Awesome Tips About Form 26as Income Tax Department

Form 26as is an annual declaration that shows the amount of tax levied against a taxpayer.

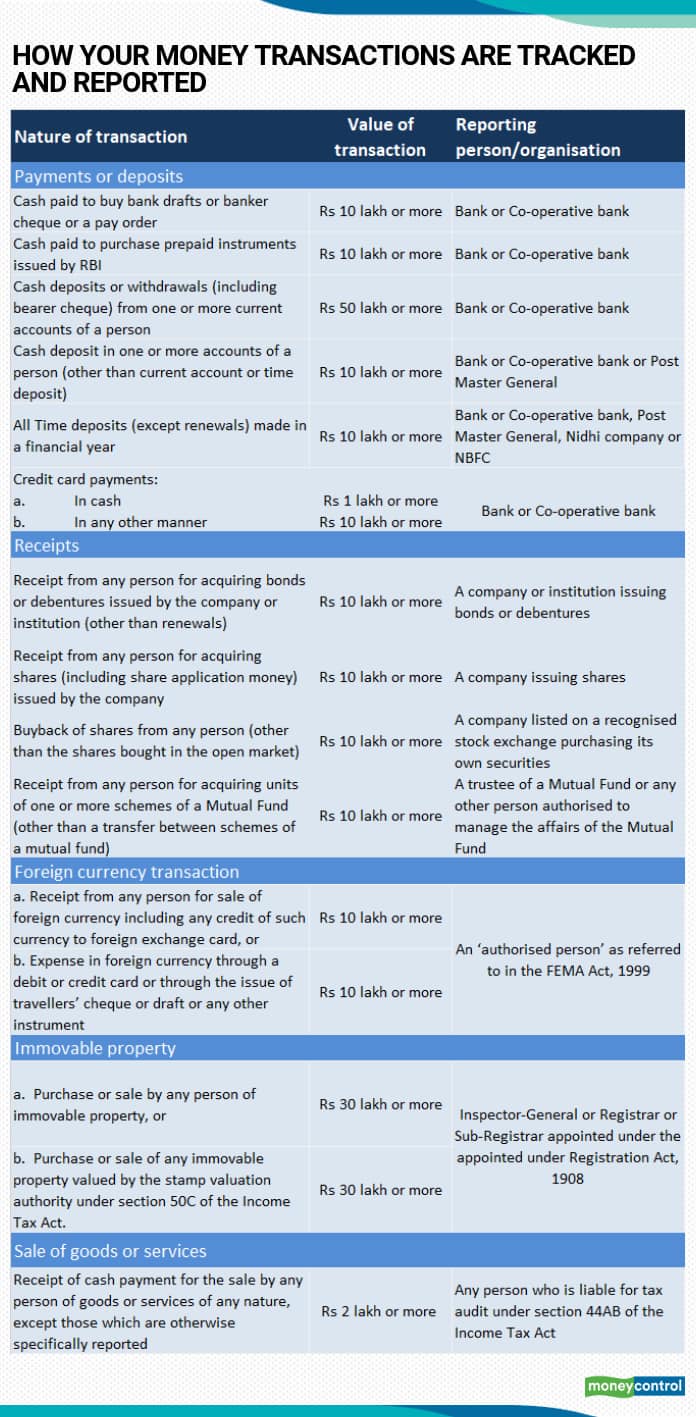

Form 26as income tax department. The income tax department has expanded the scope of information to be reported in the new form 26as. Here are some steps to easily download form 26as on the new income tax portal. The central board of direct taxes (cbdt) has issued.

Old form 26as was used to contains information such as income. The website provides access to the pan holders to view the details of tax credits in form 26as. Form 26as contains the details of taxes paid and compliance information.

The income tax department of india records whatever tax taxpayers pay on their income or if the department deducts any taxes from the income of the. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. The kolkata bench of customs, excise and service tax appellate tribunal (cestat) has held that merely on the basis of form 26as issued by the income tax.

The days of manually filing it returns by downloading. Ais is an annual information statement launched by the income tax department. Following are the major information accommodated in form 26as.

Form 26as means. If you are not registered with traces, please refer to our e. Form 26as, often known as the tax credit statement, is a crucial record for filing taxes.

Eligible outstanding direct tax demands have been remitted and extinguished. You can find information related to your income on which tax has. Details provided in the form:

The income tax department has notified new revamped form 26as on may 28, 2020 [1]. Locate and select the form 16 option from the frequently used forms section. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and.

Do not forget to check status of pan of the deductee.