Great Info About Debt On Income Statement

In this article, we will have an in.

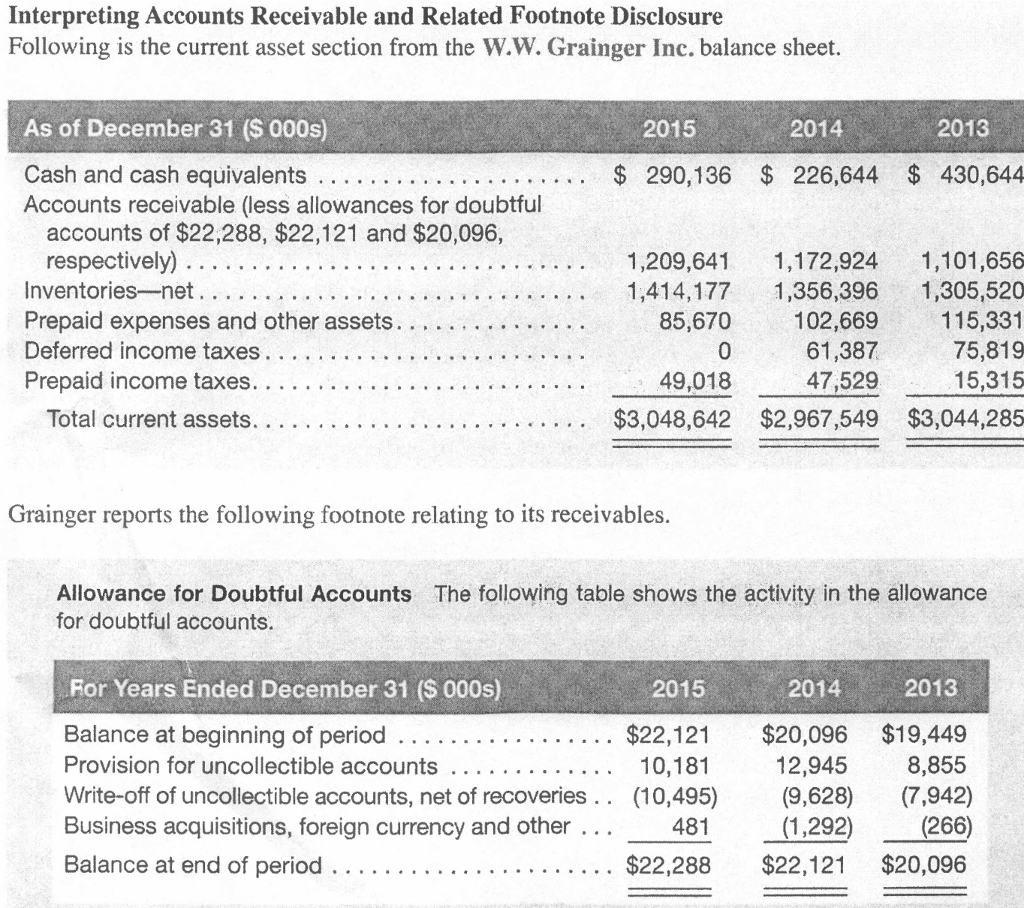

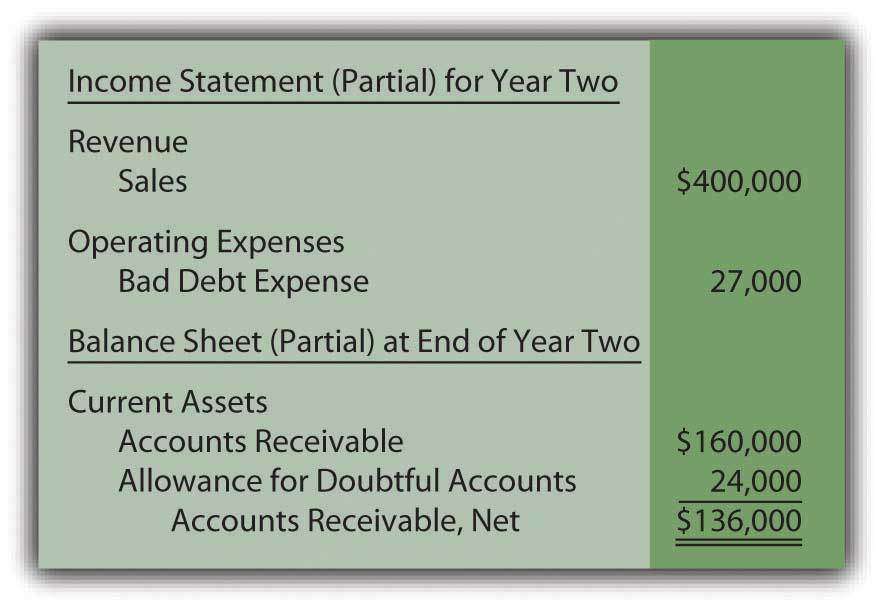

Debt on income statement. Debt settlement is when you work with a debt relief company to resolve your debts, potentially lowering your debt by as much as 20%. February 21, 2024 at 11:44 am pst. Bad debt expense occurs as a result of a customer being.

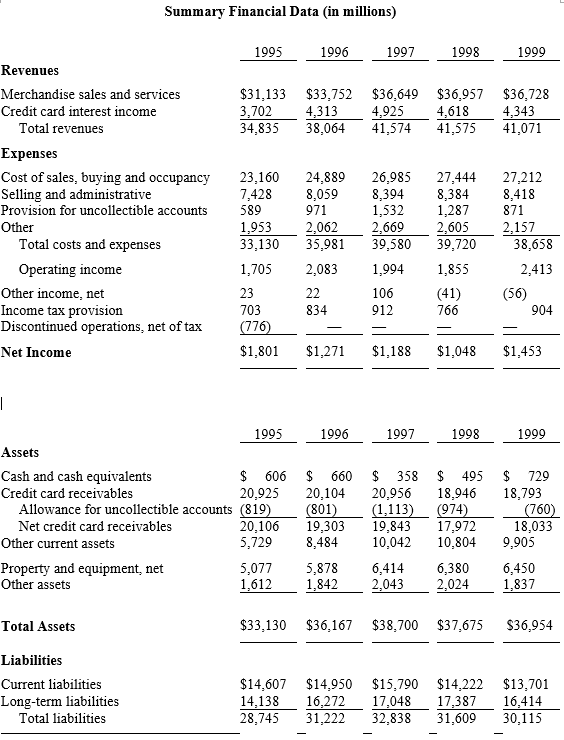

Each of the financial statements provides important. They show you the money. Bad debt expense represents the amount of uncollectible accounts receivable that occurs in a given period.

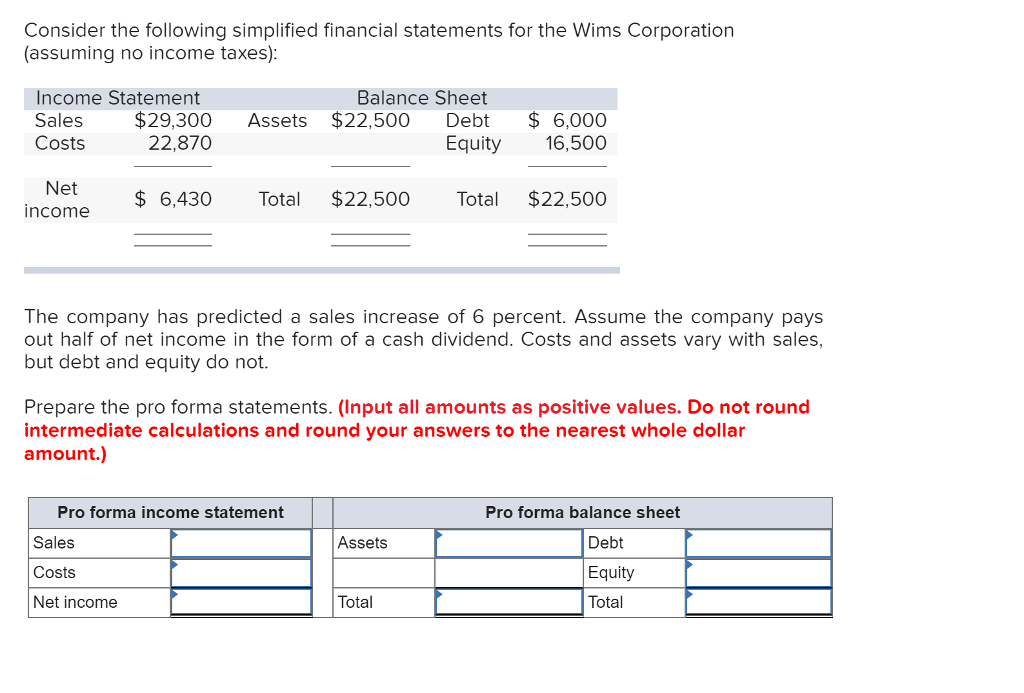

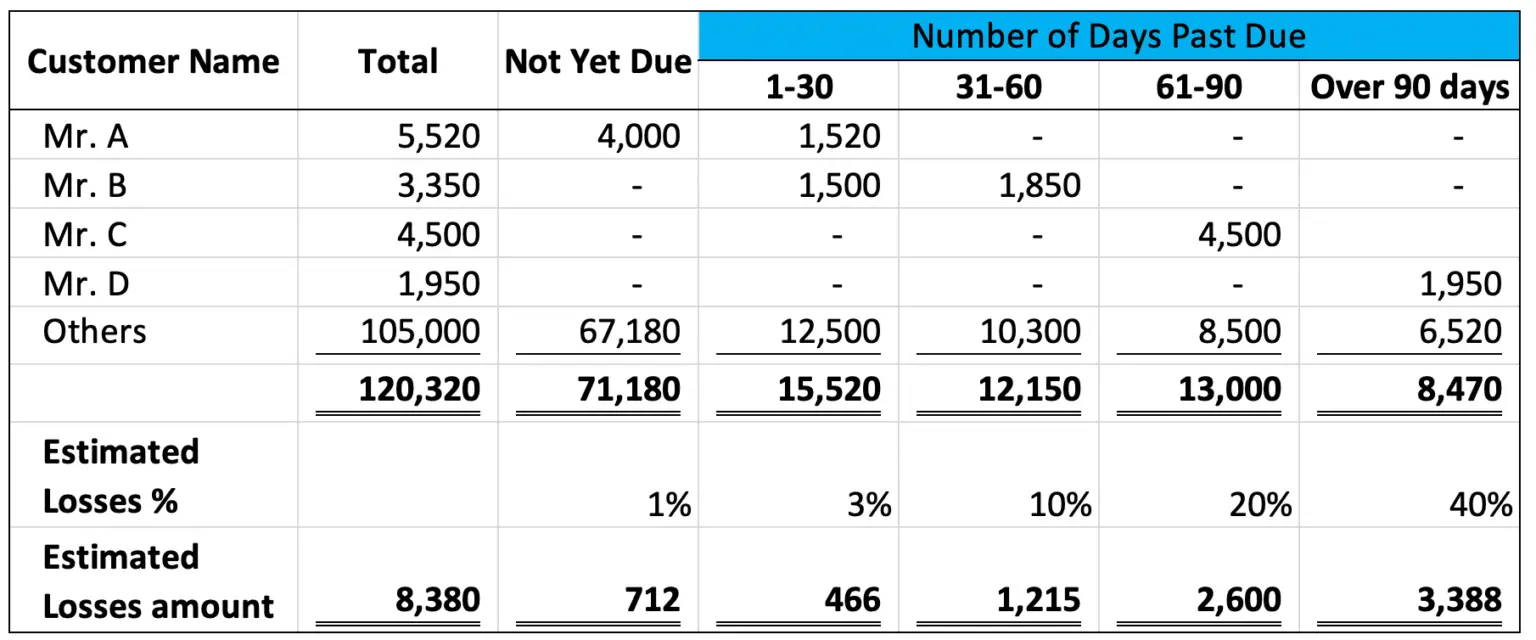

On the income statement, the bad debt expense is recorded in the current period to abide by the matching. What is an income statement? Balance sheets show the value of a company at a specific point in time.

So, in one of the. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the. The three financial statements are:

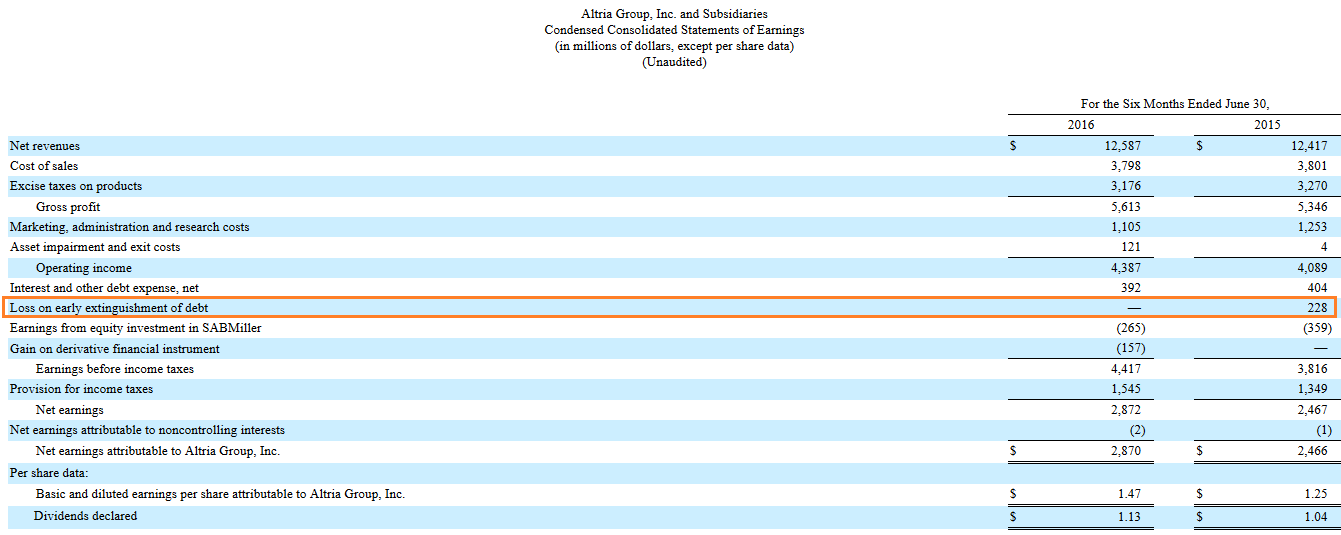

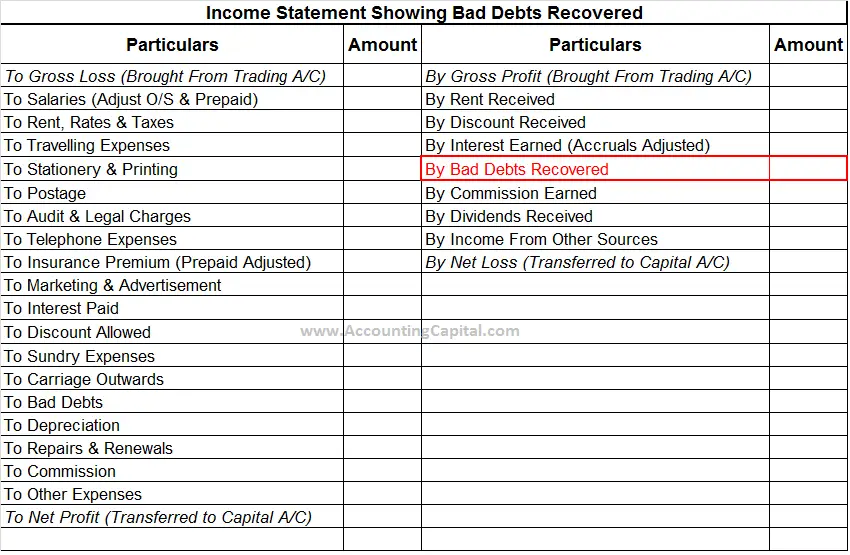

An income statement is a financial statement that reports the revenues and expenses of a company over a specific. This article explains how to treat the main possible. As we can see, the term ‘bad debt’ comprises of.

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Well, that’s what financial statements do.

They show you where a company’s money came from, where it went, and where it is now. Are bad debts recorded in income statement? President joe biden ’s administration announced that more than 150,000 borrowers will receive $1.2 billion in.

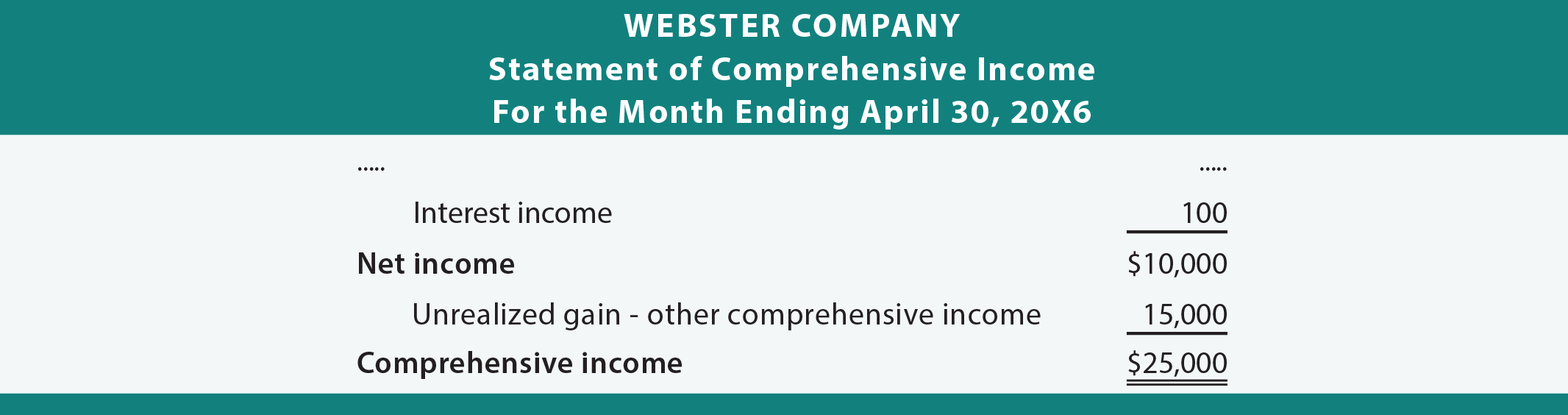

An income statement, or profit and loss (p&l) statement, gives an overview of how much money a business made or lost during a specific time. Income statements focus on revenue and expenses. Asc 205, presentation of financial statements, and asc 225, income statement, provide the baseline authoritative guidance for presentation of the income statement for all us.

Financial accounting (fa) adjustments to financial statements many candidates struggle with certain adjustments in the exam. Income statements show whether a. This got me slightly confused to be honest friends.

Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write. Settlement lowers your debt. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.