Spectacular Info About Accruals And Deferred Income Balance Sheet

Accruals and deferrals journal entries.

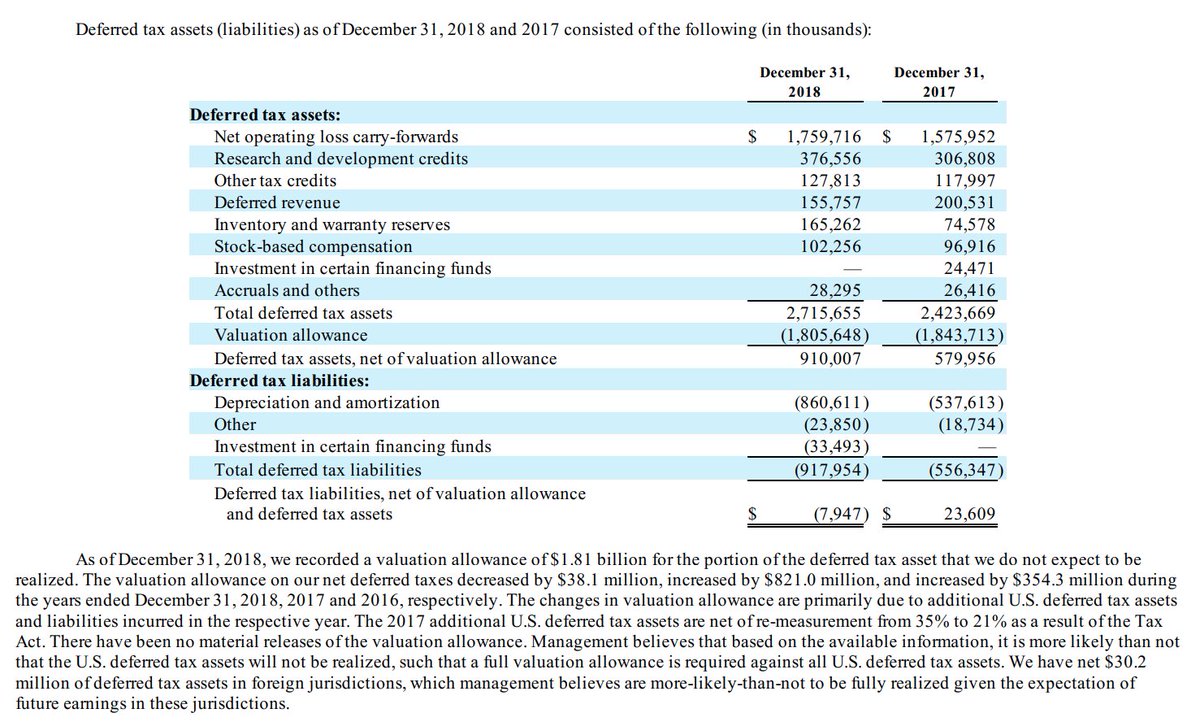

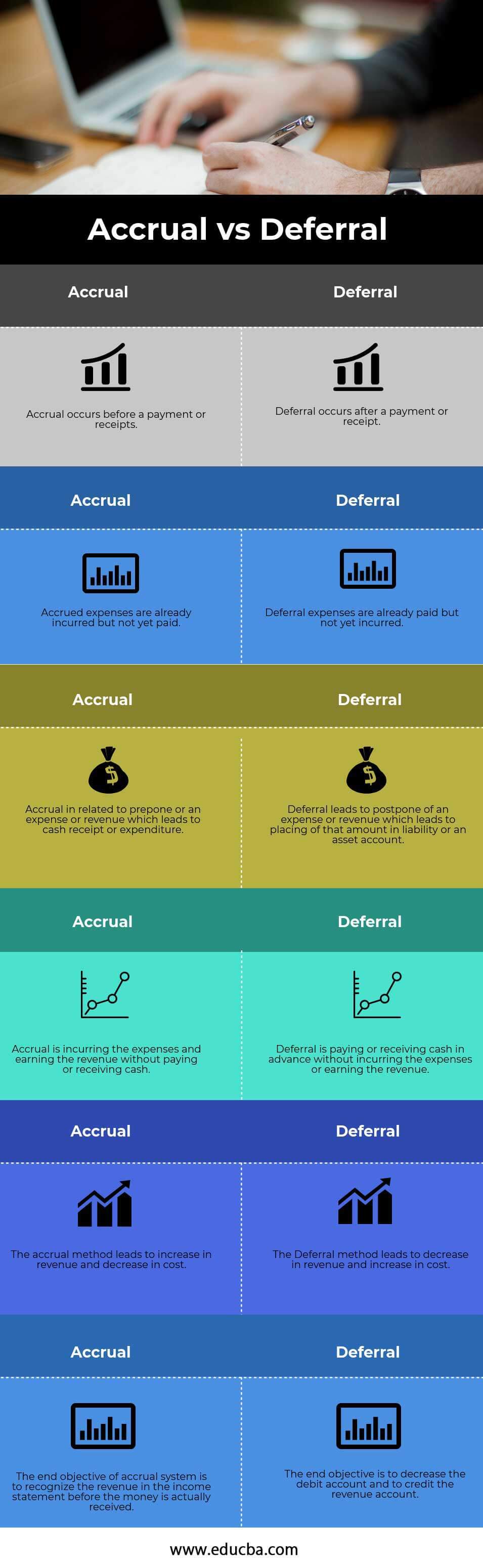

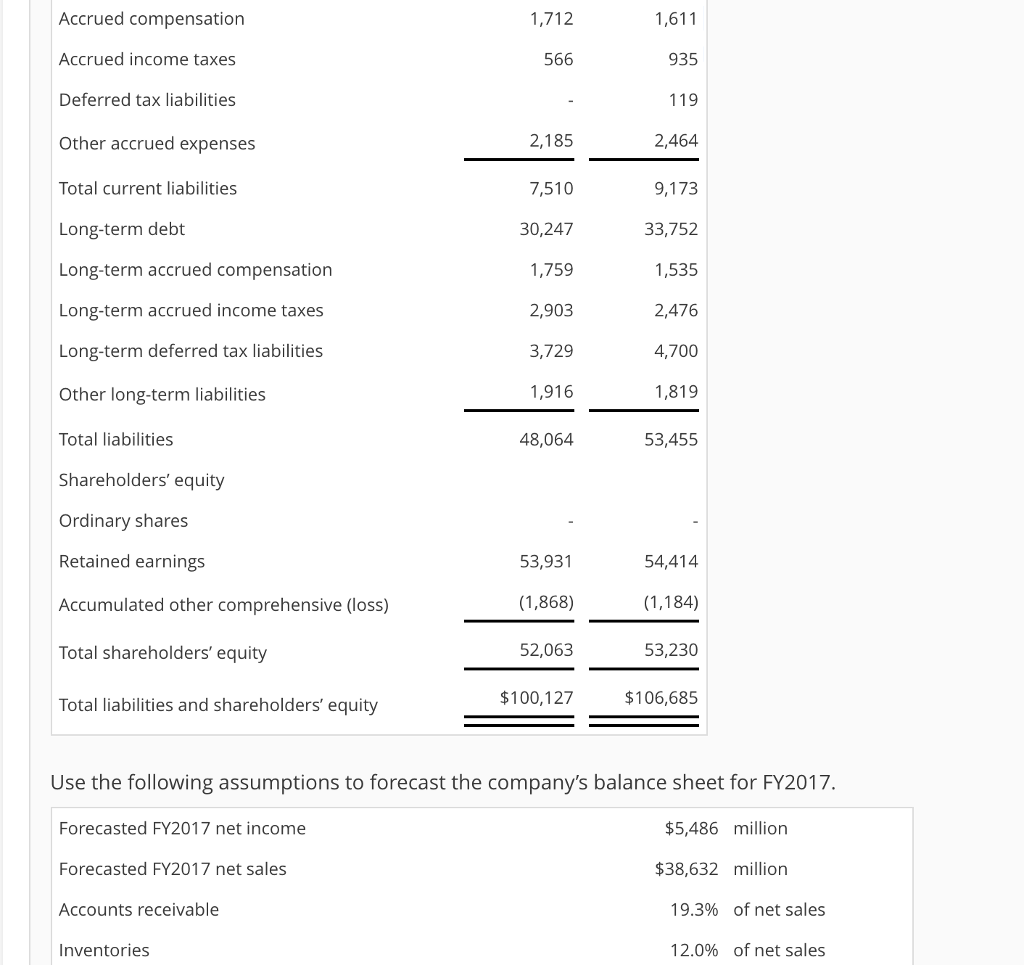

Accruals and deferred income balance sheet. Deferred revenue is an obligation on a company's balance sheet that receives the advance payment because it owes the customer products or services. Importance of deferred income. Accrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment.

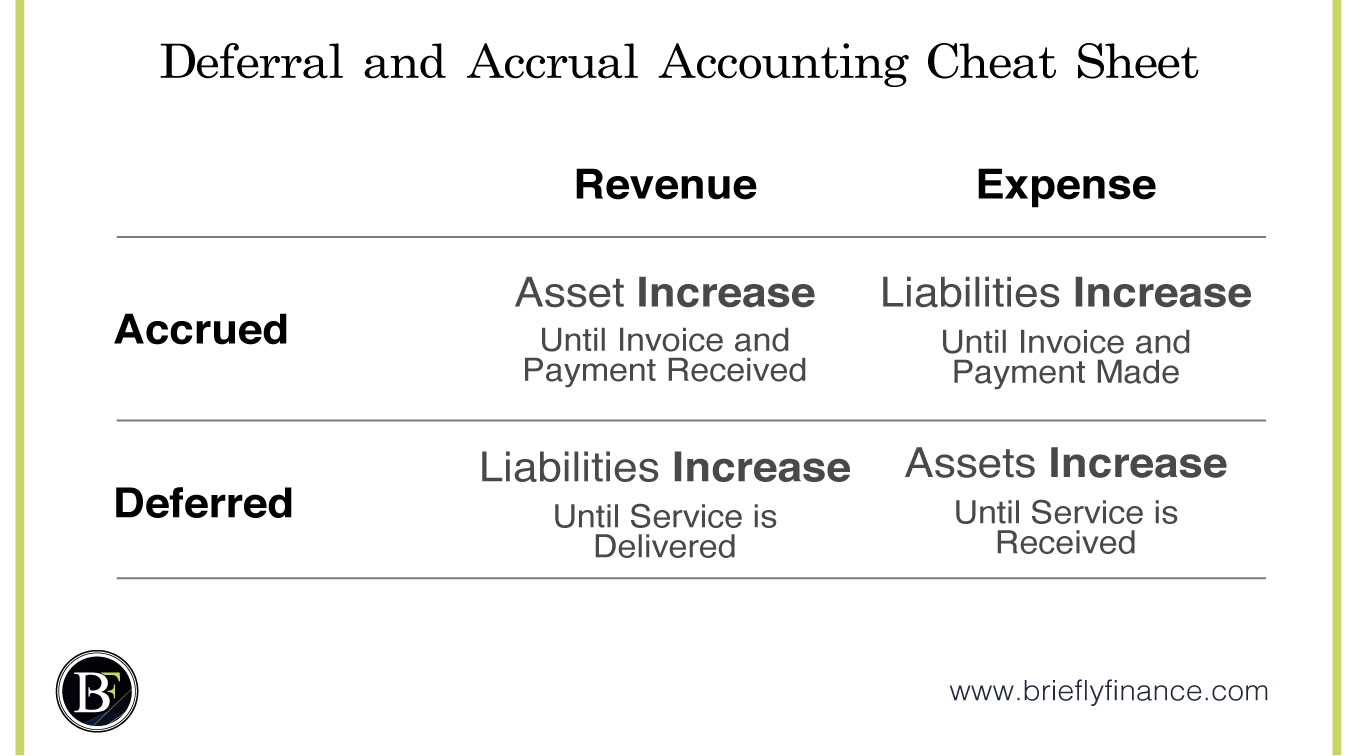

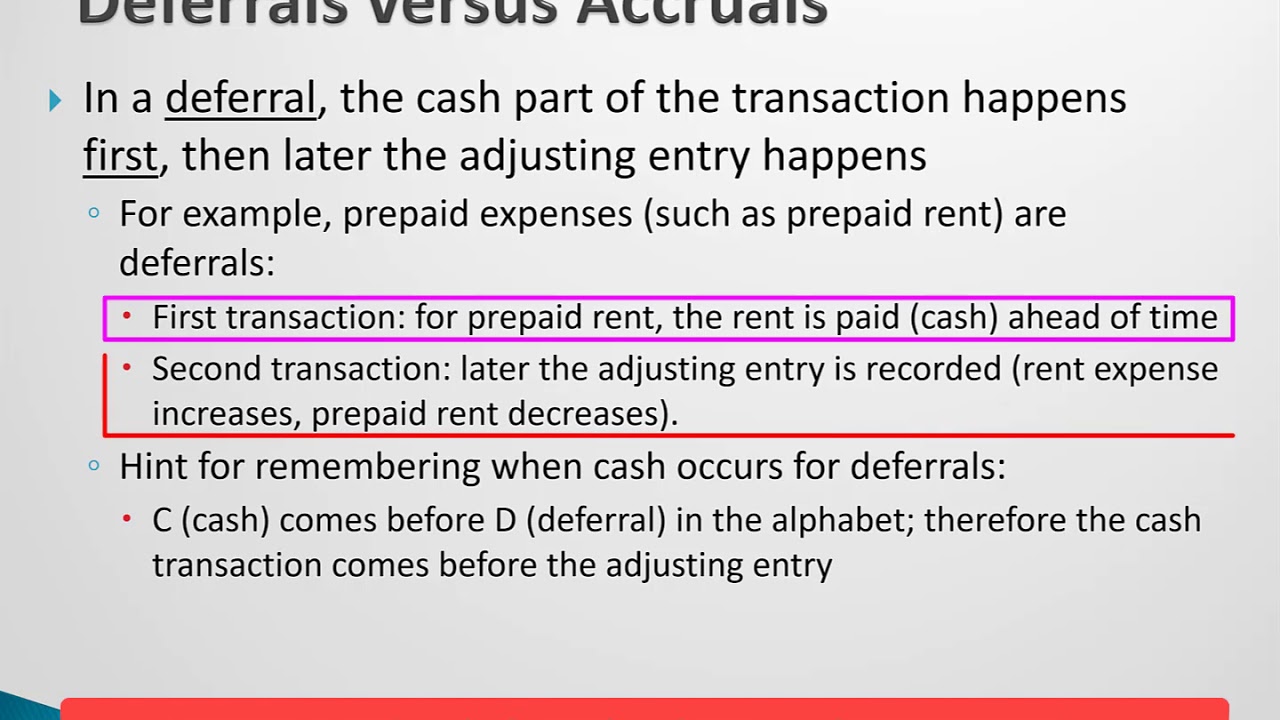

Accruals and prepayments interest depreciation, and irrecoverable debts and allowances for receivables. Deferred income is very important in accrual accounting because sometimes companies receive advances for their goods or services. The key differences between accrual accounting and deferral accounting is how revenue and expenses are recognized in different periods.

To prevent overstating certain accounts, companies need to differentiate between the revenue that they have earned versus revenue that they have not yet earned. Deferred expenses are expenses a company has prepaid. When an accrual is created, it is typically with the intent of recording an expense on the income statement.

Accrual expenses are incurred, but have yet to be paid (such as accounts receivable). Accruals are incomes of a business that have been earned but have not yet been received, in form of compensation, by the business or expenses of the business that has been borne but not yet paid for. The timing of revenue and expense recognition can affect a company's financial statements, such as the income statement and balance sheet.

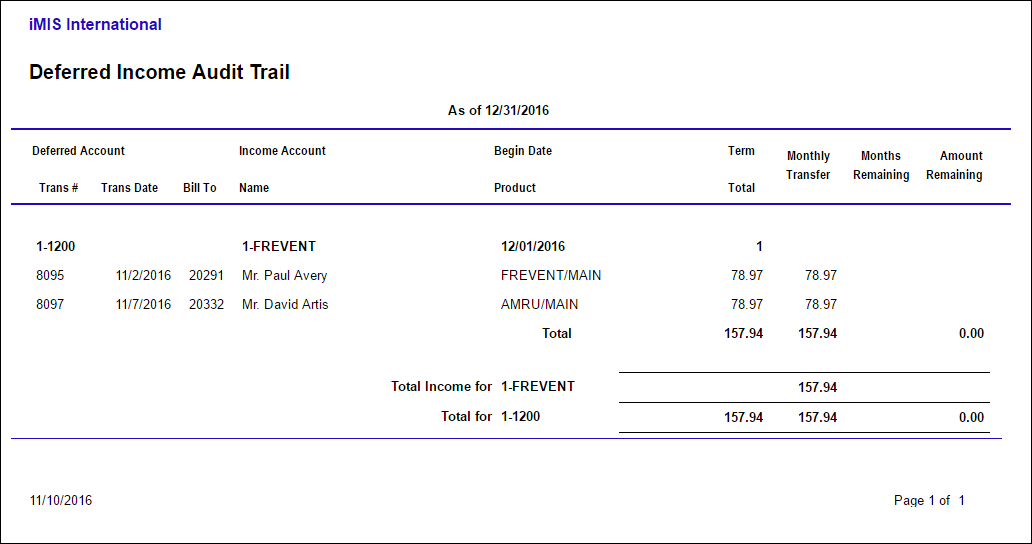

An accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. There’s an advance payment of cash. This note will only be generated if there are postings to the accruals and deferred income group on the eltd chart or the deferred government grants group on the iris chart:

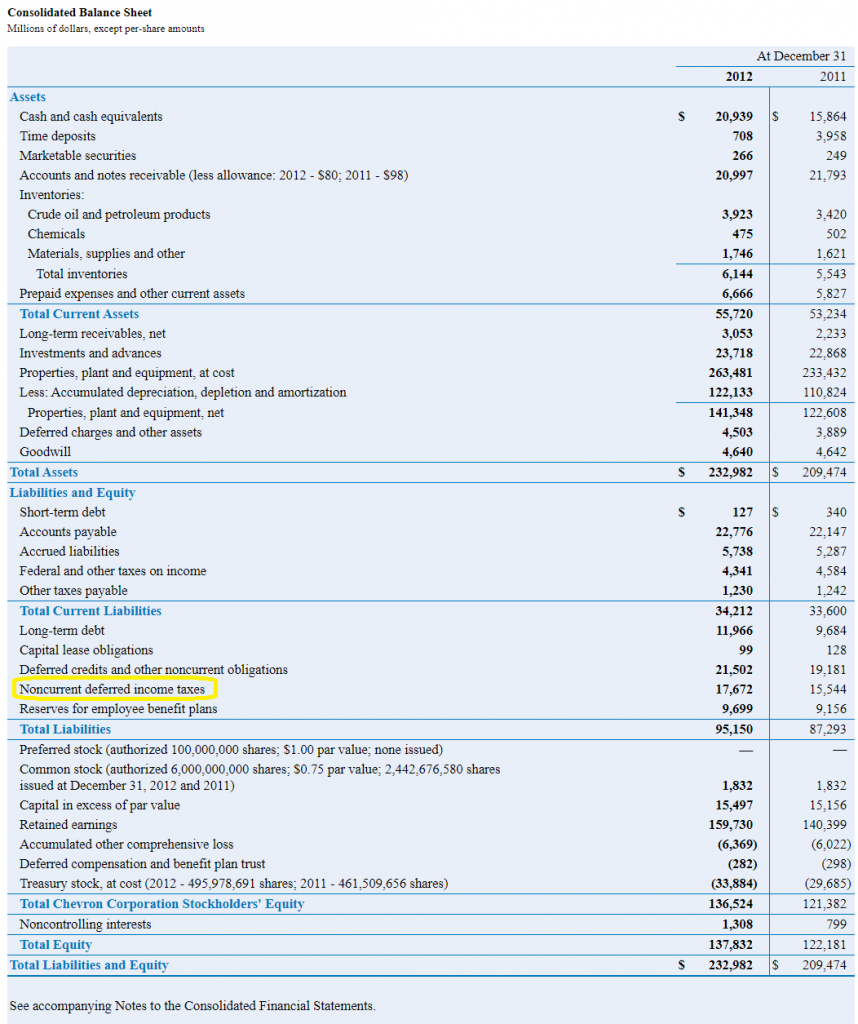

Accounts used for accruals and deferrals. Where are accruals reflected on the balance sheet? For example, if a company has performed a service for a customer but has not yet received payment, the.

Employing similar formulas, accrued wages, and revenue deferrals can be calculated. They are recorded as “assets” on a balance sheet. Excel formulas make calculating accruals and deferrals simple.

The accrual of an expense will usually involve an accrual adjusting entry that increases a company's. Money received for the future product or service is recorded as a debit to cash on the balance sheet. Most of the time, accountants will list this revenue with “accounts receivable” on their balance sheet at the time of the transaction.

An example of the accrual of revenues is a bond investment's interest that is earned in december but the money will not be received until a later accounting period. Accrued expenses would be recorded under the section “liabilities” on a company’s balance sheet. Prepaid expense * (days remaining in the period / total days in the period).

It doesn’t matter when the sale is. It could be described as accrued receivables or accrued income. There are two methods of recording revenue and expenditure deferrals, this first is the asset and liability method shown immediately below, and the second is the revenue and expenses method detailed later in this post.

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)