Underrated Ideas Of Tips About Impairment Loss Income Statement

If revaluation results in an increase in.

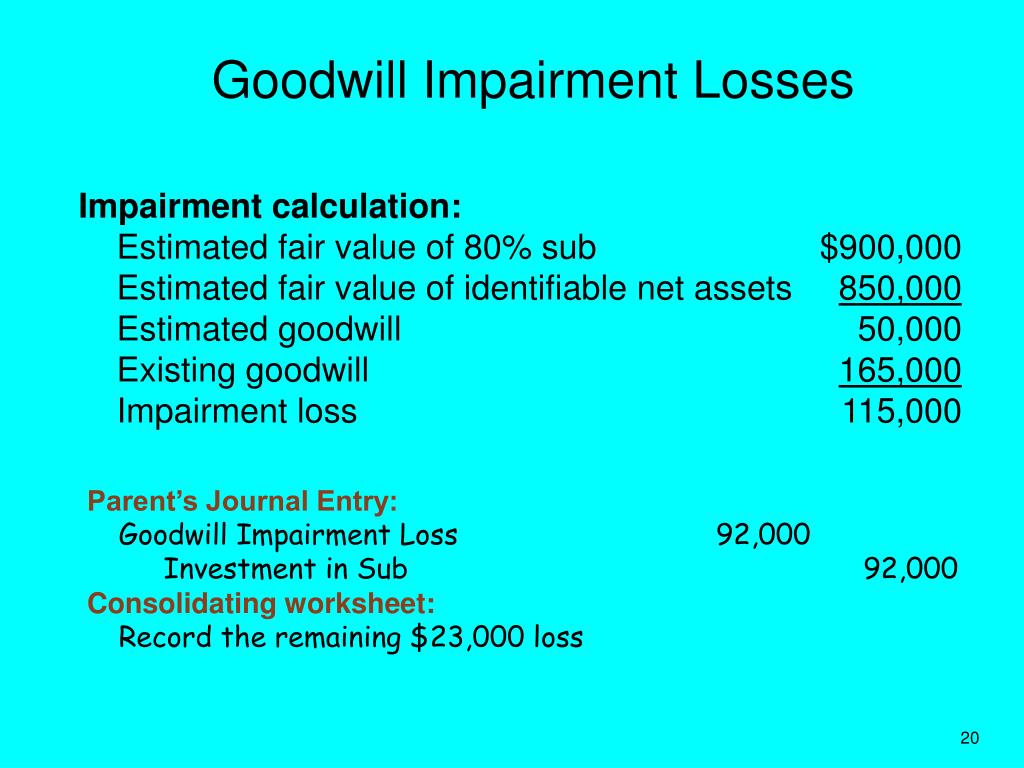

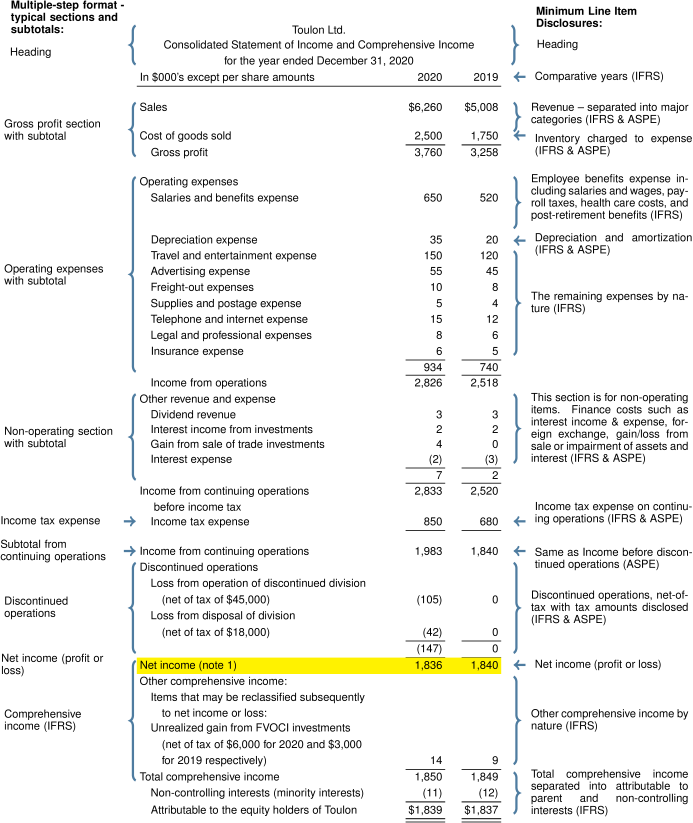

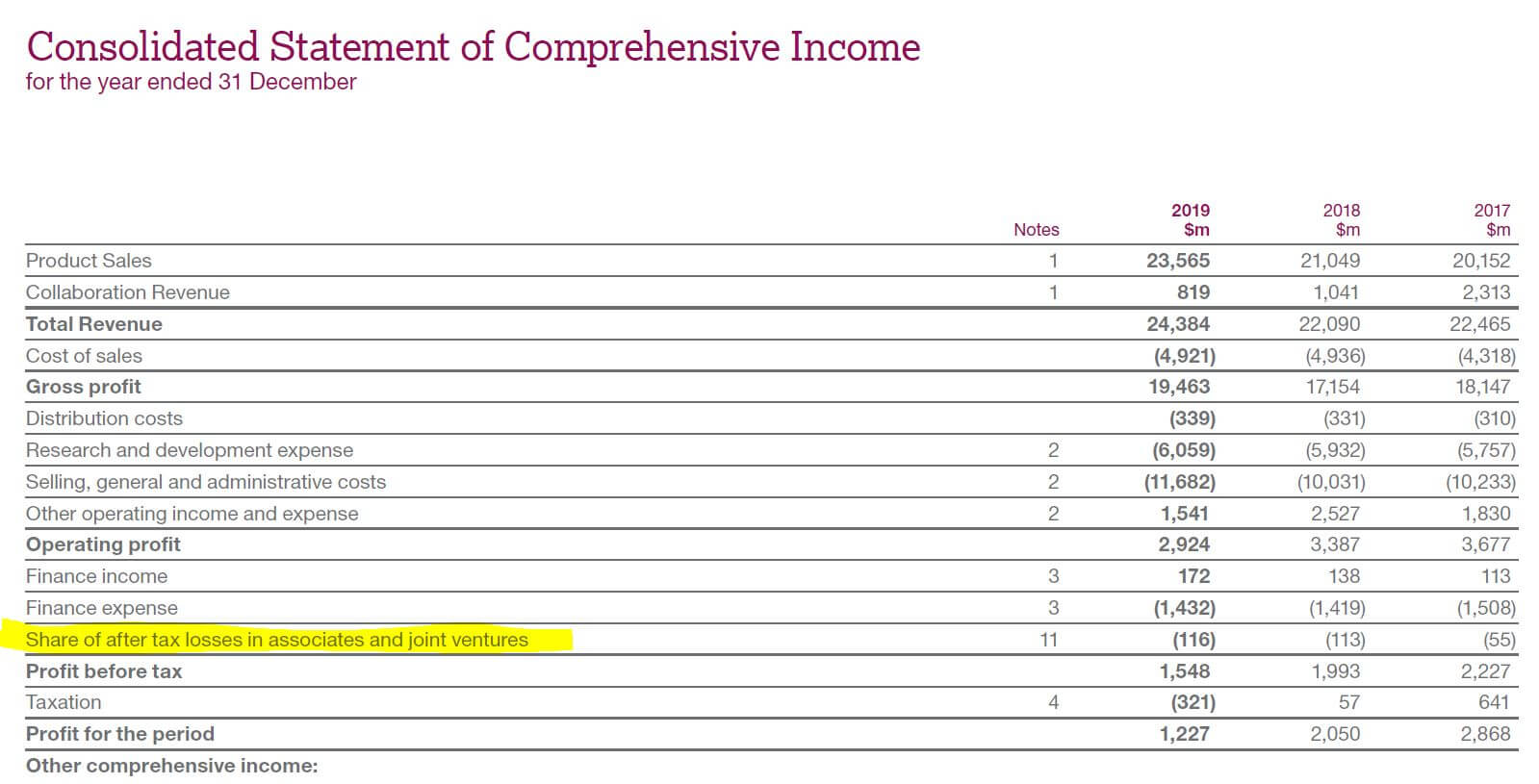

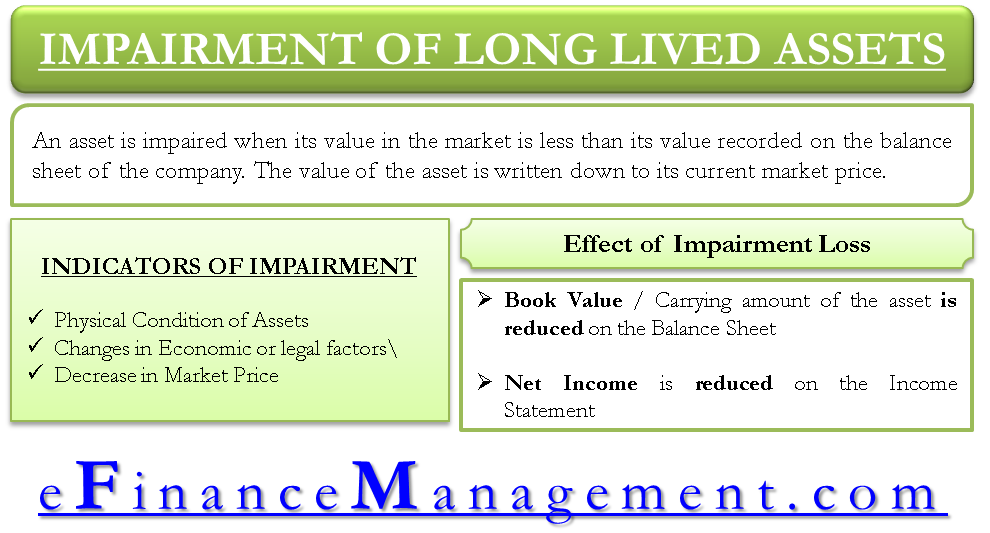

Impairment loss income statement. An organization must record this loss as an expense on its income statement. Objective 1 scope 2 definitions 6 identifying an asset that may be impaired 7 measuring recoverable amount 18 measuring the recoverable. An impairment loss makes it into the total operating expenses section of an income statement and, thus, decreases corporate net income.

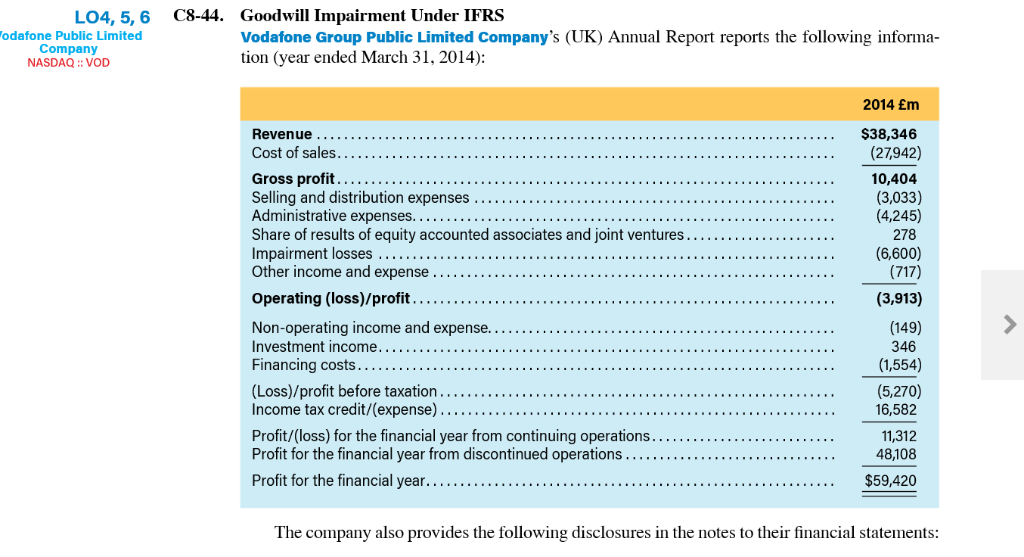

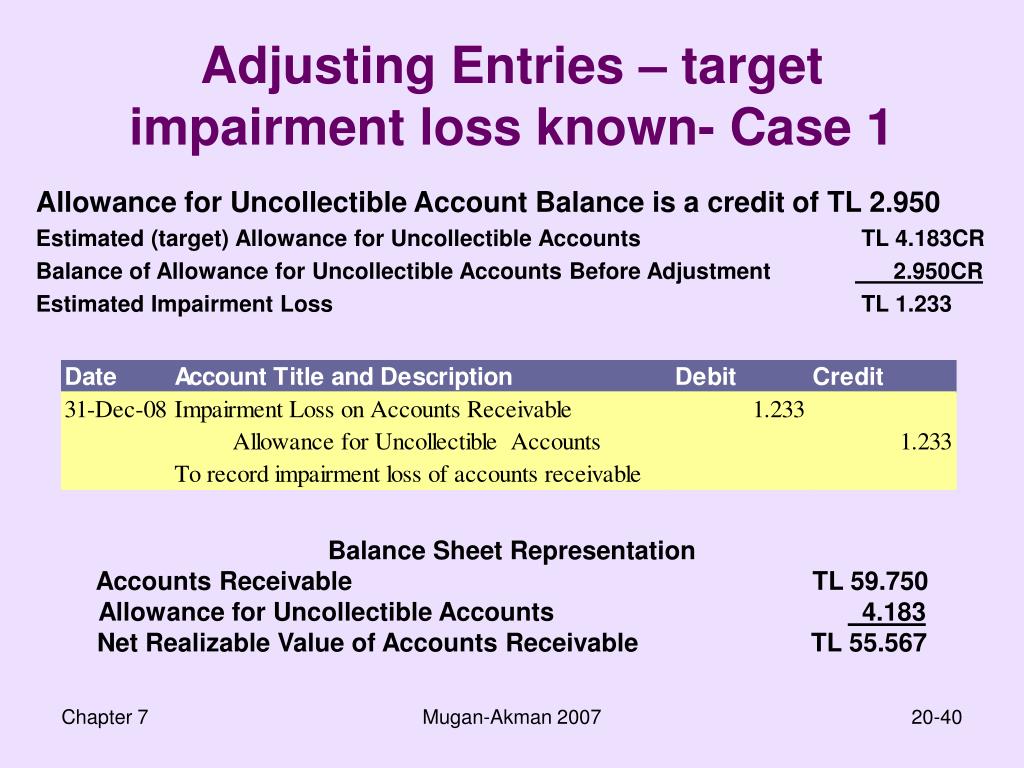

Generally accepted accounting principles (gaap) assets considered impaired must be recognized as a loss on an income statement. Gaap and ifrs have differing. If the impairment loss is greater than the revaluation surplus or this is the second impairment, we create a loss directly in the profit and loss section of the income.

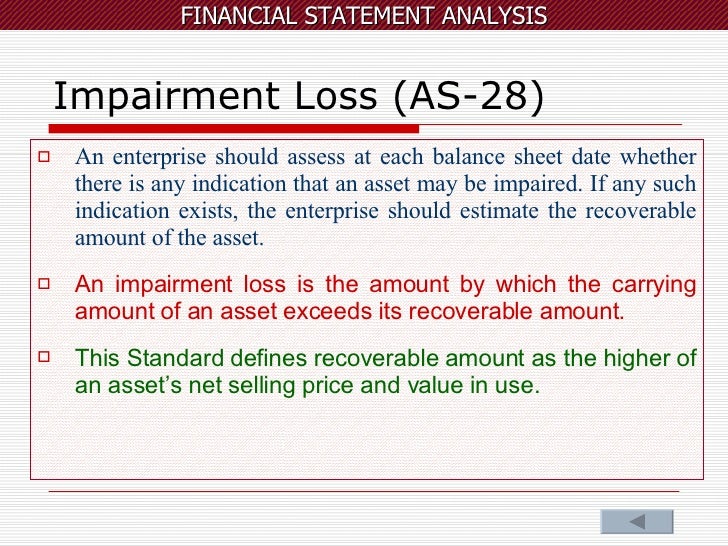

The amount at which an asset is. Under the u.s. Why should impaired assets be reported?

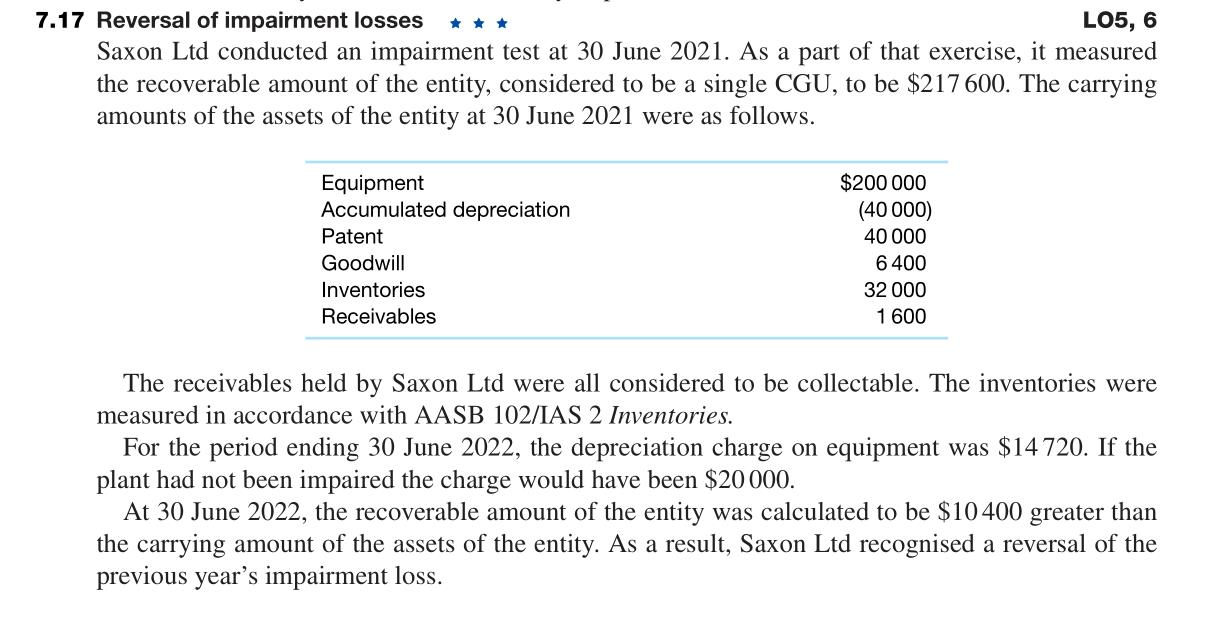

To gauge impairment loss, you may need to test the impairment value of an asset. This value decline can apply to both. It reduces the company’s profit, but there is no cash flow happens.

Where does impairment loss go on income statement? The impairment loss is the expense recorded on the income statement. At the same time, it must reduce the.

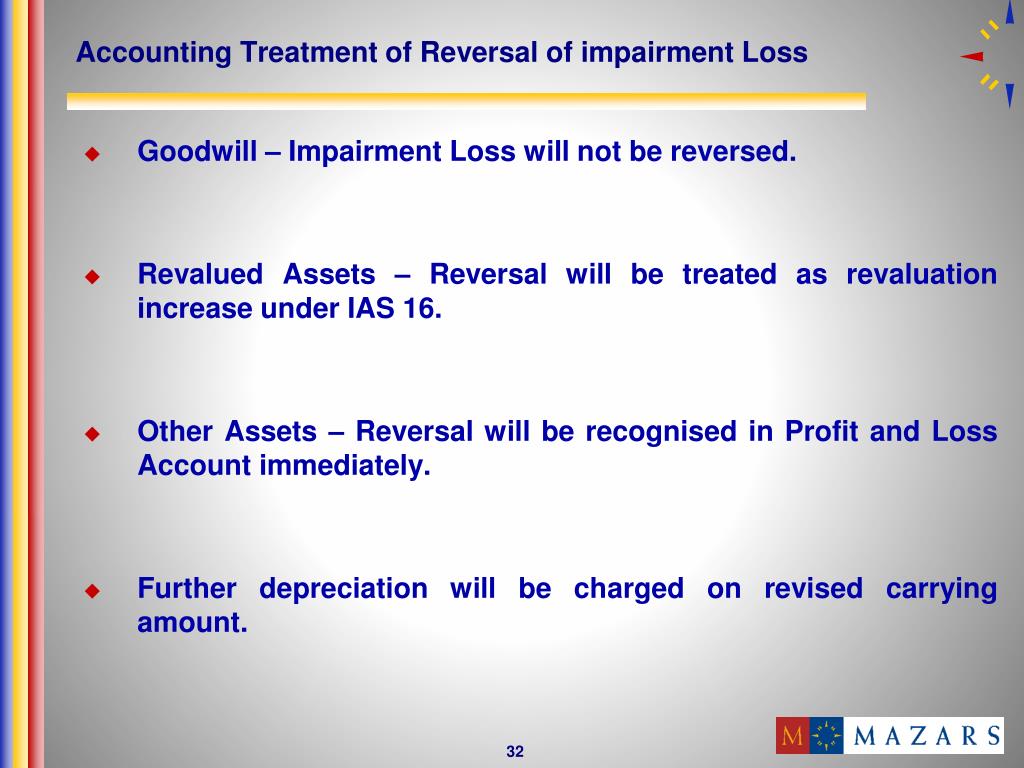

Impairments are not the same as depreciation or amortization. This value decline can apply to both intangible and fixed assets. Any reversal of an impairment loss is recognised immediately in the income statement, unless the asset is carried at a revalued amount, in which case the.

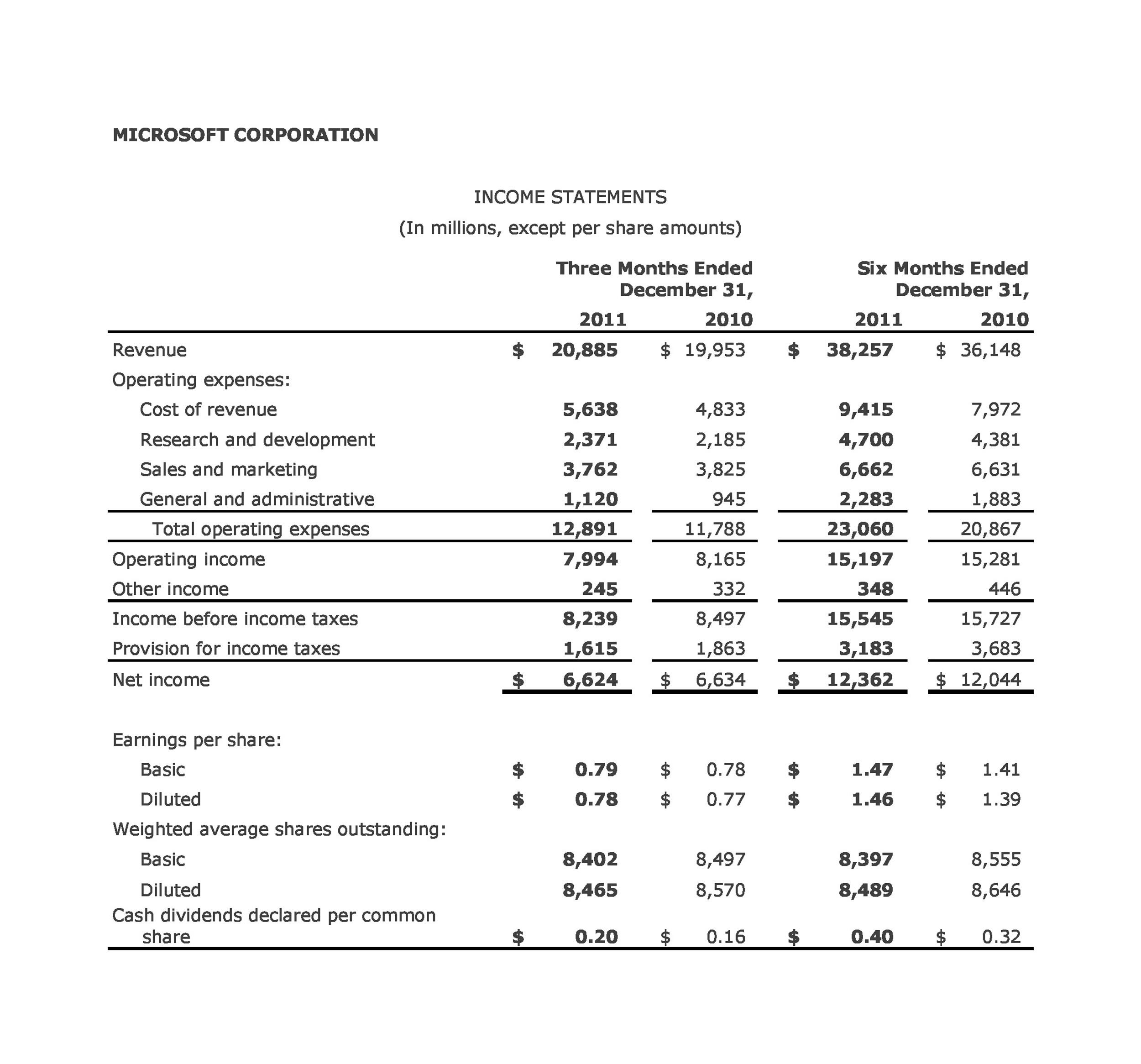

On an income statement, impairment loss represents a permanent loss of value on a company’s or business’s assets. Goodwill impairment is a charge that companies record when goodwill's carrying value on financial statements exceeds its fair value. You can do this by regularly comparing the.

On an income statement, impairment loss represents a permanent loss of value on a company's or business's assets. The asset impairment loss on income statement is reported in the same section where you report other operating income and expenses. Impairment losses reduce the carrying amount of assets and increase the net income reported on the income statement.

Under gaap, impairments are entered as a loss on the income statement. An impairment loss is recognised immediately in profit or loss (or in comprehensive income if it is a revaluation decrease under ias 16 or ias 38).

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)