Painstaking Lessons Of Tips About Cost Accounting And Auditing

With ongoing changes to accounting standards in areas like leases, financial instruments, and revenue recognition, audits now involve assessing more judgmental estimates and disclosures.

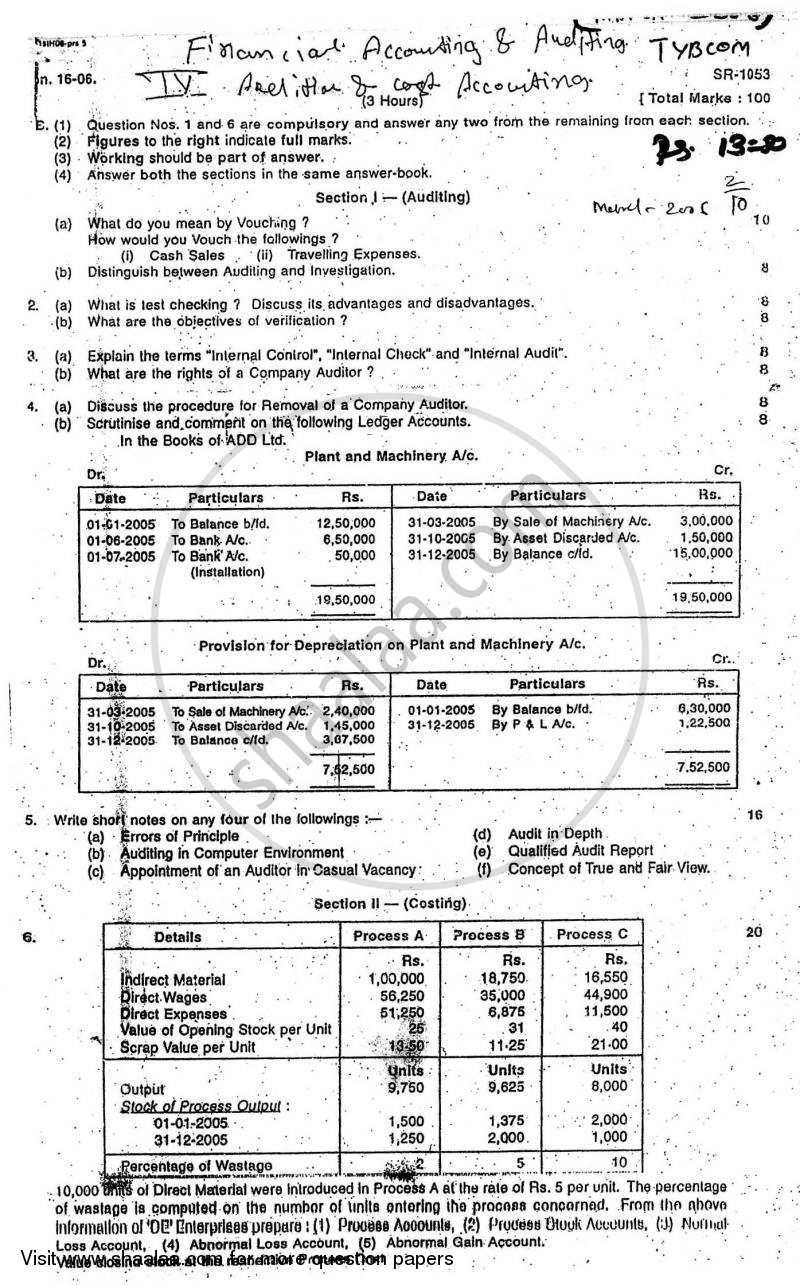

Cost accounting and auditing. Cost accounting is an internal process used only by a company to. Cost audit ensures that the organization keeps a close check on any wastage in the company. And cost audit ensures the accuracy of this process, so it is equally important.

Learn cost accounting or improve your skills online today. Environmental costing accounting contributes to an internal. Dobson, cost audit is the verification of the correctness of cost accounts and of the adherence to the cost accountancy plans. based on these definitions, cost audit refers to the detailed verification of the correctness of costing techniques , costing systems , and cost accounts.

Read this blog to know how cost audits are performed with the help of legal experts in india. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. Also, audits are performed to ensure that financial statements are prepared in accordance with the relevant.

To perform a cost audit, the company needs to appoint a cost auditor, and submit the audit report to the central government within a respective time frame. The national center for education statistics reports that, as of the. A cost audit comprises the following;

Audit is an important term used in accounting that describes the examination and verification of a company’s financial records. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. Cost audit is the verification of cost records and accounts, a check on adherence to the prescribed cost accounting procedures, and the continuing relevance of such procedures.

Cost accounting is a specialized sector of accounting that deals with recording, analyzing, summarizing, and allocating all costs associated with a business’s production processes or services. Our cost accounting courses are perfect for individuals or for corporate cost accounting training to upskill your workforce. It is to ensure that financial information is represented fairly and accurately.

An environmental cost accounting system is a flow‐ and decision‐oriented extension of traditional cost accounting systems. The main purpose of accounting is to reveal the profitability position, financial position and performance of the organization. When a new york judge delivers a final ruling in donald j.

Cost audit ascertains the accuracy of cost accounting records to ensure that they are in conformity with cost accounting principles, plans, procedures and objectives. Cost of an online accounting degree. To examine how environmental cost accounting can deliver useful information for auditing, it makes sense to distinguish between internal and external audits.

Cost auditing is the process of examining and verifying the accuracy and completeness of a company's cost accounting records. Choose from a wide range of cost accounting courses offered from top universities and industry leaders. The main objective is to inform a business’s management on how cost efficiency and financial performance can be improved to maintain a.

Cost audit is an important and continuous process that a company has to execute properly during its entire existence in the market. The process of cost accounting provides the management with this data. The purpose of cost auditing is to ensure that a company's financial statements accurately reflect the cost of goods sold and the cost of operating the business.