Fantastic Info About Dividend Paid In Profit And Loss Account

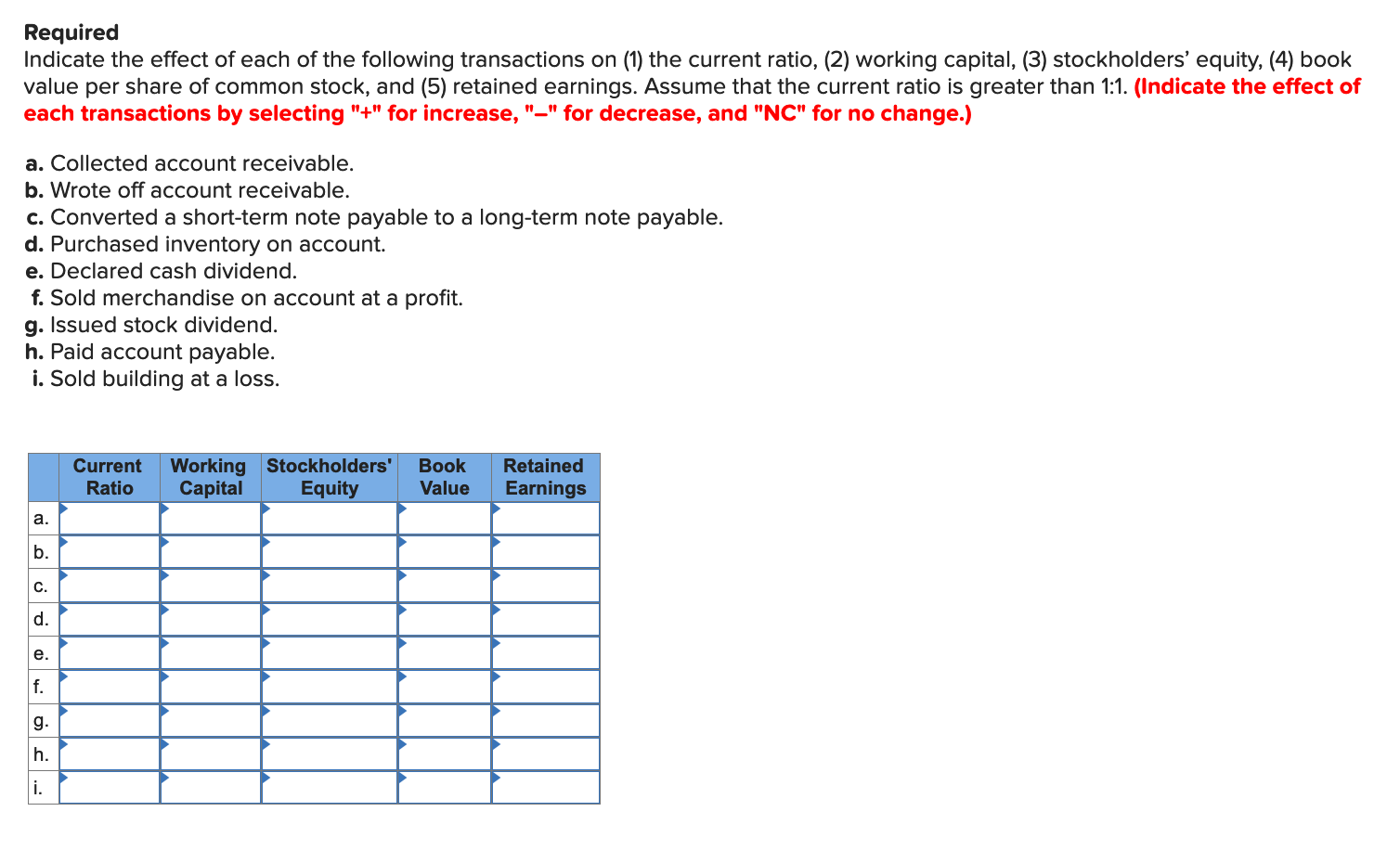

Thomas brock fact checked by michael logan cash dividends offer a way for companies to return capital to shareholders.

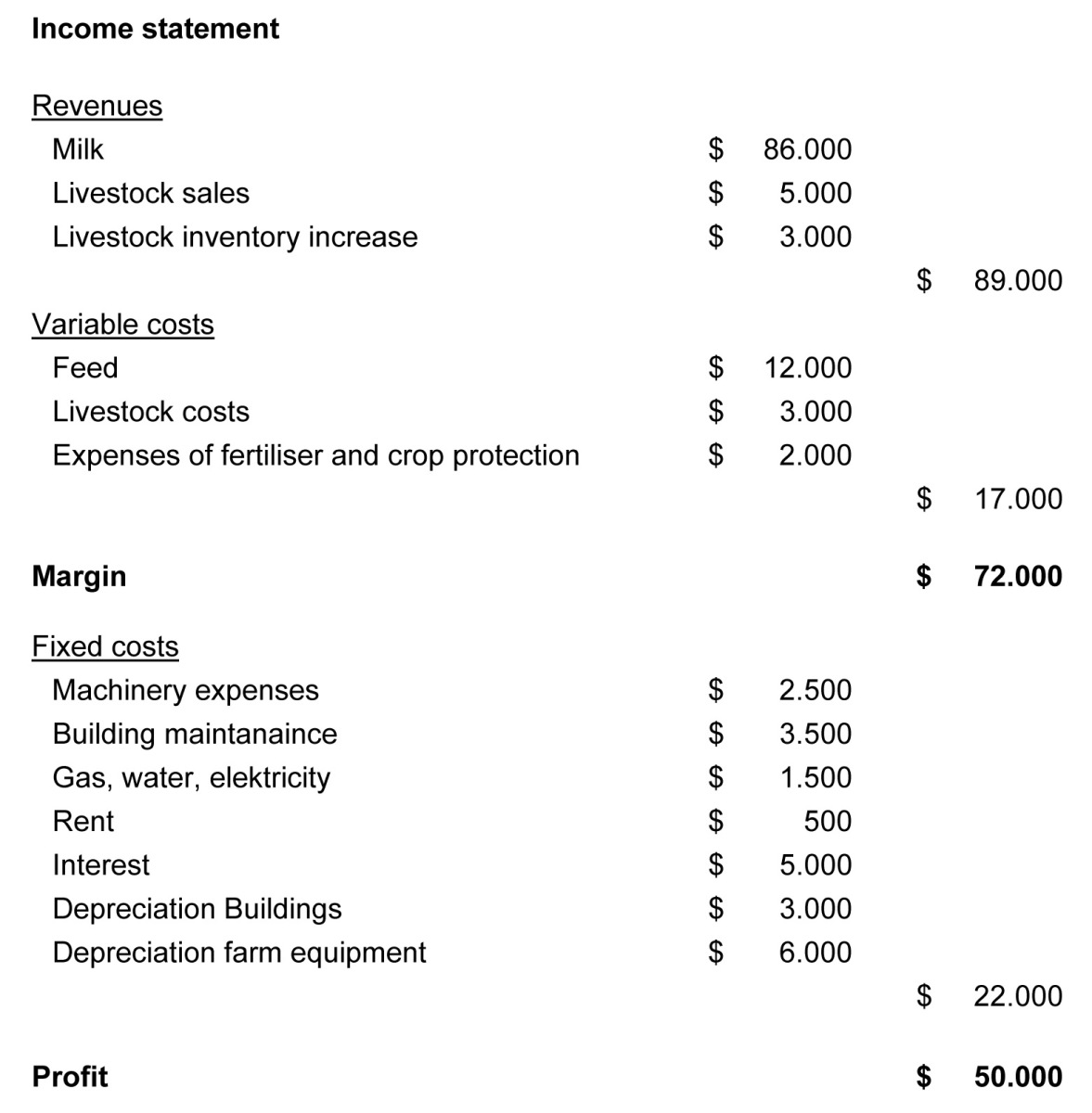

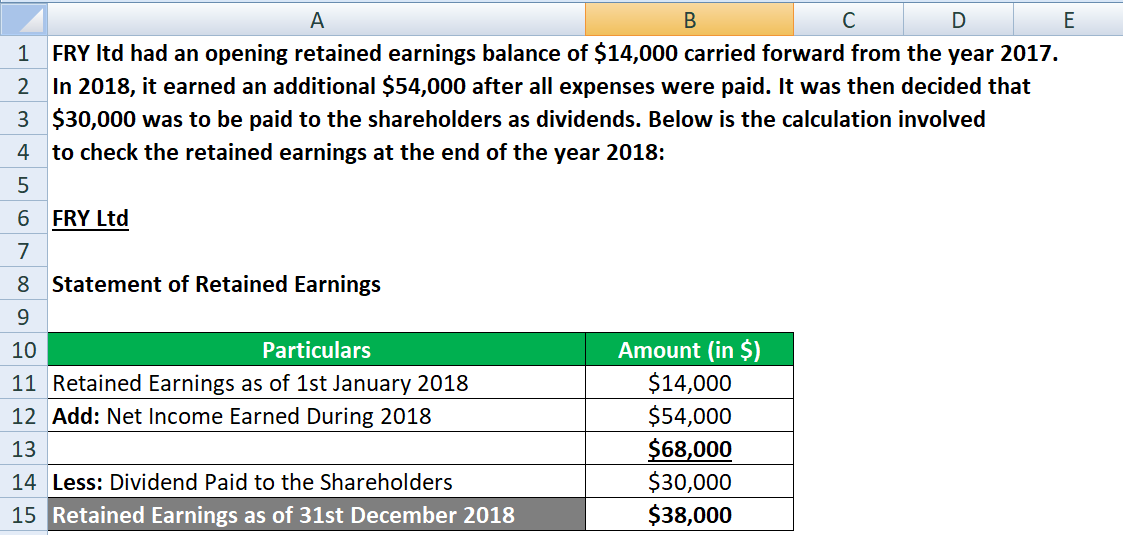

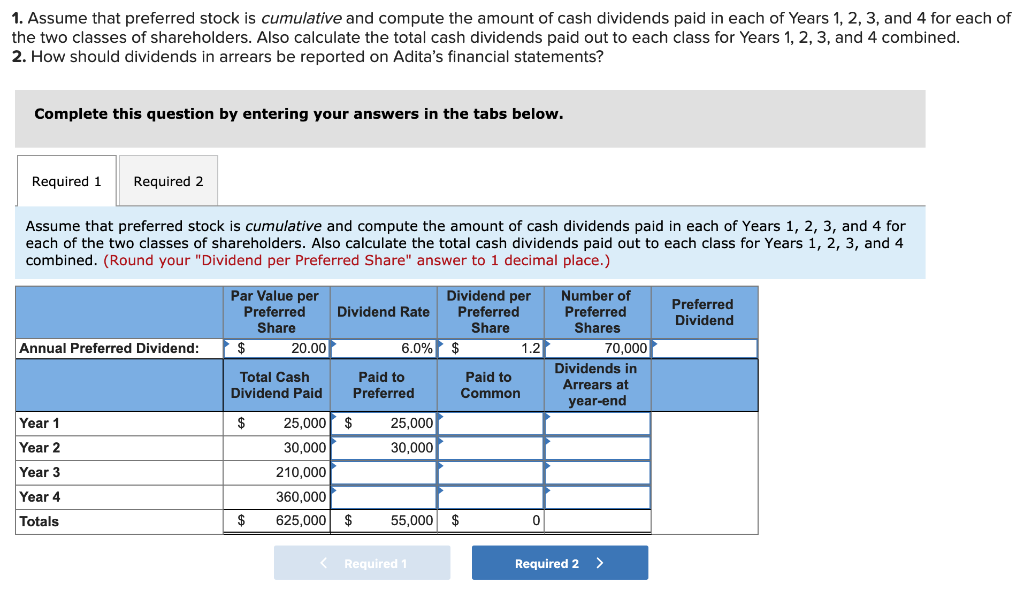

Dividend paid in profit and loss account. For business expenses, they are charged in the profit and loss account whereas for dividends paid, they are treated as appropriations. The directors’ salary or remuneration. So if a company had £10,000 undrawn profits at the start of the year and had made £1,000 of profits after tax so far this year, they might want to pay a dividend of £11,000 but it.

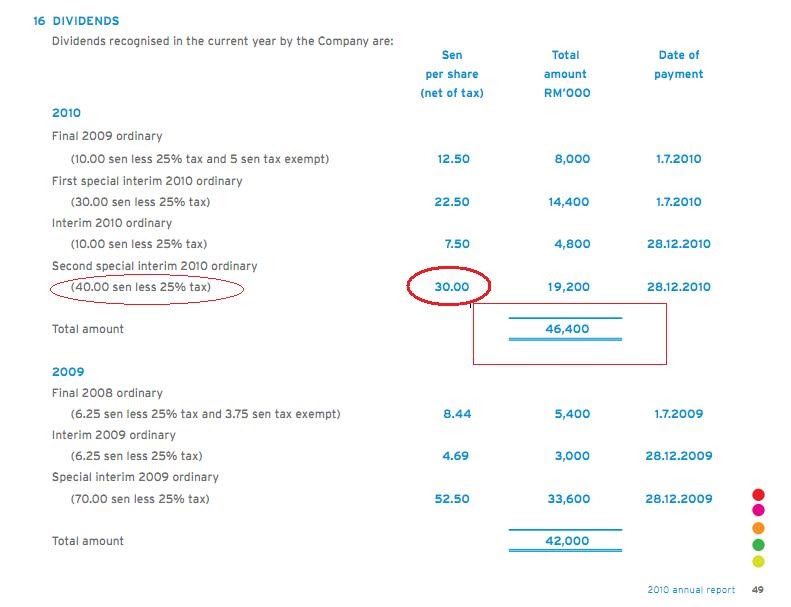

The dividend amount is decided by the board of directors of a company and then agreed by the. For investors, dividends serve as a reward, a share in the profits. Paying the dividends reduces the amount of retained earnings stated in the balance sheet.

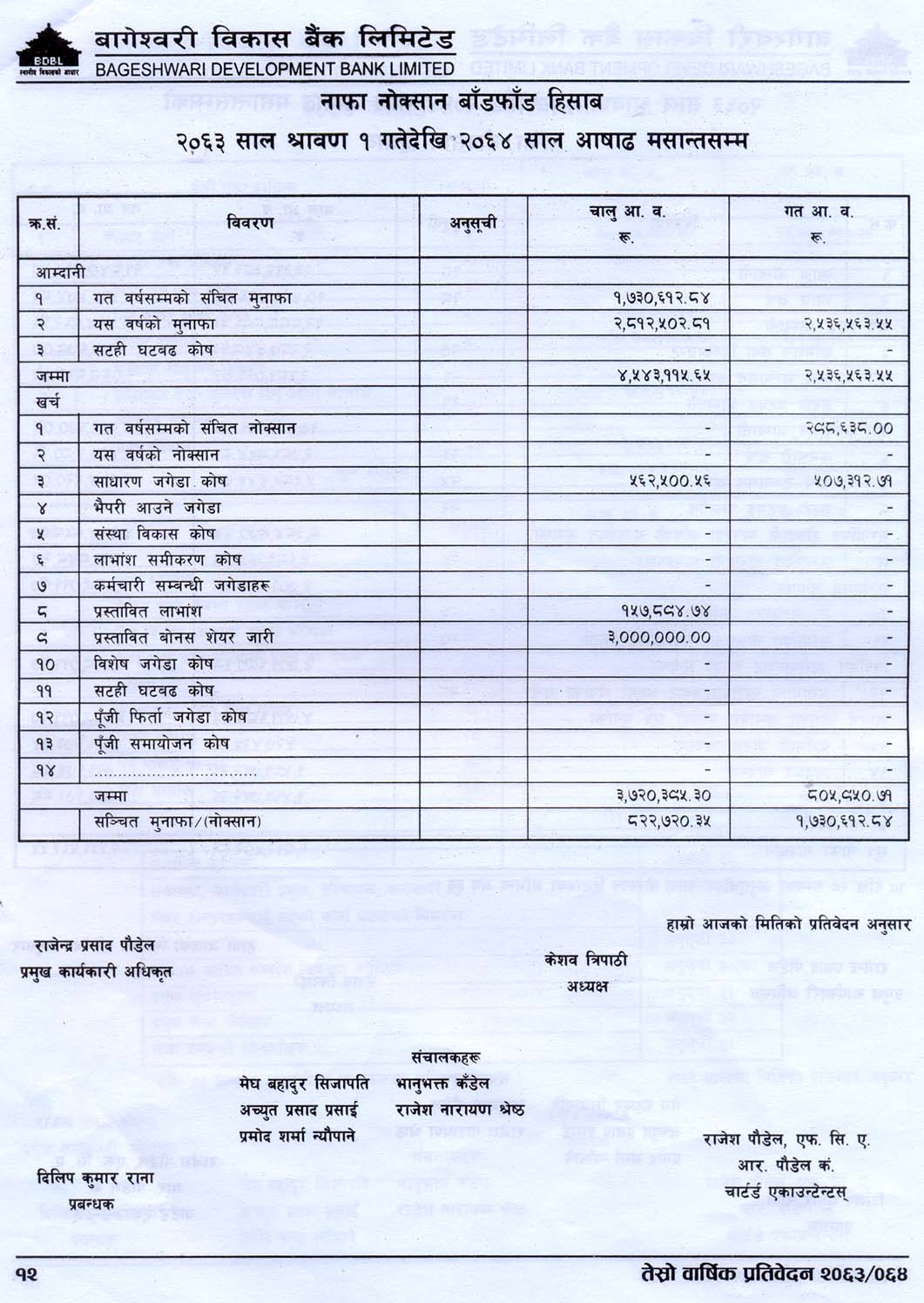

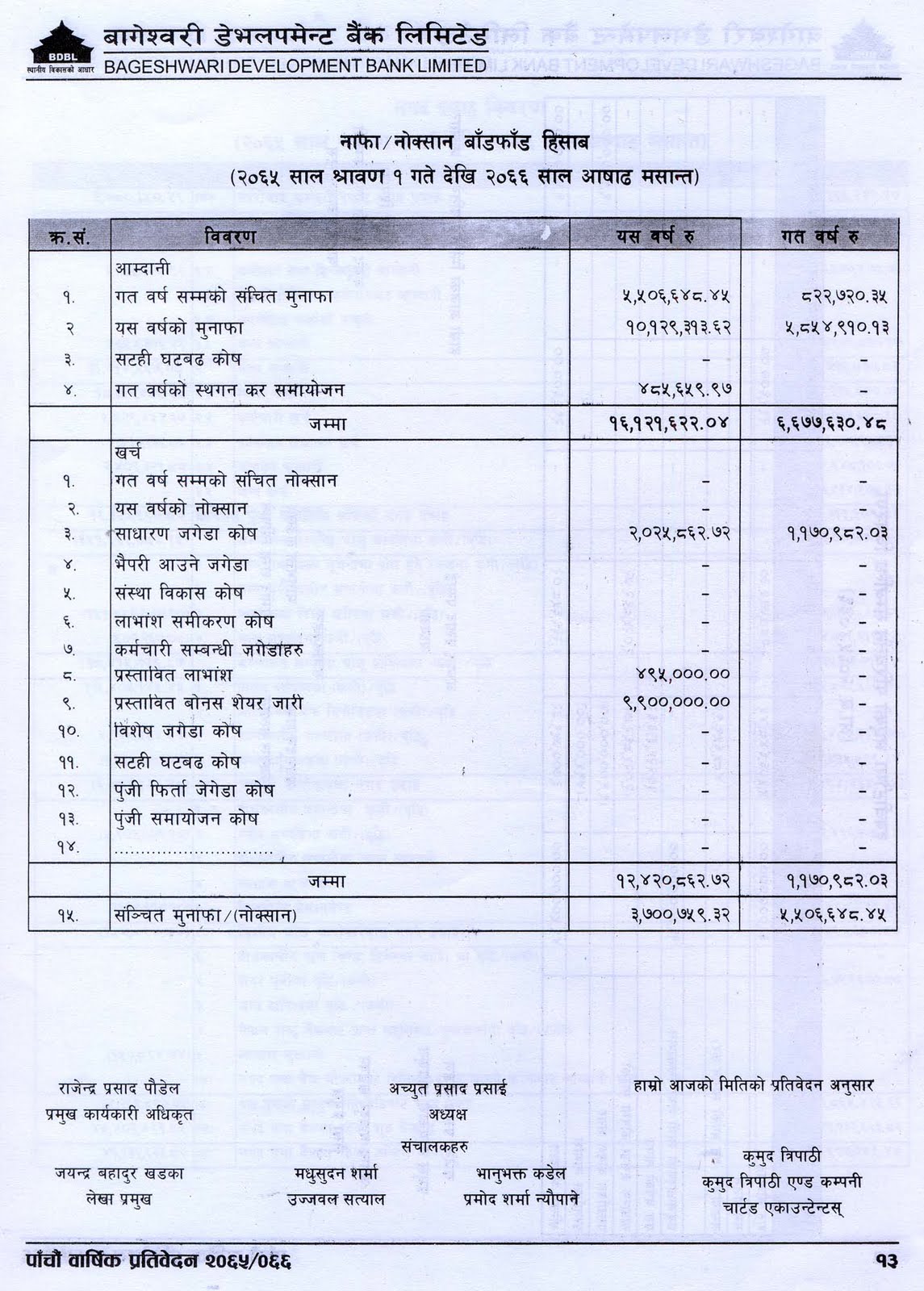

Dividends aren't allowable for corporation tax because they are distributions of after tax profits. The first step is when the board of directors of the. Consolidated statement of profit and loss.

Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment.

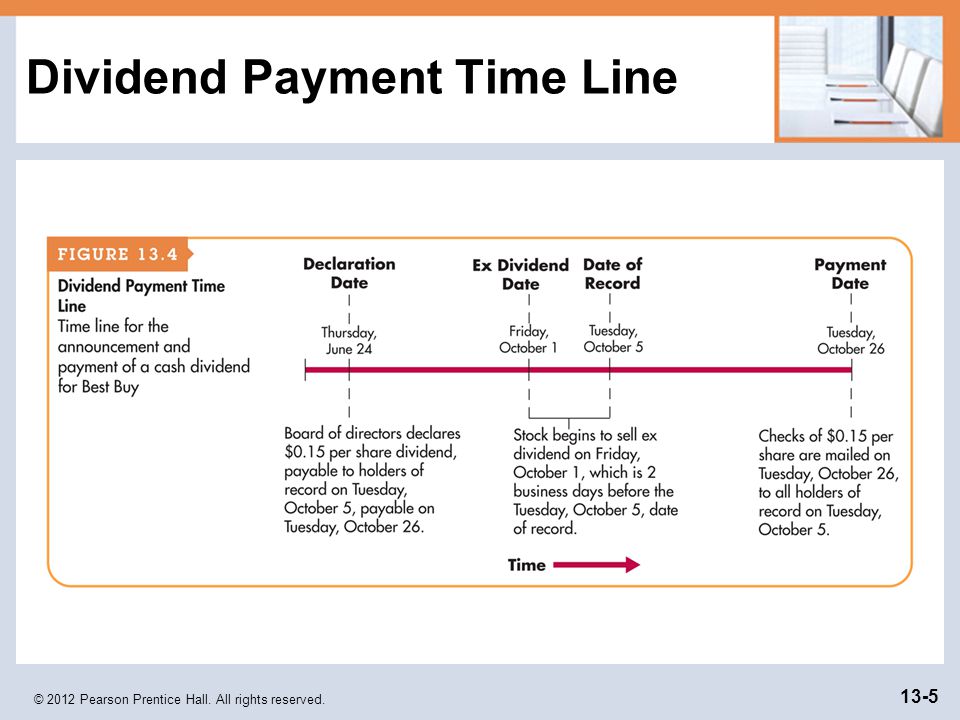

1 recognize when to record the liability of the company to pay the cash dividends. Simply reserving cash for a future dividend. Companies are not required to issue dividends on.

Dividends in the balance sheet. This occurs on the date of declaration, when the board of directors formally. The deal is that the company pays 20% tax (assuming it's small) on its.

The dividend account acts as part profit and loss account and part balance sheet account. It does not affect any element of the trading profit or the profit. The dividends declared and paid by a corporation in the most recent year will be reported on these financial statements for the recent year:

If the corporation’s board of directors declared a cash dividend. A cash dividend primarily impacts the. Dividends are payments made by companies to their shareholders out of their profits or reserves.

Before dividends are paid, there is no impact on the balance sheet. Photo by gavin young/postmedia. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

Statement of cash flows as a use of. Dividends are part of the appropriation of a company's profit. Updated may 23, 2021 reviewed by margaret james cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)