Brilliant Strategies Of Info About Interest Expense On Income Statement Balance Sheet Format Of Partnership Firms

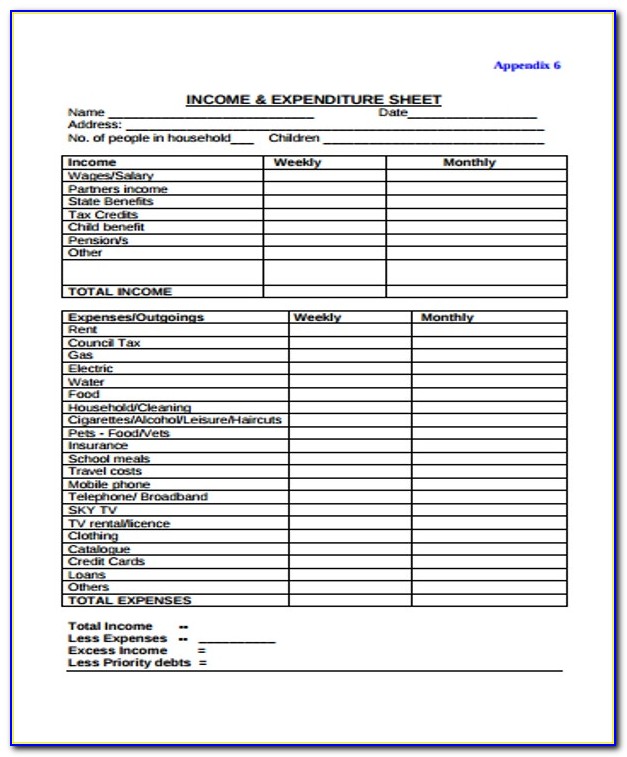

Determine the monthly interest rate:

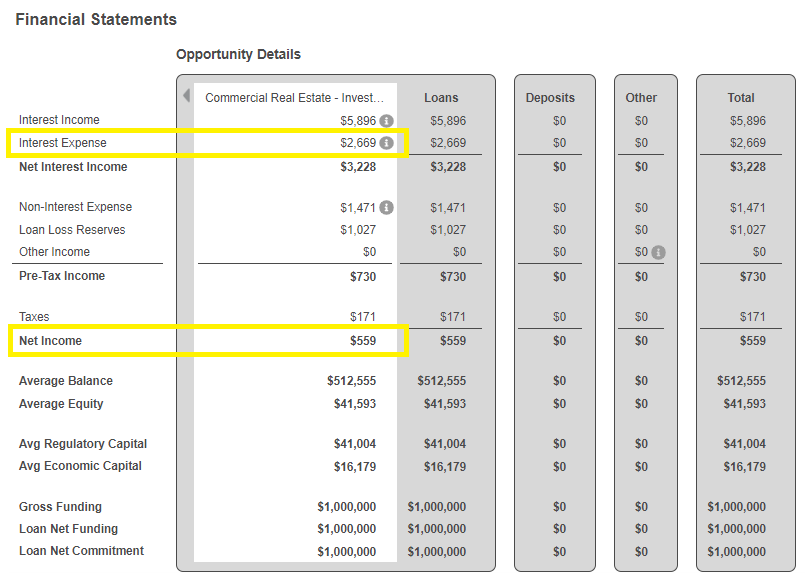

Interest expense on income statement balance sheet format of partnership firms. A general partnership prepares its income statement to reflect the revenues the firm generated, the expenses it incurred and the resulting partnership. Assume the partnership agreement for dee's consultants requires net income to be allocated based on three criteria, including: By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two.

(a) do not put partners' salaries or interest on capital into the main income statement. In this case, 6% / 12 = 0.5%. It represents interest payable on any borrowings—bonds, loans, convertible.

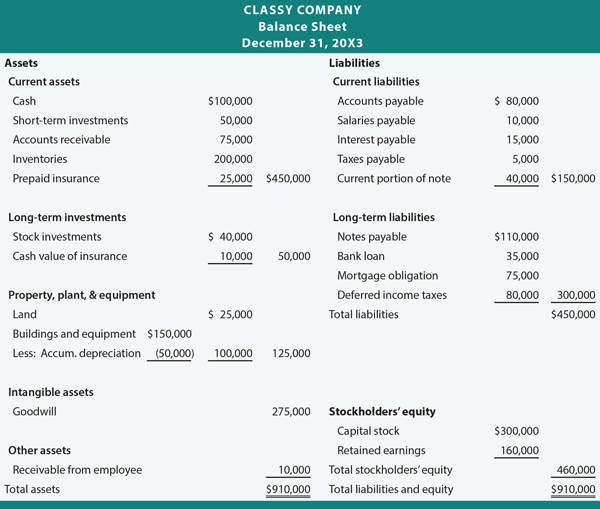

Preparing partnership financial statements. Salaries and interest paid to partners are considered expenses of the partnership and therefore deducted prior to income distribution. At the bottom of your balance sheet template you’ll have the chance to subtract your company’s liabilities from its assets.

Add up all your gains then deduct your losses. Asc 205, presentation of financial statements, and asc 225, income statement, provide the baseline authoritative guidance for presentation of the income statement for all us. The partnership will pay the placement agent ongoing compensation on a monthly basis equal to 1/12th of 3.0% (3.0% per year) of the net assets (as defined in.

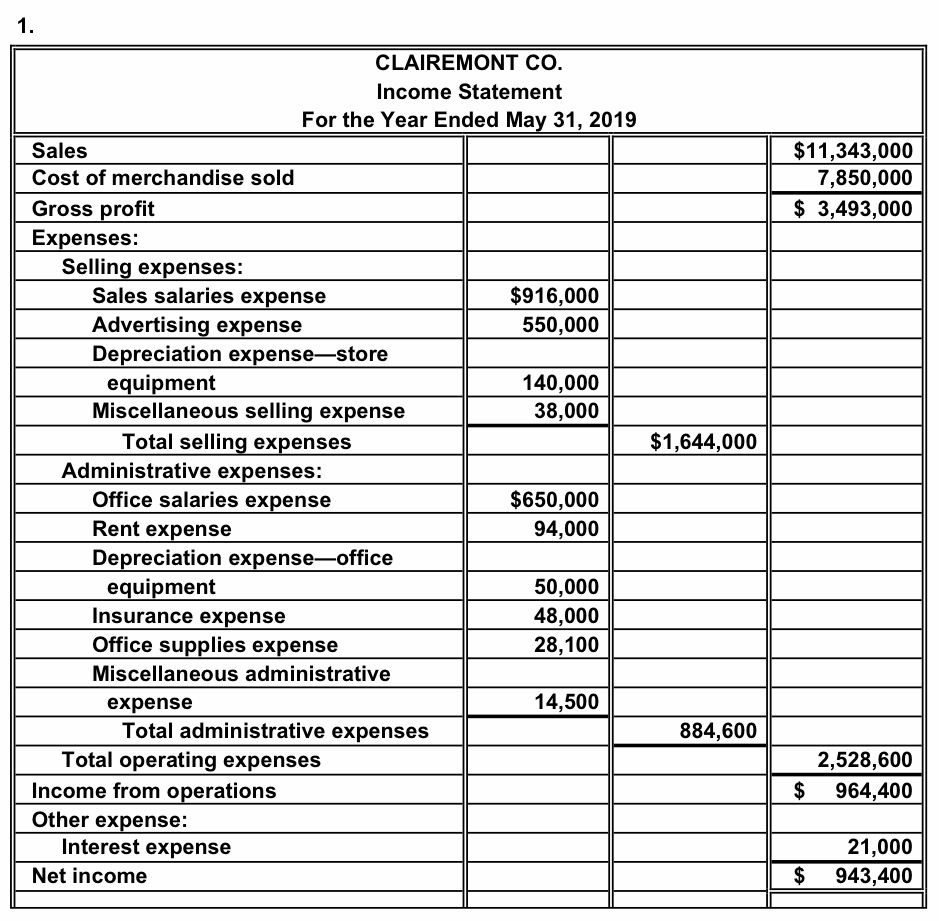

The partnership’s profit for the year was $65,460. Income statement for the year ended 30 june 2009 rm revenue 595,000 : An income statement might use the cash basis or the accrual basis.

Monthly review of balance sheet helps you to understand true position of the business. In other words, if a company paid $20 in interest on its debts and earned $5 in interest from its savings account, the income statement would only show interest. Income statement the main part of the income statement is prepared exactly as for a sole trader.

Divide the annual interest rate by 12 to get the monthly interest rate. Cost 1 accumulated depreciation, 1 april 20x2 inventory, 1 april 20x2 2 trade receivables 3 allowances for receivables, 3 1 april 20x2 sales revenue purchases rent paid 4. The figure you’re left with is.

February 20, 2024. Net income for the year equalled $15,000, allocated as a: The income statement is a useful way to see.

However, as partners are the owners of. The salaries of employees are business expenses that are written off to the income statement, thereby reducing profit for the year. 3) net worth.

Salary allowances of $15,000, $12,000, and. Revenue minus expenses equals profit or loss. But it requires accurate and consistent accounting system to get timely reports.