Glory Tips About Manufacturing Profit And Loss Account Format

The main aim of accounting is to arrange accounting data in order to ascertain the amount of profit or loss of an entity.

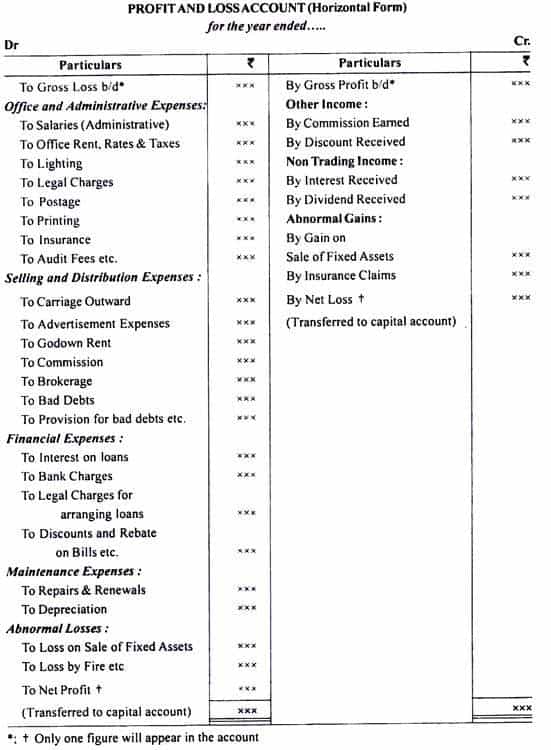

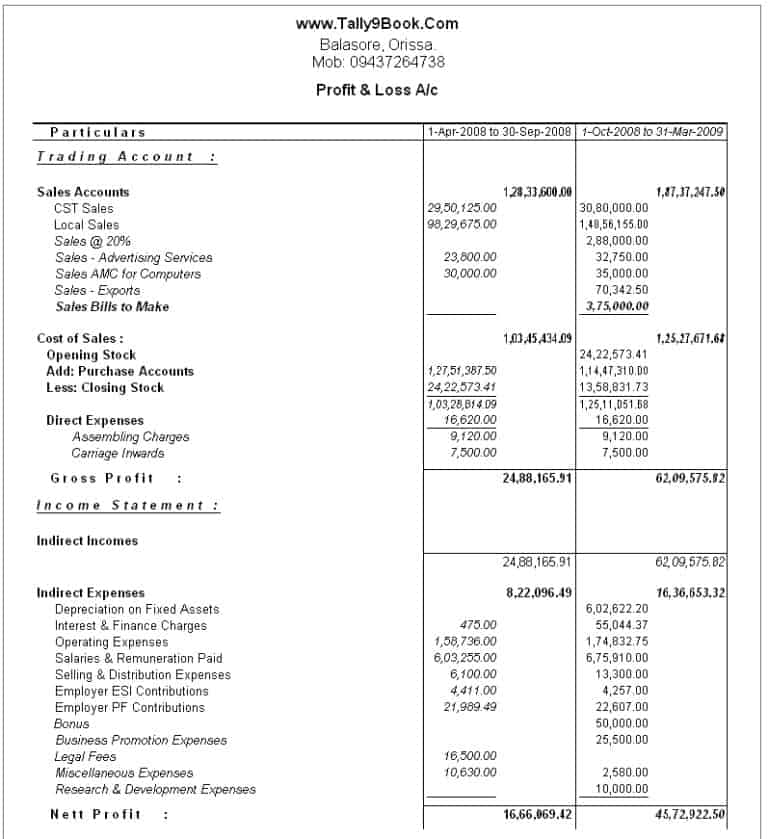

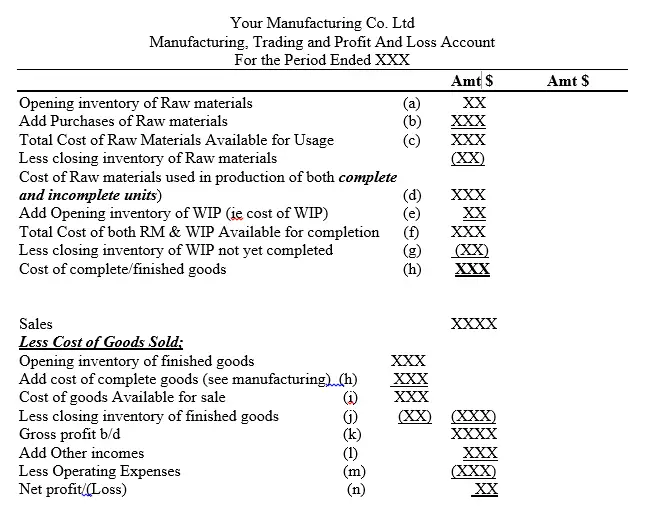

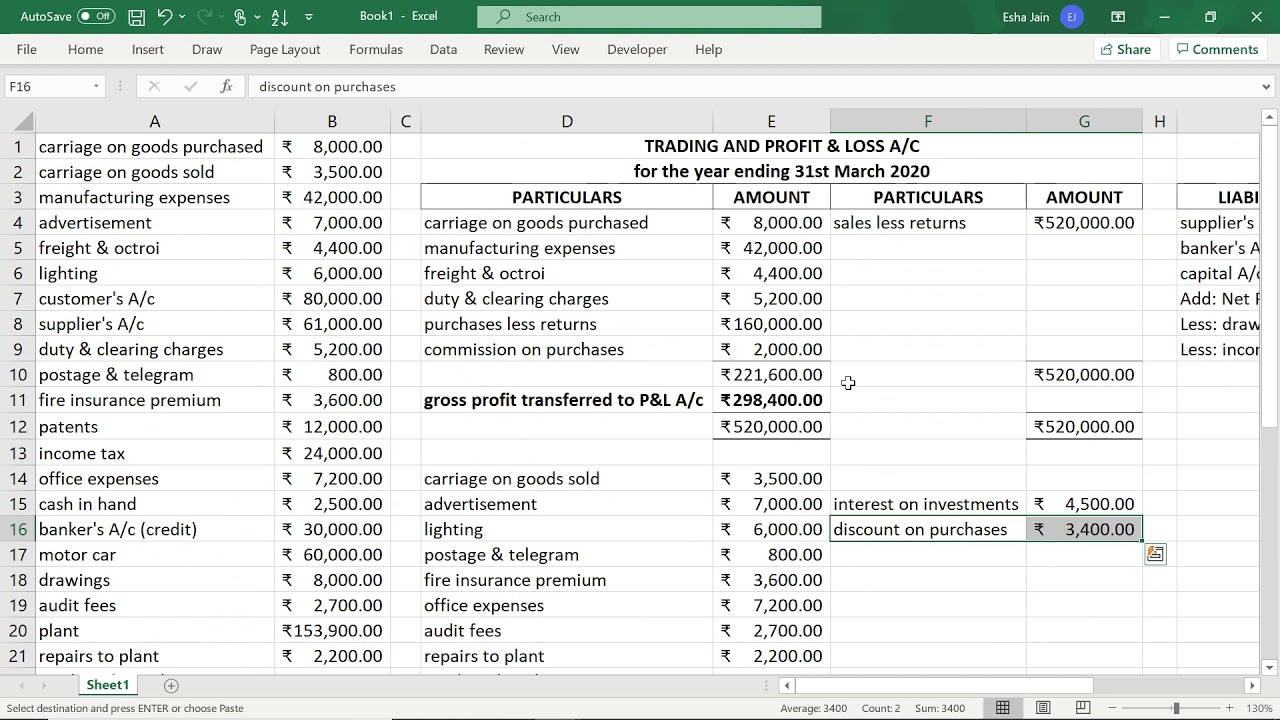

Manufacturing profit and loss account format. It is prepared to determine the net profit or net loss of a trader. Creating a profit and loss statement template for a manufacturing business can seem. Name manufacturing trading profit and loss account for the year ended 31 december.

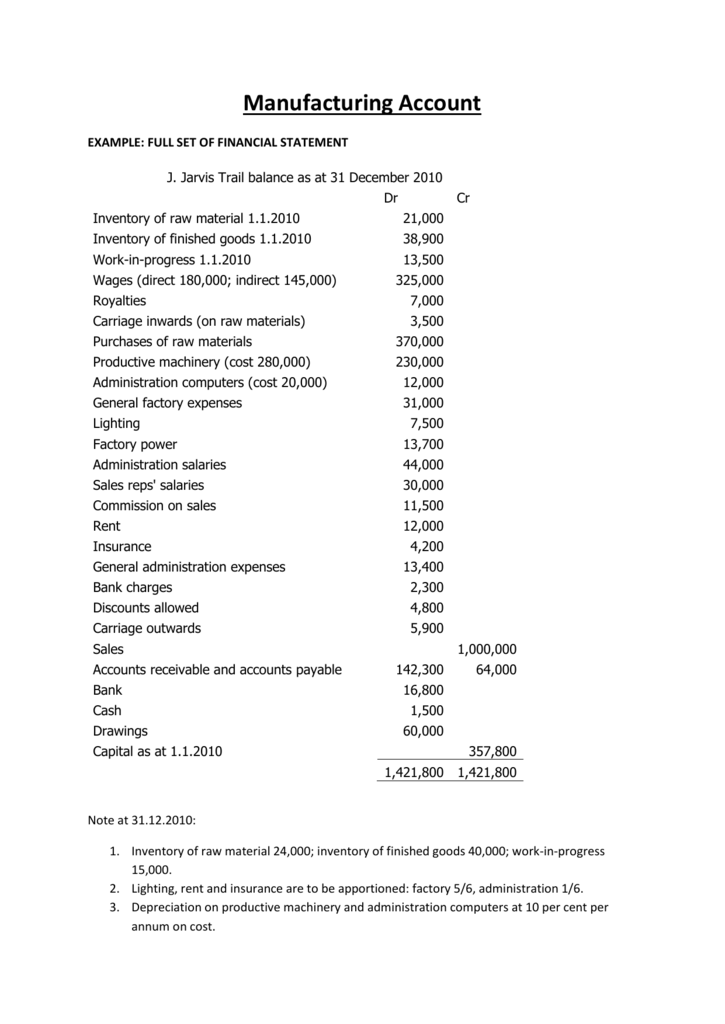

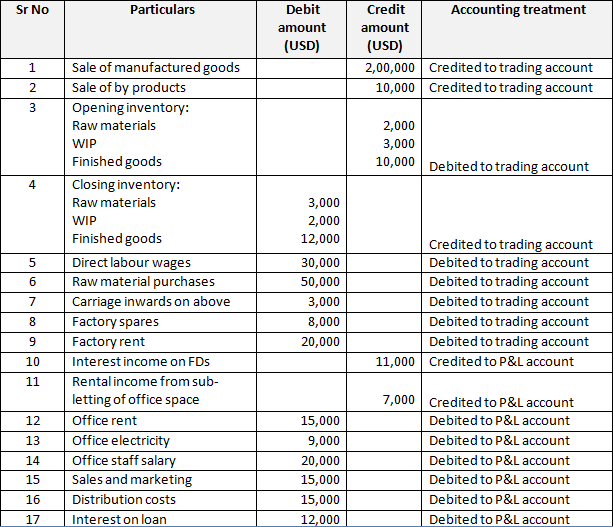

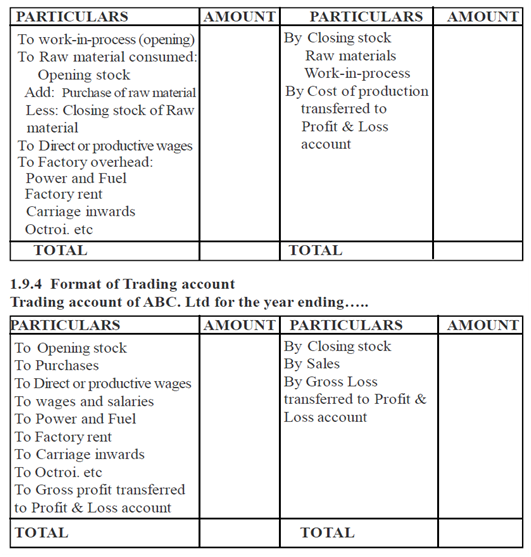

Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business. The primary purpose of preparing manufacturing account format is to ascertain the. Opening stock of raw materials xx purchases of raw materials xx add carriage inwards.

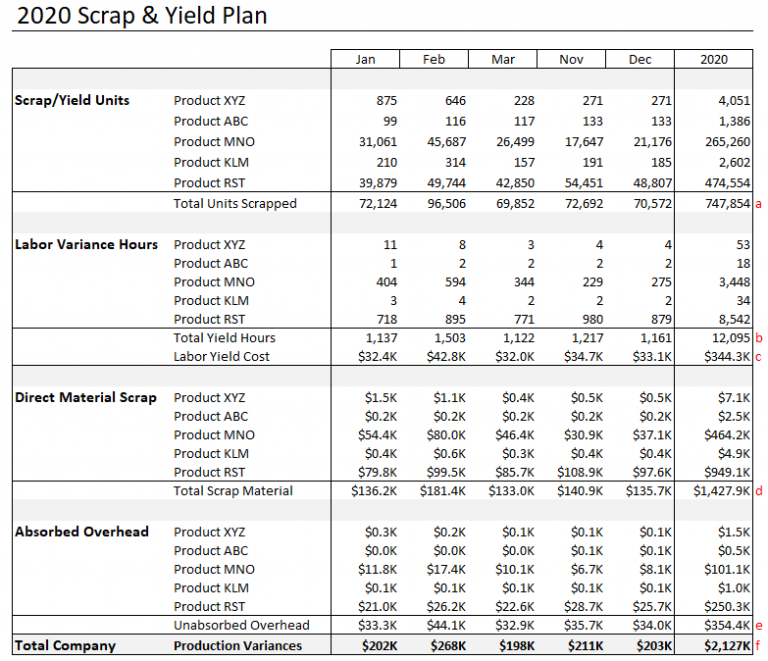

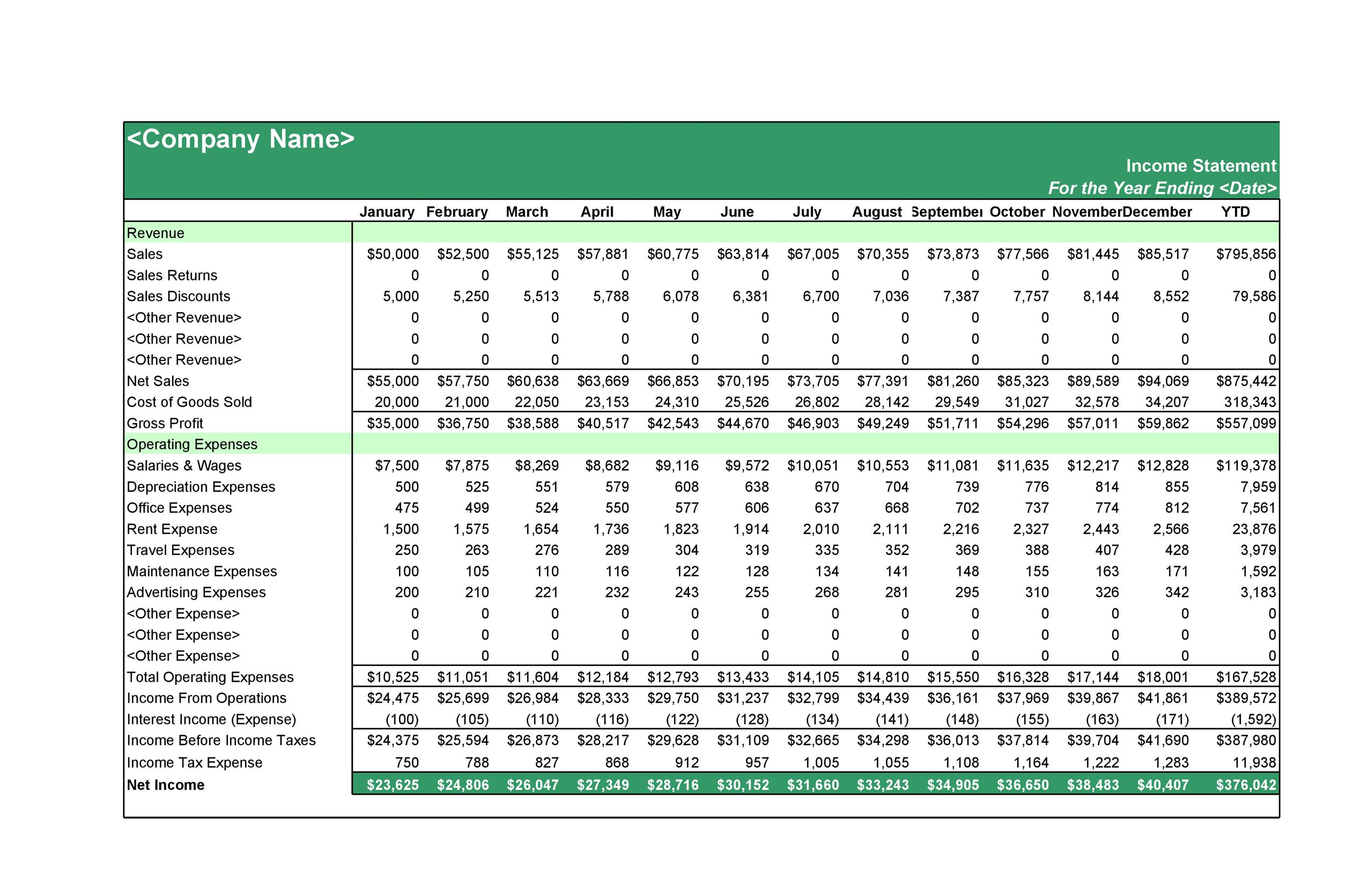

The monthly profit and loss template is perfect for small, medium, and large businesses as it can easily be adjusted to add or eliminate detail as required. The credit entry to the profit and loss account of 12,000 represents. For this purpose, we prepare the financial statements.

In the profit and loss statement, the cost of products sold (cogs) denotes the direct expenses incurred in producing or acquiring sold products. A profit and loss (p&l) account shows the annual net profit or net loss of a business. A manufacturing account shows the cost of running and maintaining the factory.

Usually, manufacturing entities prepare a manufacturing account also in addition to trading account, profit and loss account, and balance sheet. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. What does a p&l statement show?

It is prepared to calculate the cost of goods produced during the year and it is also known as. The common expenses between the. The factory overhead expenses appear in the manufacturing account while all other expenses appear in the profit and loss account.

By failing to record the inventory loss, rite aid overstated inventory (an asset) on the balance sheet by $9,000,000 and understated cost of goods sold (an.