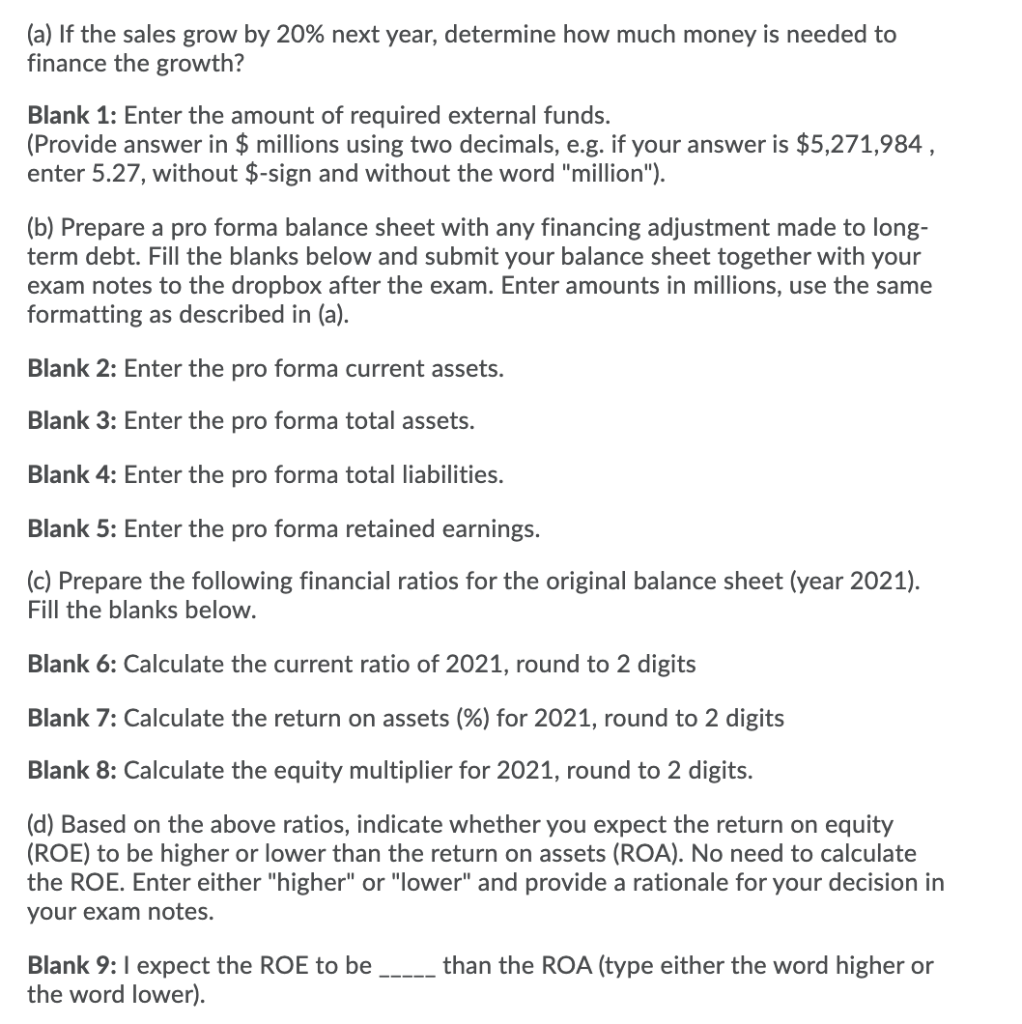

Stunning Tips About Supplies On Balance Sheet

Best practices for categorizing office supplies appropriately:.

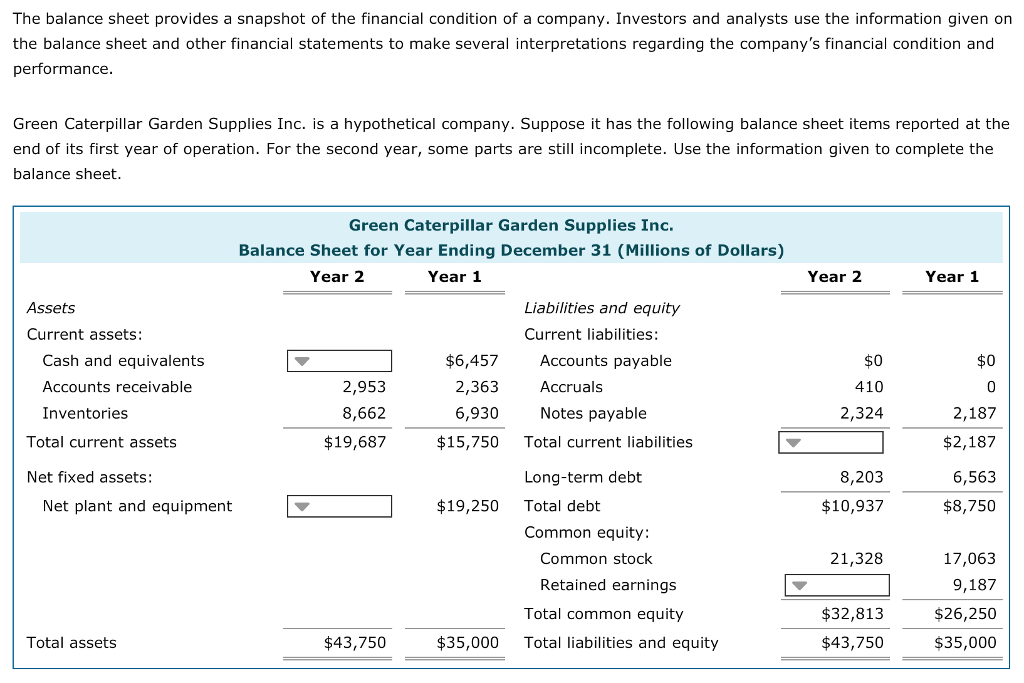

Supplies on balance sheet. Supplies expense in accounting refers to the cost of a collection of goods that the company used during a specific reporting period to operate. How to account for supplies. Inventory represents the items that a business sells to customers for a profit.

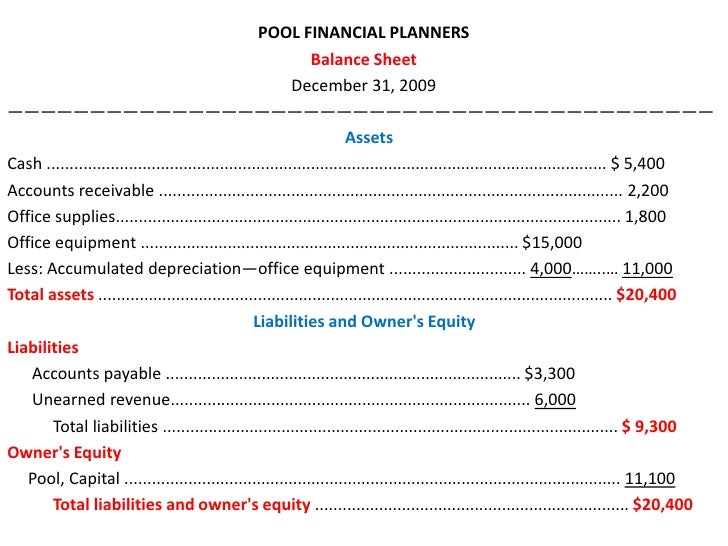

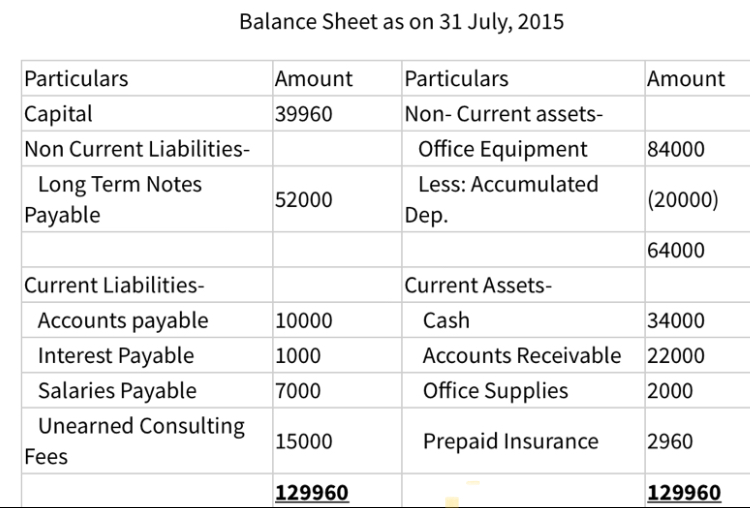

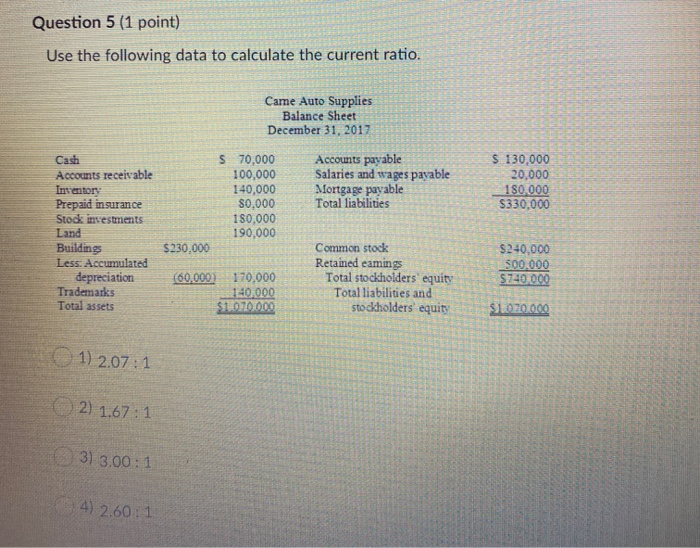

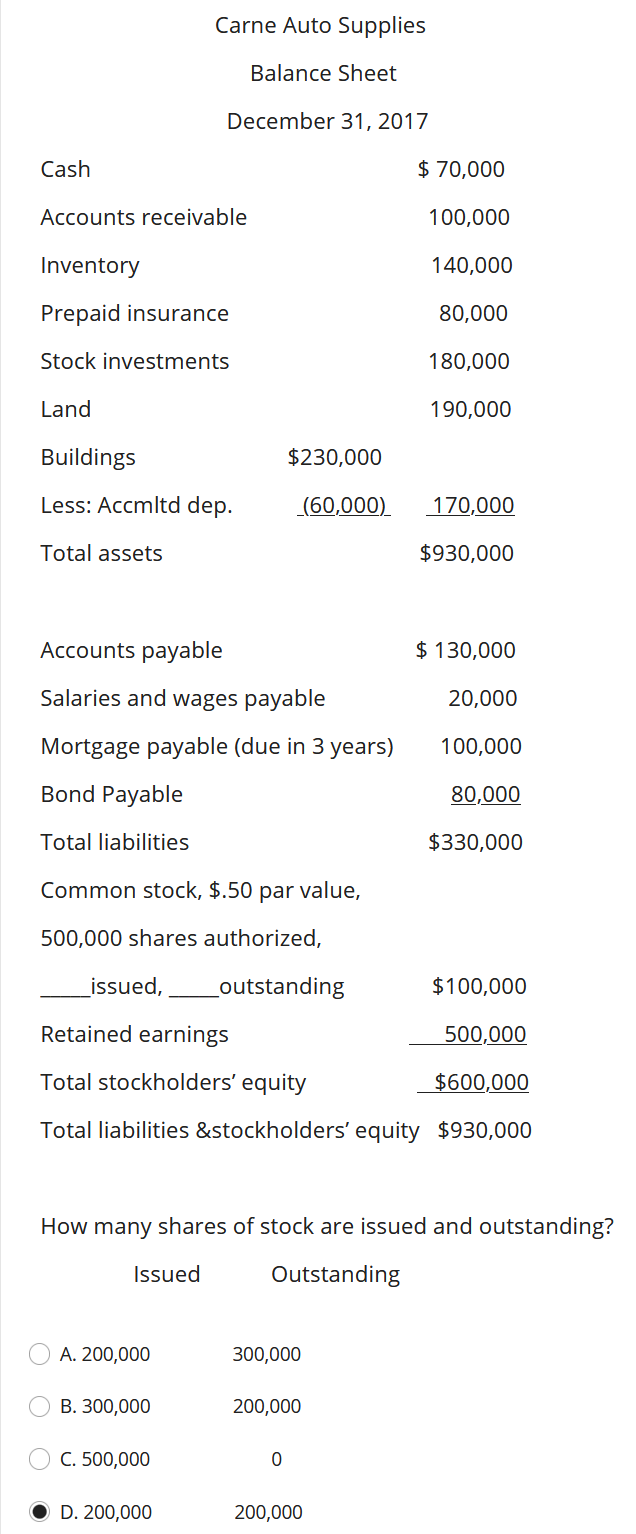

On the balance sheet, supplies itself is not a line item, instead, it is combined with other company supplies and merchandise inventory and recorded on the. Bookkeeping guidebook supplies on hand supplies are usually charged to expense when they are acquired. Office supplies may or may not be considered a current asset depending on their cost.

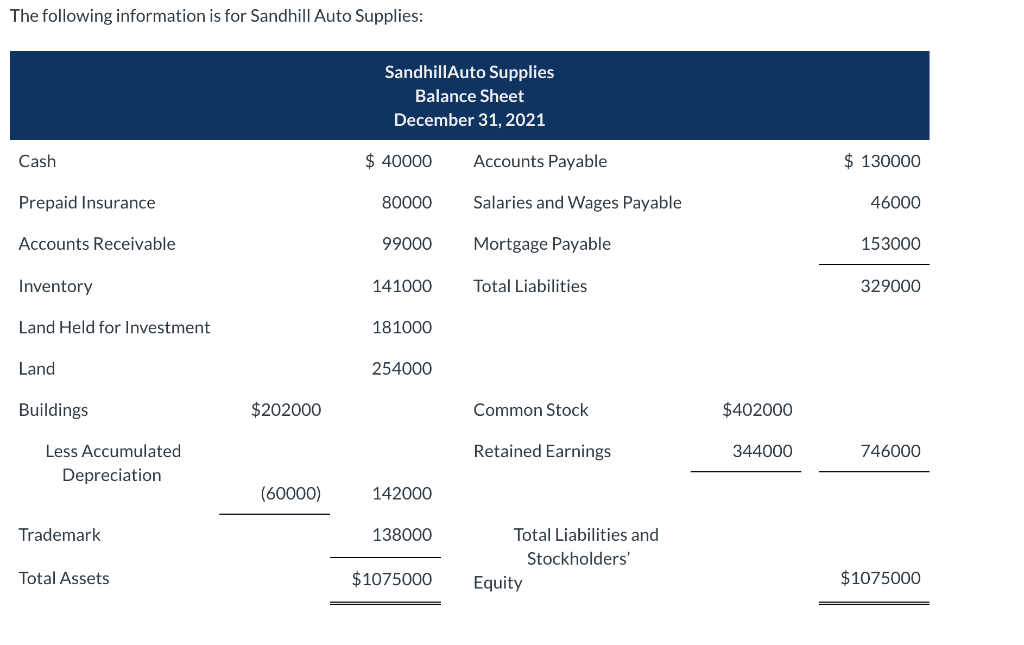

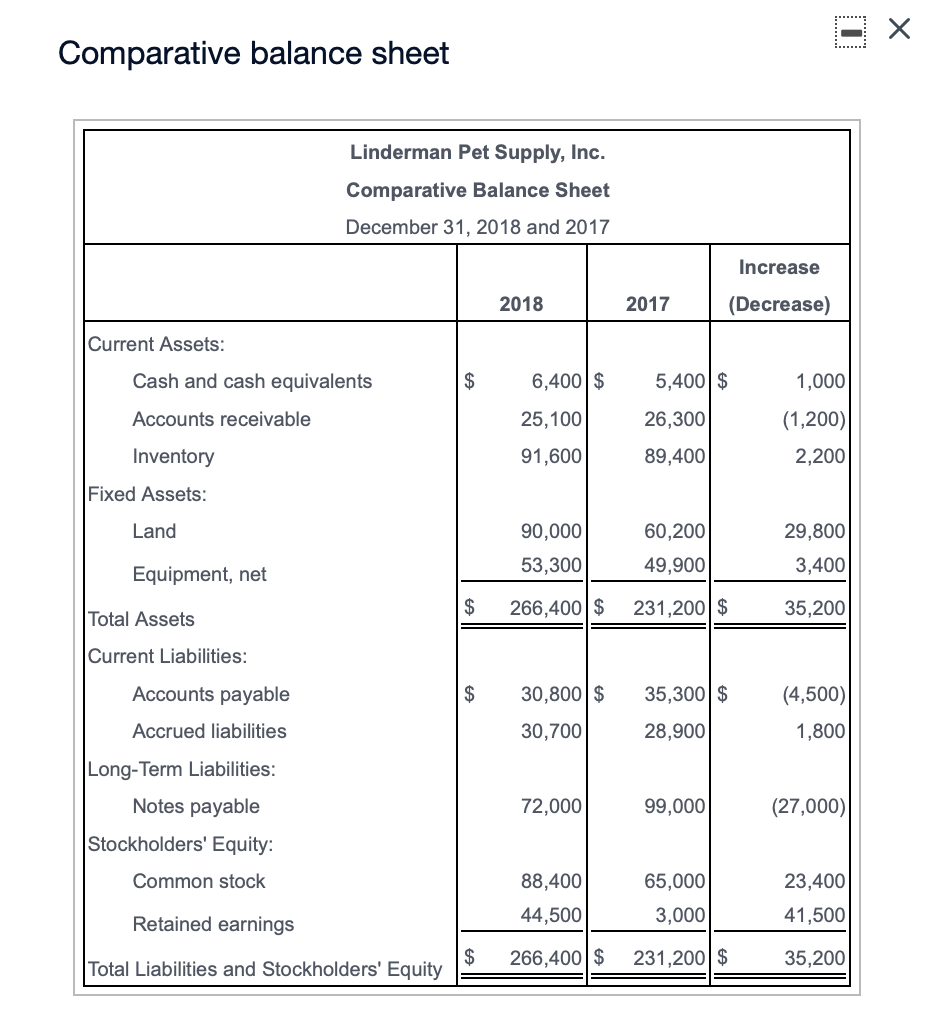

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a. The account is usually listed on the balance sheet after the inventory account. On the previous year’s balance sheet,.

Once supplies are used, they are converted to an expense. Supplies are incidental items that are expected to be consumed in the near future. A current asset representing the cost of supplies on hand at a point in time.

Generally, supplies are recorded as current assets on a. What is inventory? Supplies can be considered a current asset if their dollar value is significant.

2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; The cost of manufacturing supplies on hand at the end of an accounting period will be reported in a balance sheet current asset account such as inventory of manufacturing. How to categorize office supplies, office expenses, and office equipment on your balance sheet with example;

Supplies expense will start the next accounting year with a zero balance. At the beginning of a financial year, some supplies might be carried forward from the previous year. The balance in supplies expense will increase during the year as the account is debited.

If the cost is significant, small. The normal accounting for supplies is to charge them to expense when they are purchased, using the following. Supplies at the beginning of the year:

Office supply accounts for a relatively small. Article by madhuri thakur updated july 20, 2023 what is balance sheet items? Supplies on hand are shown on the balance sheet of the business as a current asset as they are expected to be used within one year.

Office supplies are typically current assets on a company’s balance sheet and are expected to be consumed within one year.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)