Simple Info About Profit And Loss Ebitda

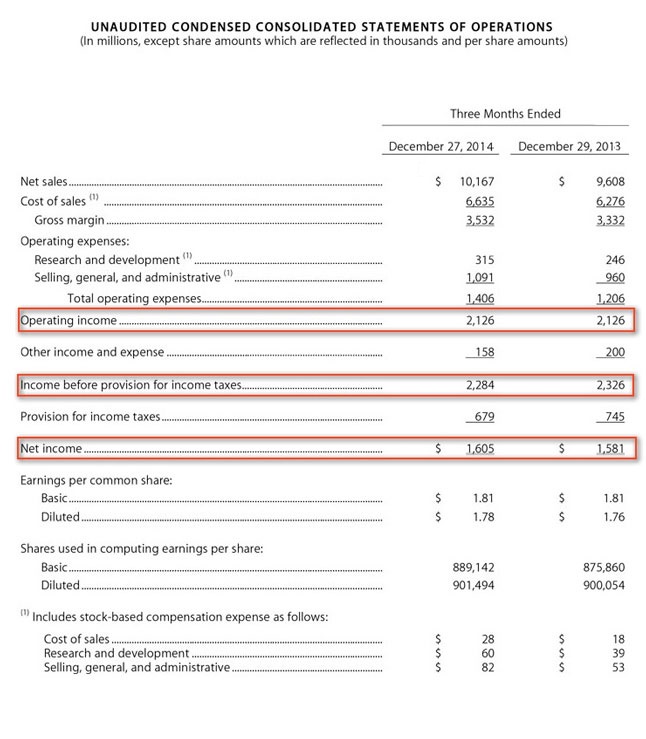

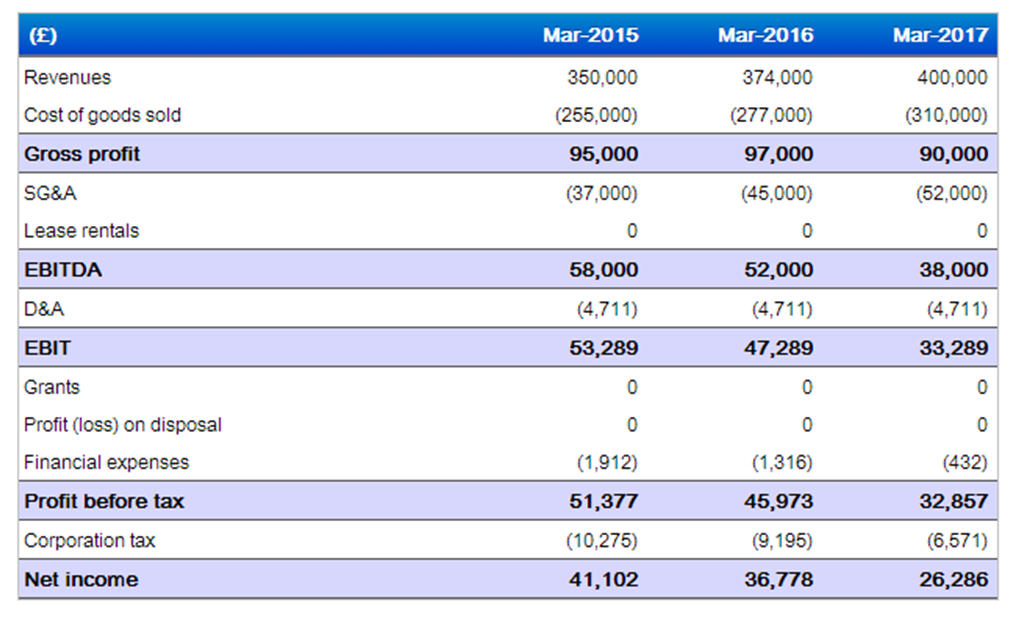

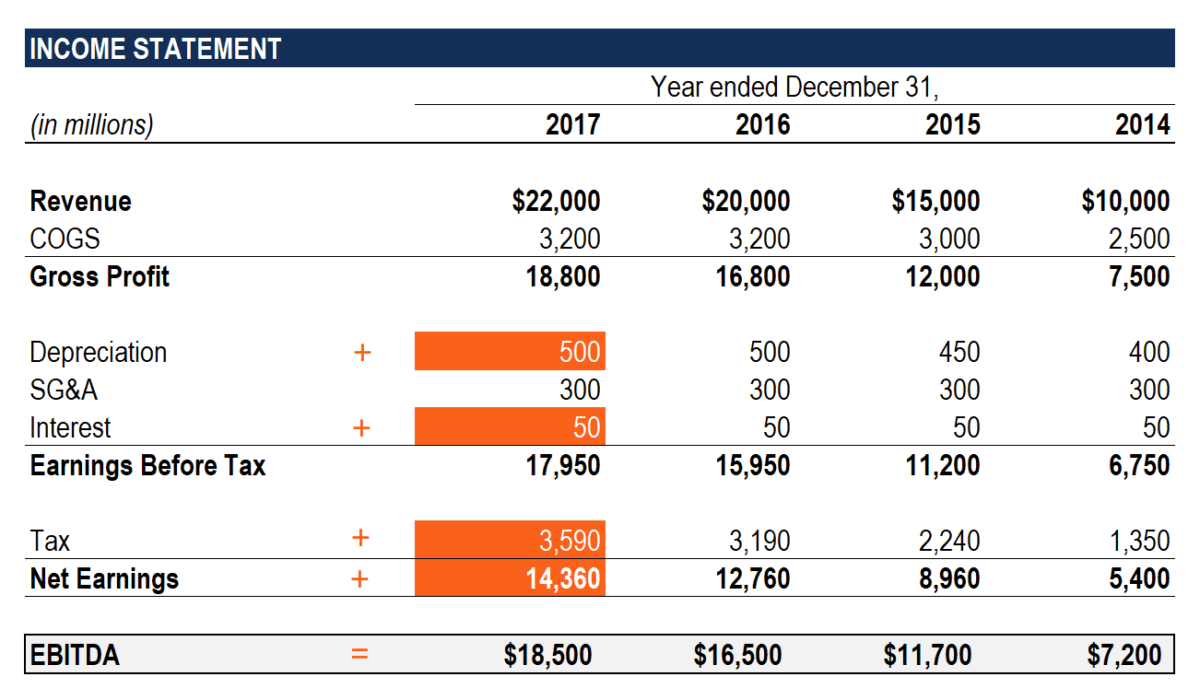

However, the two metrics calculate profit in different ways.

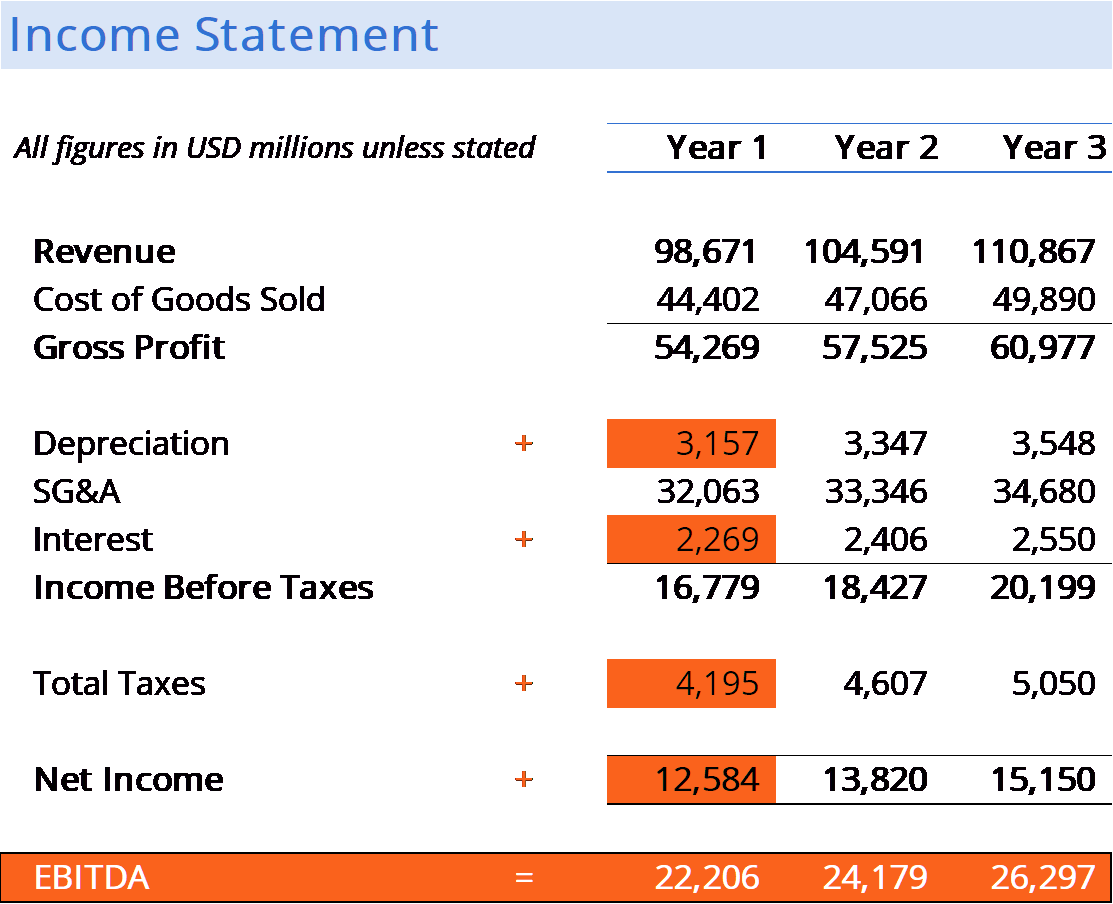

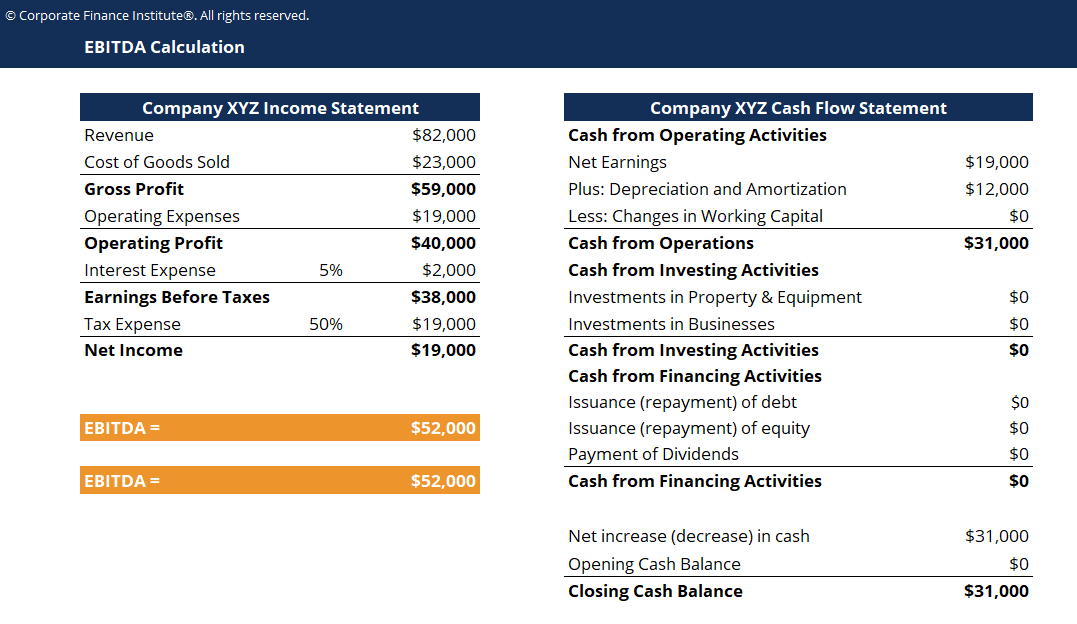

Profit and loss ebitda. Investors and analysts may want to look at both profit metrics to gain a better understanding of a company's. The ebitda (earnings before interest, tax, depreciation, and amortization) formula, as the name indicates, is the calculation of the company’s profitability which can be derived by. One very common and specific example would be capital expenses.

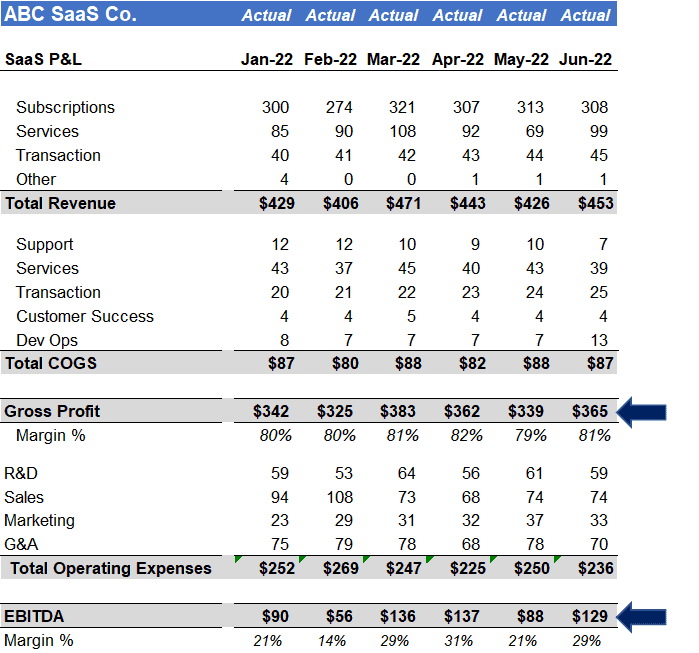

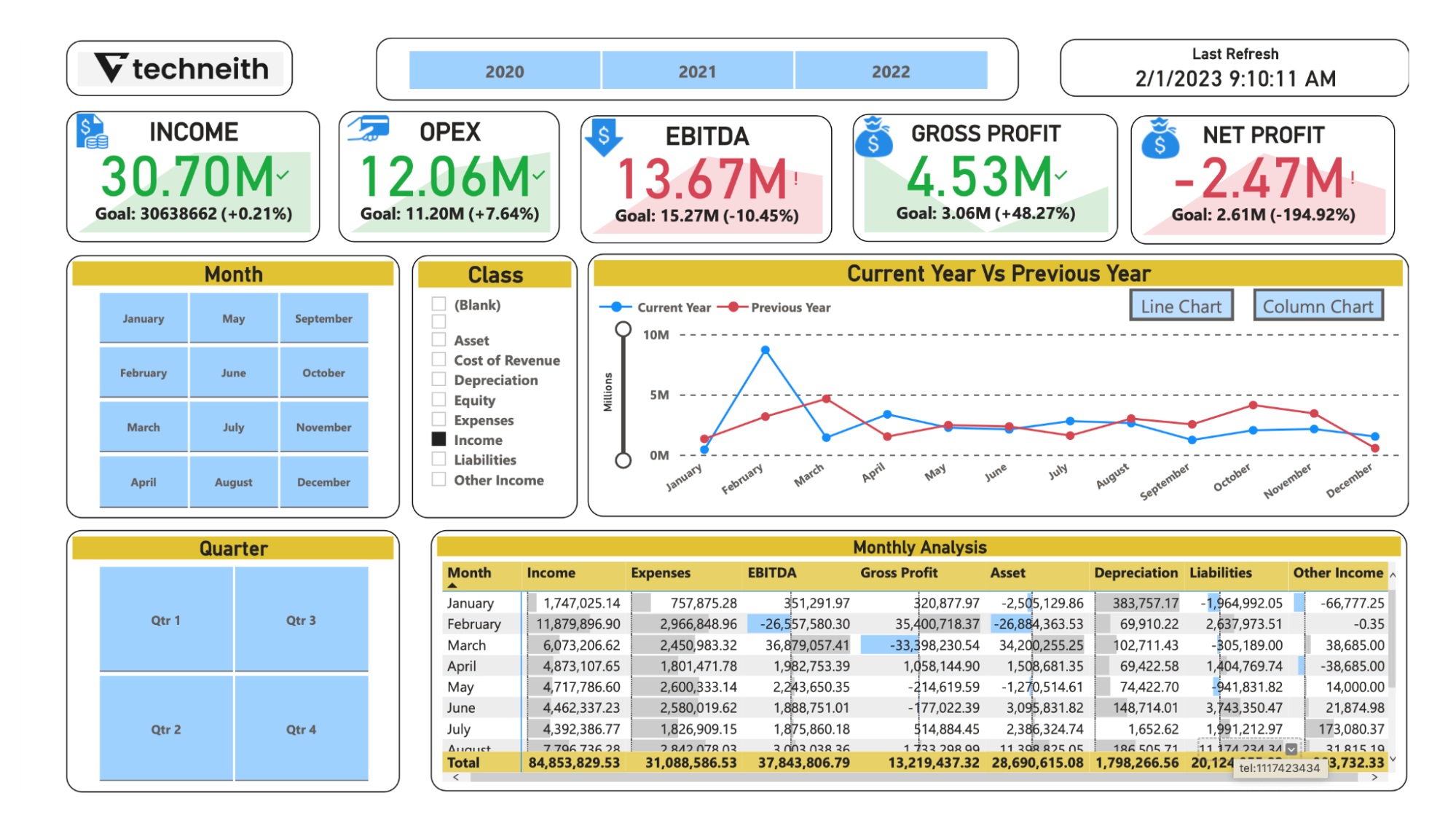

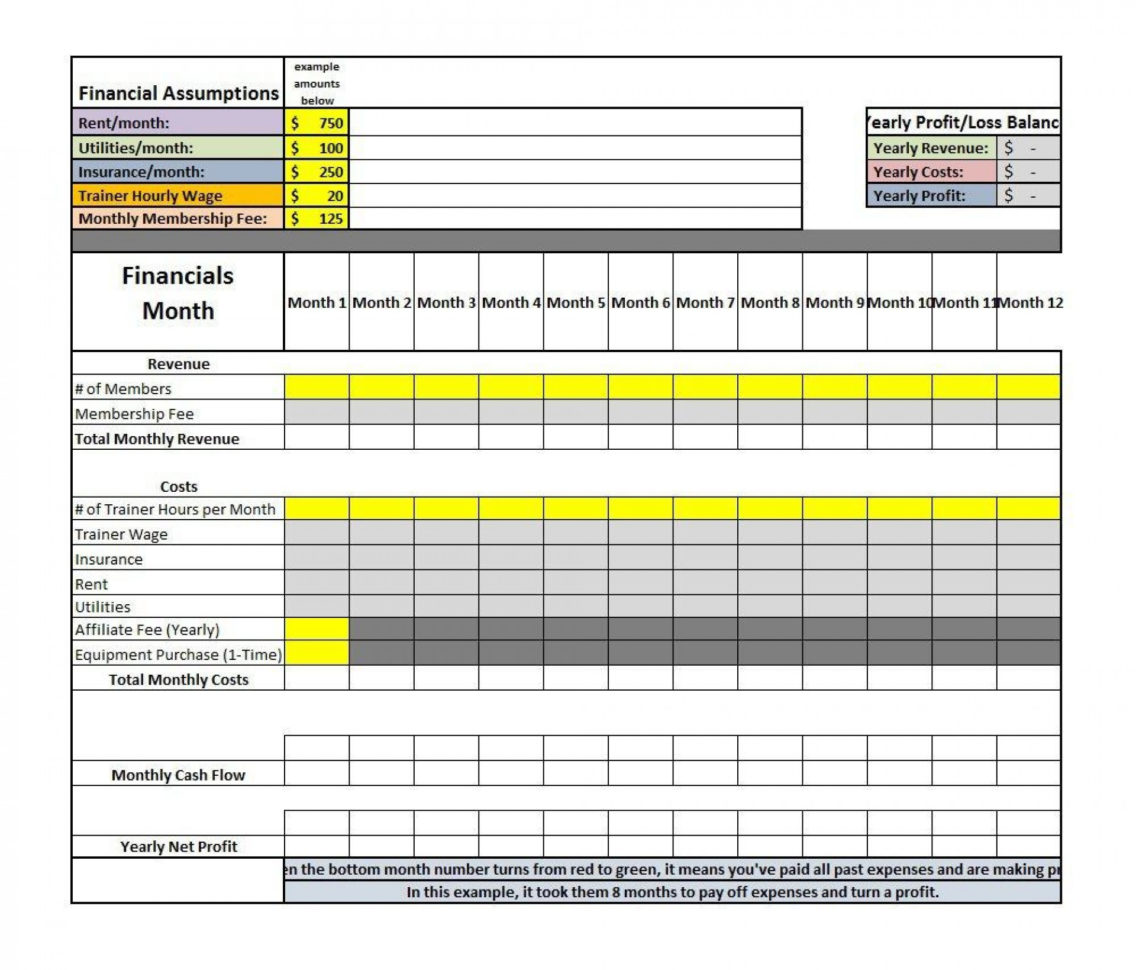

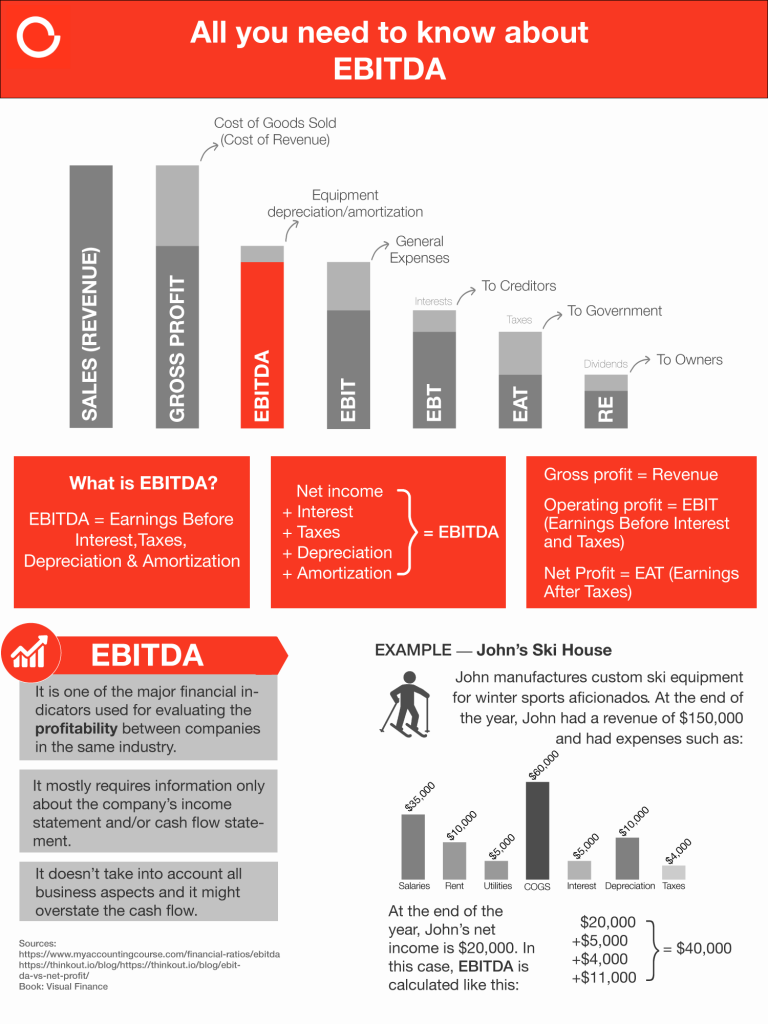

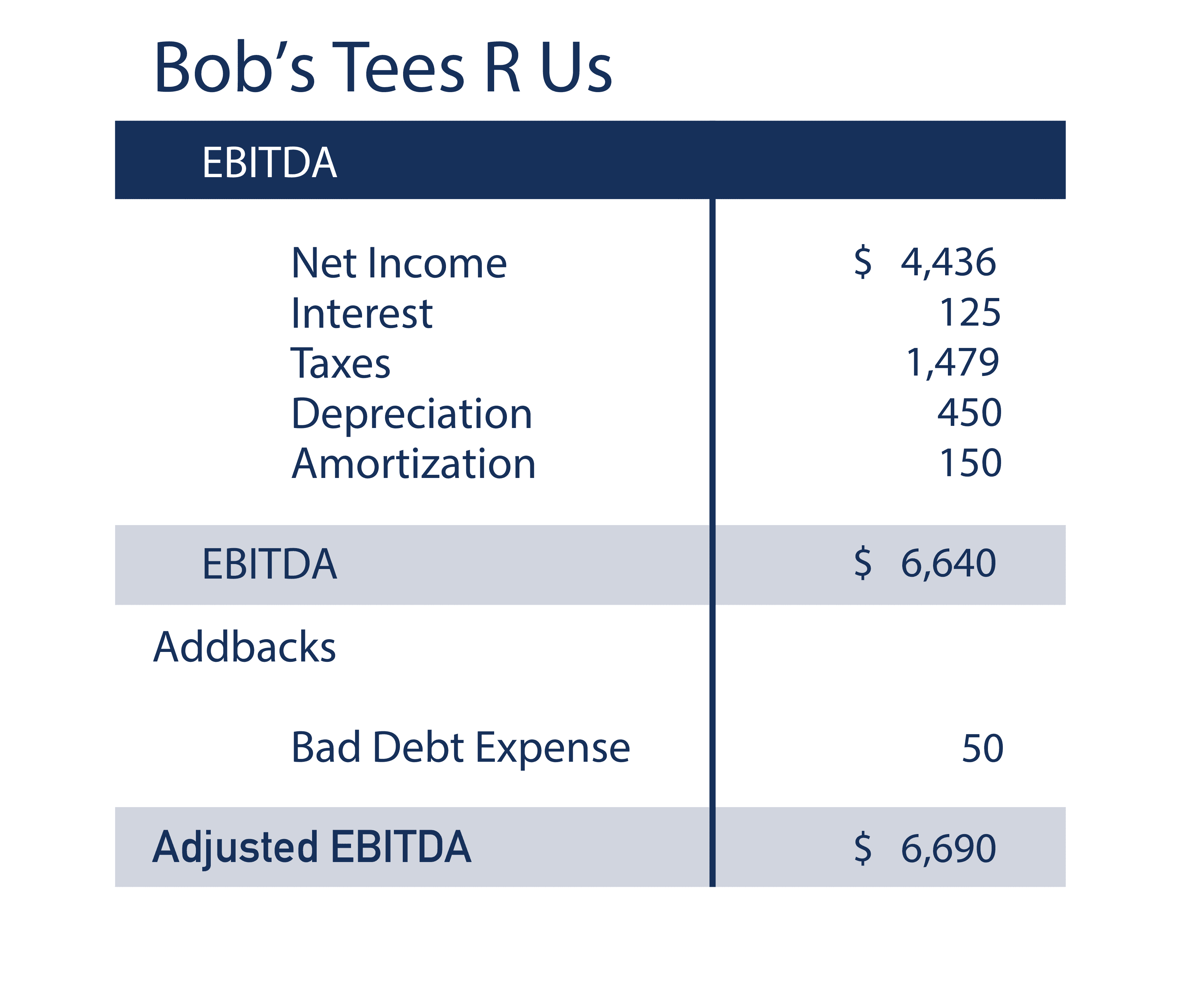

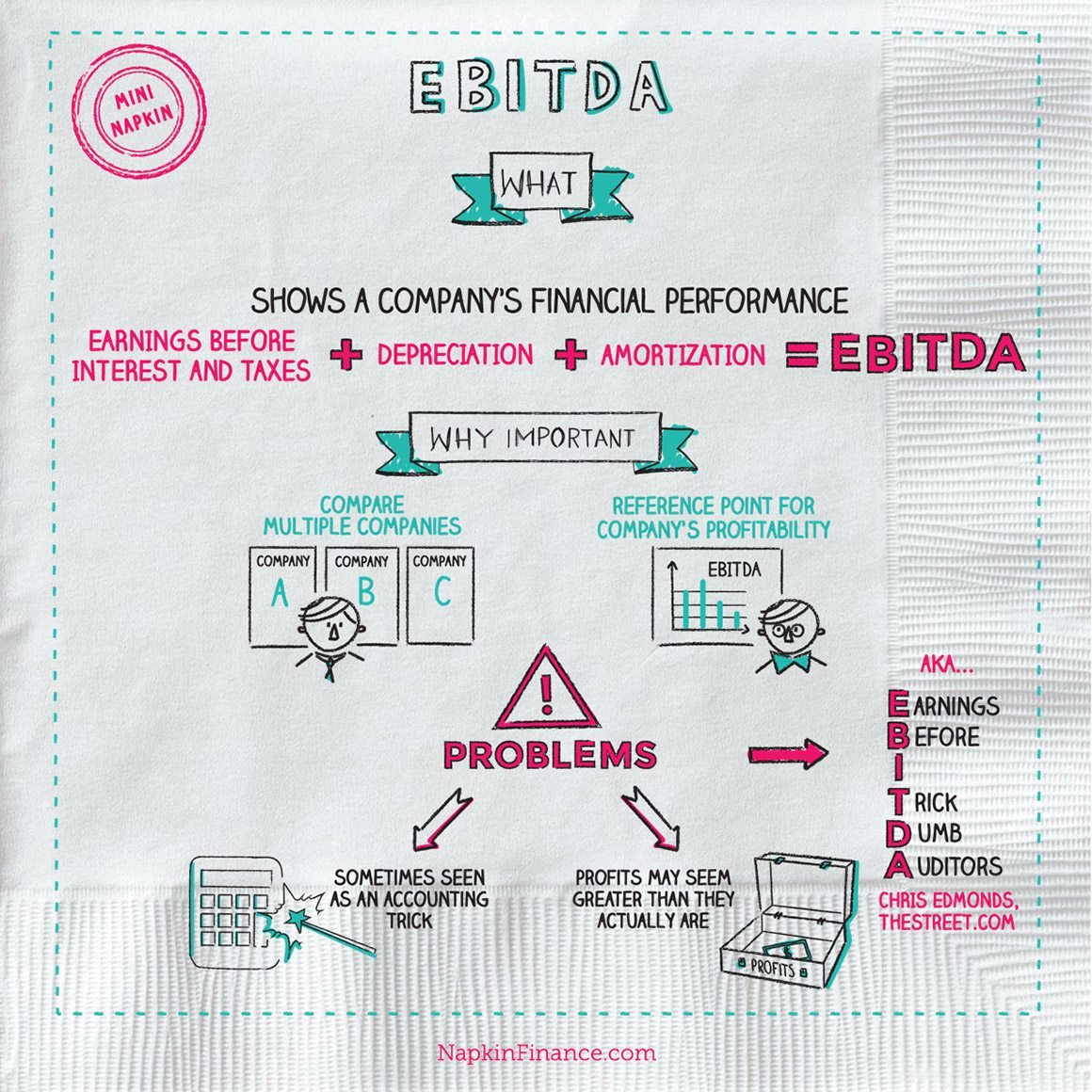

A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. Businesses must establish key profitability metrics, such as gross profit ratio, ebitda margin, and net profit margin, to effectively monitor their actual financial. A company's earnings before interest, taxes, depreciation, and amortization (commonly abbreviated ebitda, pronounced / iː b ɪ t ˈ d ɑː /, / ə ˈ b ɪ t d ɑː /, or / ˈ ɛ b ɪ t d ɑː /) is a.

Measures your company’s ability to. Q4 ebitda profit sek 8.5 million versus loss sek 2.6 million year ago. Q4 net sales sek 93.3 million versus sek 91.4 million year.

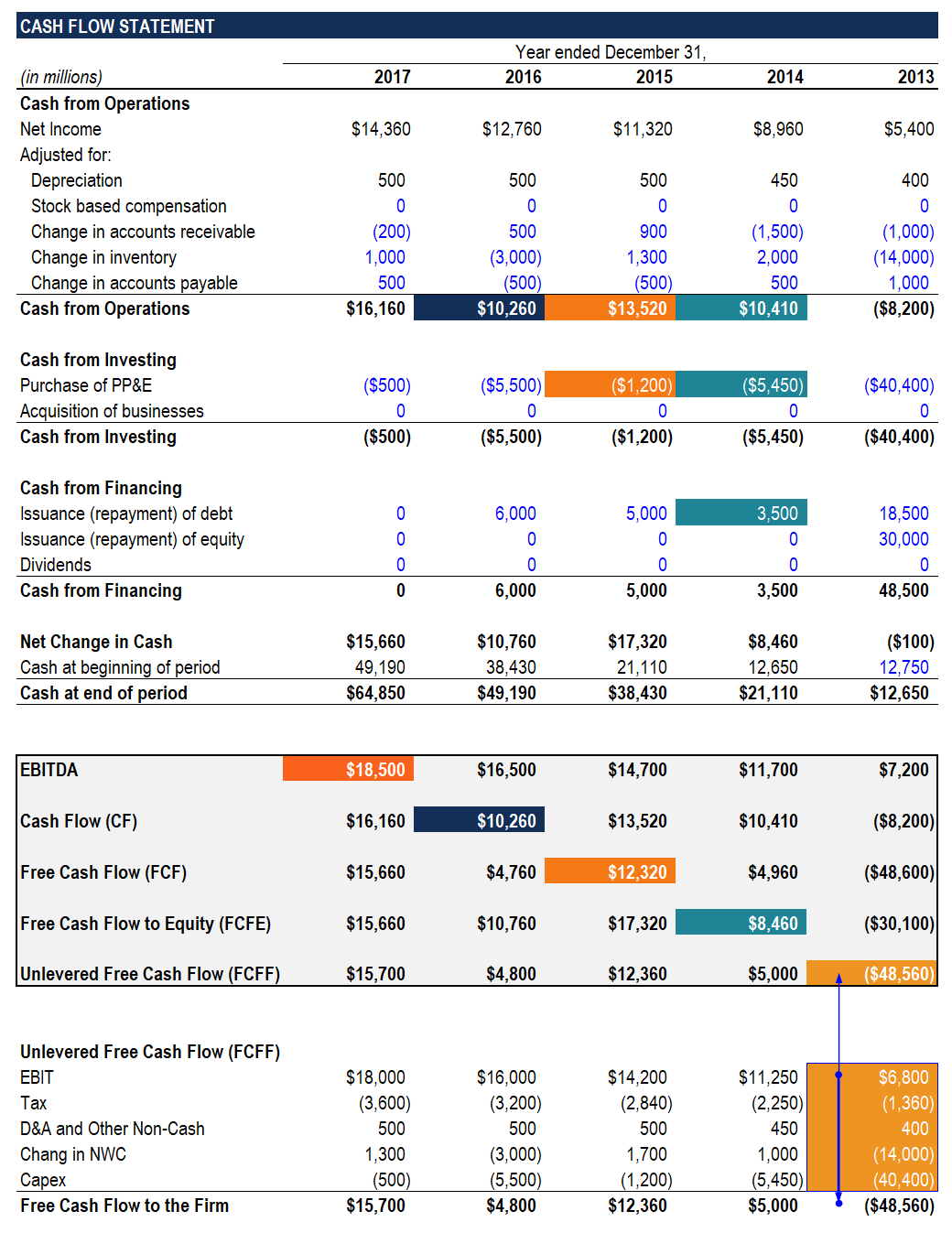

Ebitda = operating profit + amortization + depreciation for example, the management team of your company has control over sales, pricing, and promotion. The profit and loss (p&l) statement is a good indicator of how efficiently your company is growing. Gross profit and ebitda (earnings beforeinterest, taxes, depreciation, and amortization) each show the earnings of a company.

Ebitda is most commonly used by investors or creditors to compare companies' actual profits, free from losses that aren’t related to production revenue or.

:max_bytes(150000):strip_icc()/McDonalds-a114d966ba2047978e84ef9db2dabbff.jpeg)