Outrageous Tips About Doubtful Debt In Income Statement

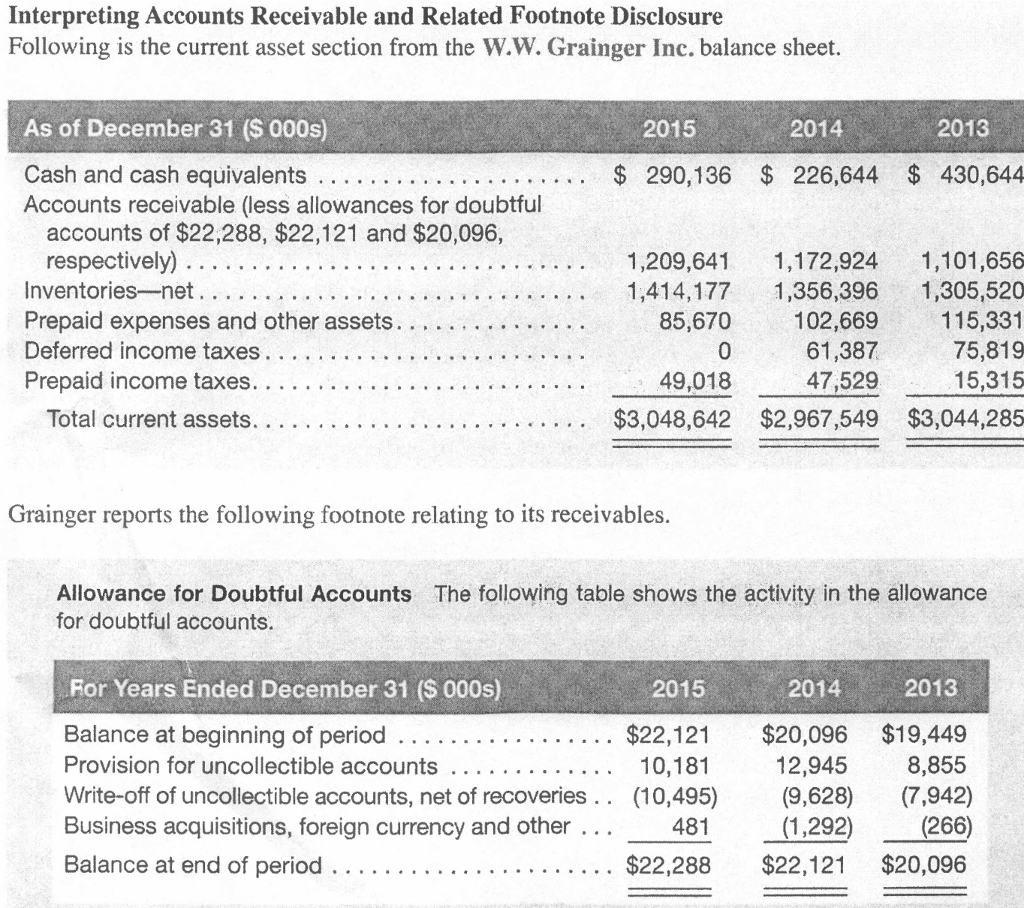

Creating an allowance for doubtful accounts (ada) allows you to offset your accounts receivable account balance.

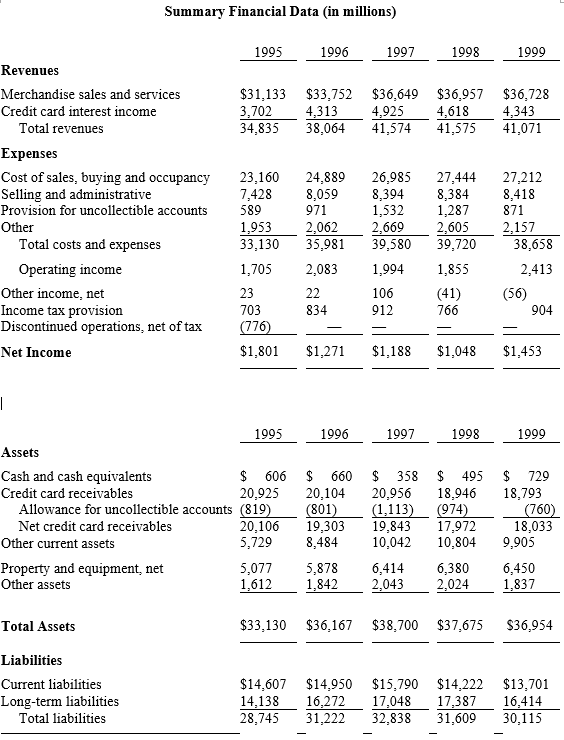

Doubtful debt in income statement. Learn how to estimate the ada with these examples. The income statement method (also known as the percentage of sales method) estimates bad debt expenses based on the assumption that at the end of the period, a certain. Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write.

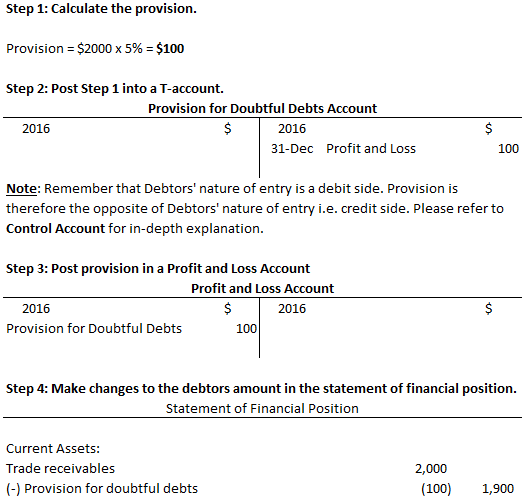

The allowance for uncollectible accounts or allowance for doubtful accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is more. Creating a provision for doubtful debts for the first time. As a general allowance of $1500 has already been created, only $500 additional allowance must be charged to the income statement:

Credit provision for doubtful debts account. Debit profit and loss account. Allowance for doubtful debts (expense).

Cr provision for doubtful debts. Accounting treatment for provision for doubtful debts: Accounts receivable should be measured at net realizable value.

Every business has its own process. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will.

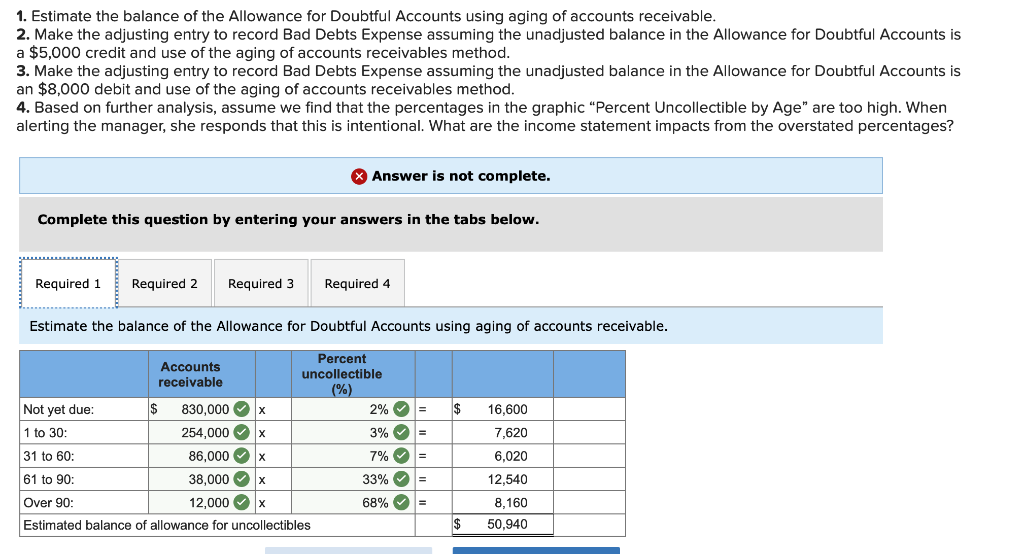

You currently use the income statement method to estimate bad debt at 4.5% of credit sales. Prepare journal entries to write off the irrecoverable debt and create the allowance for doubtful debts to be used in the financial statements. In the balance sheet, include the provision for doubtful debts for the year, which is.

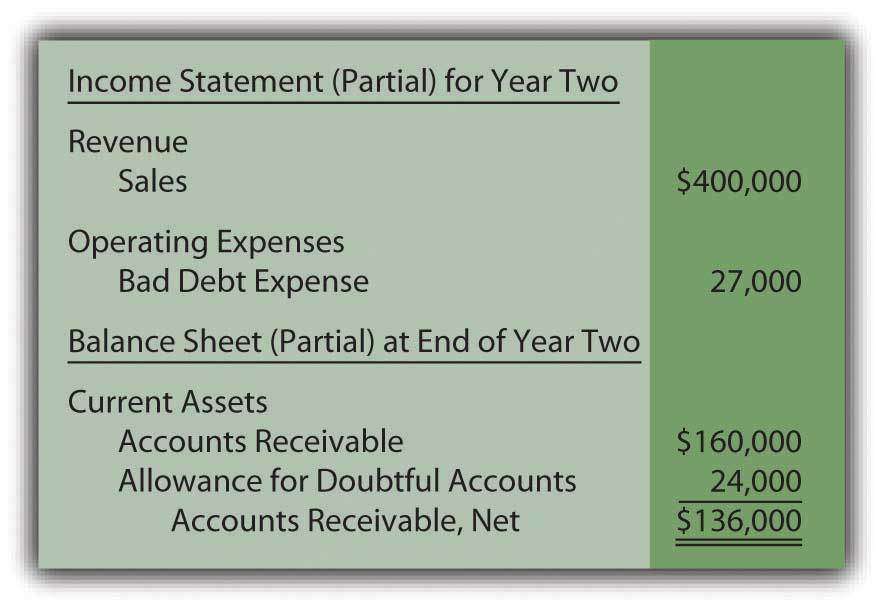

It therefore charges $5,000 to the bad debt expense (which appears in the income statement) and a credit to the allowance for doubtful accounts (which appears. Adjustments to financial statements many candidates struggle with certain adjustments in the exam. This article explains how to treat the main possible post trial balance.

On the income statement, the bad debt expense is recorded in the current period to abide by the matching. Bad debt expense = $20 million × 1.0% = $200k. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

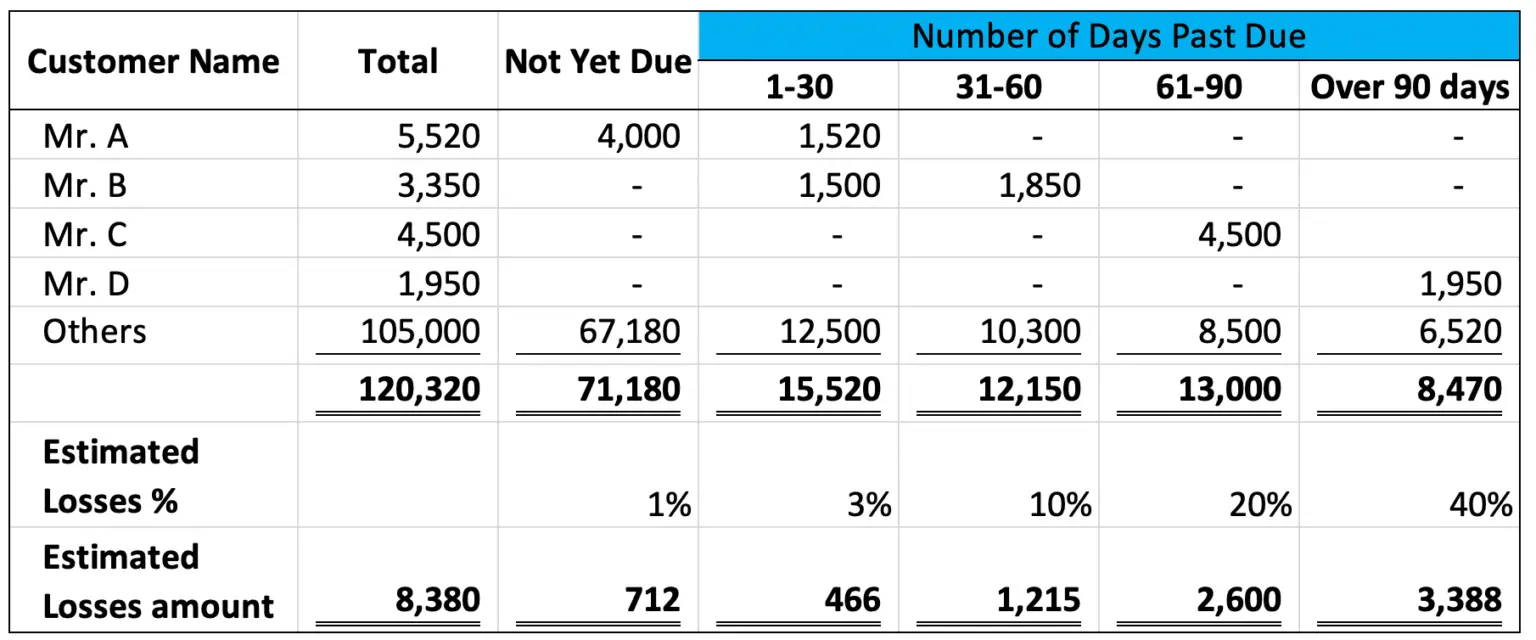

Also called doubtful debts, bad debt expenses are recorded as a negative transaction on your business’s financial statements. In this lesson, you will learn how to calculate and record bad debts, provision for bad debts, and how to adjust the provision for bad debts using the balanc. You are considering switching to the balance sheet aging of receivables method.

We do this by estimating how much will not be paid:

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)