Nice Info About Deferred Revenue Accounts Receivable

Pdf | this study develops and calibrates a revenue accruals model.

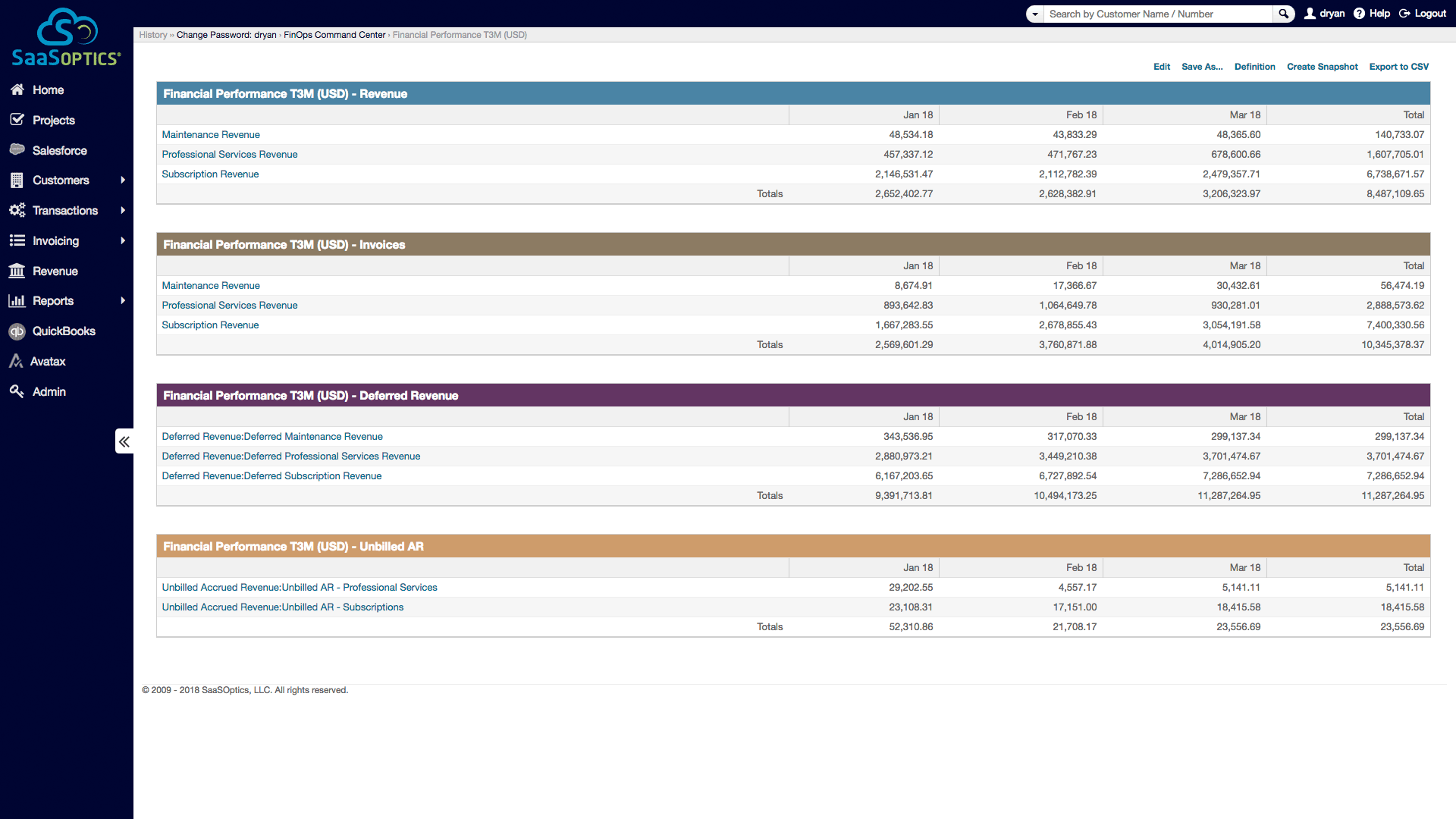

Deferred revenue accounts receivable. What is deferred revenue? | find, read and cite all the research. In many deferred revenue examples cash is received in the first period.

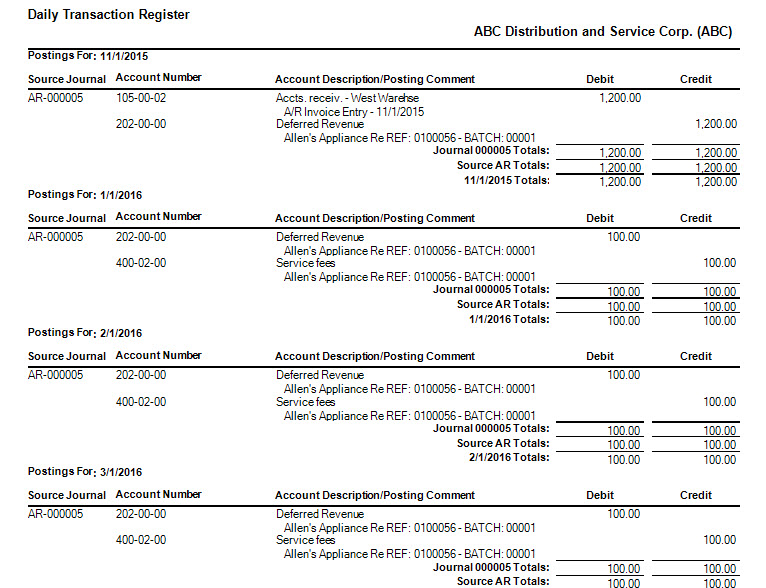

Since the goods or services have been delivered, the company has earned revenue and. Deferred revenue is most common among companies. Deferred revenue, a component of accrual accounting, aligns with gaap principles, providing a conservative and transparent approach to financial reporting.

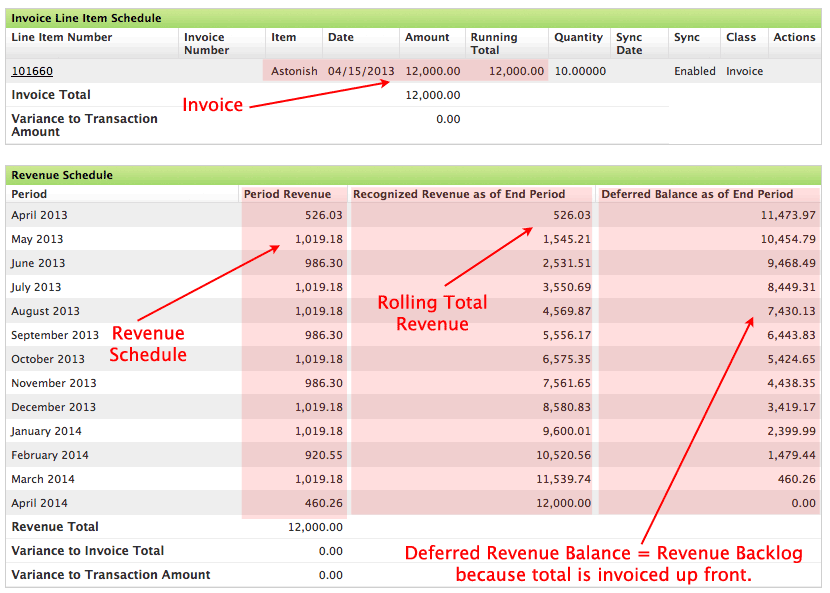

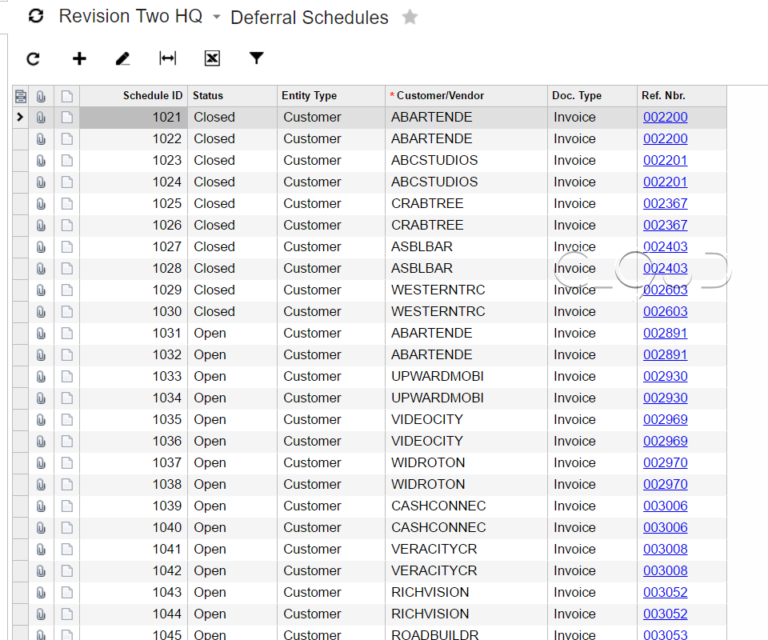

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. When the deferred revenue is adjusted down in purchase accounting, there is essentially an amount that never gets recorded as revenue in the future, which is sometimes referred to as a “haircut.”. In accrual accounting, revenue is only recognized when it.

An asset/revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web design project, collecting a year of rent payments upfront, or a retainer for legal services, for example. Therefore, you cannot report these revenues on the income statement.

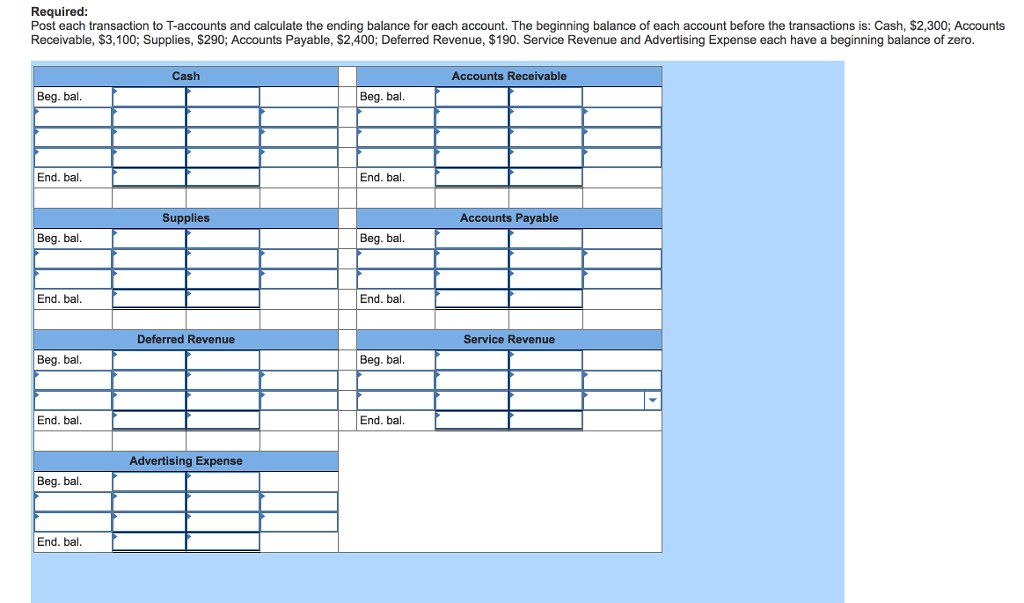

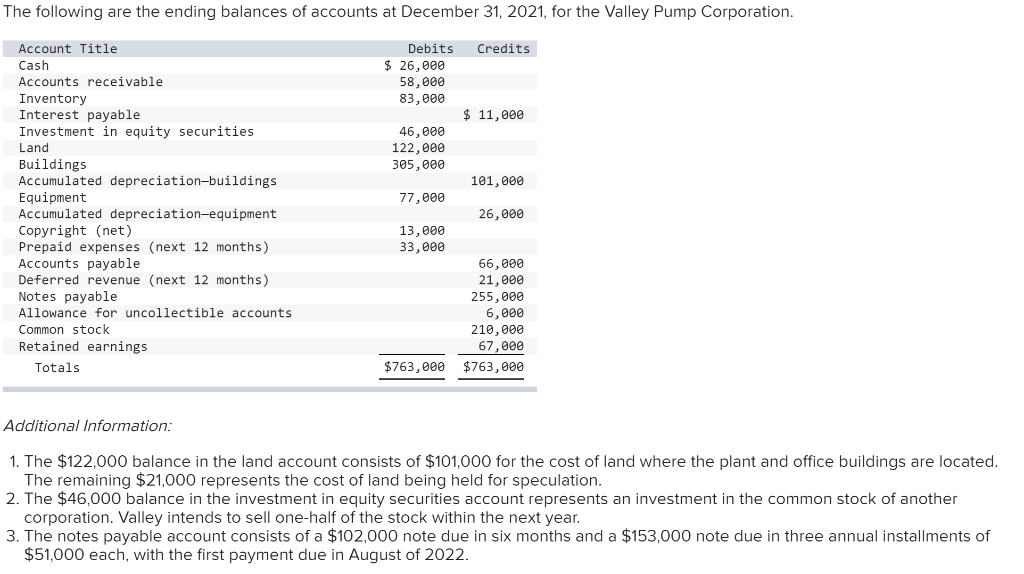

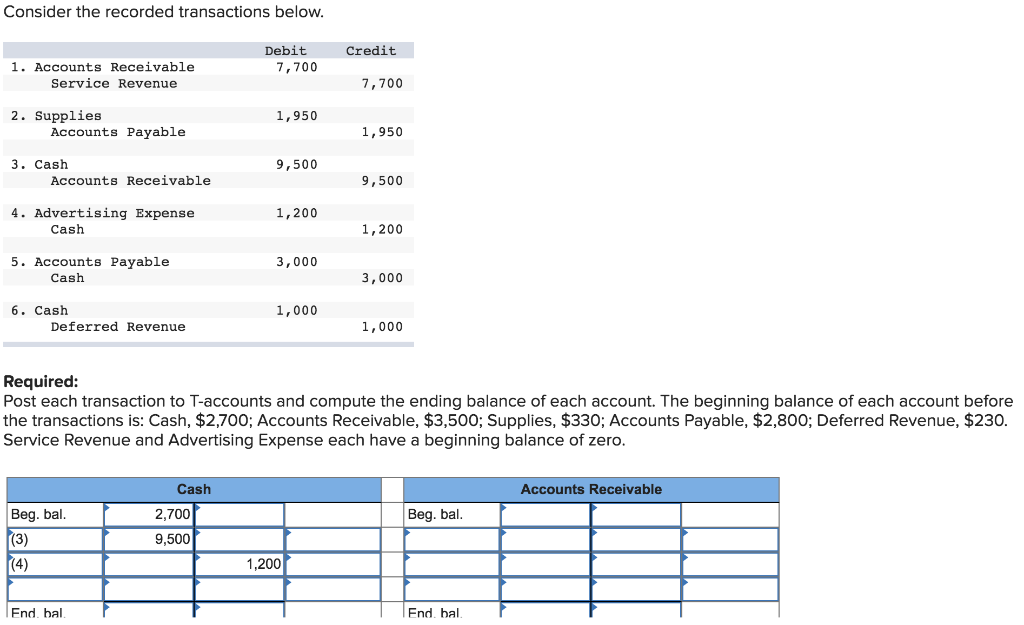

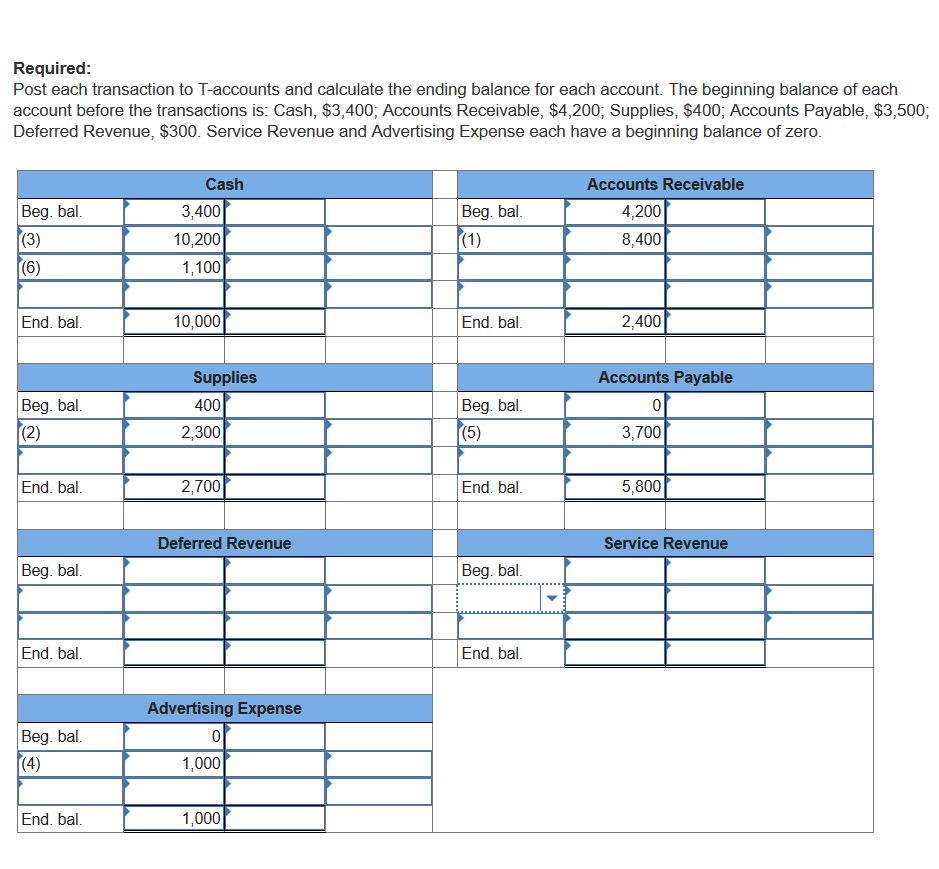

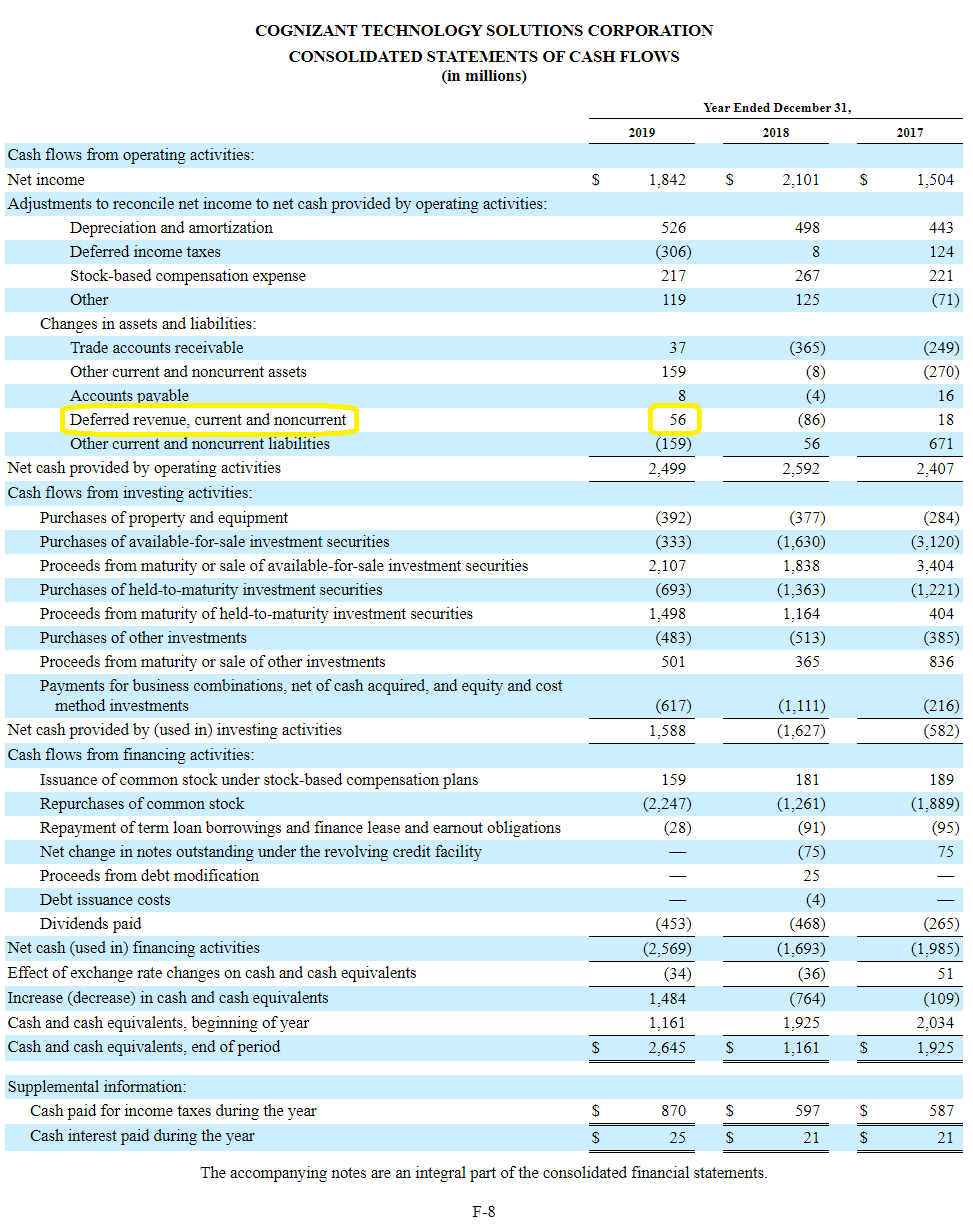

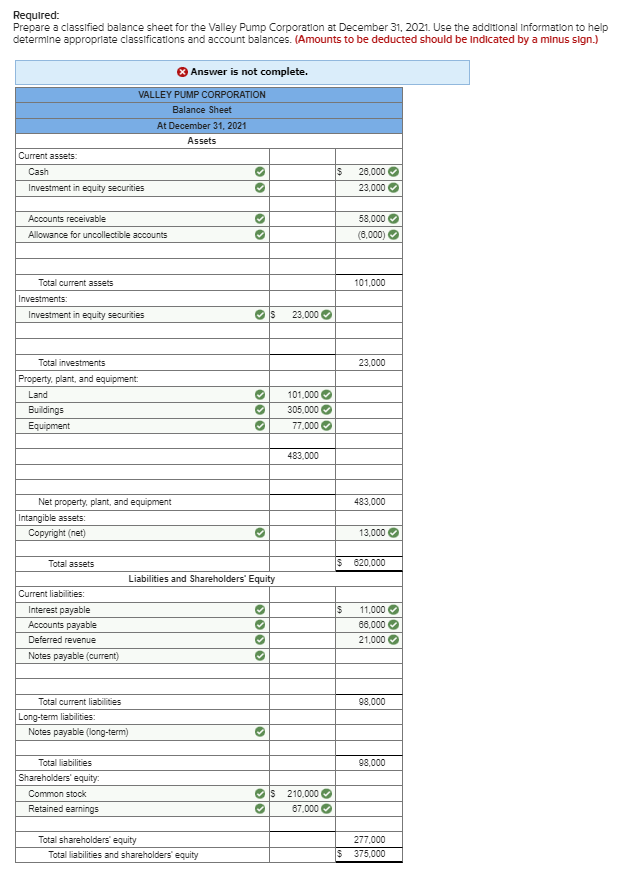

Deferred revenue is money that has been received but not yet earned, while accounts receivable is money that has already been earned but not yet collected. Is deferred revenue a liability? The deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting.

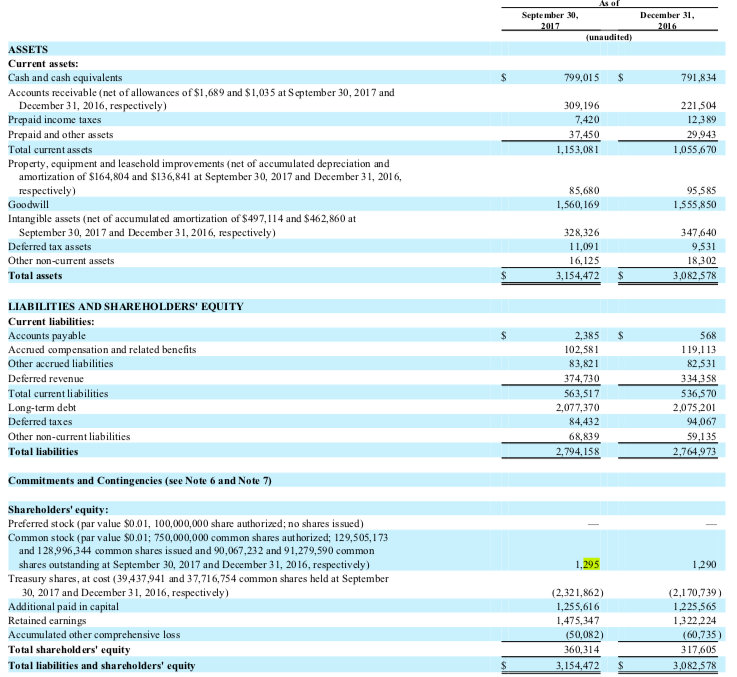

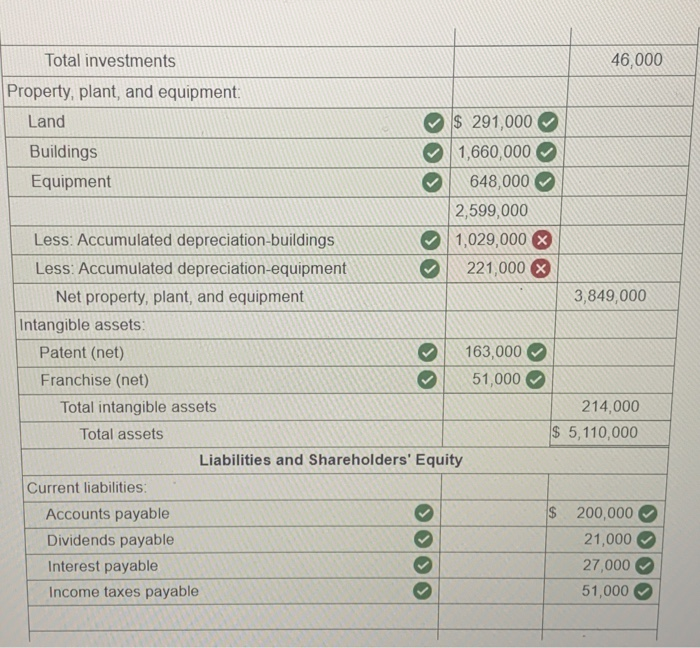

Instead, you will report them on your balance sheet as a liability. Careful attention should be paid to this during due diligence phases so that forecasted amounts of top line revenue can be made accurately. Gaap requires that the deferred revenue be measured at fair.

Accrued revenue, on the other hand, is initially recorded as an asset account, such as accounts receivable, and is later transferred to a revenue account when the. It is money that customers owe the company. D eferred revenue vs accounts receivable are both important financial concepts.

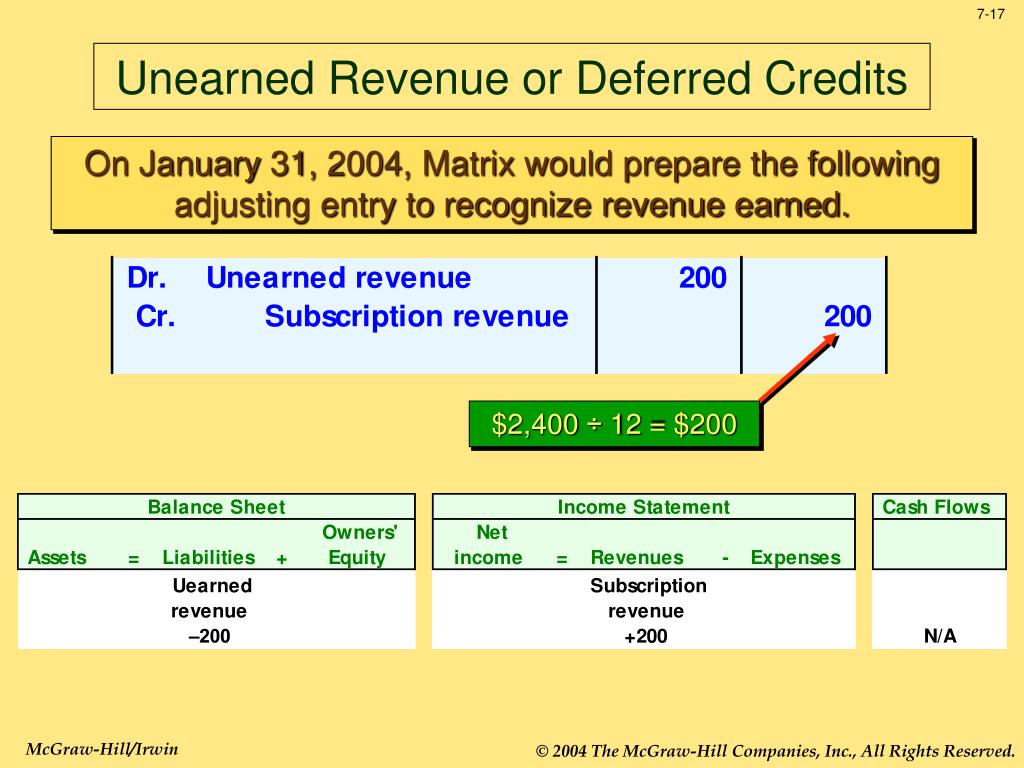

Deferred revenue is an obligation on a company's balance sheet that receives the advance payment because it owes the customer products or services. Technically, you cannot consider deferred revenues as revenue until you earn them—you deliver the products or services prepaid. You need to make a deferred revenue journal entry.

Rent payments received in advance or annual subscription payments received at the beginning of the year are common examples of deferred revenue. Accounts receivable (asset) increases by $100, and deferred revenue (liability) increases by $100. It remains in this state until the group either attends the booking or the expiry date is reached.

When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. This means that deferred revenue is a liability account showing your obligation to your customer. They represent different stages in the process of earning income.