Exemplary Info About Statement Of Profit And Loss Formula

List of types and how.

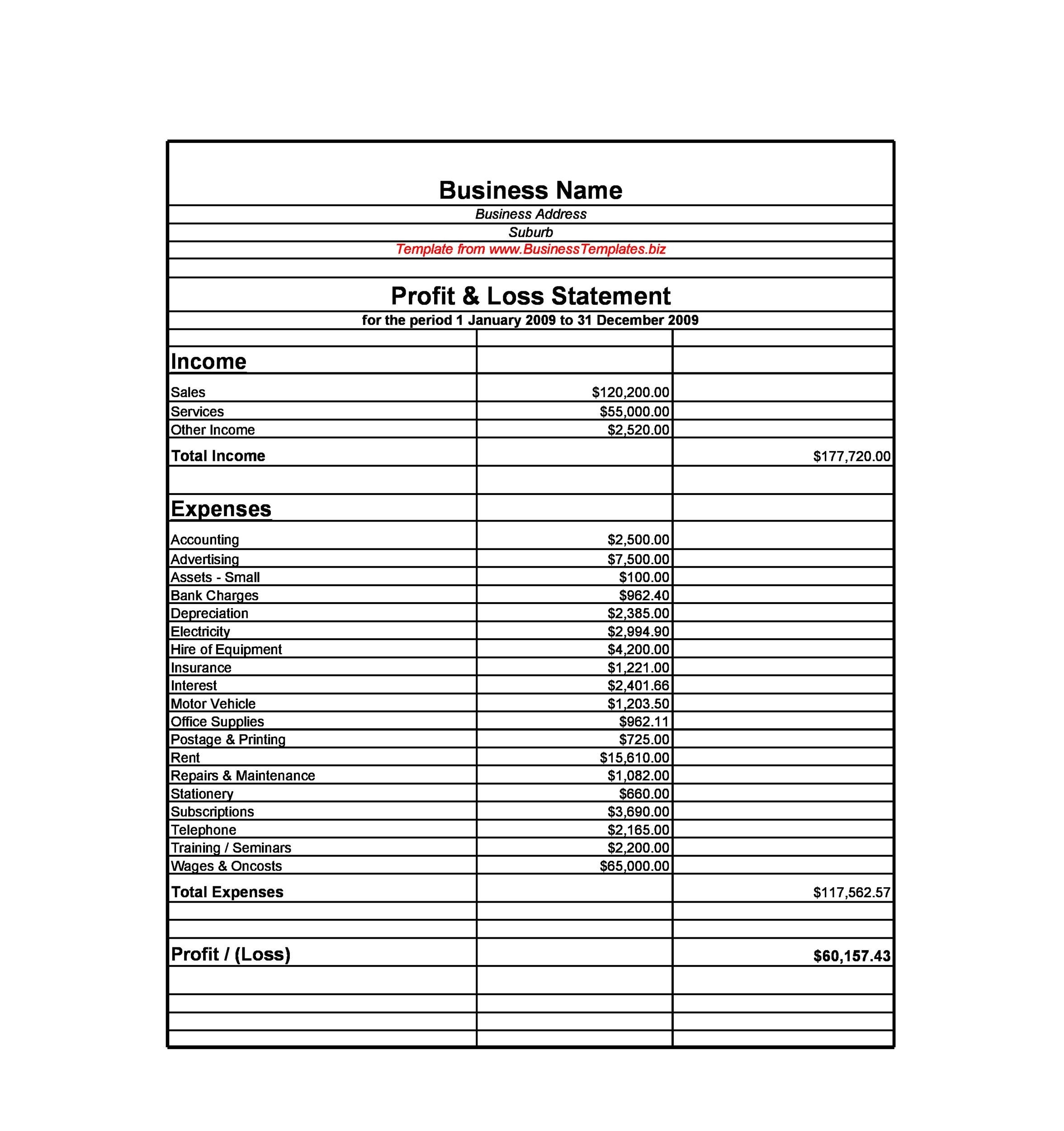

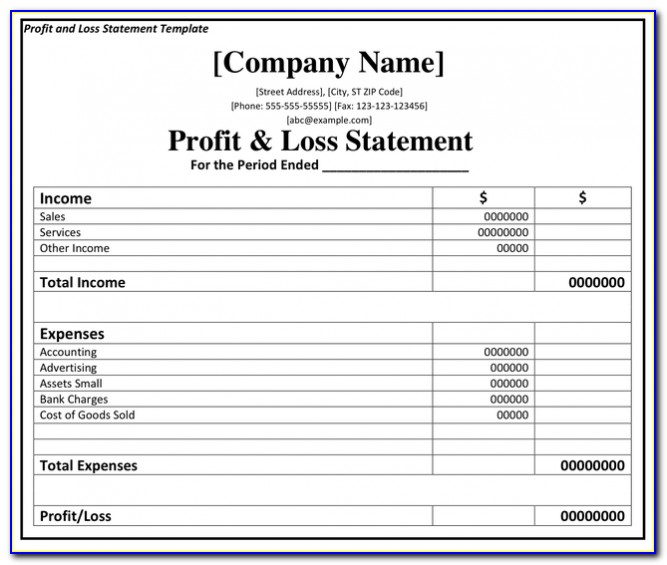

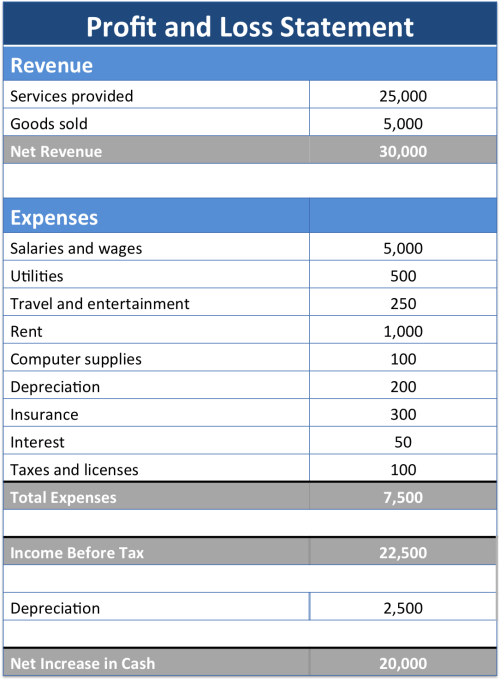

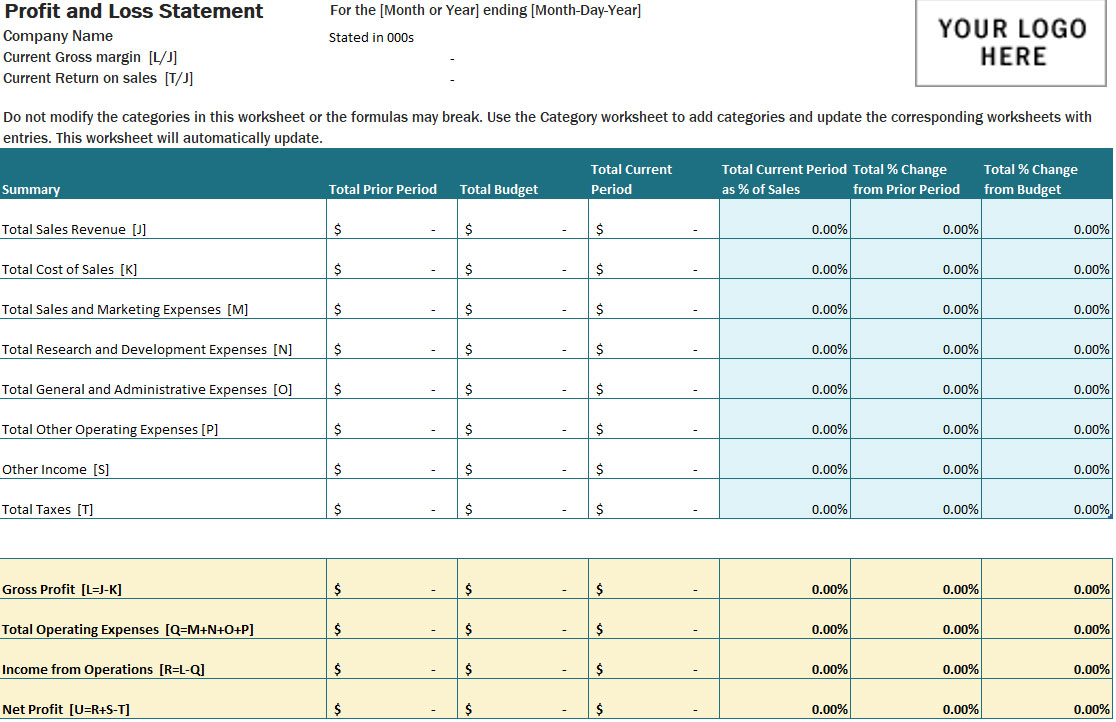

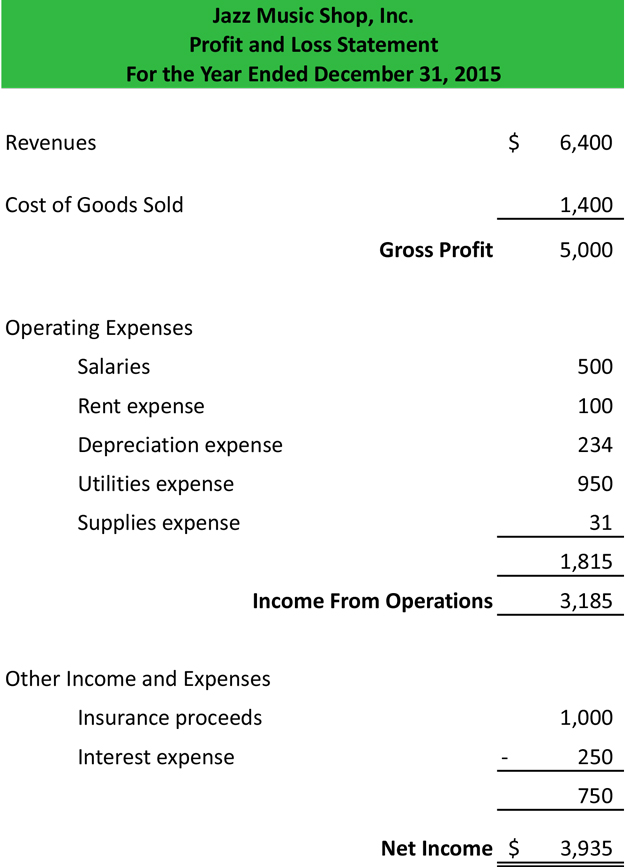

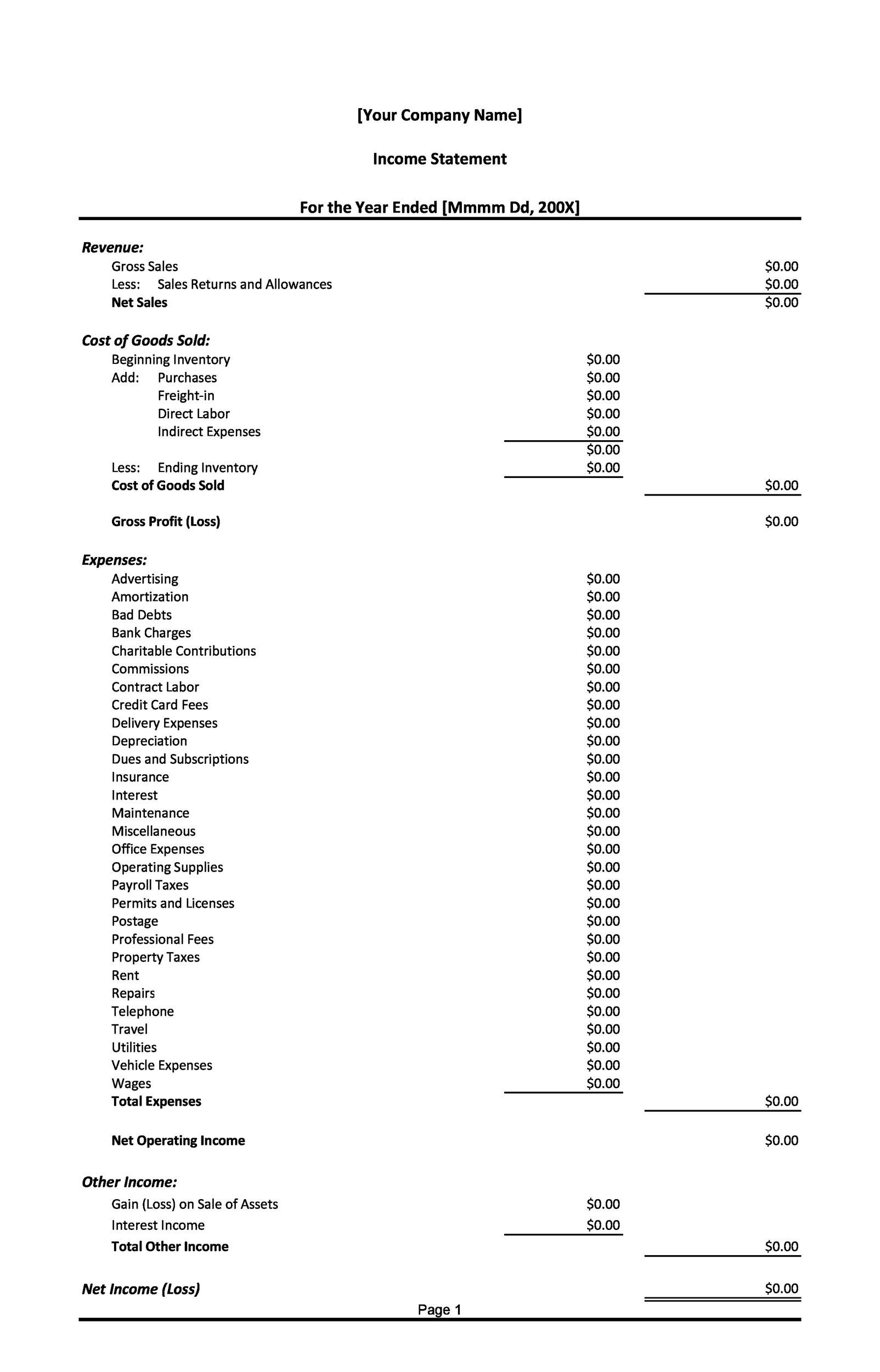

Statement of profit and loss formula. This summary provides a net income (or bottom line) for a reporting period. The format you choose depends on the type of business. A condensed profit and loss statement presents summaries of revenue and expense categories.

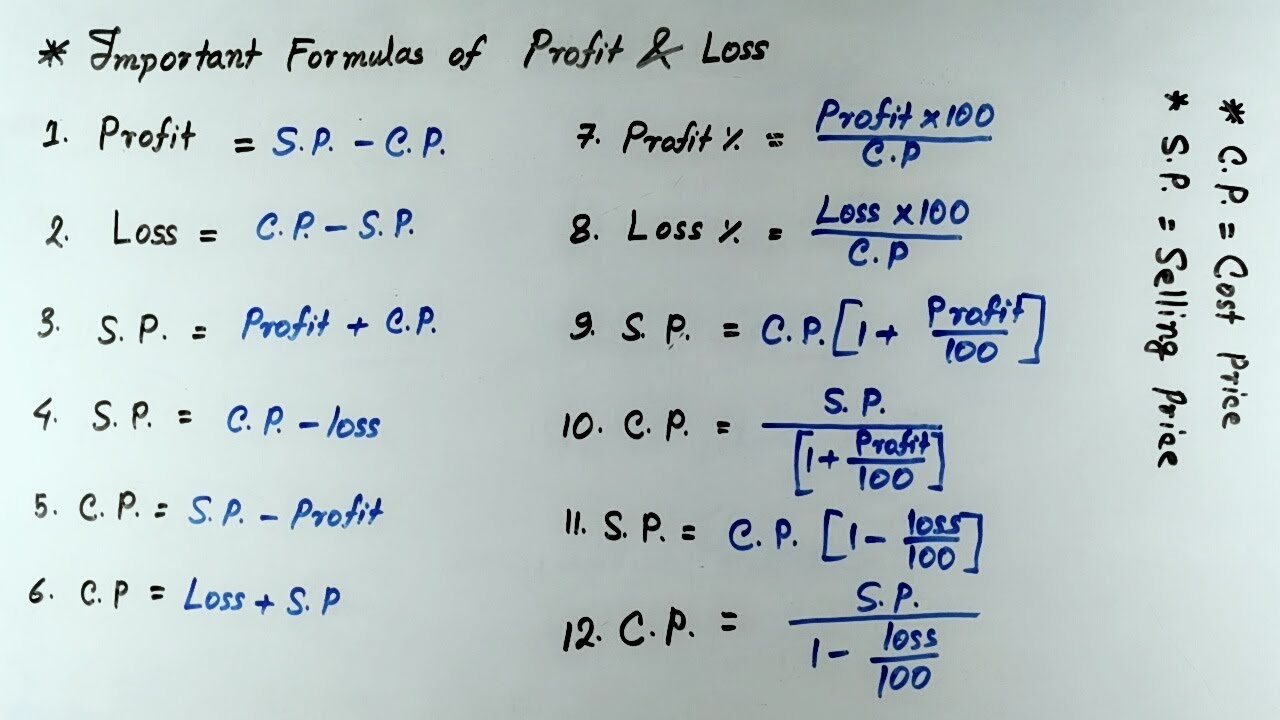

It shows company revenues, expenses, and net income over that period. But sometimes, profit percentage/loss percentage is given in the question and we are asked to find either the selling price (s.p.) or the cost price (c.p.). The result is either your final profit (if things went well) or loss.

What makes it complicated is that there may be other names for sales. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings. The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually.

In most cases, companies report gross profit and net income as part of their externally published financial statements. Add up all your income for the month. Profit and loss statement template (p&l) suppose we’re creating a simple profit and loss statement (p&l) for a company with the following financial data.

Basic income statements contain the following elements: The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Sp = rs 700 + rs 350 = rs 1050.

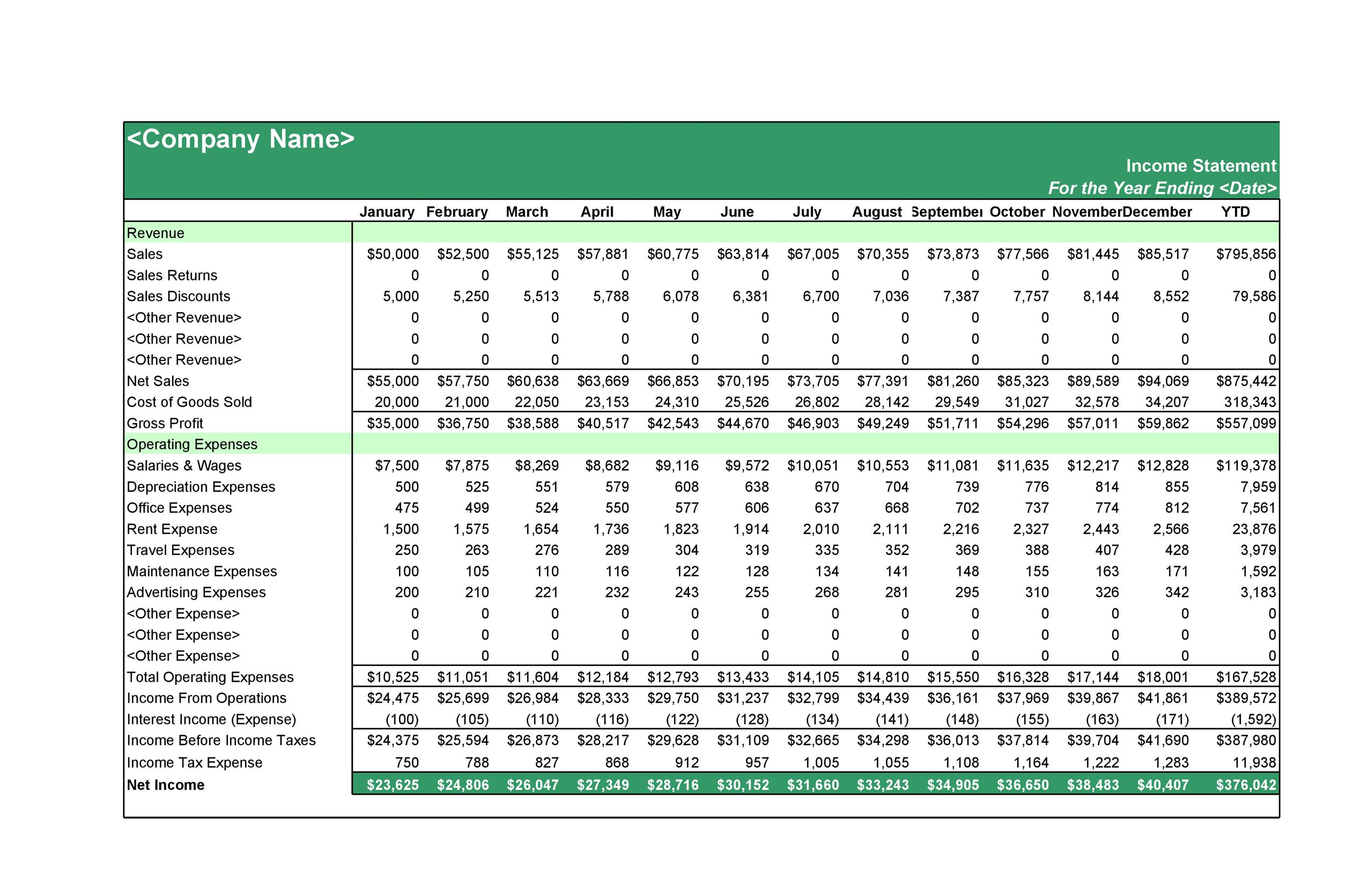

And costs will have varying names; This basic profit and loss statement template records finances over the course of 12 reporting periods. Profit and loss statement of a company is an important statement for any company because it helps in knowing whether the company is earning the profits or not, which is the main motive.

Cp = [100 x 100 x p/(100+m)(100+n)]. To calculate the accounting profit or loss you will: Just like a balance sheet, the p+l is a complex demonstration of a simple accounting equation.

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. Track your revenue, cost of goods sold, and expenses to calculate the gross profit and net income for your small business over 12 months. Calculate the difference by subtracting total expenses away from total income.

The formula of a profit and loss statement is: 2) a shopkeeper bought two tv sets at rs 10,000 each such that he can sell one at a profit of 10% and the other at a loss of 10%. The p&l statement is one of three.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Add up all your expenses for the month. Profit percentage (p%) = (profit / cost price) × 100.