Brilliant Strategies Of Tips About Proprietor Current Account In Balance Sheet

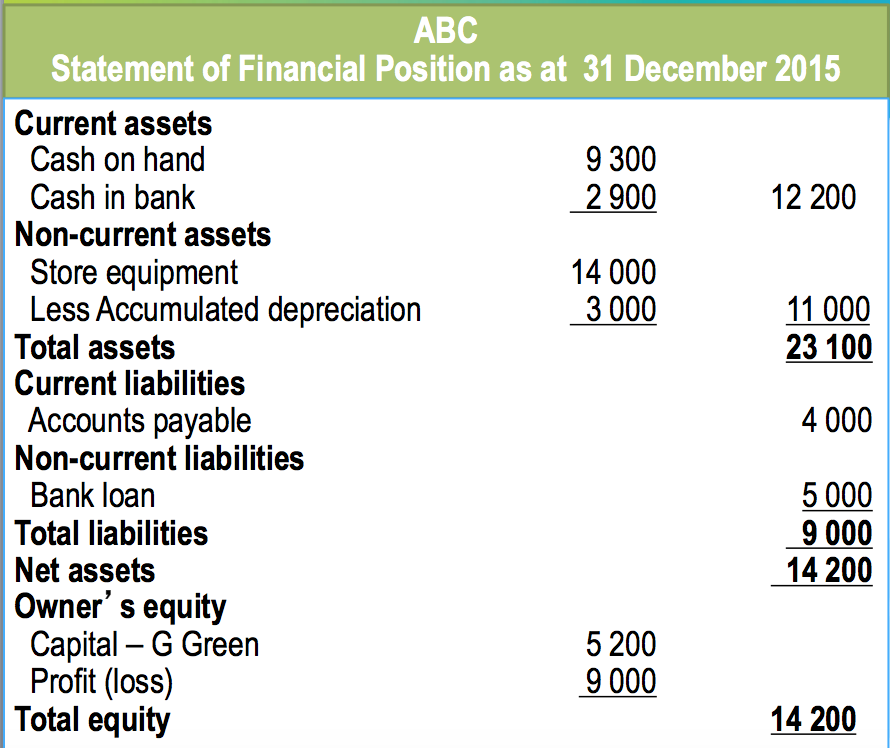

Cash ($6,200) and equipment ($12,500).

Proprietor current account in balance sheet. The balance of payments includes the current account and the capital account. Microsoft excel will provide you with a platform where you can easily create a balance sheet format for proprietorship. Let’s create a balance sheet for cheesy chuck’s for june 30.

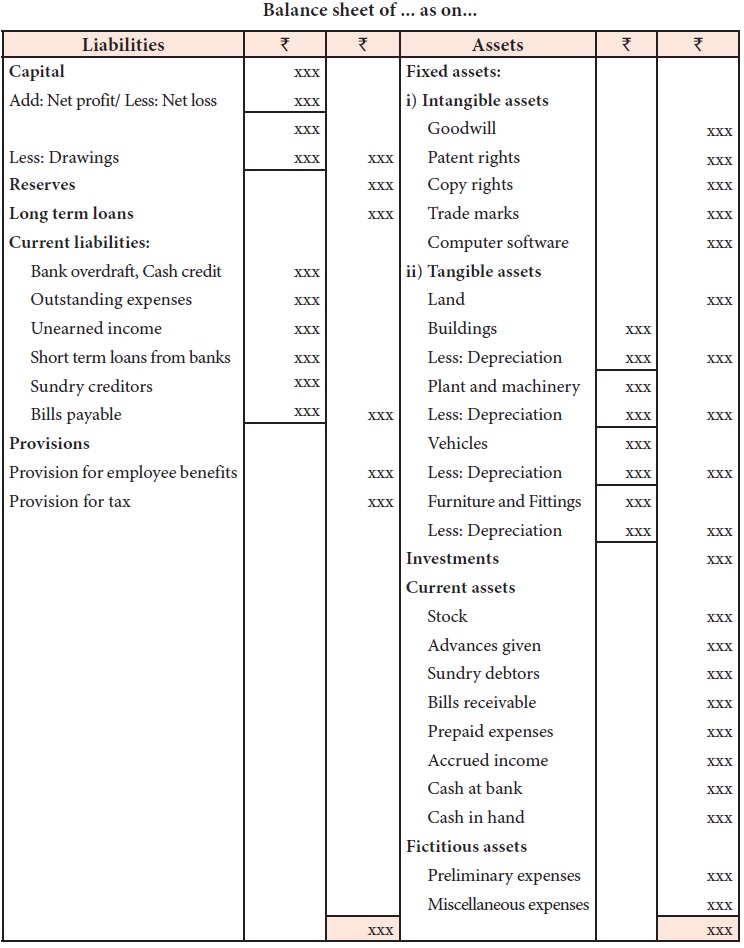

As a reminder, the balance sheet has three major sections: Entities include trading account, profit and loss account and balance sheet while final accounts of manufacturing entities include manufacturing account, trading account, profit and loss account and balance sheet. There are typically two accounts listed:

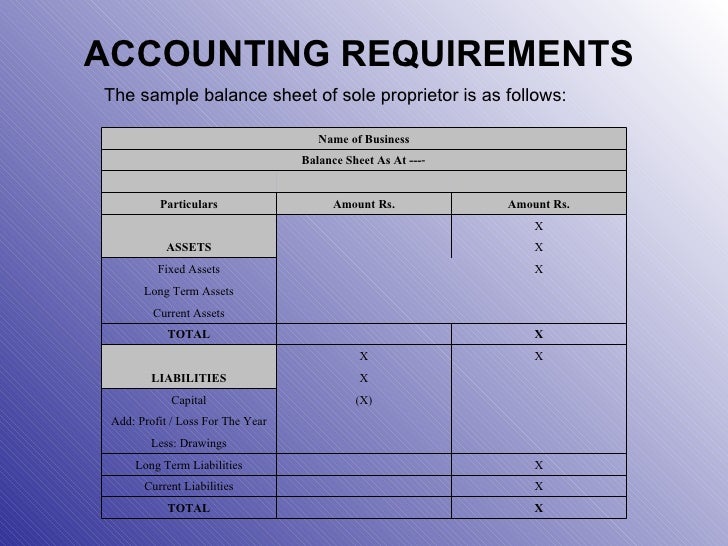

In accounting, the balance sheet of the sole proprietorship reflects the accounting equation: 05 january 2018 no it's not negative capital. Our unique financial statement format for sole proprietorships in excel consists of automated reports including an income statement, balance sheet, cash flow statement, statement of changes in equity and the notes to the financial statements.

The owner's capital account is shown in the business balance sheet as [owner name], capital account. partnerships/llcs: Since the trading a/c and the profit and loss a/c are. This balance represents how much money the owner has put into the business.

The equation assets = liabilities + equity is true for all entities. The profit and loss a/c is also a nominal account. This chapter has been divided into two units :

It shows a proper balance including assets, liability, and owner’s equity. For a sole proprietor, equity is called owner’s equity. Cheesy chuck’s has two assets:

Current assets are properties that will be converted into cash within 12 months or within the operating cycle of the business. The owner’s capital account and owner’s draw account. The balance sheet for a partnership is equal to the balance sheet for a single proprietorship and the only different is equity owner’s share.

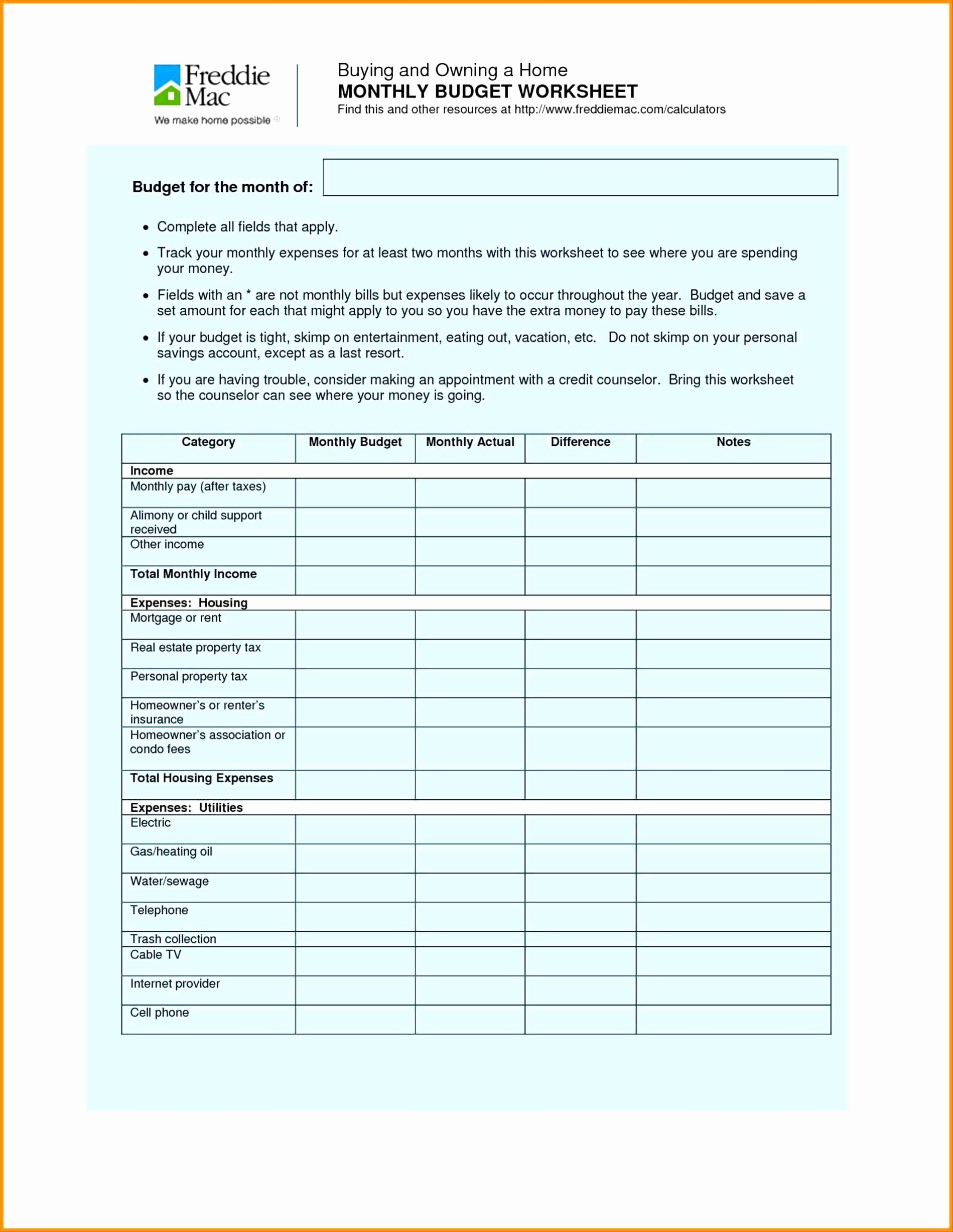

The accounting for a sole proprietorship differs somewhat from the requirements for other types of business entities. The current account is the sum of net income from abroad, net current transfers, and the balance of trade. Balance sheets provide the basis for.

Once the statement of owner’s equity is completed, accountants typically complete the balance sheet, a statement that lists what the organization owns (assets), what it owes (liabilities), and what it is worth (equity) on a specific date. Current assets appear on a company’s balance sheet and include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, prepaid liabilities, and other liquid assets. A sole proprietor has 100% ownership in the business.

To begin, we look at the accounting records and determine what assets the business owns and the value of each. To set up a balance sheet for a sole proprietorship, list assets and liabilities to capture the company's overall financial picture as well as its financial relationship with its owner. Capital account and current account in balance sheet 1.