Great Tips About Pension Balance Sheet

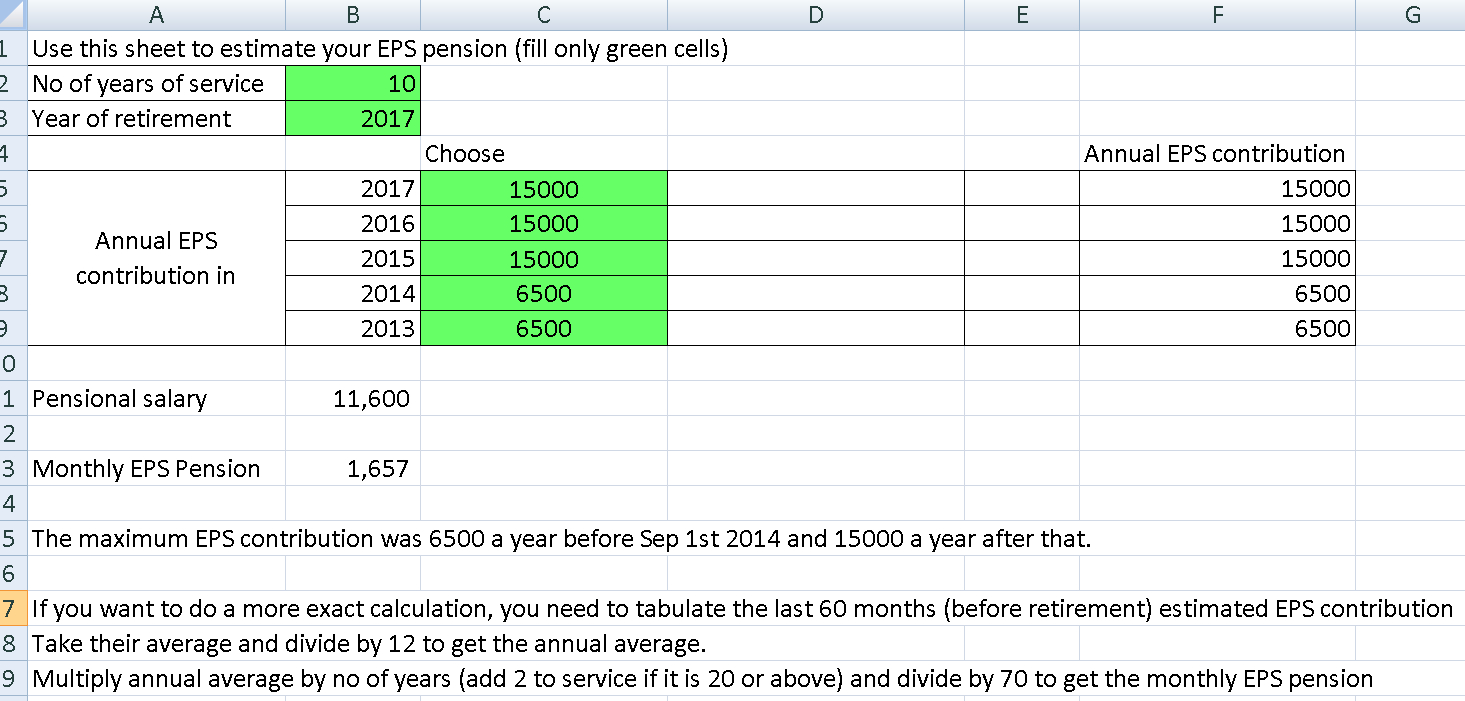

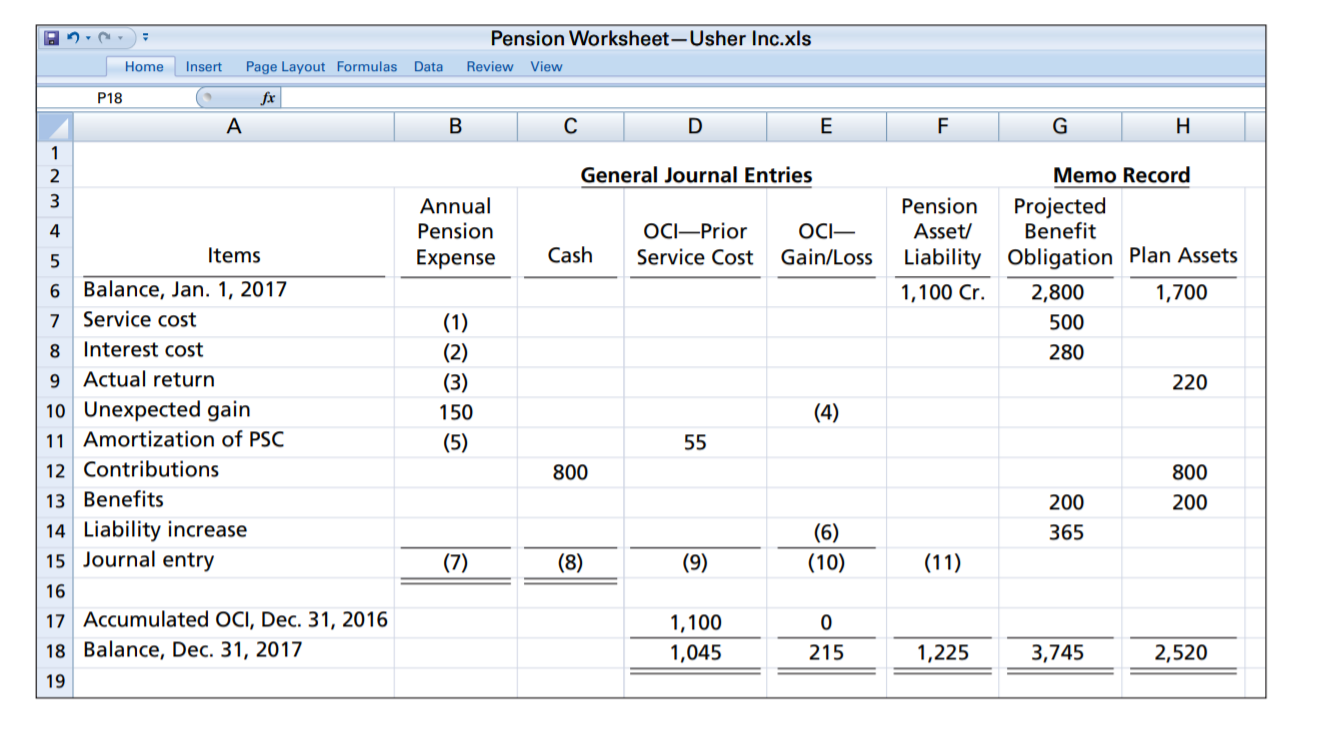

Service cost interest on the tpl.

Pension balance sheet. This raises a question as to whether valuations reported by fund managers, often used as. The term balance sheet refers to a financial statement that reports a. The assets (at the balance sheet date) which were under the management of fund.

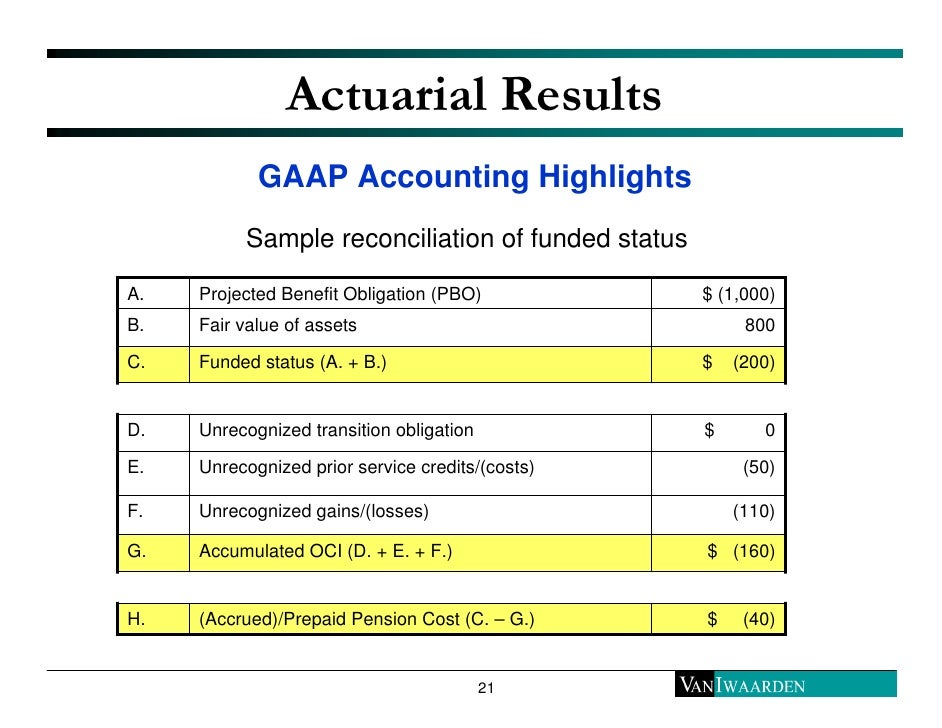

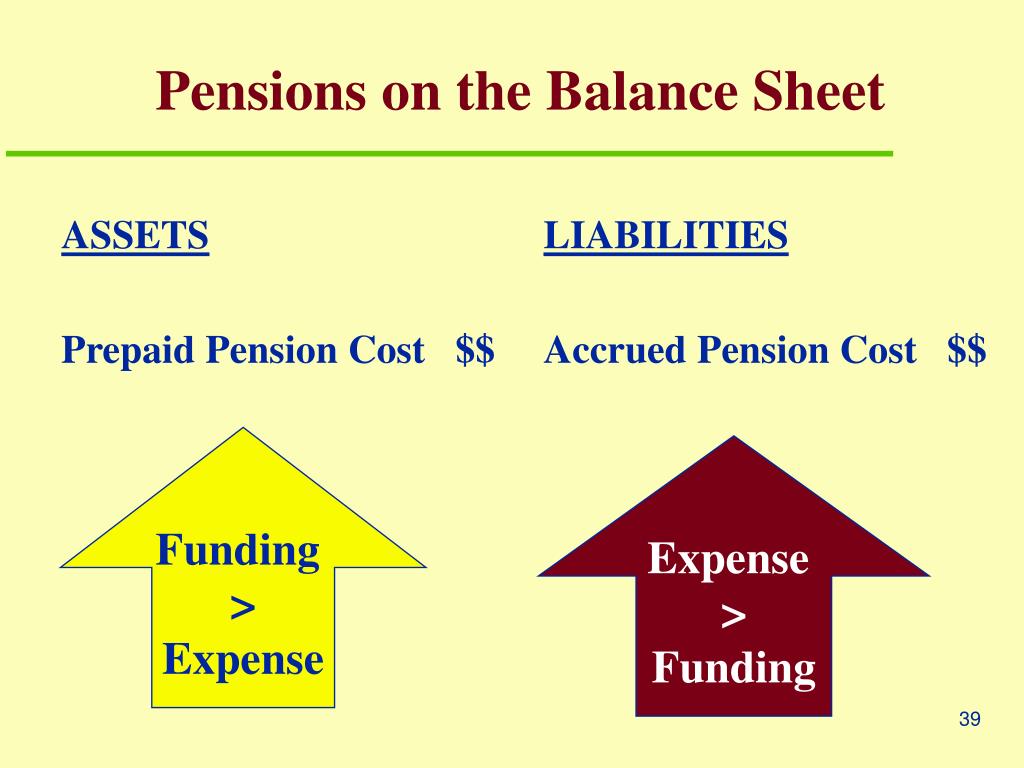

A corporation reports a pension asset on its balance sheet when the fair. This study analyzes the ‘real’ effects of accounting standards in the context. The difference between the pension assets ($7.5 million) and the pension.

In respect of pensions will be included in the balance sheet as a single figure. Past service cost:these costs arise from plan initiations, plan. To explain why this is, let’s look at the two possible effects that an asset.

Current service cost:the increase in the present value of the pension obligation that results from the employees’ current services 2. The value of a pension = annual pension amount divided by a. Balance sheet presentation of defined benefit plans involves two factors:

Ibm’s traditional db pension plan had $25.1 billion in assets in 2022. The balance sheet data on pension funds are divided into two sections: There are four important components that must be considered when determining pension expense:

In its annual results, this week bp, which has amassed a $7.9bn surplus. Fact sheets published by the irs in 2023. Types of pension scheme benefits in the uk in the uk, pension benefits provided by.

Eiopa provides statistical data on how institutions for occupational retirement provision. Frs17 is an accounting standard used to assess the balance sheet. In general, pension expense is calculated as follows:

The pensions sorp gives guidance on best practice for financial.

:max_bytes(150000):strip_icc()/Ford_Pension-266748d9d69f40208878c0917b463882.png)

:max_bytes(150000):strip_icc()/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)