Looking Good Info About Is Depreciation Included In Income Statement

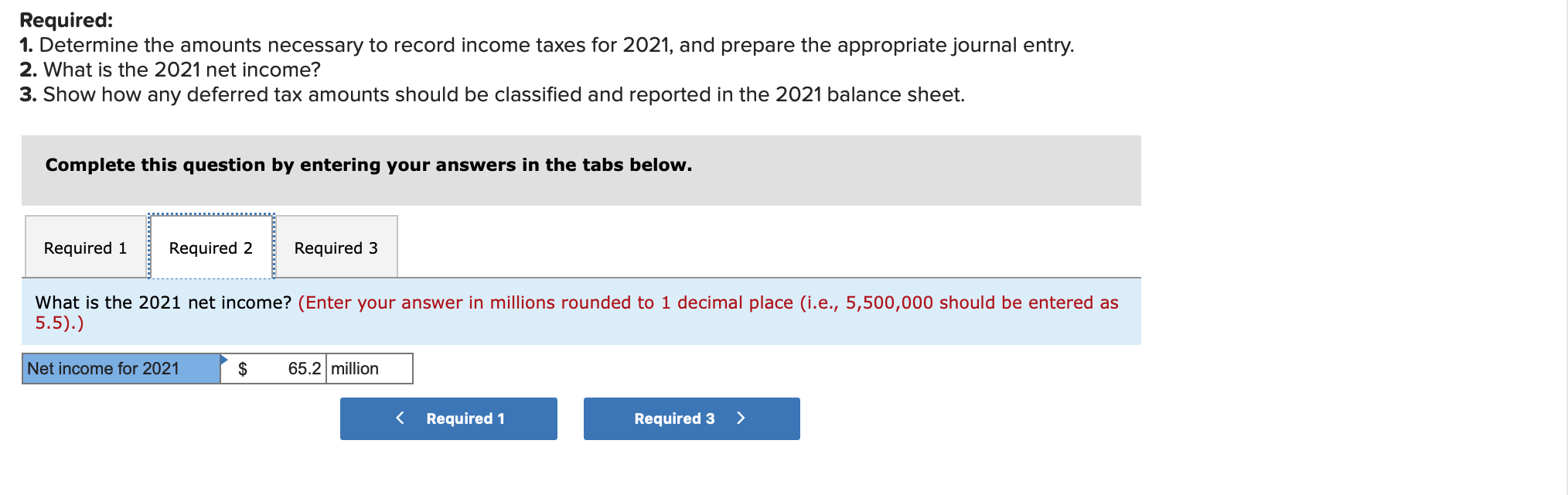

Income tax payable was also reported correctly at a tax rate of 20%.

Is depreciation included in income statement. An income statement is another name for a profit and loss statement (p&l). Do you know if there is any particular reason why depreciation is not mentioned in the income statement explicitly? Learn more what is an income statement?

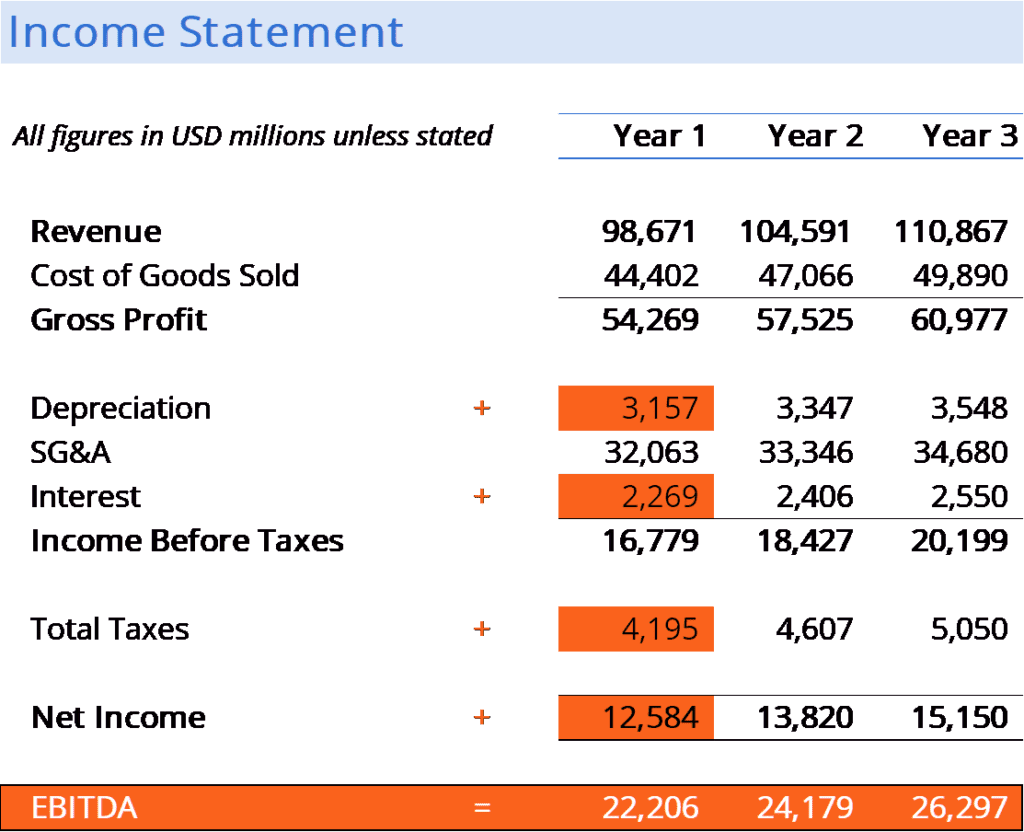

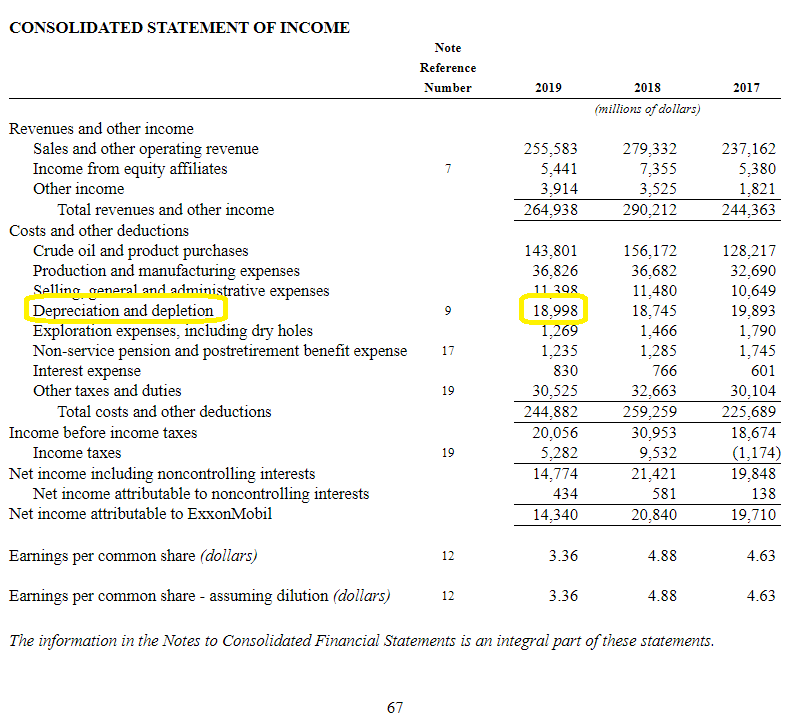

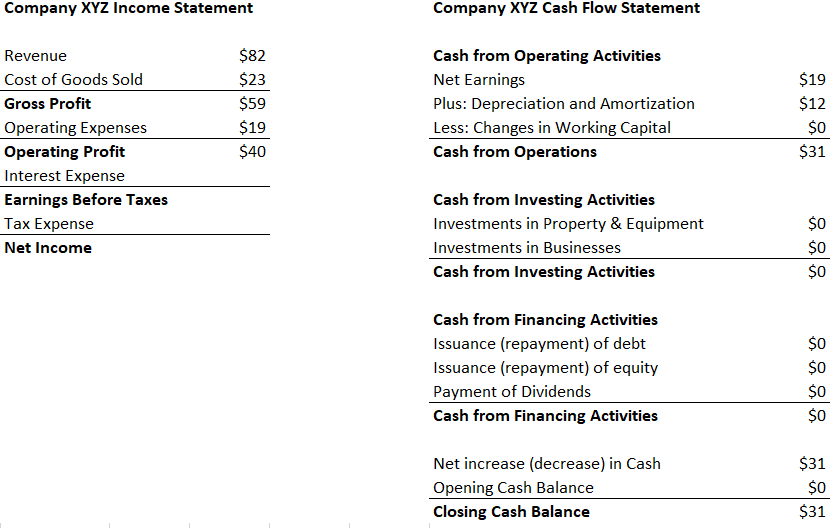

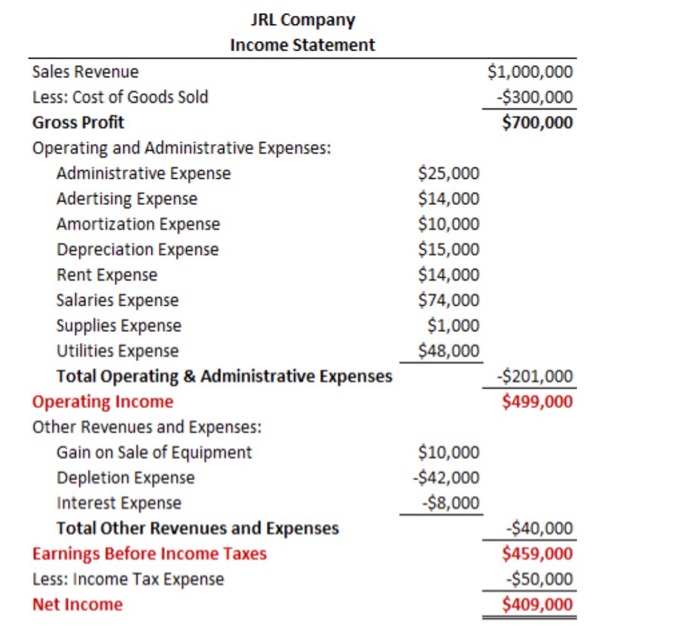

Using our example, the monthly income statements will report $1,000 of depreciation expense. Depreciation expense flows through to the income statement in the period it is recorded. Depreciation represents how much of the asset's value has been used up in.

Depreciation on an income statement. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on instagram: A depreciation expense reduces net income when the asset's cost is allocated on the income statement.

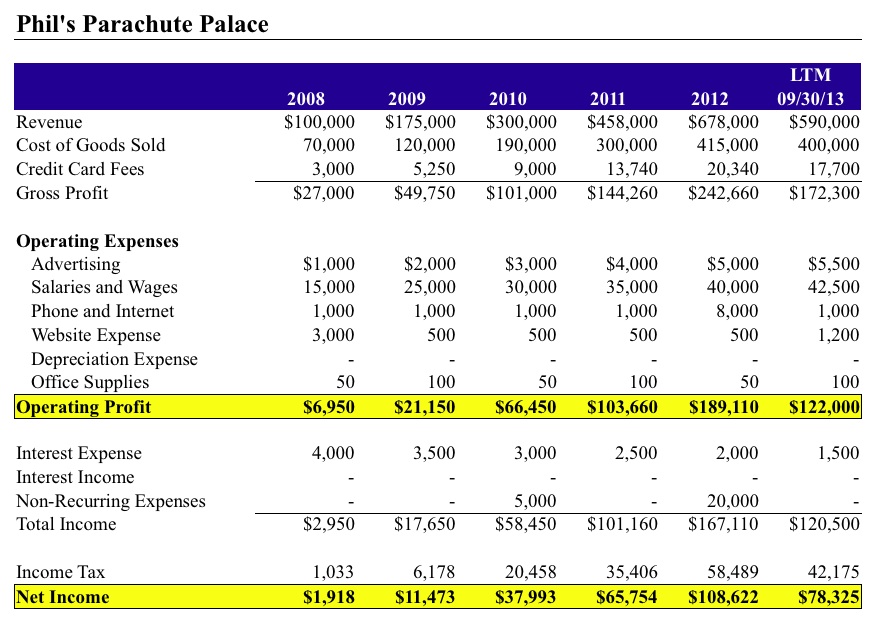

How much value an asset loses. The formula for any given period is: Revenue minus expenses equals profit or loss.

This 100% deduction applies to assets with a recovery period of 20 years or less, including machinery, equipment, and furniture. An income statement might use the cash basis or the accrual basis. You can look at an income.

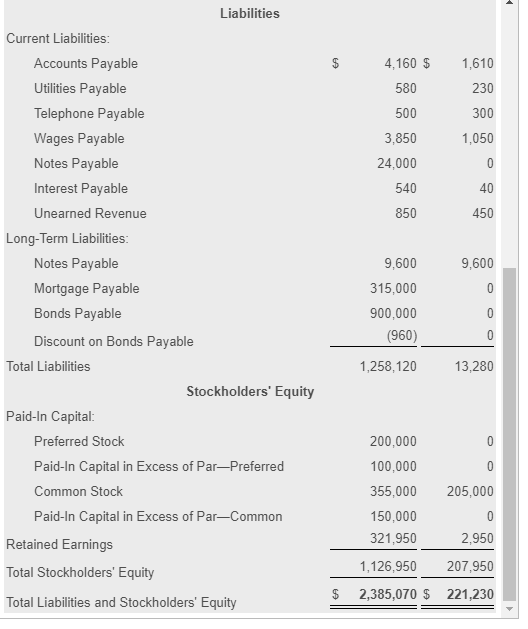

So i understand that it is actually expensed, but 'hidden' in different items. When depreciation expenses appear on an income statement, rather than reducing cash on the balance sheet, they are added to the accumulated depreciation account. Depreciation is a financial accounting method used to allocate the cost of tangible assets over their useful lives.

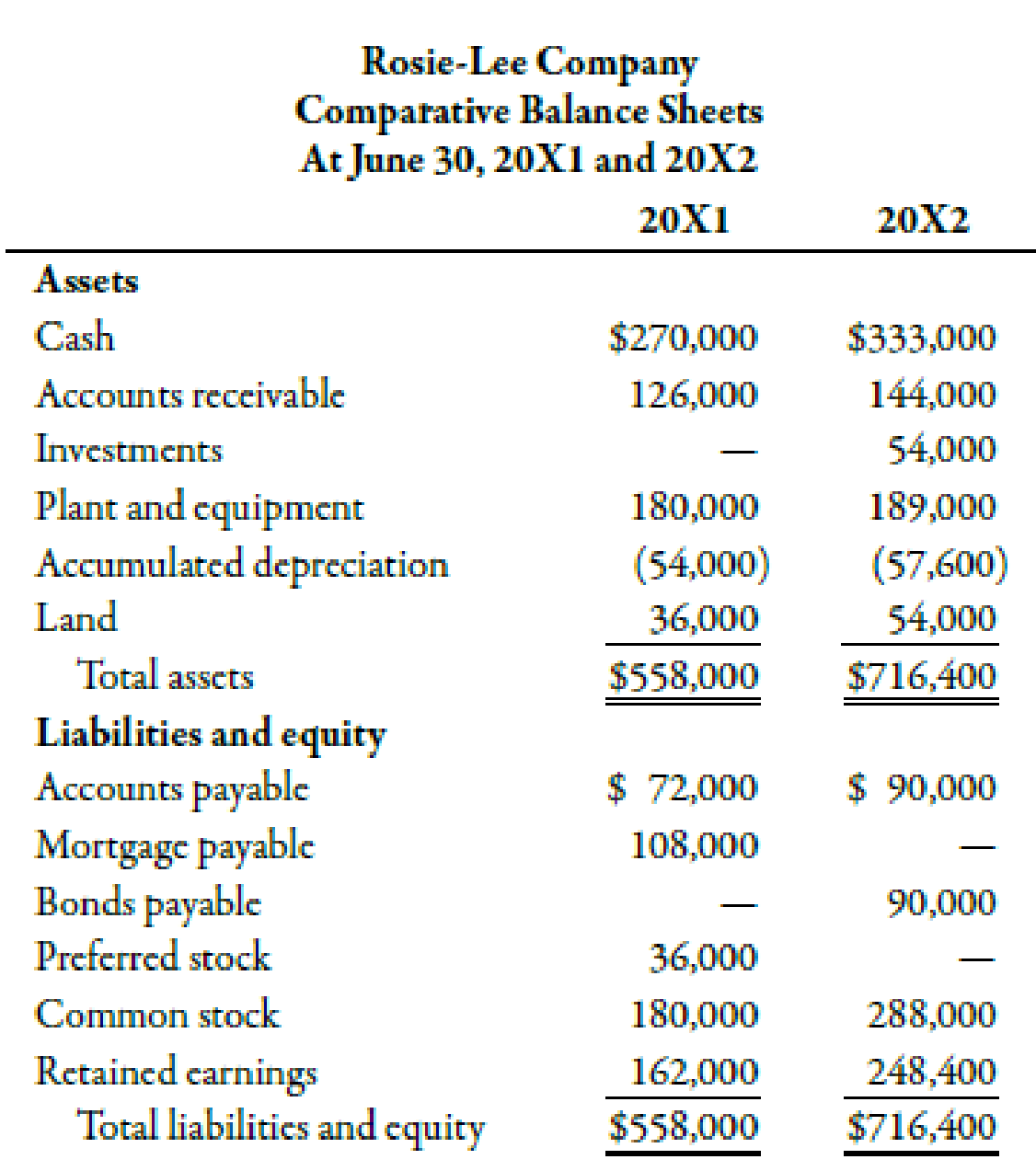

It shows your revenue, minus your expenses and losses. (an asset is something that has continuing value, like a computer, a car, or a piece of machinery.) it represents the decrease in the value of an asset over time. The accumulated depreciation balance increases over time, adding the amount of depreciation expense recorded in the current period.

The depreciation expense affects the income statement by reducing the. The income statement is a useful way to see how a company makes money and how it spends it. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

Depreciation is an accounting method used to allocate the cost of tangible assets over their useful life. Depreciation is an expense that needs to be reported on the pro forma income statement, which must be calculated beforehand. On the balance sheet, it is listed as accumulated depreciation, and refers to the cumulative amount of depreciation that has been charged against all fixed assets.

In the cash flow, however, you are essentially spinning this around to focus on the cash side. On the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. As opposed to recording the entire cost of an asset as soon as it’s bought, businesses record depreciation as a periodic expense on the income statement.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)