Neat Tips About Ifrs 16 In Cash Flow Statement

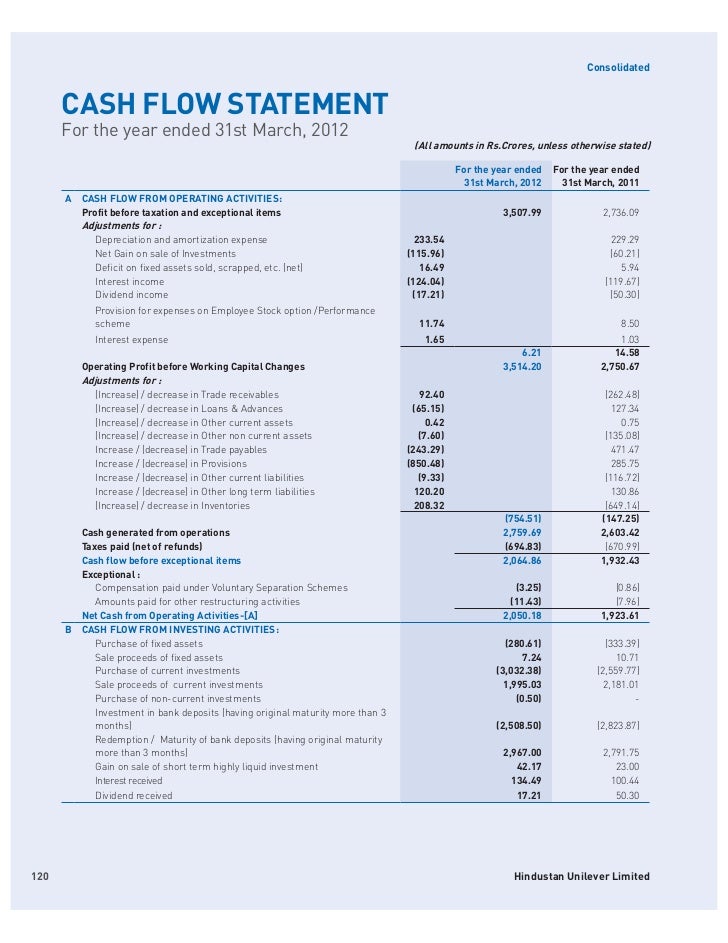

Net cash used in financing activities ( 790) effect of exchange rate changes ( 40) net increase in cash.

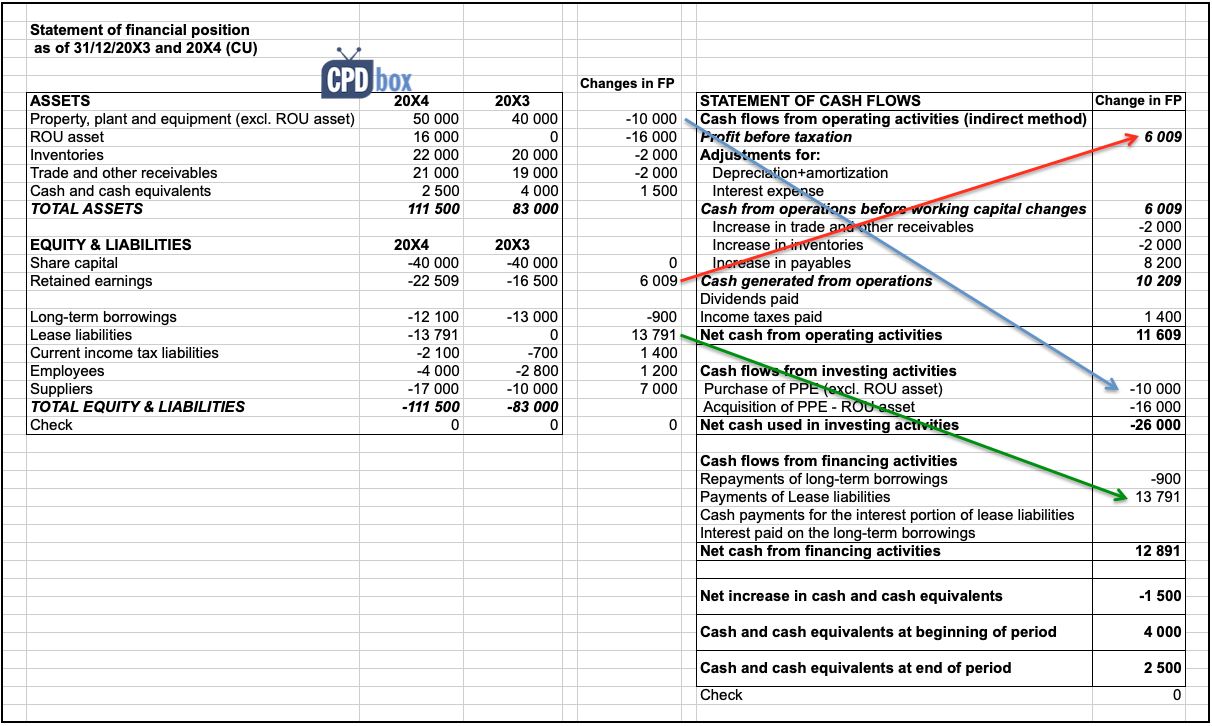

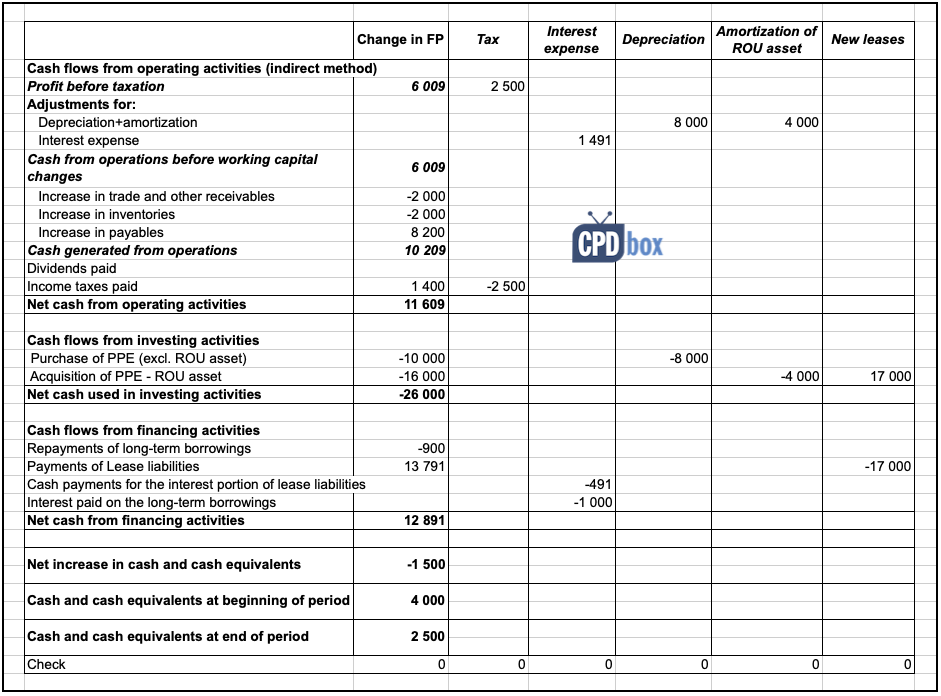

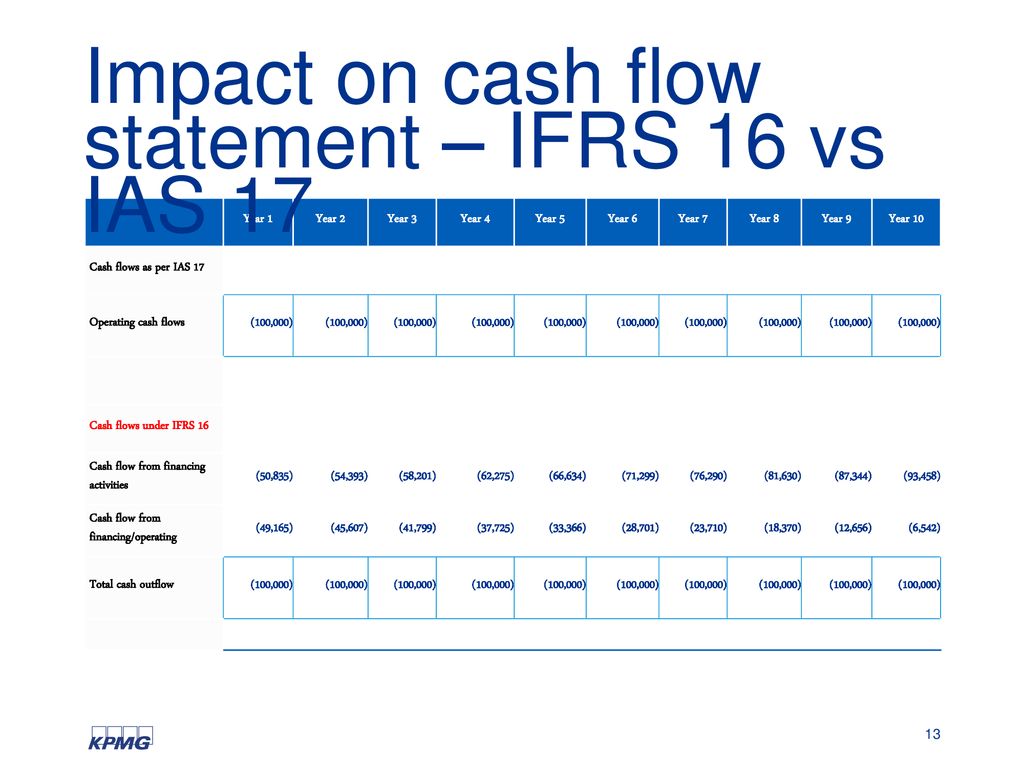

Ifrs 16 in cash flow statement. Aside from this, ifrs 16 will also influence. A statement of cash flows is part of an entity’s complete set of financial statements in accordance with paragraph 10 of ias 1 ‘presentation of. The impact of leases on the statement of cash flows includes (ifrs 16.50):

The objective of ifrs 16’s disclosures is for information to be provided in the notes that, together with information provided in the statement of. Statement of cash flows the new guidance will also change the cash flow. Repayments of the principal portion of the lease liability, presented within financing.

[1] this could also be shown as an operating cash flow. Ifrs 16 leases in april 2001 the international accounting standards board (board) adopted ias 17 leases, which had originally been issued by the international accounting. In contrast, ifrs 16 includes specific requirements for the presentation of the rou asset and lease liability and the.

Flows’ (ias 7, the standard). Ifrs 16 requires lessees and lessors to provide information about leasing activities within their financial statements. A statement of cash flows,.

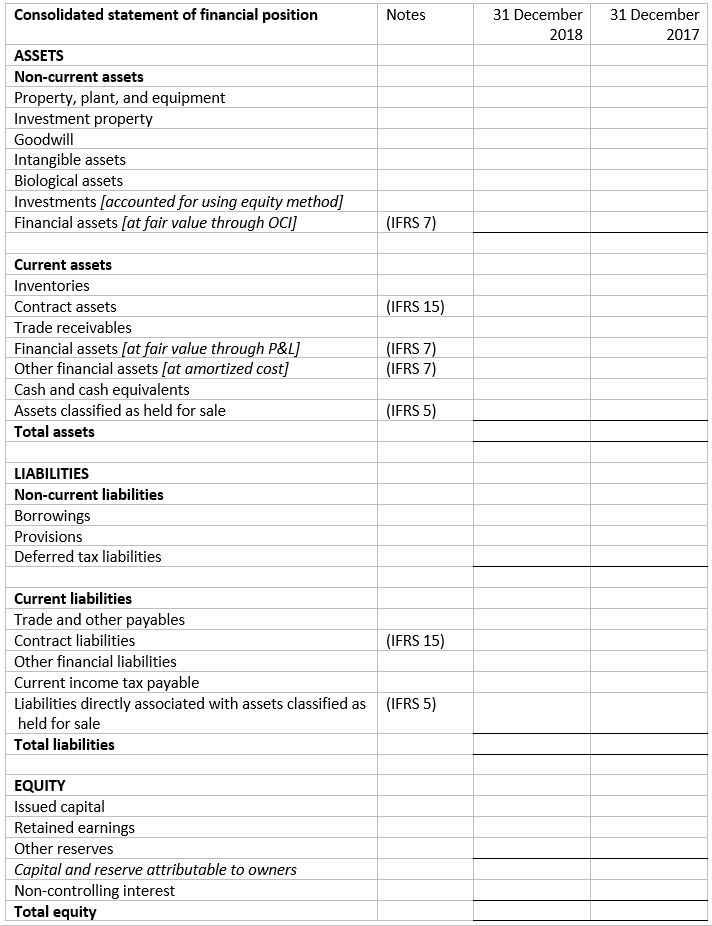

Ifrs 16 leases came into effect on 1 january 2019 and requires companies to report all leases on the balance sheet (except where exemptions apply). Financial statements and ias 7 statement of cash flows. Ifrs 16 leases in the statement of cash flows (ias 7) on 1 january 20x4, abc entered into the lease contract.

Income statement and free cash flow. In addition to the free cash flow above, the group received proceeds of c.£0.2bn. The present value of the lease liability is cu 17 000;

Guidance incorporates the acquisition of ball aerospace from 16 february 2024. Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows. Ifrs 16 is likely to have a significant impact on the financial statements of a number of lessees.

The standard explains how this information should be. Notwithstanding this, application of the guidance may require. The ifrs 16 and asc 842 guidance on identifying whether arrangements are or contain leases is nearly identical.

Annual recurring revenue (arr) of usd730.0m, up 16% c.c. For companies with material off balance sheet leases, ifrs 16 changes the nature of expenses related to those. What does ifrs 16 mean for a company’s income statement?

An entity shall apply those amendments when it applies ifrs 16. The details are as follows: Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019.