Unique Tips About Selling Expenses Income Statement

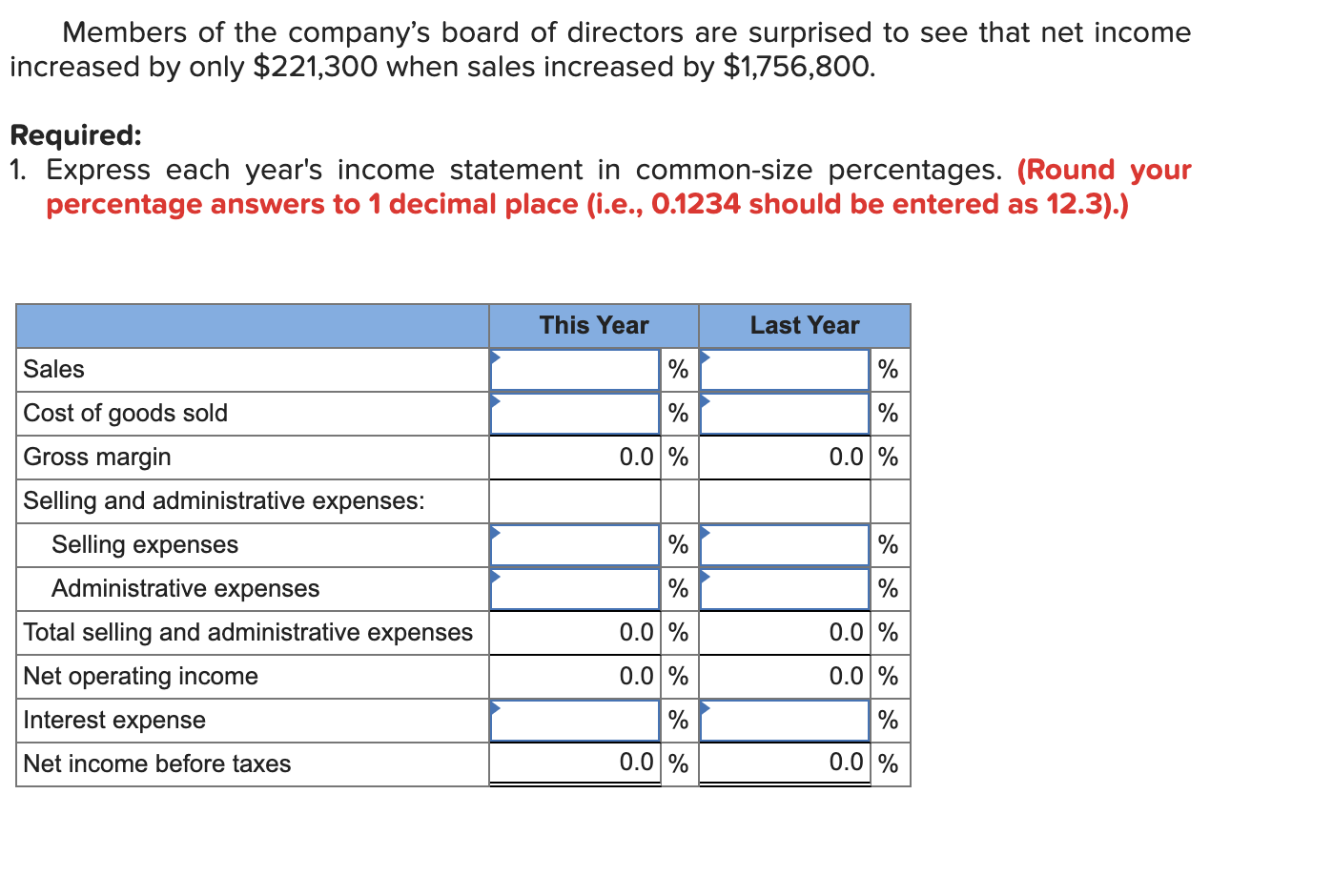

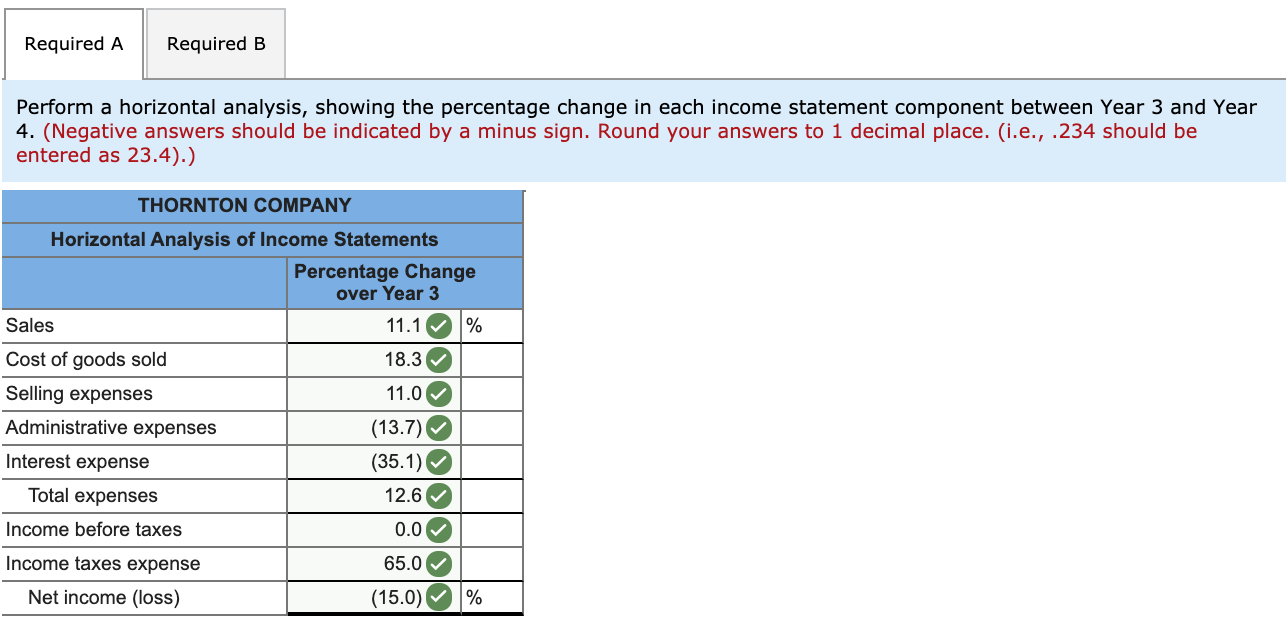

The income statement is a useful way to see how a company makes money and how it spends it.

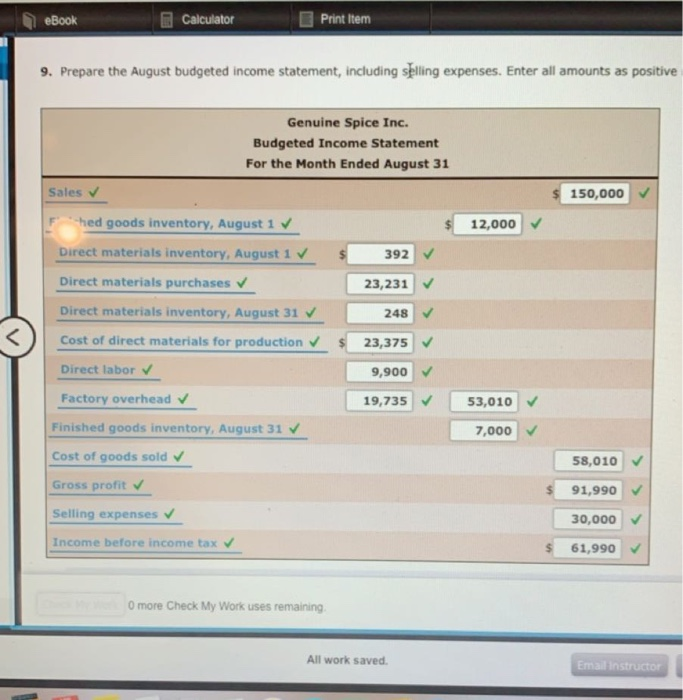

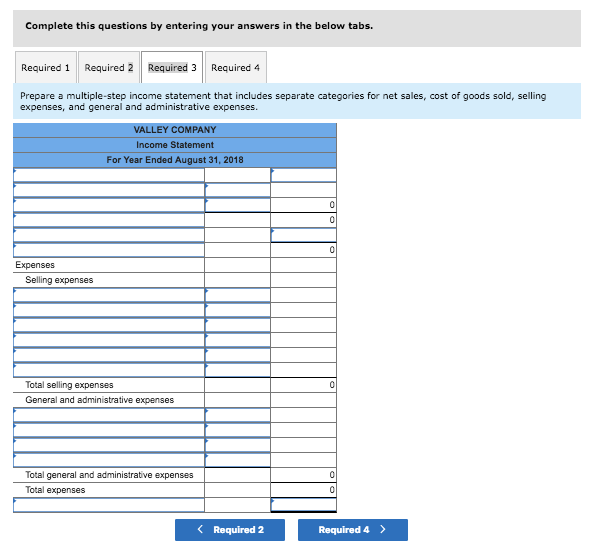

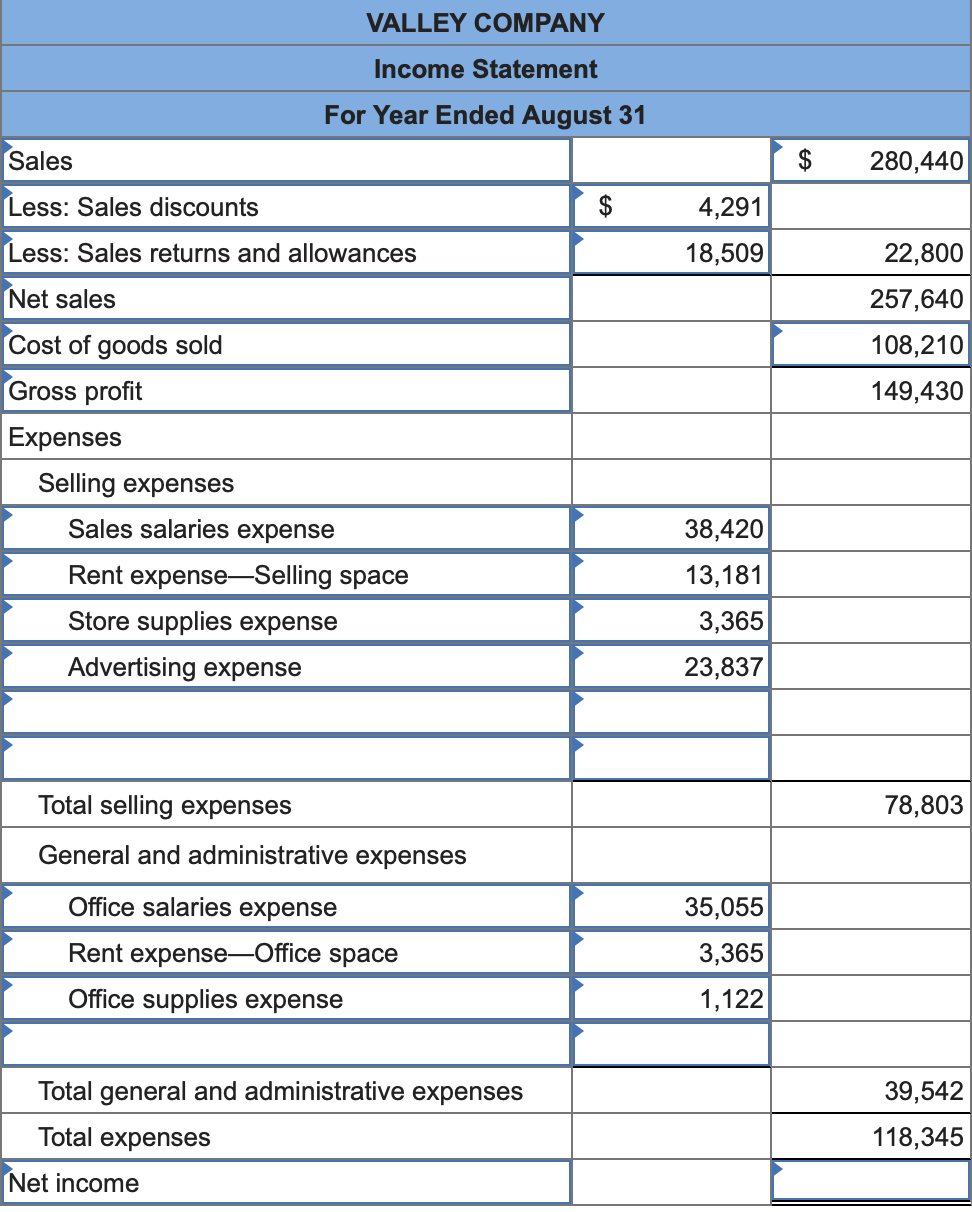

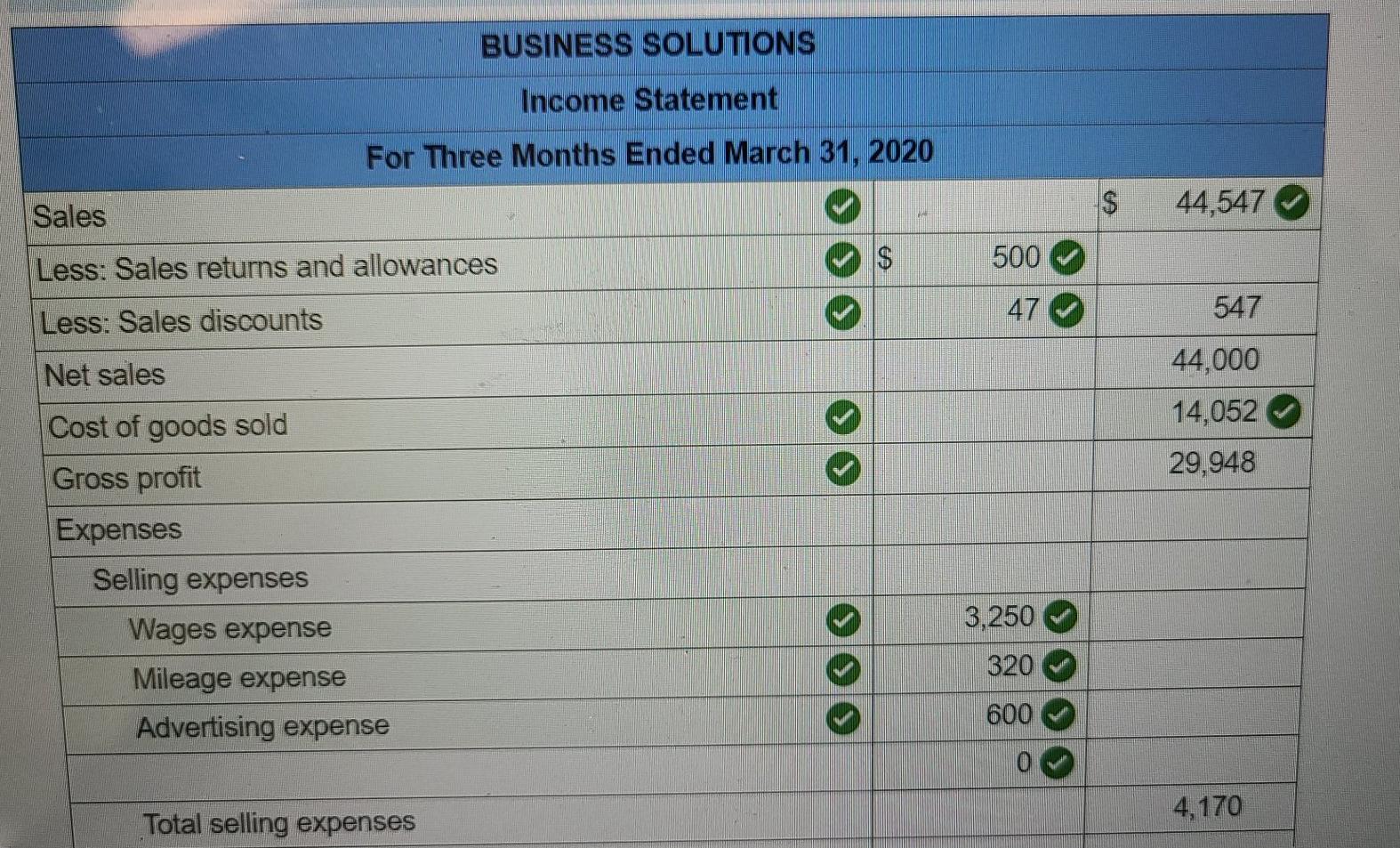

Selling expenses income statement. Selling expenses are traditionally listed before general and administrative expenses because investors and creditors are typically more concerned about the costs related to producing income. However, under a contribution margin income statement format, you would be justified in reporting commissions within the variable production expenses section of the income statement,. For the year ended june 31, 2011.

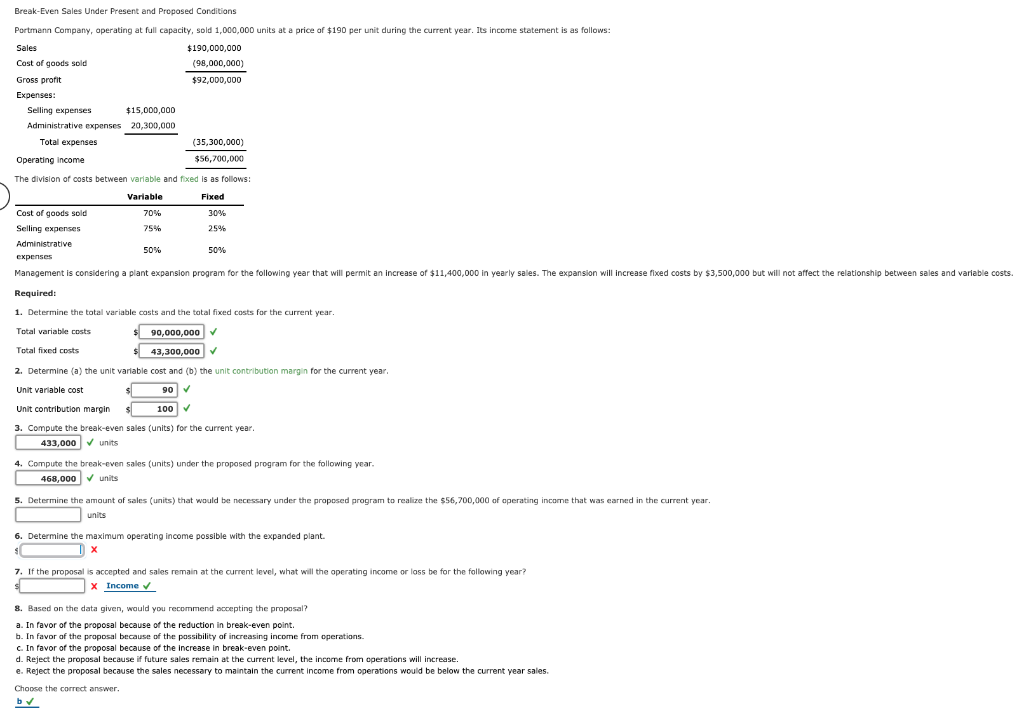

Operating expenses = selling expenses + administrative expenses. Under the accrual basis of accounting, selling expenses appear on the income statement in the period in which they occurred (not the period in which they were paid). Some of the more common examples of operating expenses are as follows.

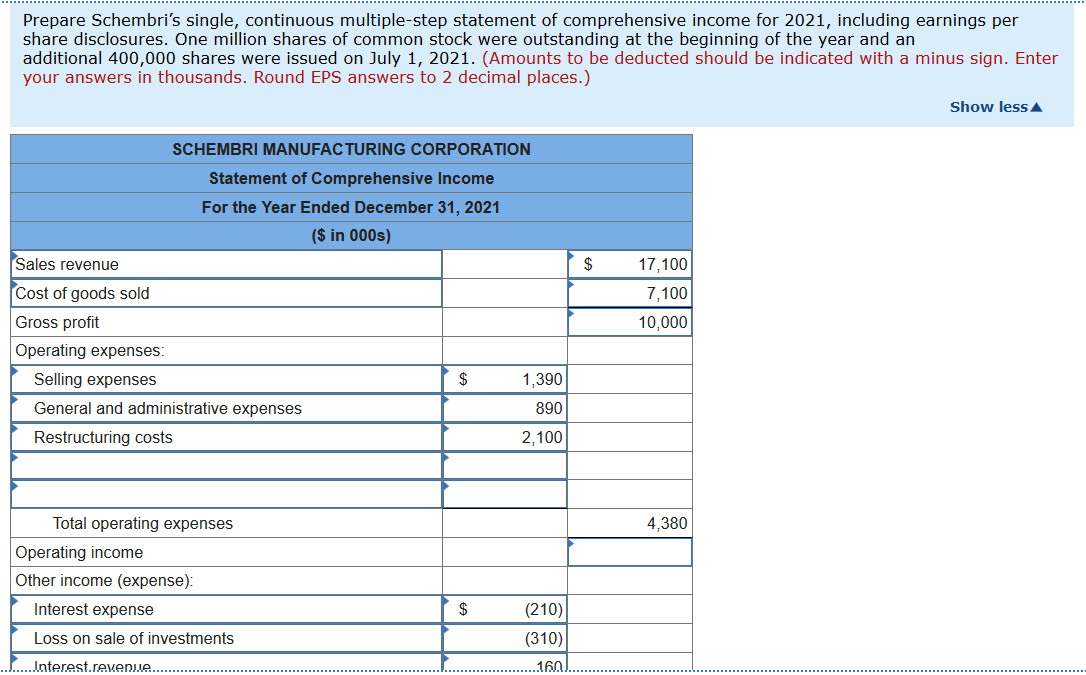

Deduct your expenses and losses from your revenue and gains to reach your income before tax and interest (ebit). An income statement might use the cash basis or the accrual basis. As seen before with best buy, macy's gross profit of $2.14 billion dramatically differs from its net income of $43 million, due to sg&a costs, interest expenses, impairment and restructuring costs.

Example of calculating selling expense and example of administrative expense. Selling expenses are different from the expenses that make up the cost of goods sold (cogs) or cost of sales. How much money a business took in during a reporting period;

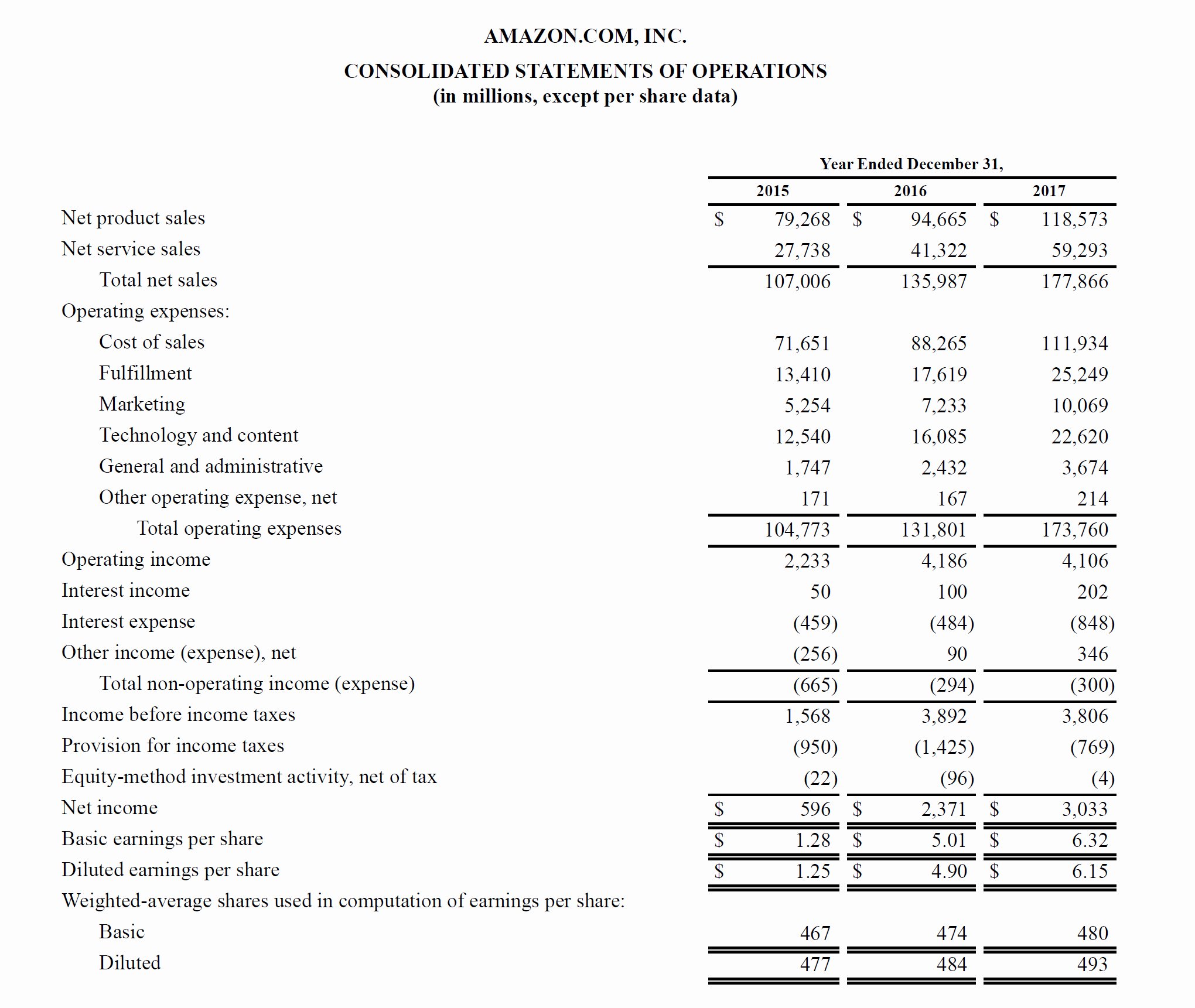

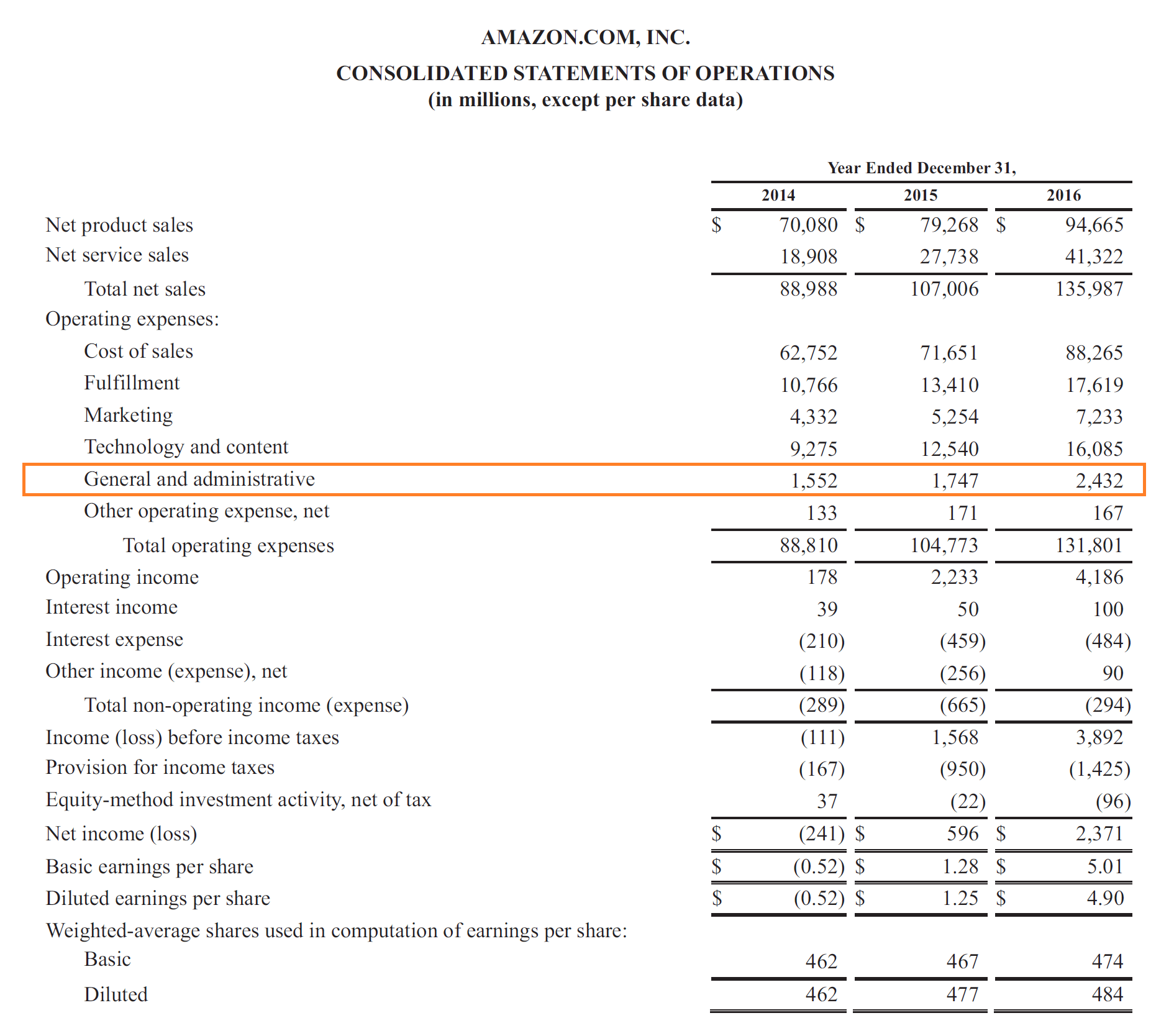

Below is a very summarized income statement that illustrates the key components of any income statement. For example, once a product is sold, it must be packed and shipped. In an income statement, gross profit less sg&a (and depreciation expense) equals the operating profit, also known as earnings before interest and tax (ebit).

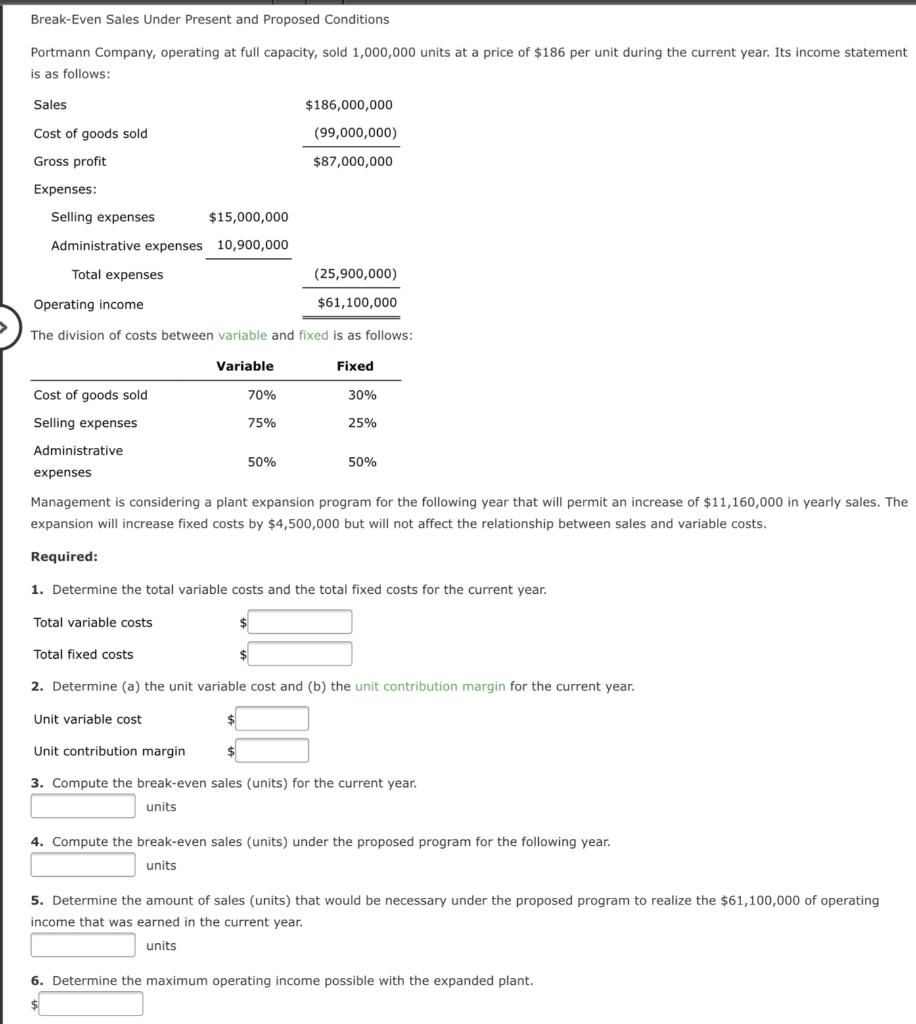

To summarize the important relationships in the income statement of a merchandising firm in equation form: Add up all your revenue and gains. Therefore, you should treat the selling and administrative costs like a mixed cost.in this case, the variable rate is $5 per unit and the fixed cost is $112,000.

Sales on credit) or cash. Revenue minus expenses equals profit or loss. For the sake of example, let's imagine a company that sells commercial ovens to bakeries.

Some components can change as sales volumes increase or. The goal is to maximize. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

Selling and administrative expenses can be variable or fixed. Managers should not only calculate selling and administrative expenses, but also analyze them selling and administrative expenses are typically a huge line item on a company's income. Some firms classify both depreciation expense and interest expense under sg&a.

Costs of goods sold (cogs): Selling, general and administrative (sg&a) research and development (r&d) sales and marketing (s&m) advertising expenses; Sg&a expenses are not assigned to a specific product and.