Smart Info About Accounting Treatment For Dividend Paid

A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment.

Accounting treatment for dividend paid. And final dividends may be declared by the company in. Dividend is usually declared by the board of directors before it is paid out. This account records all dividends paid by the company to its stockholders during a given period.

It also addresses other related matters such as: A dividend is a share of profits and retained earnings that a company pays out to its shareholders and owners. Accounting treatment for cash dividends.

Acca has a technical factsheet guide which looks at company law, reporting, and tax issues to provide a broad overview of issues in relation to dividends and distributions in specie. Then you can credit the dividends payable account on the date of declaration. That’s what makes the dividend champions so special.

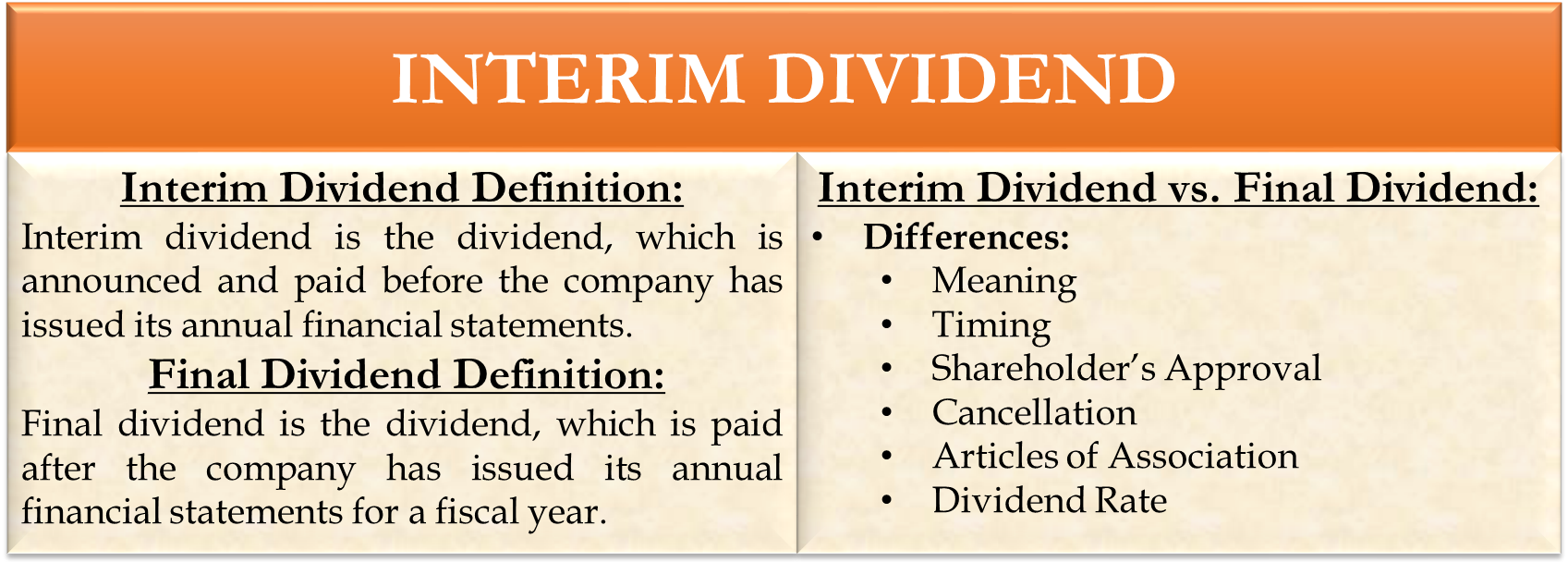

Interim dividends may be paid by directors from time to time; Companies are not required to issue dividends on common shares of stock, though. Record the dividend as a liability accounting specialists record dividends as a liability under standard accounting procedures.

The balance on the dividends account is transferred to the retained earnings, it is a distribution of retained earnings to the shareholders not an expense. For corporation tax act, cta10/s1168 (1) says ‘for the purposes of the corporation tax acts dividends shall be treated as paid on the date when they become due and payable’. When the company actually pays the dividend, enter the date of payment.

Property dividends in certain instances, a company may choose to pay a dividend with assets other than cash. For instance, when the company in the above example pays its shareholders dividends of $10,000, it must use the following accounting treatment to record the transaction. If followed this year, eligible alaskans would receive a roughly $3,400 dividend, but the budget would be close to $1 billion in deficit.

4.4.3 dividend in kind a dividend in kind is paid by distributing property of the reporting entity, so is considered a nonmonetary transaction. Companies’ articles often provide that: In this article, we discuss what dividends are, describe how a company may pay them out and list steps to show you how to account for them in a company's financial books.

The total cash dividend to be paid is based on the number of shares outstanding is: What is the accounting for stock dividends? Cash dividends declared are generally reported as a deduction from retained earnings.

Proper accounting for dividends ensures that a company's books remain complete and balanced. The dividends account is a temporary equity account in the balance sheet. This means that cash dividends reduce the retained earnings of a company, which impacts its overall.

If a corporation issues less than 25 percent of the total amount of the number of previously outstanding shares to shareholders, the transaction is accounted for as a stock dividend. Dividend paid is the timeline when the declared dividends are actually. The accounting for dividends paid involves recording the distribution in the company’s financial statements, reflecting the impact on relevant accounts.

![[Solved] need help on 16 Match the accounting treatm](https://media.cheggcdn.com/study/fec/feccbbf8-1039-4e1d-af79-14647887c103/image)