Looking Good Info About Income Statement Reports Deferred Tax Disclosure Example

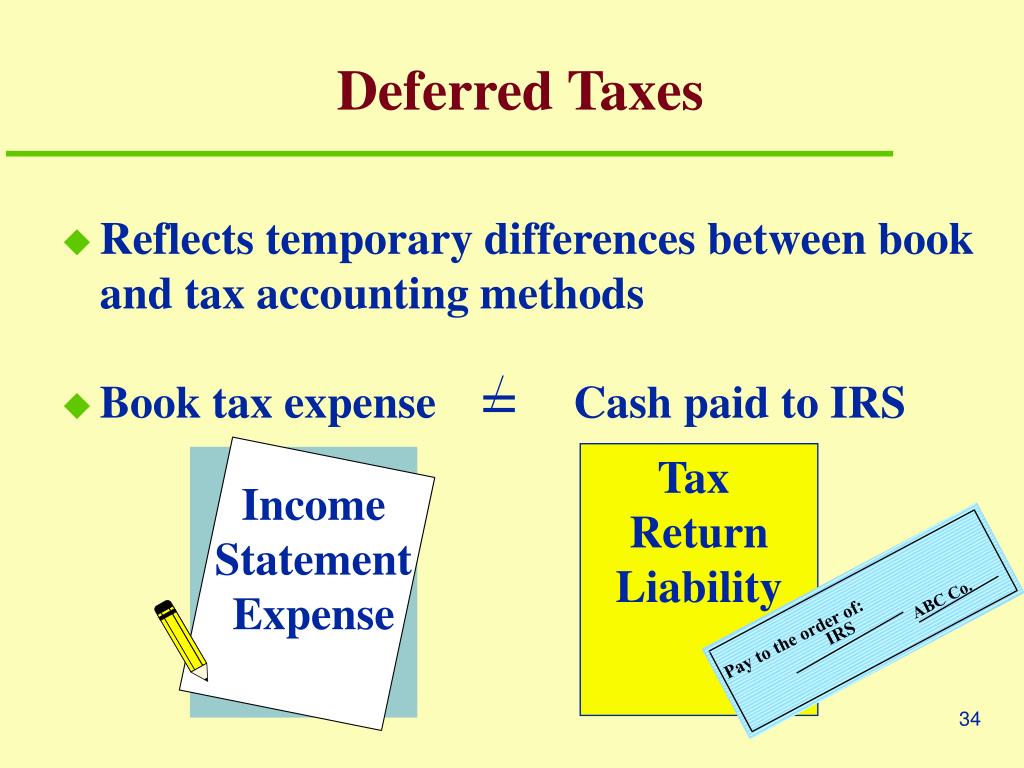

Deferred tax amounts on a balance sheet.

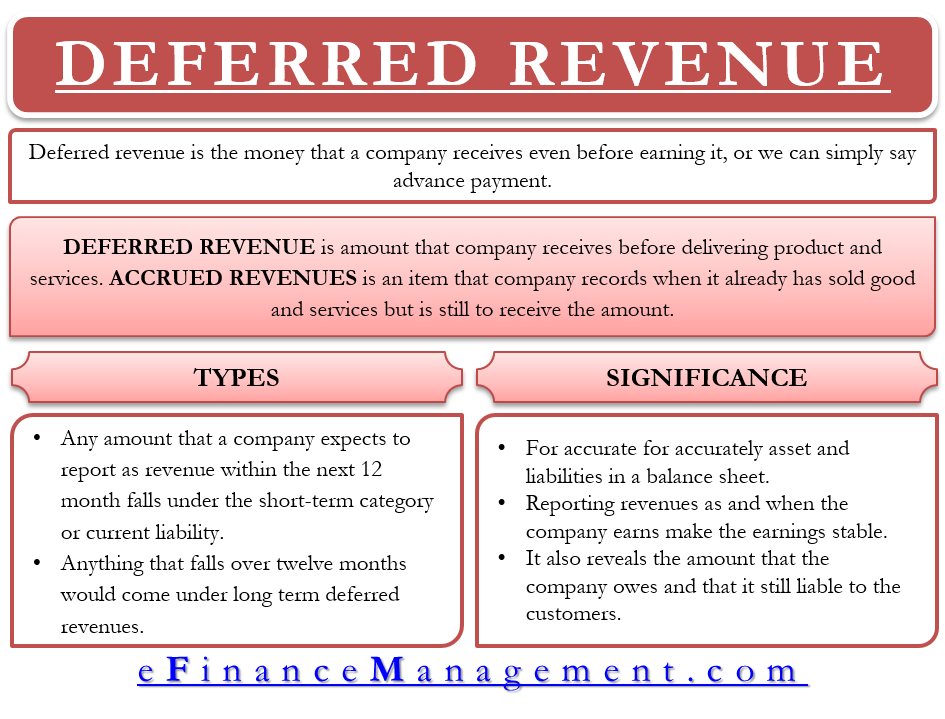

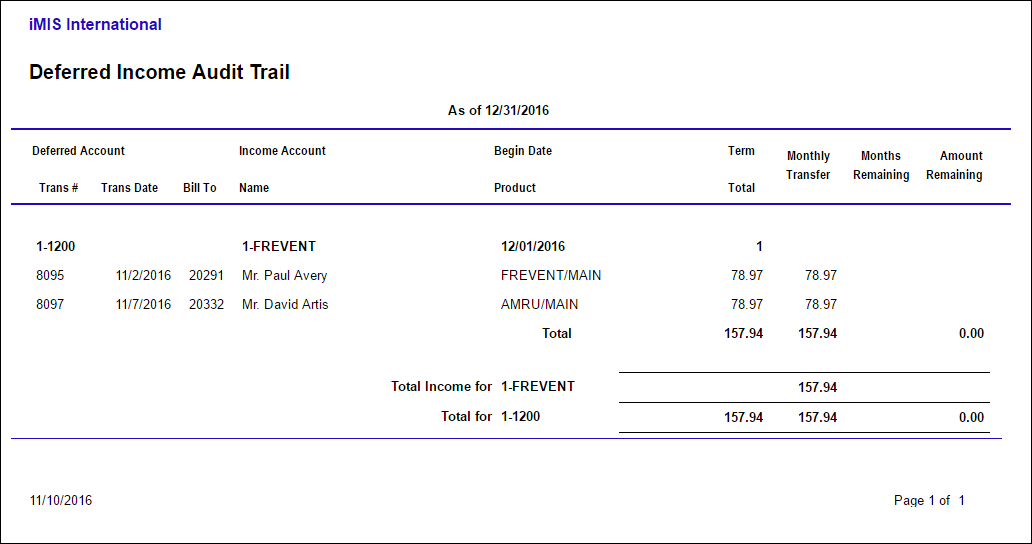

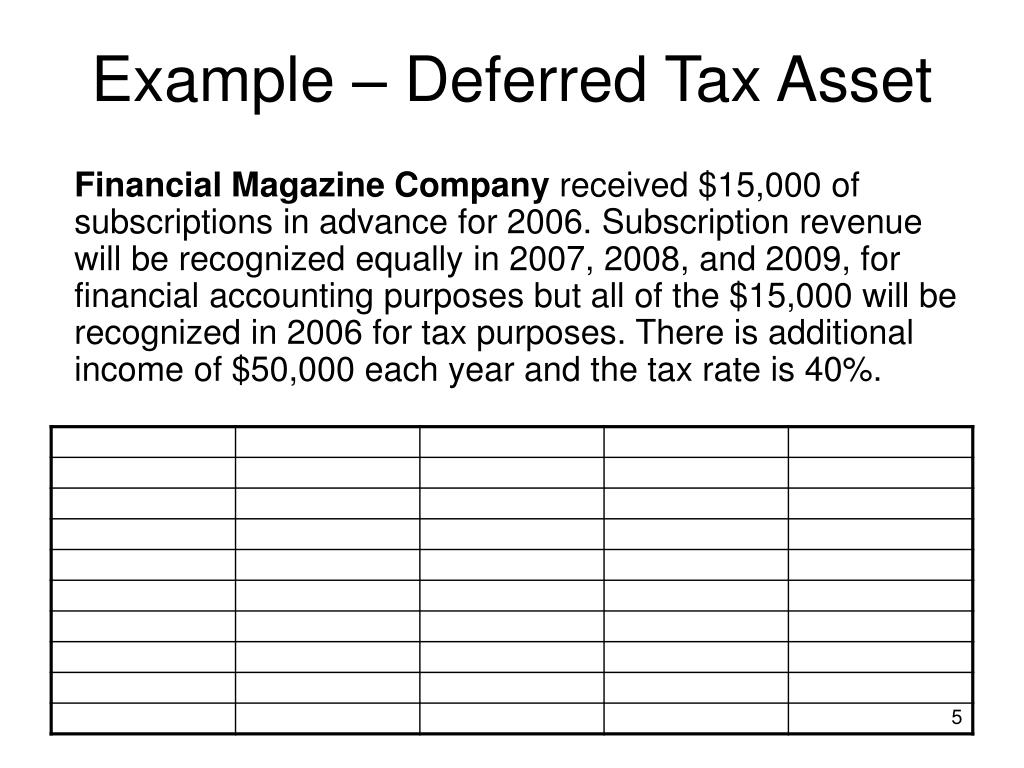

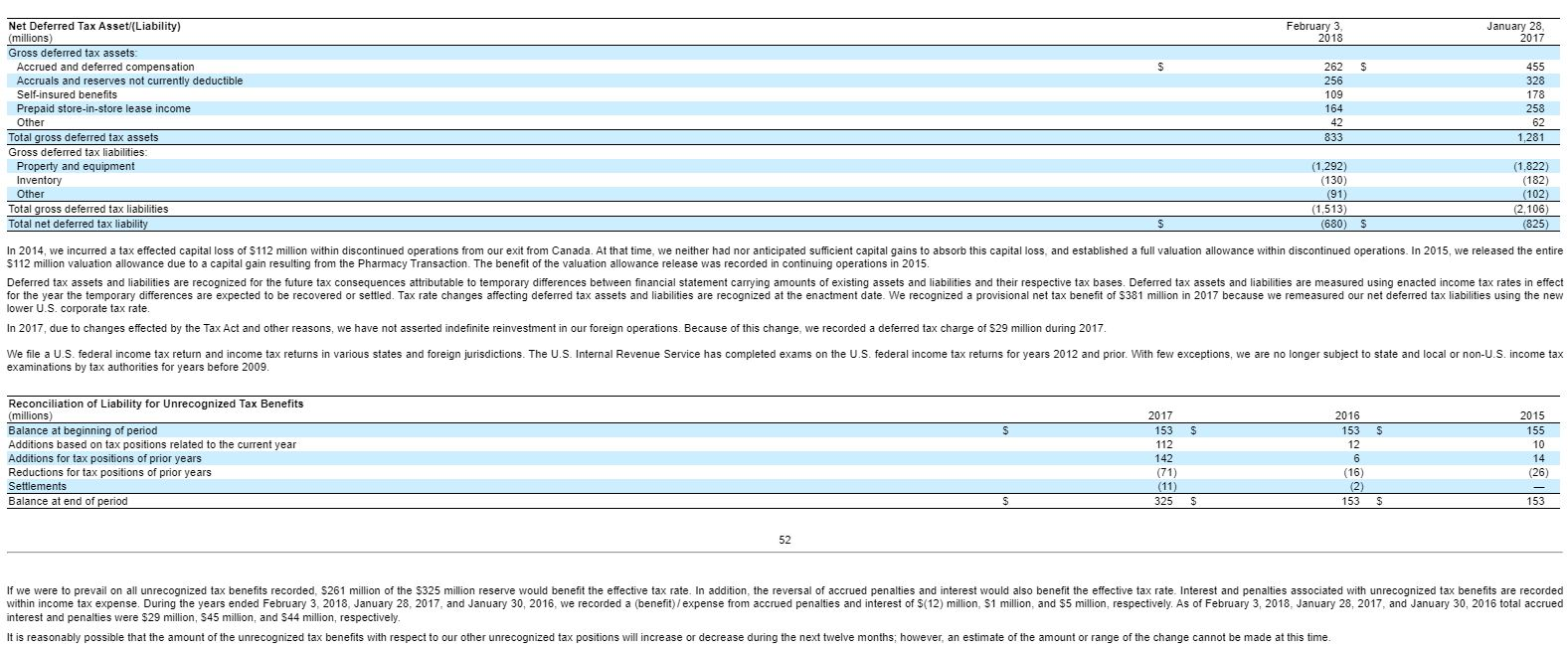

Income statement reports deferred tax disclosure example. Examples include disclosure of the expected period of recovery of deferred tax assets, and geographical analysis of tax disclosures. Unrecognized tax benefits should be presented in the financial statements as a reduction to the deferred tax asset related to an nol carryforward, a similar tax. The following illustration shows a representative example of a typical public company’s fulfillment of this requirement.

(a) deferred income tax assets the group recognises deferred income tax assets on carried forward tax losses to the extent there are sufficient estimated future taxable. Securities and exchange commission (sec). Deferred tax reversal clearer explanation would be welcome as to the.

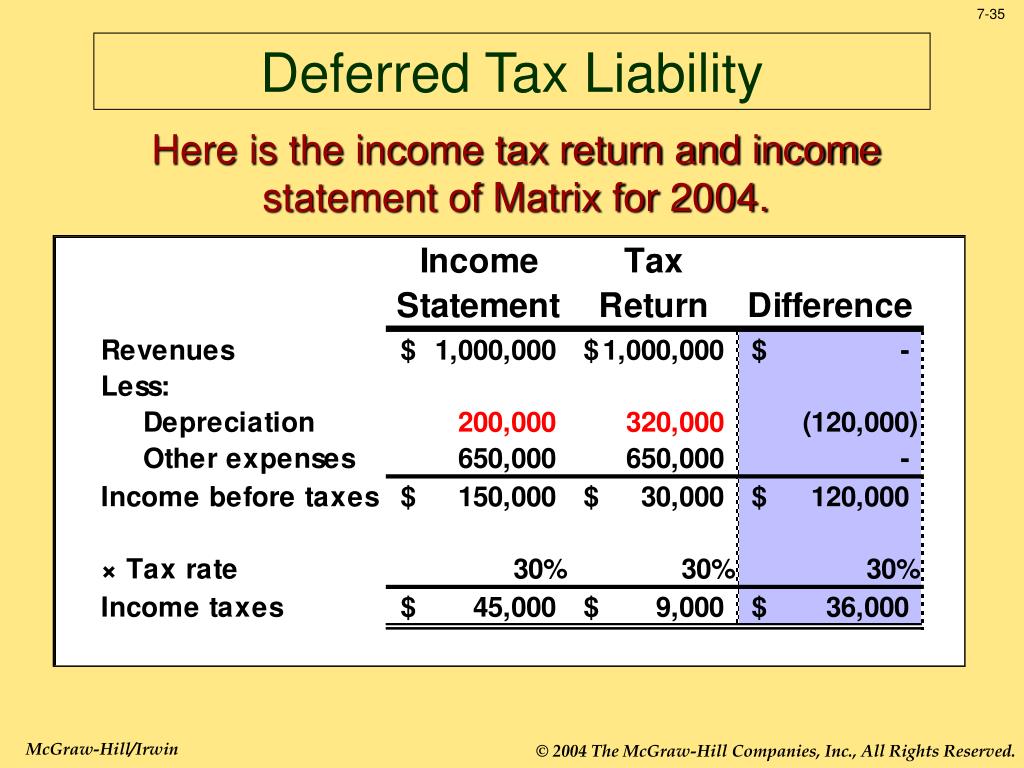

Deferred tax liabilities and assets for the future tax consequences of events recognized in its current. In this scenario, the deferred tax is fully raised through profit or loss and there are no assessed. This paragraph mandates that if a transaction leads to equal taxable and deductible temporary differences, an entity is required to recognise the corresponding.

A reporting entity that meets this criteria and elects to include the allocated amount of current and deferred tax expense in its separately issued financial statements must. (ii) the amount of the deferred. (i) the amount of the deferred tax assets and liabilities recognised in the statement of financial position for each period presented;

For example, the sec staff has emphasized the need to provide disclosures regarding the relevant positive and negative factors considered when assessing the realization of. Solution the correct answer is a. Disclosure on the face of the statement of financial position about current tax assets, current tax liabilities, deferred tax assets, and deferred tax liabilities [ias.

Statements reconcile to the cash tax position. These example accounts will assist you in preparing financial statements by illustrating the required disclosure and presentation for uk groups and uk companies. While the specific categories for disclosures for nonpublic entities are not defined, categories used could include the categories specifically defined in the.

Basic deferred tax asset and liability. Ifrs and its interpret ation c hange o ver time. Amount of taxes payable or refundable for the current year.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)