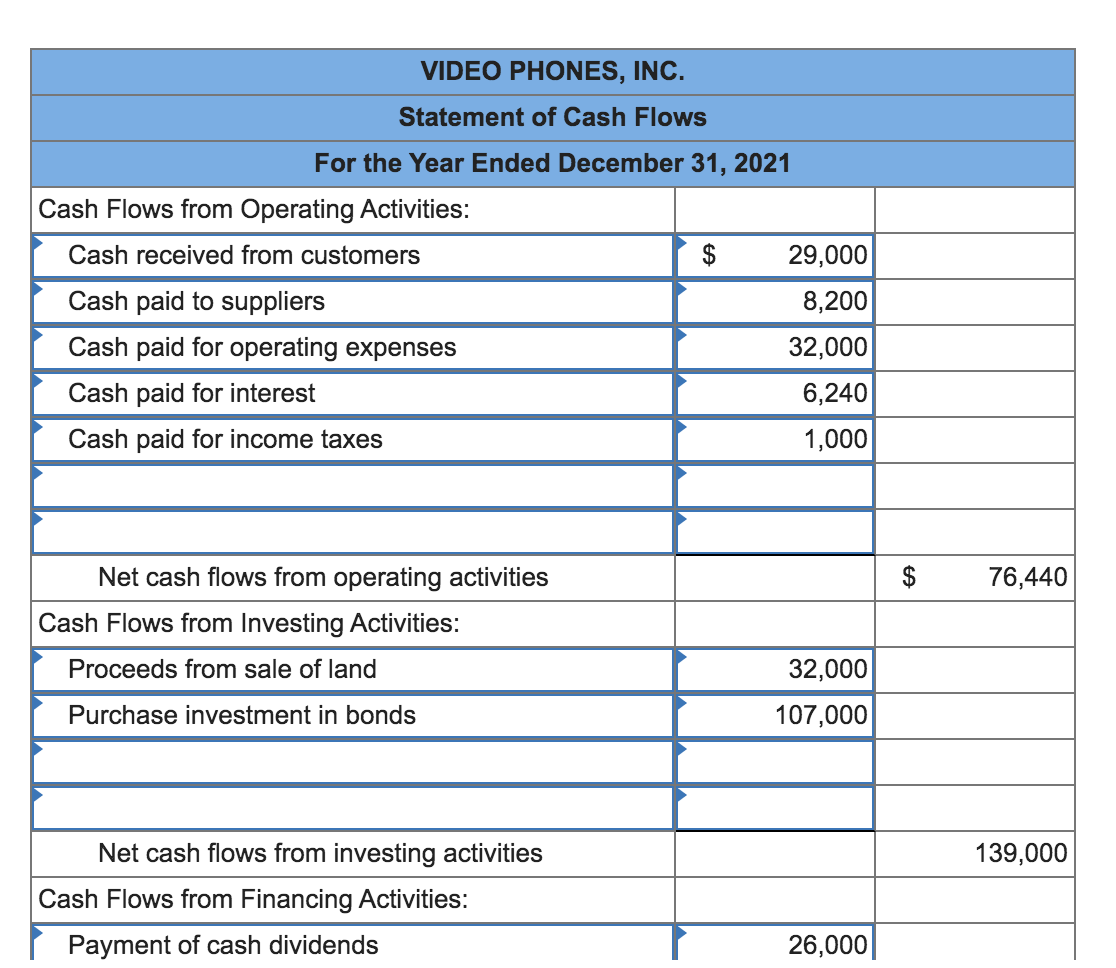

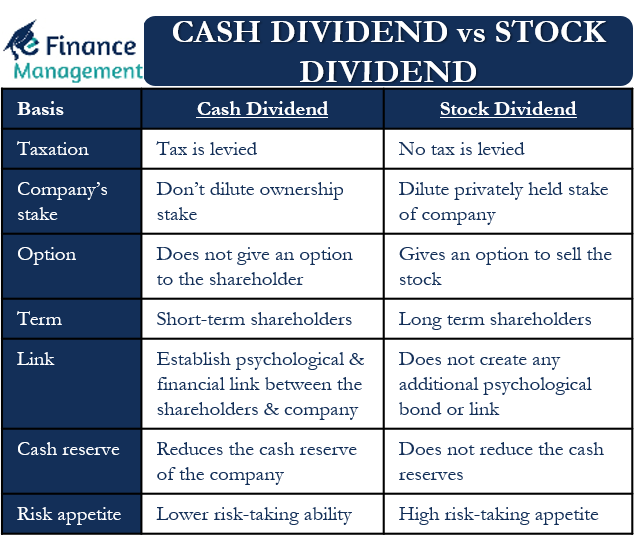

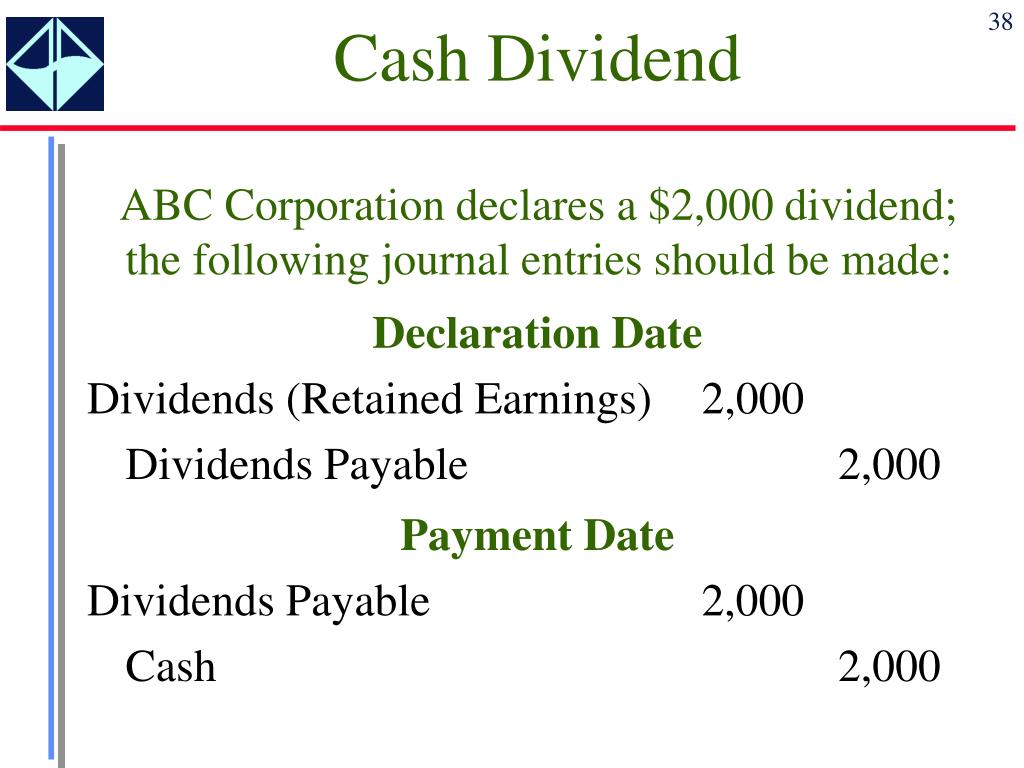

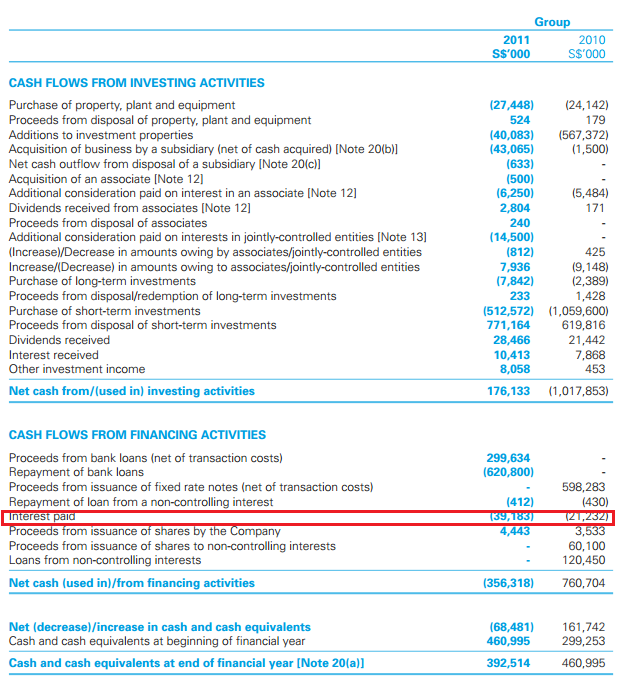

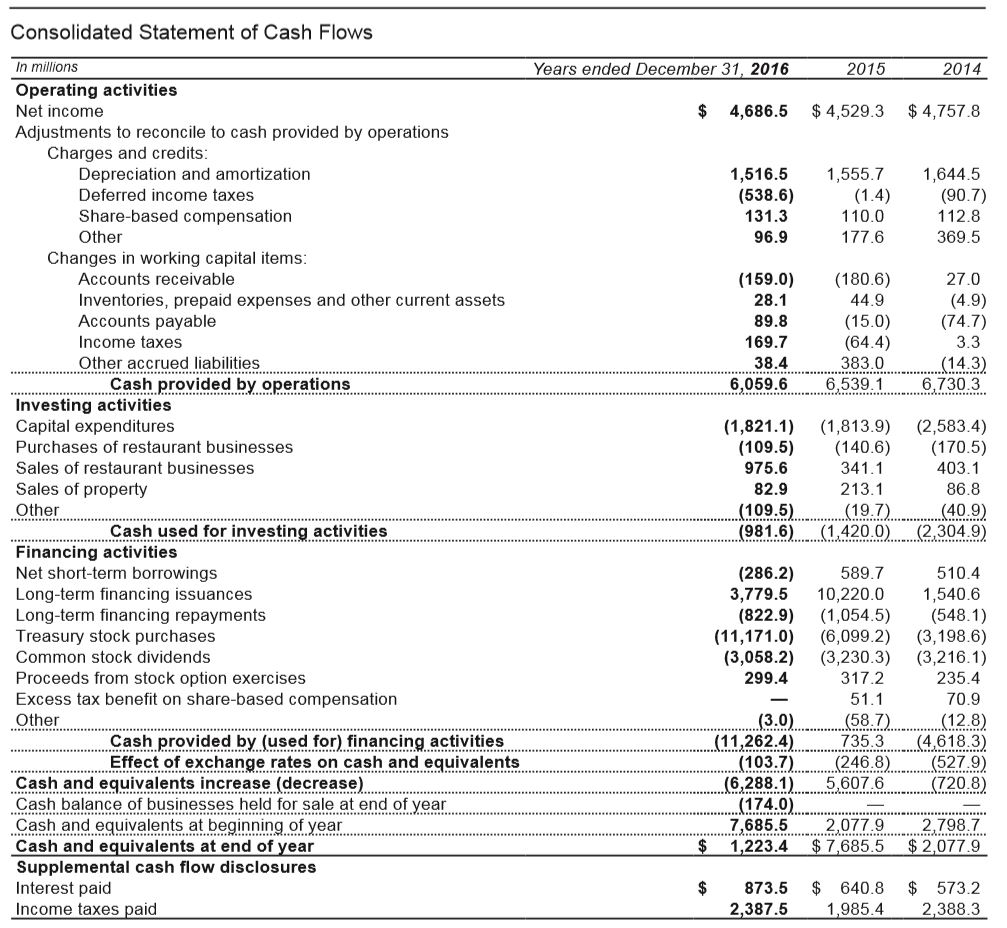

Dividend declared cash flow statement. The income statement is not affected by the declaration and payment of cash dividends on common stock. Dividends paid may be classified as a financing cash flow because they are a cost of obtaining financial resources. In the case of dividends paid, it would be listed as a use of cash for the period.

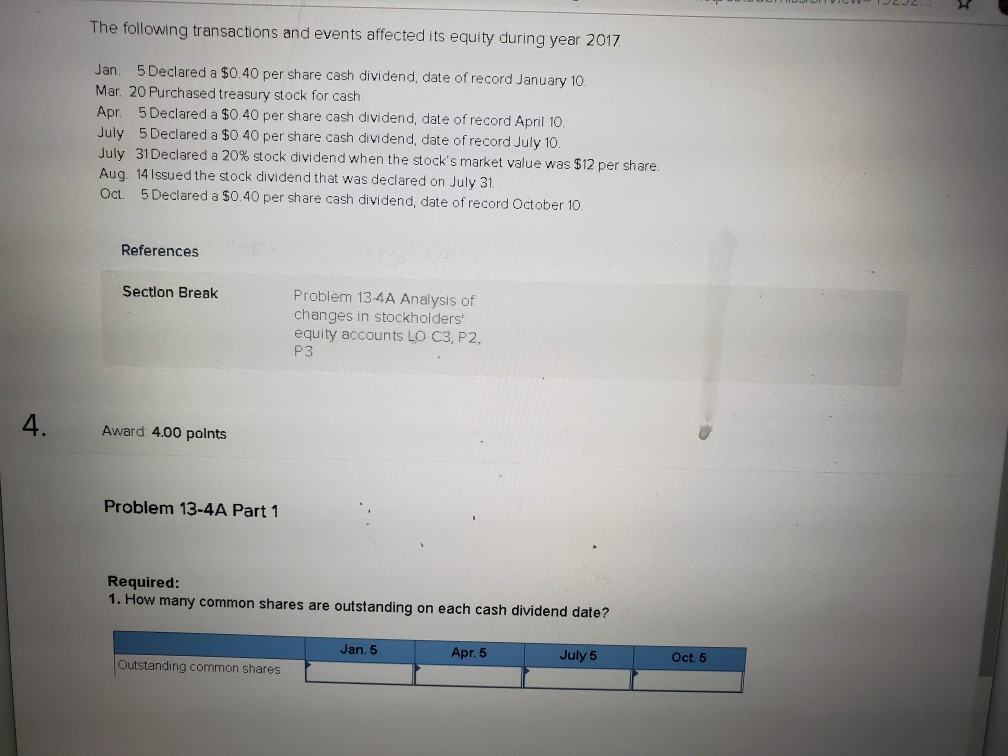

During 2010, cash dividends of $50,000 were paid and a stock dividend of $30,000. It’s listed in the “cash flow from financing activities” section. Each financing activity transaction is listed on its own line on the statement of.

Dividends in the statement of cash flows. How do dividends impact cash flow? Retained earnings at 1/1/1x was $150,000, and at 12/31/1x, it was $200,000.

To determine how much outward cash flow results from a dividend payment, you have to know the amount of the dividend and the number of shares outstanding. This is the sole impact that dividend issuance. Statement of cash flows as a use of cash under the heading financing activities statement of stockholders' equity as a subtraction from retained earnings

For instance, if a company has 1. The dividends declared and paid by a corporation in the most recent year will be reported on these financial statements for the recent year: In summary, on the cash flow statement, dividends paid to shareholders are reported as cash outflows in the financing activities section.

According to the definitive international statement on this, international accounting standards (ias) 7, statement of cash flows: In the absence of retained earnings, cash. Dividends are classified under current liability because the cash payments are typically made within a few weeks of the announcement.

This part of the cash flow statement shows all your business’s financing activities, including transactions that involve equity, debt, and dividends. As cash dividends are cash outflows, they are shown as negative numbers in the financing section of the cash flow statement (examined in detail in chapter 8). Cash dividends declared are generally reported as a deduction from retained earnings.

Stock dividends have no impact on the cash. Cash dividends affect the cash and shareholder equity on the balance sheet; This is included in the cash flow from financing activities section of the report.

They are presented separately from other cash flow activities to provide transparency and highlight the impact of dividend distributions on a company’s cash flow position. When a corporation declares a dividend, it debits its retained earnings and credits a liability account called dividend payable. The answer to this is not so straightforward.

Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. Treatment of proposed dividend in cash flow statement dividend can appear in the question in the following names: (however, the cash dividends on preferred stock are deducted from net income to arrive at net income available for common stock.) the statement of cash flows will report the amount of the cash dividends as a use of cash in the financing.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

-page-001.jpg)