Beautiful Work Tips About Gratuity Fund Trust Balance Sheet

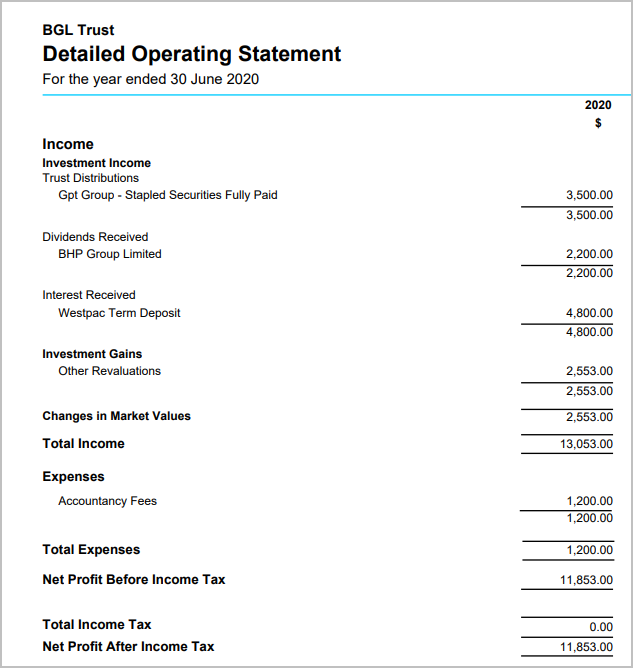

P&l reporting of gratuity scheme.

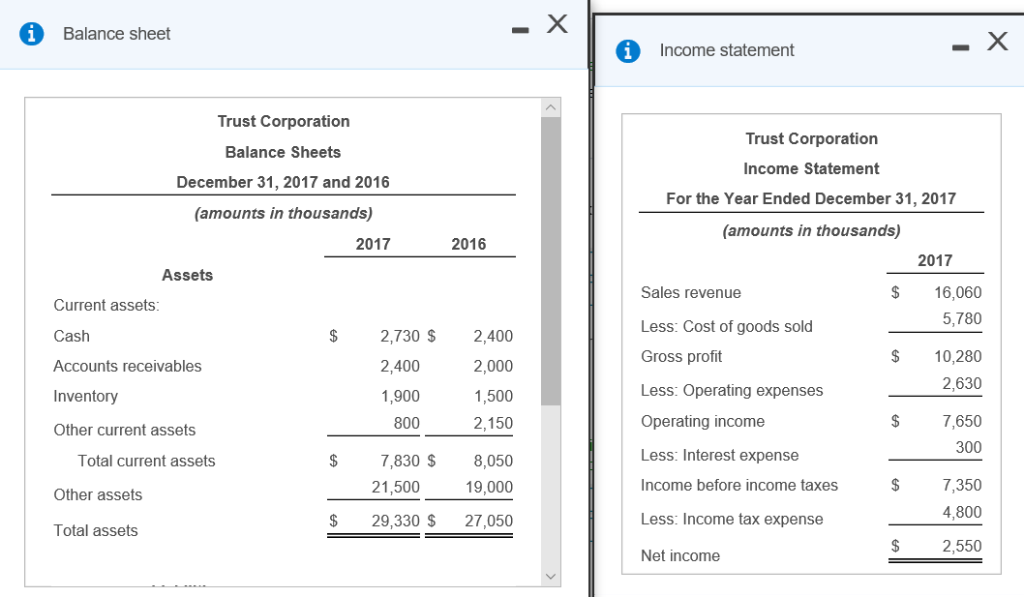

Gratuity fund trust balance sheet. The alternative uses for the money, as well as. The balance of your bank account will. In the traditional method we just create provision for gratuity liability in balance sheet, however funds are never transferred to separate pool to meet future liability.

In the books of gratuity trust, the main source of fund is contribution received from employer company. For the proper administration of the trust creating a gratuity fund for the benefit of the employees of the corporation bank known as “corporation bank employees’ gratuity. The main motto of the gratuity trust is to manage the funds contributed by employer company & to pay the gratuity amount to the employee at the time of retirement or separation.

These 2 tax benefits are not available to companies, if they make the provision of gratuity liability in balance sheet at the end of each financial year. When you are reviewing your balance sheets each month, the money in your client trust accounts will show up as a liability. 2.should a provision for gratuity be made ?

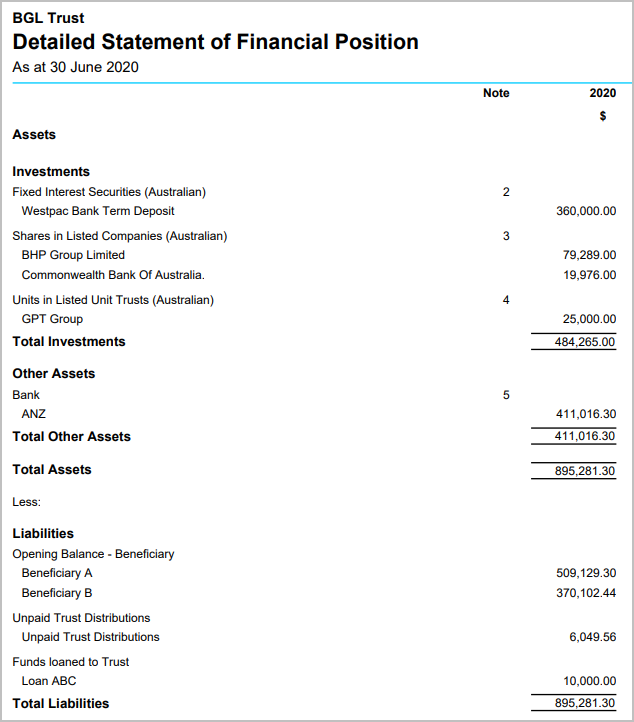

Therefore, as per the law, the audit of the approved gratuity. This fund is mainly used for investment as per the. As per provisions of section 129 of the companies act 2013, indian and multinational companies operating india needs to prepare the financial statement such.

The financial reporting council have said they will review the determination hierarchy as part of the triennial review of frs 102 due in 2018. 1) income tax compliances: Gratuity trust must be set up for providing gratuity benefits to the employees trust to act as a separate legal entity.

Resolved report abuse follow query ask a query amit gupta (querist) follow 25 august 2010 dear all,. Companies must agree to a gratuity trust and raise money from within the company to cover their gratuity liabilities. Employer can appoint trustees for.

For achieving the tax benefits under section 36(1)(v) for contribution of gratuity equivalent to gratuity provision in the balance sheet based on actuarial report. When an entity has a surplus in the dbo, it shall measure it at the lower of surplus in the dbo or the asset ceiling. 12 jan 2019 235,359 views 23 comments ca ahmad faraz* about the article the author has aimed to summarise the provisions of gratuity fund and accounting thereof as.

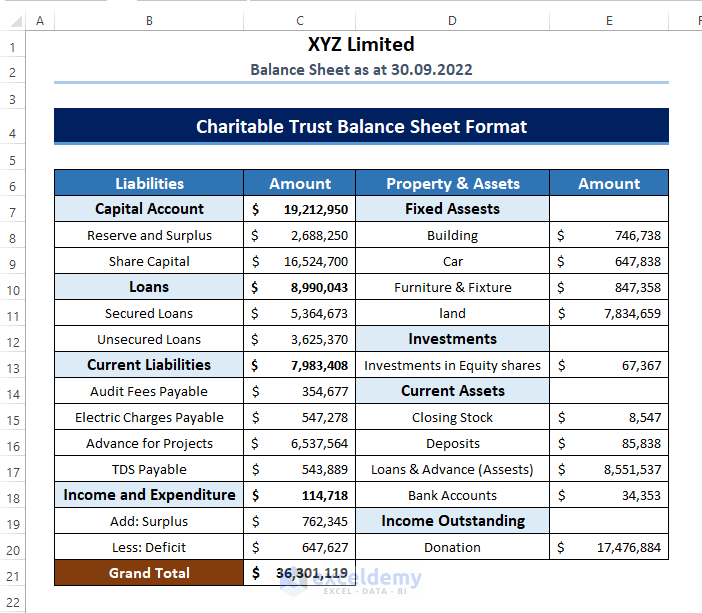

1.when a company has set up a gratuity fund and paying lic premium yearly. Reduce all the manual processing and complex gratuity calculations with factohr’s gratuity fund trust. Format of balance sheet of gratuity trust this query is :

Streamline gratuity fund management with factohr today. In the balance sheet, the net defined benefit liability (asset) shall be recognised. The approved gratuity fund is a separate entity in the eyes of law.