Favorite Info About Financial Income Statement Example

Some investors and analysts use income statements to make investing decisions.

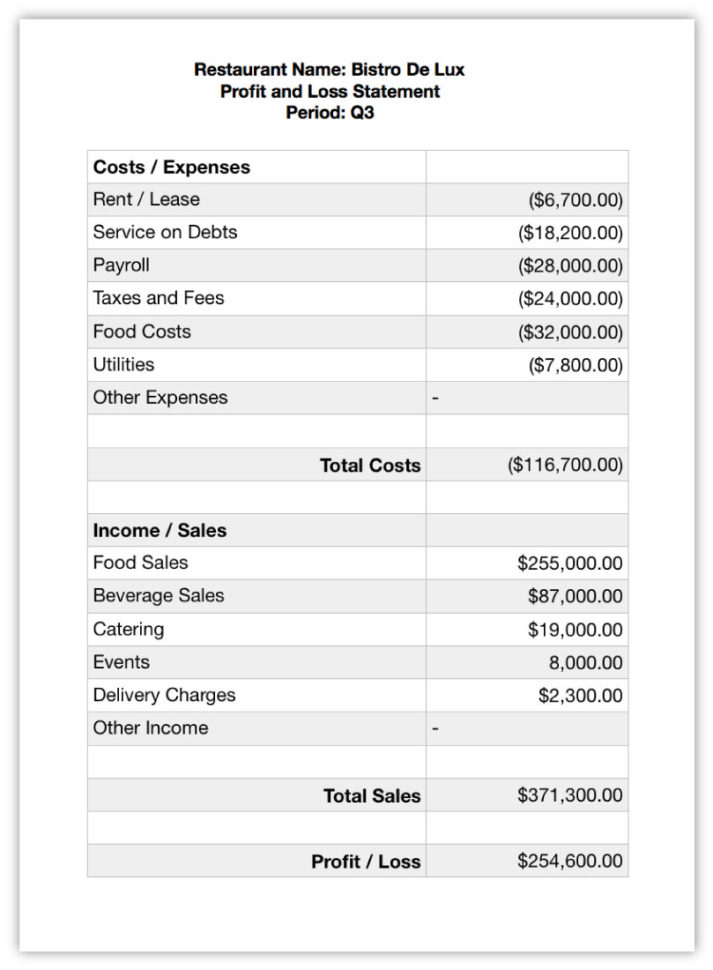

Financial income statement example. Common examples of items on an income statement are: The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

It shows whether a company has made a profit or loss during that period. A real example of an income statement. Income and tax withhodings and l corporate income taxes as well as.

Net cash € 10.7 billion. Example of an income statement. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time.

For example, a loan of $10,000 may have an interest rate of 10%. Sales on credit) or cash vs. Increases tax expense and reduces net income in the period the allowance is recognized.

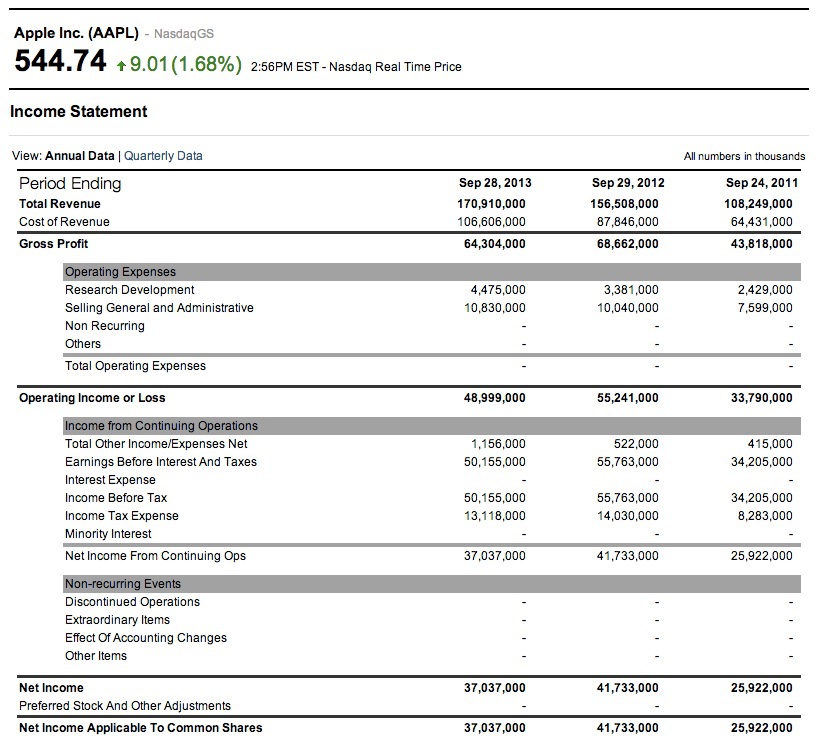

The income statement is the most common financial statement and shows a company's revenues and total expenses, including noncash accounting, such as depreciation over a period of time. A real example copied now that you have the idea of what an income statement is, let’s look at a real example. However, it provides greater details on what occurred during the stated time period, especially regarding specific income types and.

10 importance list of financial statements; In most cases, companies report gross profit and net income as part of their externally published financial statements. This has been a guide to financial statement examples.

The income statement starts with a heading made up of three lines. Below is a portion of exxonmobil corporation's income statement for fiscal year 2021, reported as of dec. Income statement example.

(1) the name of the company, (2) the title of the financial statement, and (3) the period covered by the report. The gao audit report on the u.s. An income statement is a financial statement detailing a company’s revenue, expenses,.

O entities administering federal employee and veteran benefits programs, including the va, dod, and. Impact on financial statements. As you can see at the top, the reporting period is for the year that ended on sept.

Then they are deducted from the total income to get net income before tax. The income statement of a service type business is quite simple. The cash flow statement shows the changes in a company’s cash position during a fiscal period.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)