Outstanding Info About Cash Flow And Fund

A cash flow analysis should be preceded by a funds flow analysis.

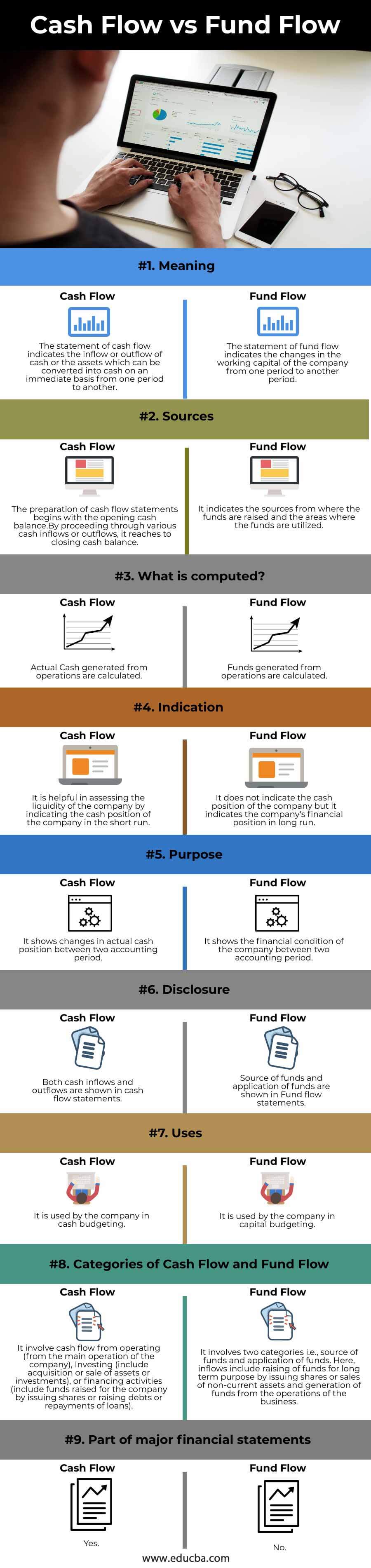

Cash flow and fund flow. Cash flow refers to the concept of inflow and outflow of cash and cash equivalents during a particular period. Much of this cash found its way into money market funds. Payments to investors or payments are given to the firm in return for goods and services are examples of these transactions.

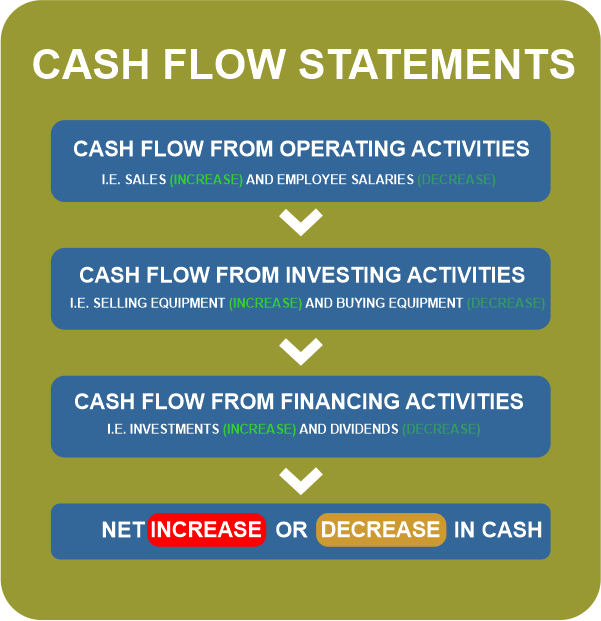

In this chapter, the importance of cash flow analysis as a modern day tool of appraisal and monitoring is highlighted. Cash flow statements are created for specific time. The cash flow will record a company's inflow and outflow of actual cash (cash and cash equivalents).

It is useful for short term financing. The major cash flows are presented in one of three classifications: One is for accounting, while the other is for investment.

On the other hand, fund flow is the net of the different financial assets, including the cash which flows in and out of your business. Cash flow : Fund flow is accounted on the basis of accrual of funds and not actual payment or collection.

It's usually measured on a monthly or quarterly basis. Fund flow is the cash that flows into and out of various financial assets for specific periods of time. It starts with opening and closing balance of cash and deals only with cash and it shows causes for changes in cash.

They help investors, managers, and stakeholders assess the financial health and stability of a. The difference between cash and fund flow statements means their analysis can be used to understand several things. Cash flow is used to identify the net cash flow of a business for a given period.

Cash flow statements are best used to understand the liquidity power of a firm. Accounting for cash flow is done only when liquid cash is involved in the form of currency or bank transfer. There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its weekly roundup of fund flows.

However, if expectations of a soft landing for the u.s. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Ttm = trailing 12 months.

Economy becomes the market consensus in 2024, cash also could flow. In cash flow cash from the operations is calculated. Some exchange traded funds, including.

Cash flow and fund flow differences. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric. Major differences between fund flow and cash flow

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/GettyImages-1163745146-8e67b32f7c8042d5b10b799dd850cec7.jpg)