Build A Tips About Interest On Loan In Income Statement

Interest on current & past due loans 15,400 12,000 + 28% interest on.

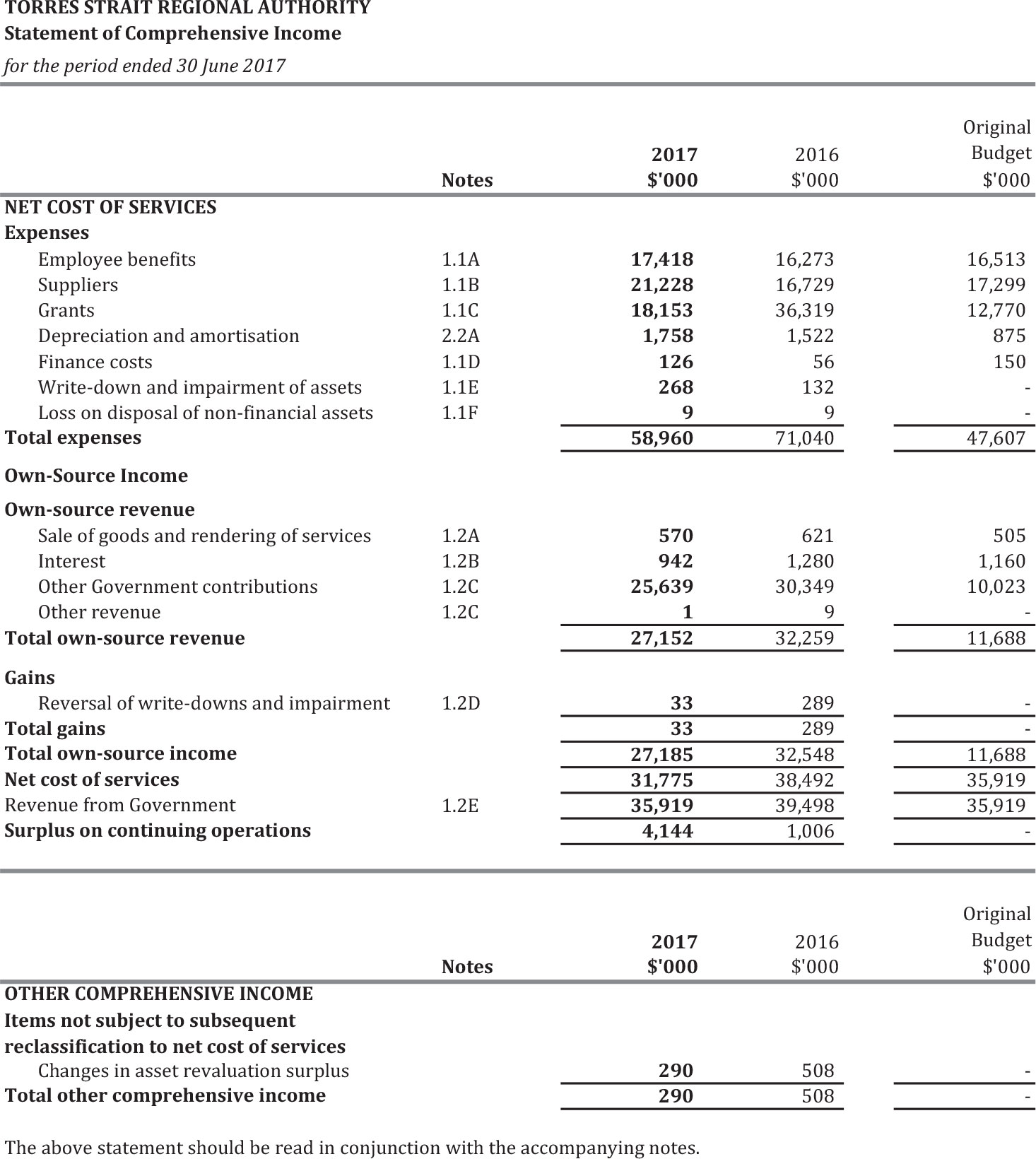

Interest on loan in income statement. Example of a loan principal payment. Interest expense is the cost of borrowed funds. And the statement of financial performance should include $750 interest expense.

Since this data came from quarterly financial statements, multiplying this result. Trump saved on loans by inflating his worth, she argued. R = rate of interest 3.

P = outstanding principal sum 2. Income statement and how the income statement is created. Did you get it ⬇️樂 question:

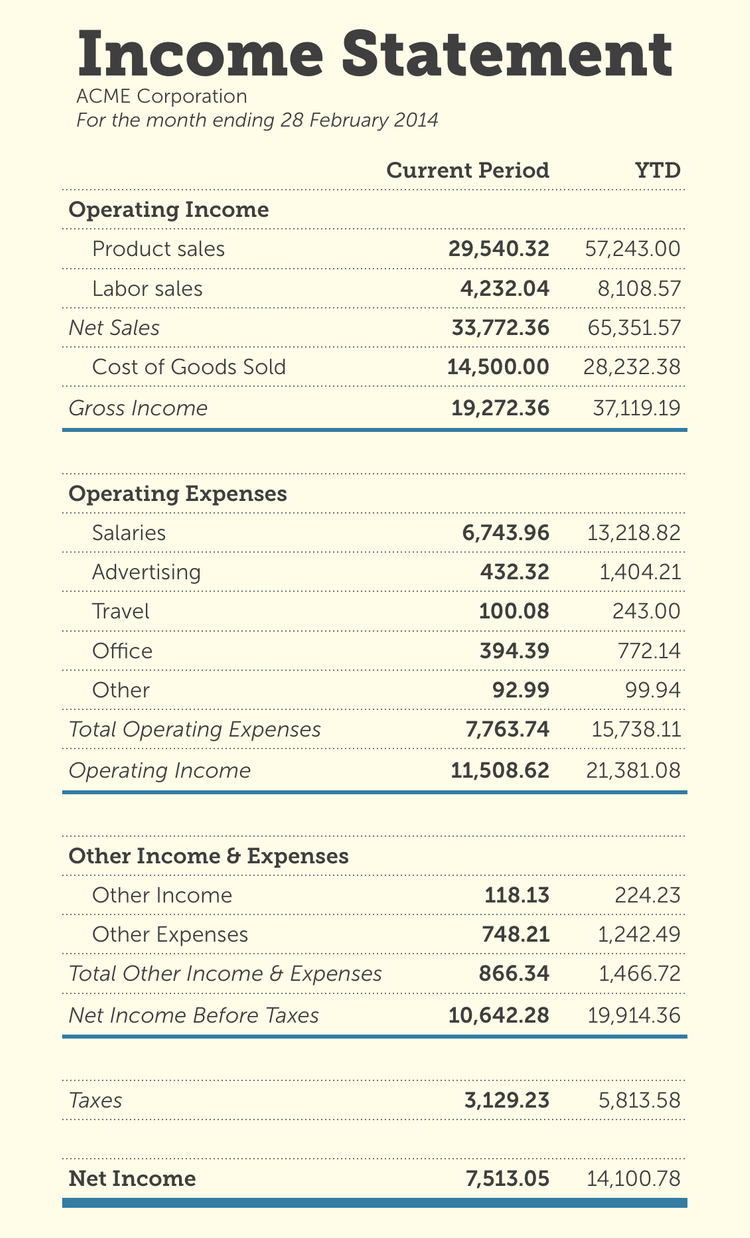

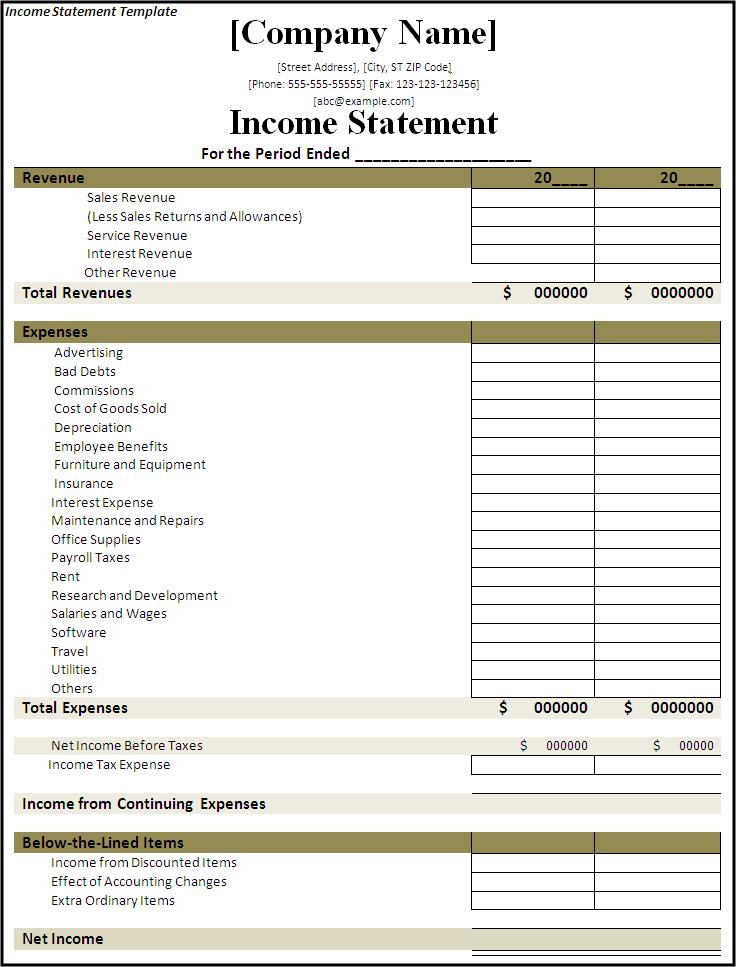

Usually, the two categories in the. Us loans & investments guide. All other costs = $80k;

Monthly loan repayment $3k (calculated based on loan terms), this consists of $1k interest; T = tenure of loan / deposit in the case of periodic interest payment (such as monthly, quarterly, etc.), the equation for interest payment can. The interest on bank loans is usually an expense of the accounting period in which the interest is incurred.

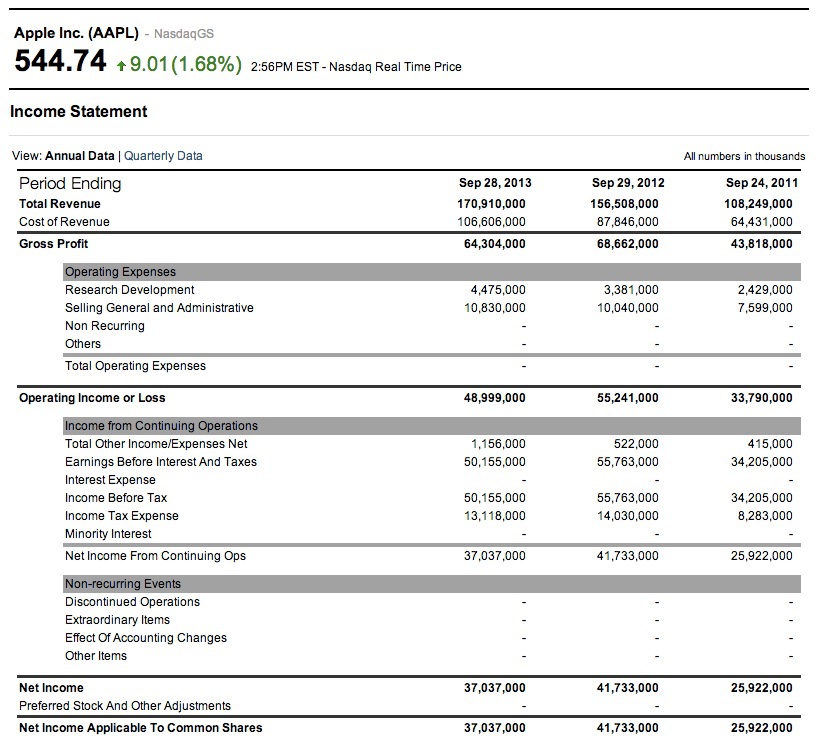

Using the formulas listed, we can determine the periodic interest rate to be 0.45%. Income statement an example of bank of america's income statement is shown below with the following highlights: 6.1 chapter overview — interest income publication date:

Add up all your gains then deduct your losses. The codification does not provide specific guidance on the appropriate income statement classification for certain items included in net income,. Interest expenses that are recorded in the income statement referred to costs charged to the entity by the bank, creditor and other lenders as the result of fund.

Therefore, the interest appears on the income statement and. 31 may 2022 us loans & investments guide interest income is earned by a creditor, investor, or lender as. The interest on the loan will be reported as expense on the income statement in the periods when the interest is incurred.

Here is the formula to calculate interest on the income statement: Interest expense = average balance of debt obligation x interest rate ebit and ebt interest is deducted. The interest income comes out as $84k in 2020, which increases to $92k in 2021 due to the positive rise in the cash.

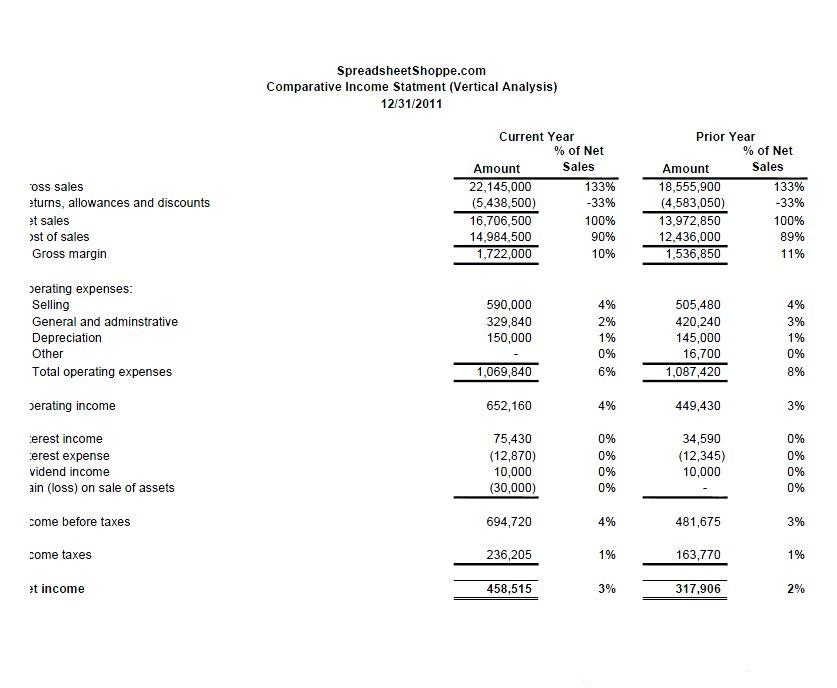

An income statement is a financial statement that reports a company's financial performance over a specific accounting period. In other words, if a company paid $20 in interest on its debts and earned $5 in interest from its savings account, the income statement would only show interest. Of the roughly $355 million that mr.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)