Neat Info About Lease Liability In Cash Flow Statement

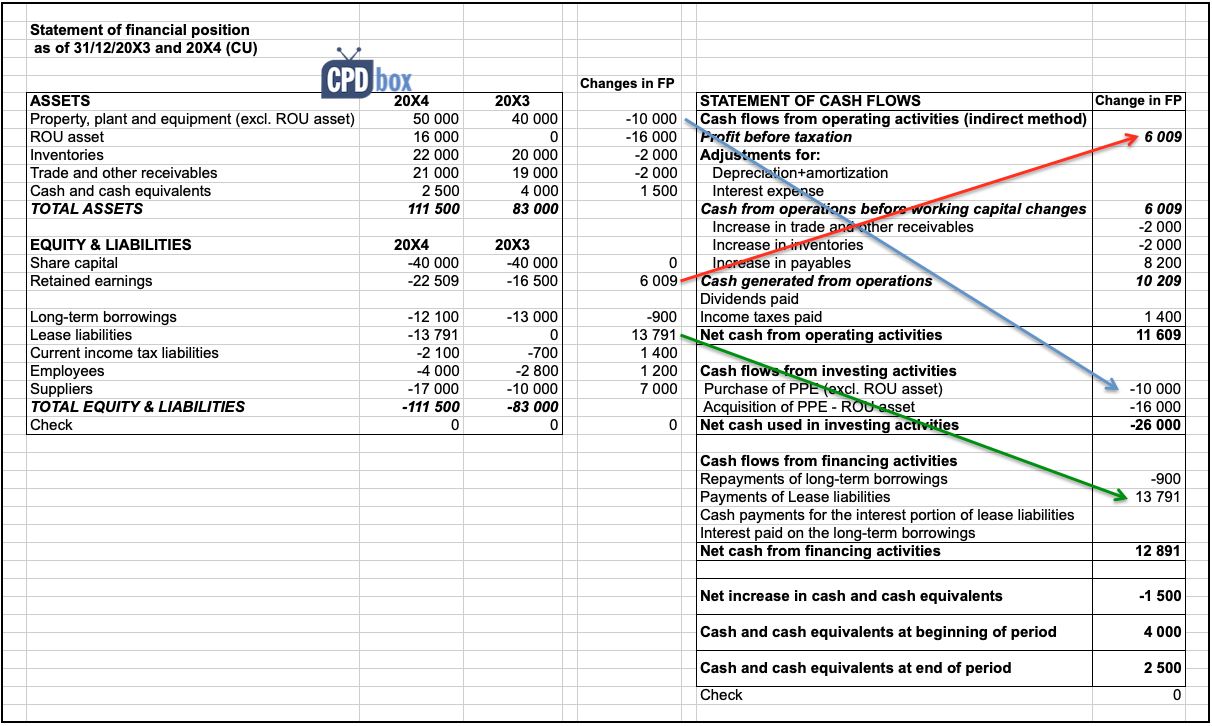

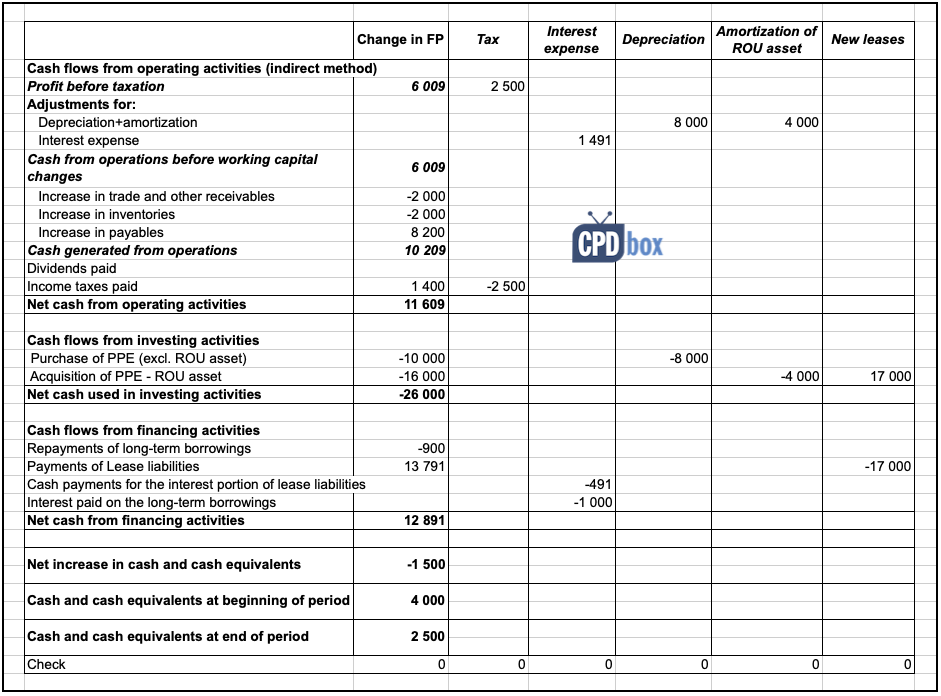

Net cash used in financing activities ( 790).

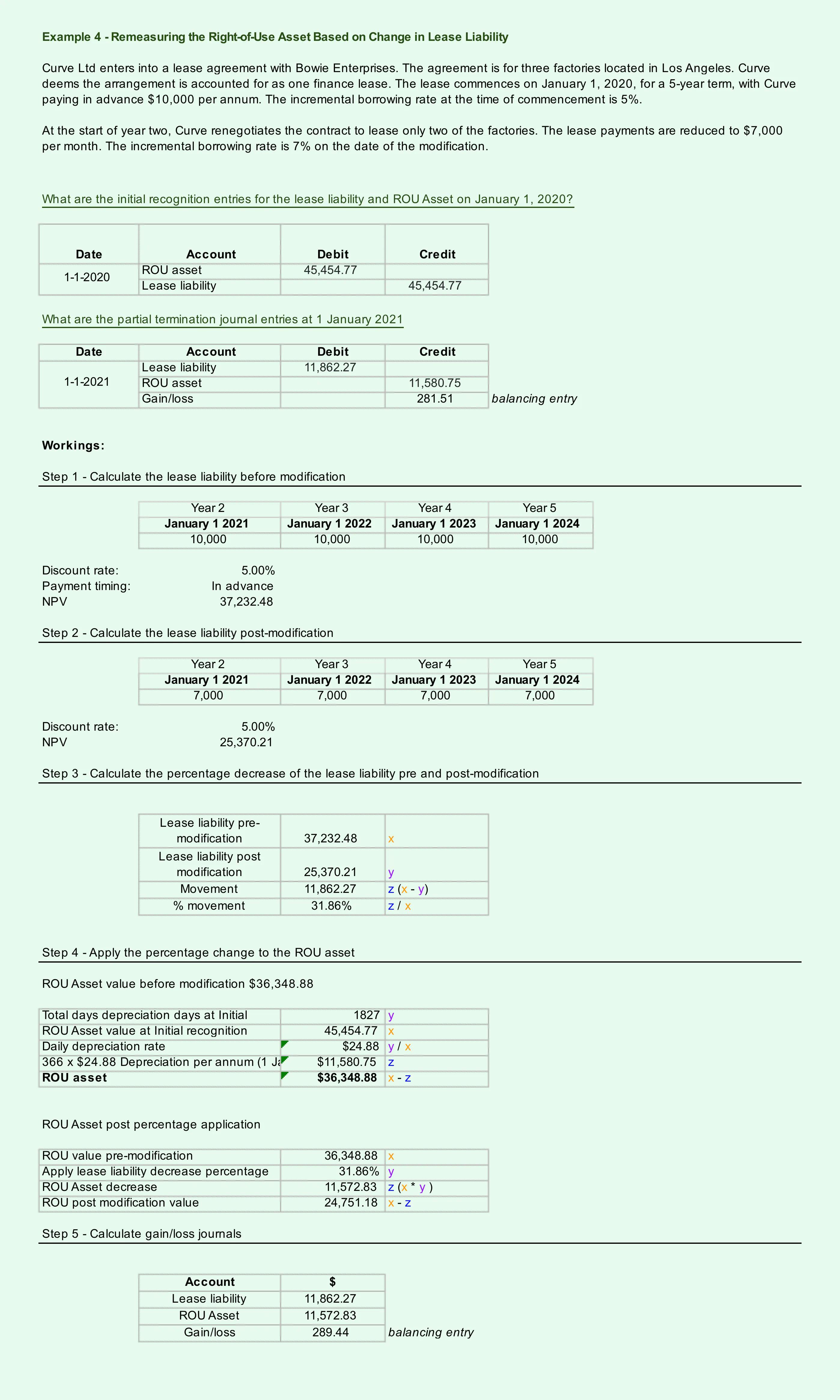

Lease liability in cash flow statement. 2.1.3 statement of cash flows. However, applying previous lease accounting requirements, most leasing transactions. The repayment of the lease liability was cu 3 209;

Classification of the lease liability as current or noncurrent is. The impact of leases on the statement of cash flows includes (ifrs 16.50): Leasing assets obtains an asset and typically also a liability at the start of a lease.

A lease conveys the right to use an asset for a period of time in exchange for cash payments. Both gaaps classify the following as operating cash flows: Repayments of the principal portion of the lease liability, presented within.

One acceptable presentation is for ironside co. During 20x4, abc paid the lease payments in total amount of cu 3 700, thereof: In the cash flow statement, cash payments for the principal portion of the lease liability and its related interest are classified within financing activities.

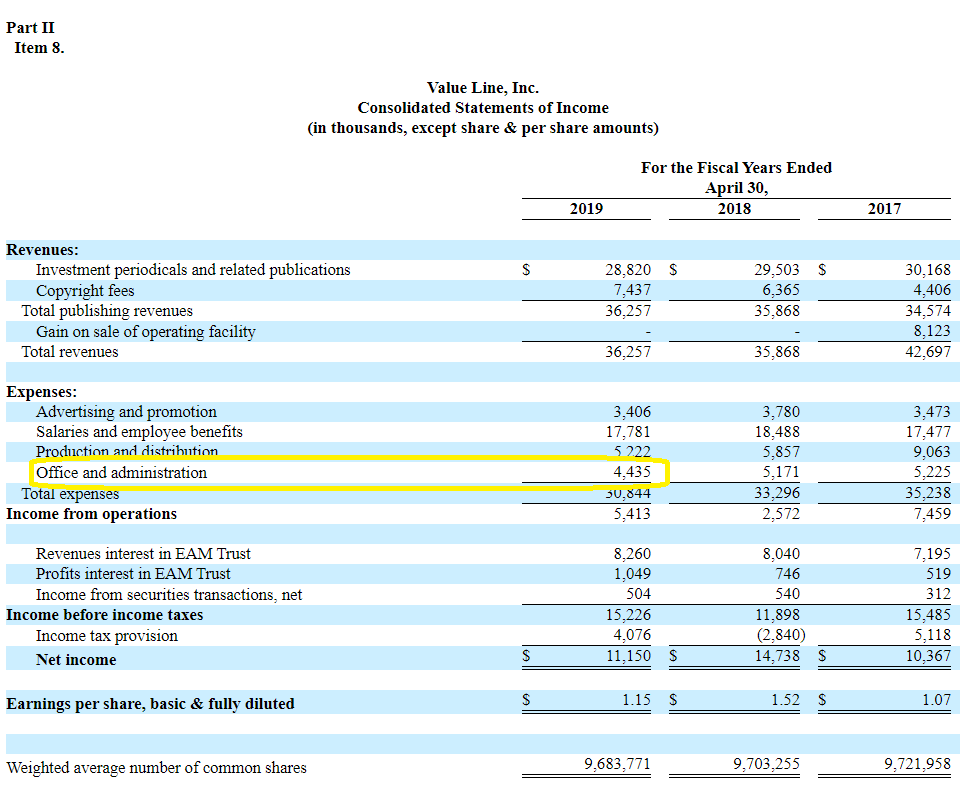

Finance lease income statement presentation. In operating leases, the lessee records a lease expense on its income statement during. Uses the above information to prepare its statement of cash flows.

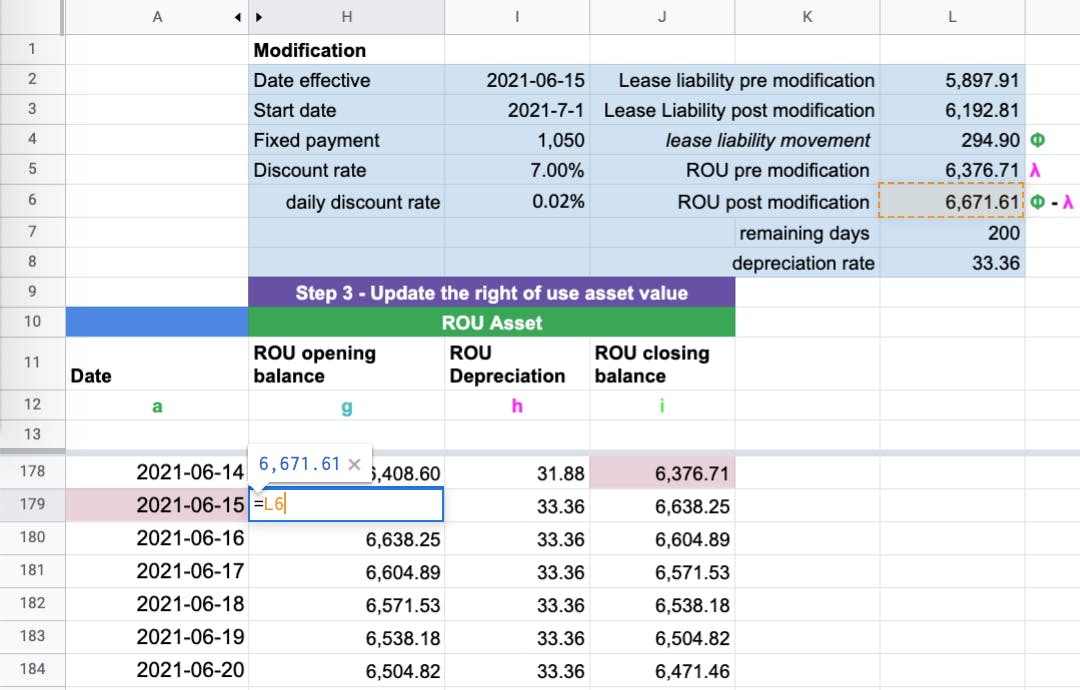

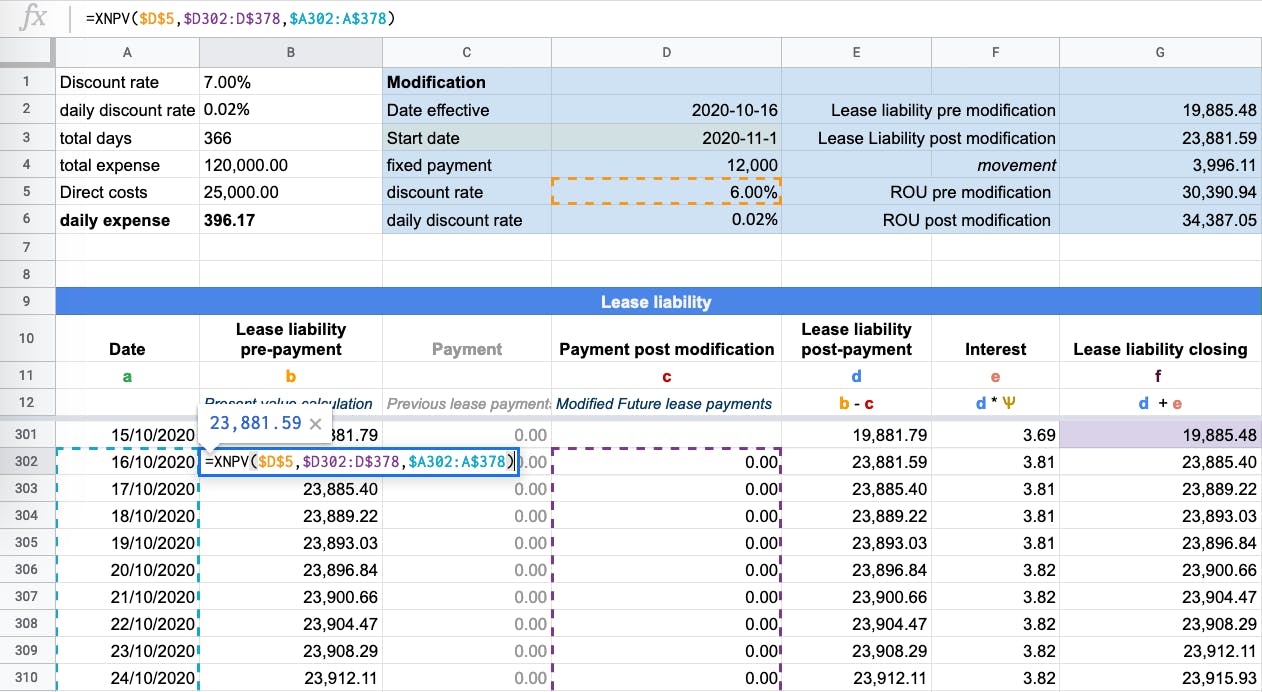

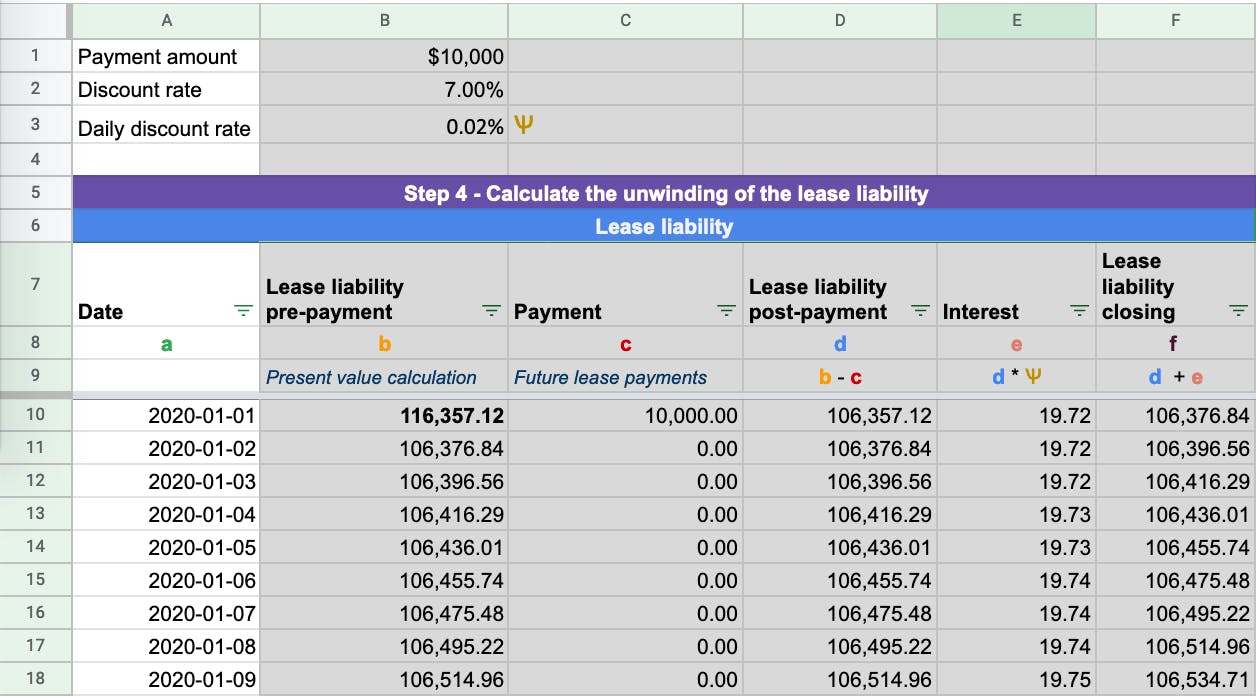

The lease liability essentially functions as an amortizing loan fsp 12.8 provides guidance for these types of liabilities. Under the new lease accounting standard ifrs 16 / aasb 16, the net present value calculation is referred to as a lease liability, and the leased asset is referred to as. Lease payments that relate to contracts that have previously been classified as operating leases are no longer.

Initial direct costs paid in cash are cu 3 000. Only the part of the lease payments that reflects interest on the lease liability can be presented as an operating cash flow (if it is the entity’s policy to present interest. The part of the lease payment that represents.

In the statement of cash flows, lease payments are classified consistently with payments on other financial liabilities: The present value of the lease liability is cu 17 000; Payment of lease liabilities ( 90) dividends paid [1] ( 1,200) [1] this could also be shown as an operating cash flow.

In the statement of cash flows, a lessee is required to classify cash payments for the principal portion of the lease liability within financing.