Nice Tips About Trial Balance Does Not

I f the debit dr and credit cr balance totals do not match in the trial balance exercise, there is an accounting error somewhere in the account balances.

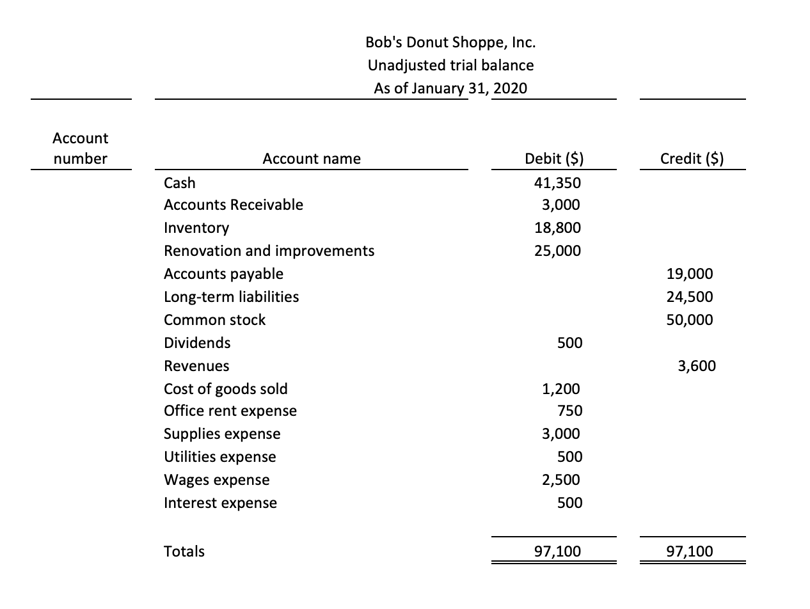

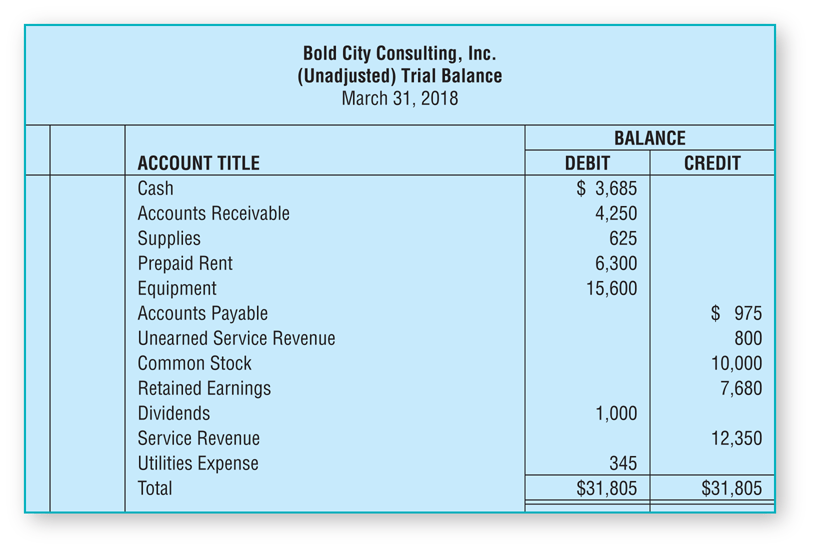

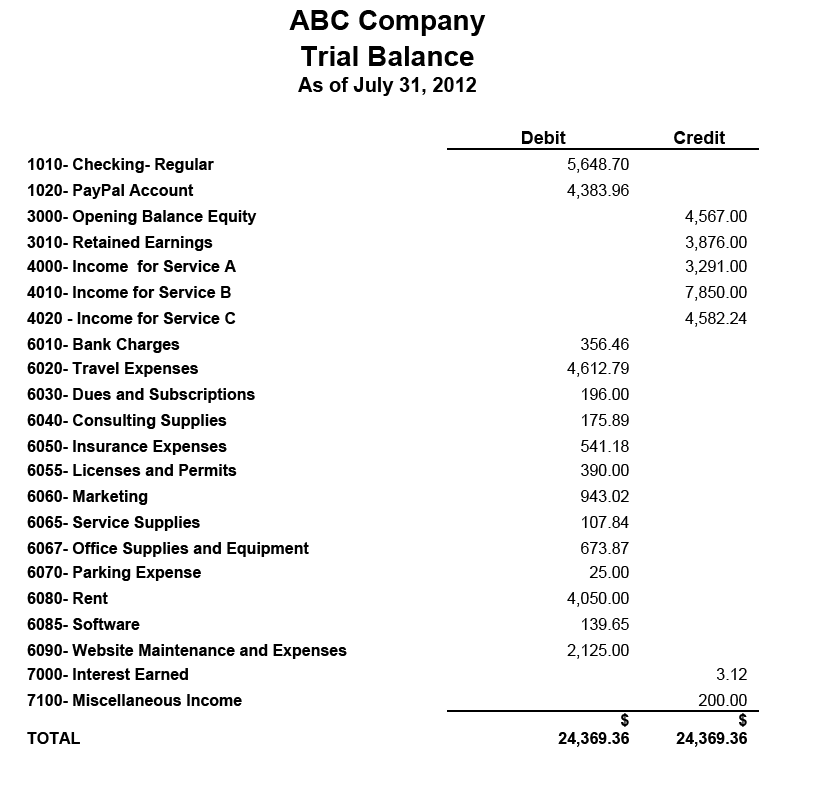

Trial balance does not balance. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. It is an internal document that provides a clear image of a company’s financial health, summarizing all the debits and credits transactions of the business. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

Causes of an unbalanced trial balance a trial balance might fail to. Trial balance accounting. My trial balance doesn’t balance!

To help identify the reasons why a trial balance may not balance the following steps can be taken. It is very easy under the pressure of an exam to make silly mistakes when adding up a long. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

The firm will try to find the mistakes responsible for the mismatch, and correct them, before publishing financial statements. The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. Errors not highlighted by a trial balance.

A trial balance is a statement or report generated at the end of an accounting period, listing all the accounts and their balances. Mathematical accuracy, however, does not mean that the trial balance is absolutely correct. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

Check all additions again, in particular those in the cash book and those of the purchases and sales accounts; One way to find the error is to take the difference between the two totals and divide the difference by two. Imbalances in trial balances could also result from errors in posting or incorrect account balances, or it could miss an entry or a transfer mistake while data is transferred from the general ledger account.

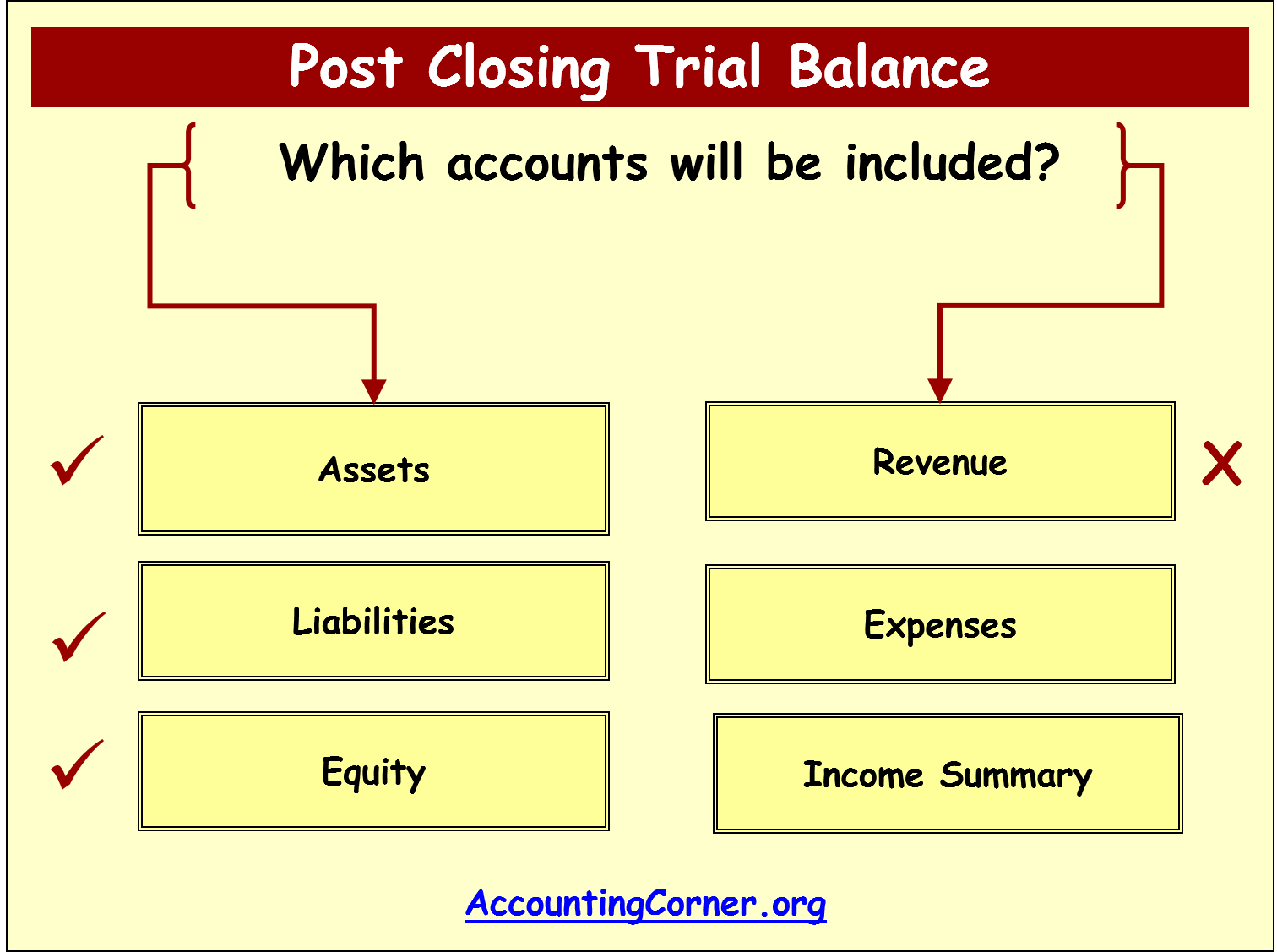

When the trial balance does not balance: Sometimes errors may occur in the accounting process, and the trial balance can make those errors apparent when it does not balance. It is important to recognize that some errors are not highlighted by a trial balance.

Check the trial balance additions again—your figures may be out of alignment; The trial balance will not agree if both sides of it are wrongly totaled; The tb does not form part of double entry.

Key takeaways the trial balance is used to test the equality between total debits and total credits. Errors that result in an unbalanced trial balance are usually the result of a one sided entry in the bookkeeping records or an incorrect addition. The trial balance is meant to check the mathematical accuracy of accounts’ debit and credit balances.

Run the trial balance report for all accounts showing the beginning balance, activity and ending balance. This statement comprises two columns: Trial balance finds some but not all errors.