Best Tips About Manufacturing Overhead Balance Sheet

What are manufacturing overhead costs?

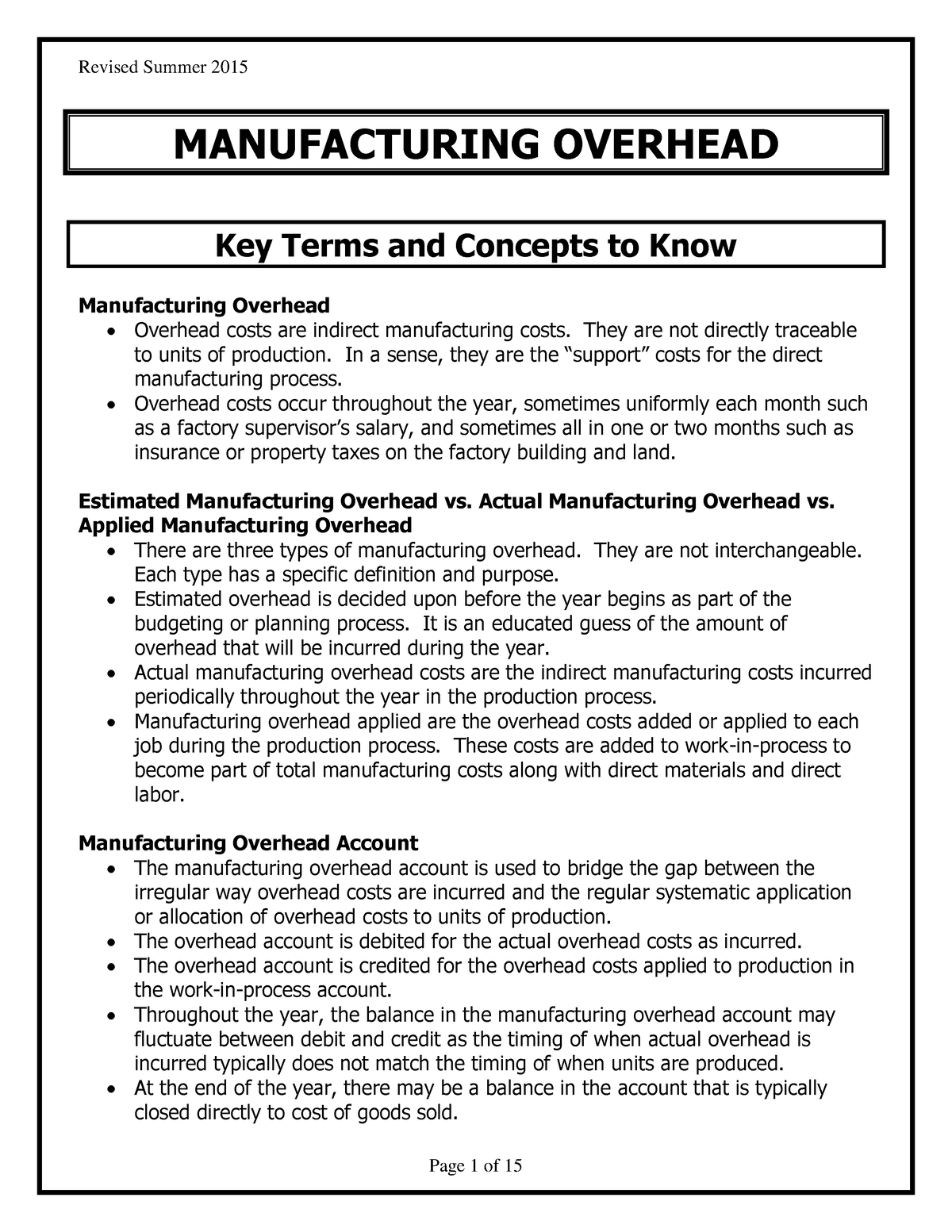

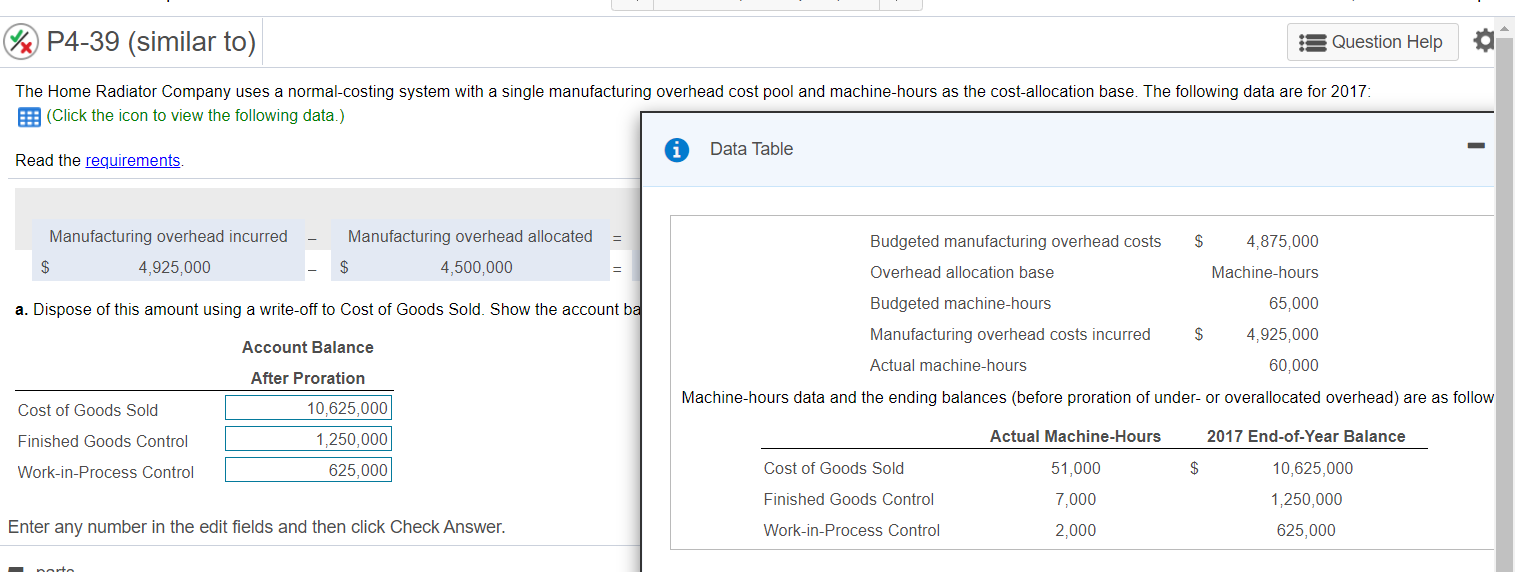

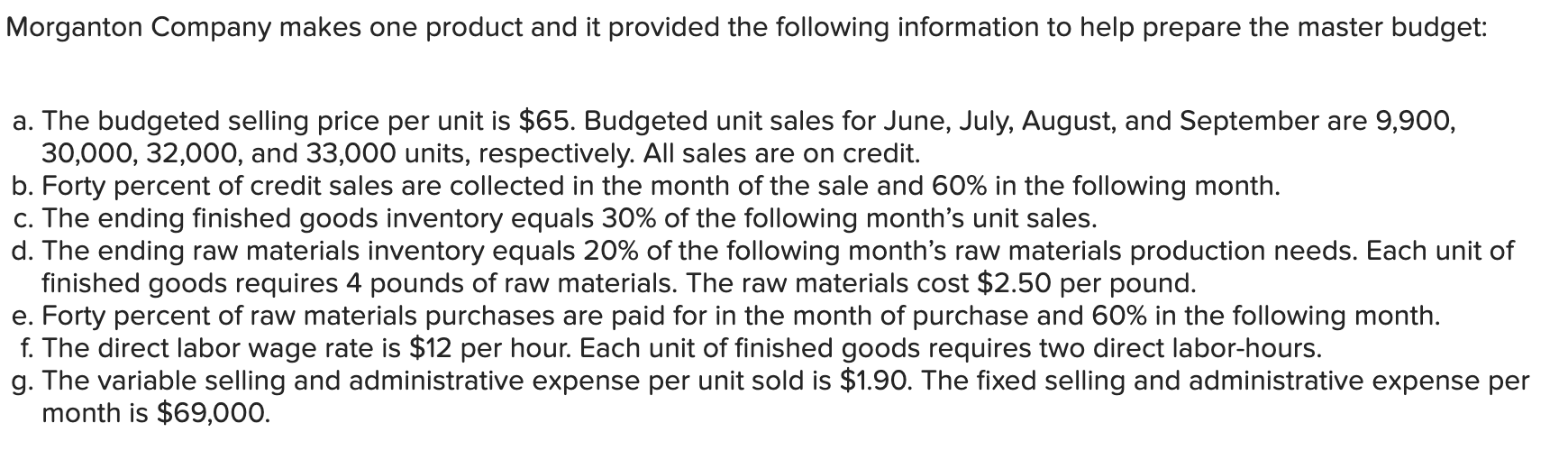

Manufacturing overhead balance sheet. This includes all indirect costs indirect cost indirect cost is the cost that cannot be directly attributed to the production. It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor. First, the manufacturing overhead account tracks actual overhead costs incurred.

Thus, the formula to calculate manufacturing overhead is as follows: This allocation is vital to ensuring accurate financial statements. September 06, 2023 what is manufacturing overhead?

This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more. Manufacturing overheads are those costs that are not directly traceable. Why does it matter if you assign a product $900 or $500 of the costs in the example above?

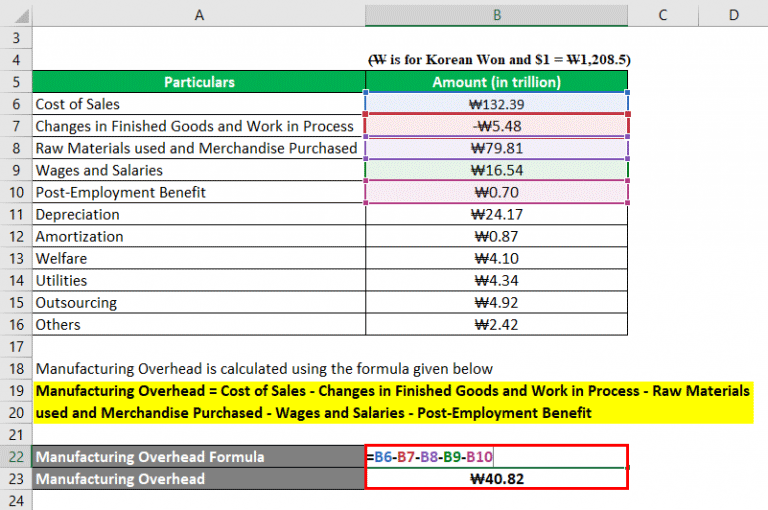

Compile and analyze your company’s income statements in. Examples of costs that are included in the manufacturing overhead category are as follows: Hence, the company’s manufacturing overhead for the year stood at $97 million.

The manufacturing overhead cost — also known as the factory overhead cost or manufacturing support cost — is the cost that business owners incur outside the expenses associated with direct labor or the cost of raw and direct materials. According to generally accepted accounting principles (gaap), manufacturing overhead must be included in the cost of work in process inventory and finished goods inventory on a manufacturer's balance sheet, as well as in the cost of goods sold on its income statement. What are the different types of indirect costs related to manufacturing overhead?

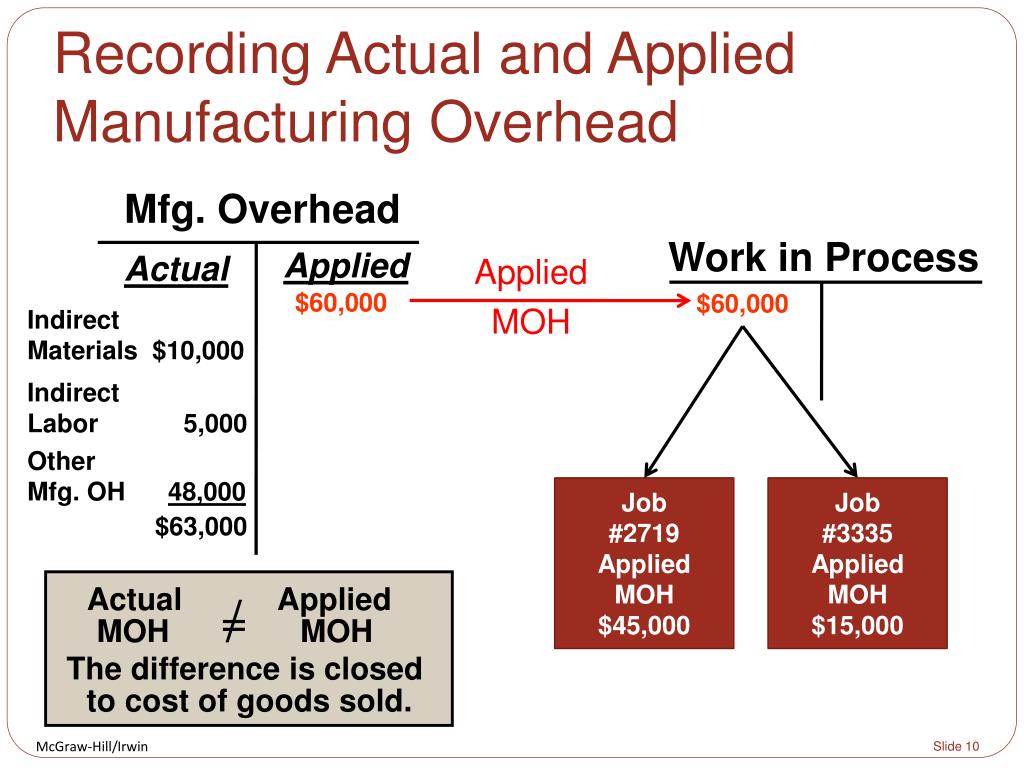

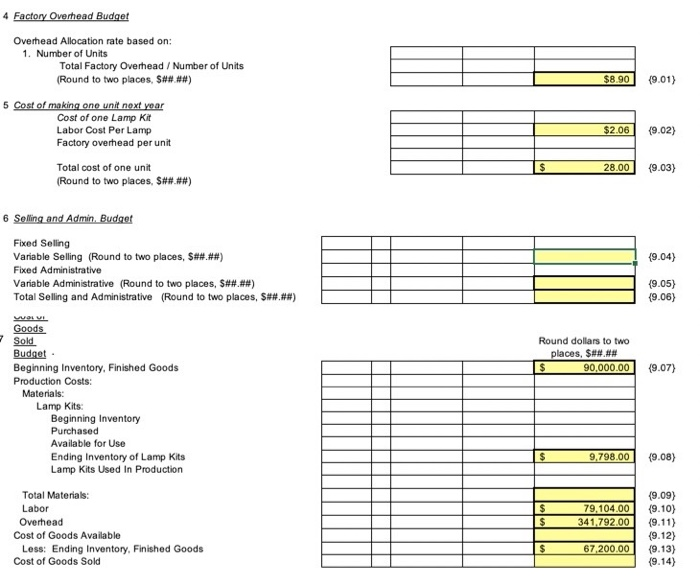

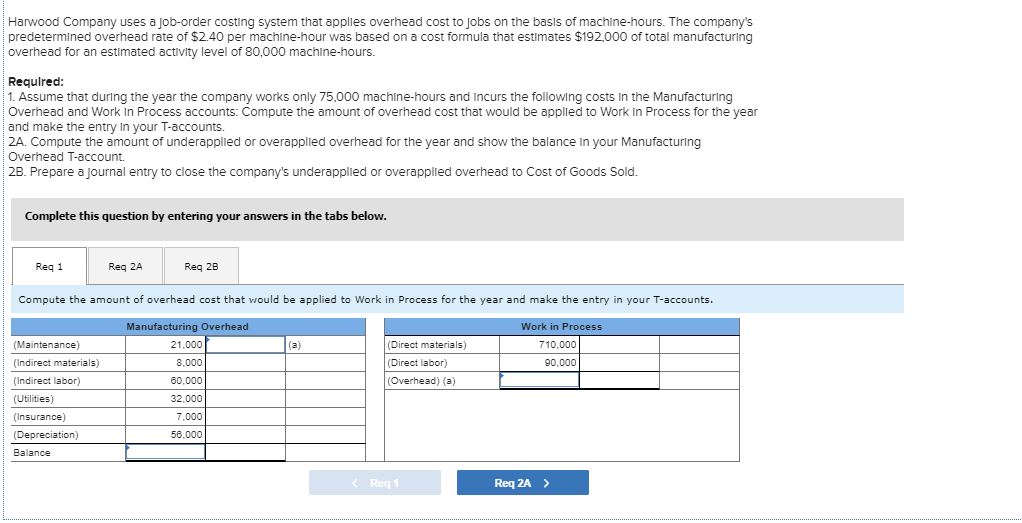

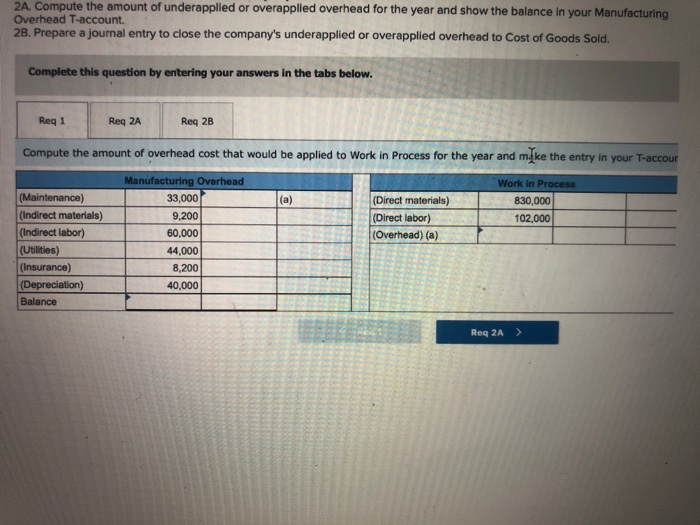

The balance of factory overhead since the factory overhead account is debited for actual overhead incurred and credited for allocated (applied) overhead, the general ledger account would appear as follows (the job costs are newly assumed for this illustration): Manufacturing overhead = depreciation + salaries of managers + factory rent + property tax. Cash disbursements for manufacturing overhead:

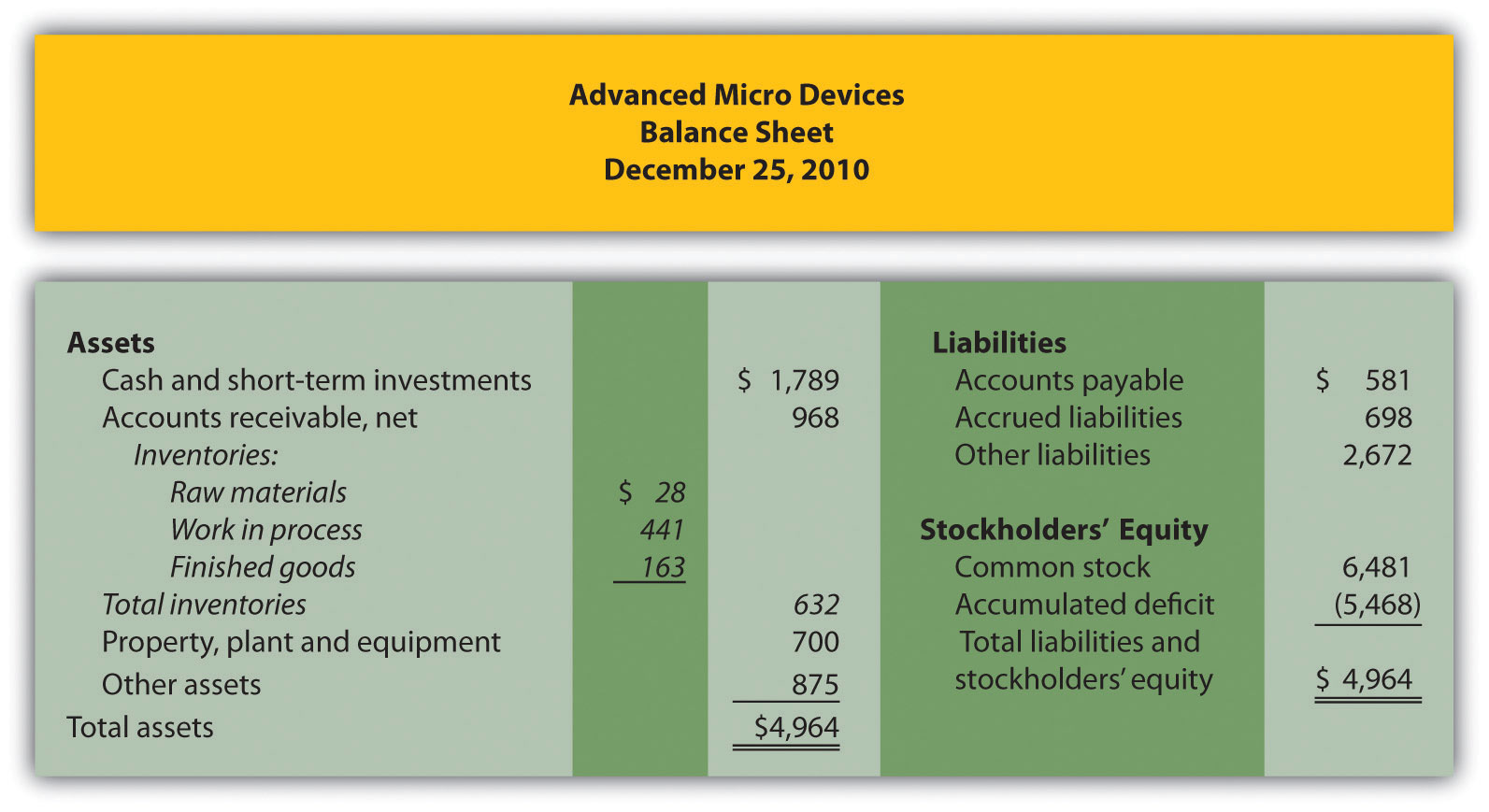

What is total manufacturing overhead? According to gaap (generally accepted accounting principles), manufacturing overhead should be included in the cost of finished goods in inventory and work in progress inventory on a manufacturer’s balance sheet and in the cost of goods income statement. B from the company’s balance sheet at may 31.

Manufacturing overhead is all indirect costs incurred during the production process. Recall that manufacturing overhead costs include all production costs other than direct labor and direct materials. The manufacturing overhead account tracks the following two pieces of information:

Hence, manufacturing overhead is referred to. The certificates include debits and credits, adjusting entries, financial statements, balance sheet, income statement, cash flow statement, working capital and liquidity, financial ratios, bank reconciliation, and payroll accounting. = $15 million + $60 million + $17 million + $5 million = $97 million.

All manufacturing overhead items are classified on the balance sheet in a general asset account. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales. As per generally accepted accounting principles (gaap), manufacturing overhead appears in the balance sheet as the cost of work in process (wip) inventory and under the cost of finished goods inventory.