Great Tips About Different Types Of Financial Statements

These documents are used by the investment community, lenders, creditors, and management to evaluate an entity.

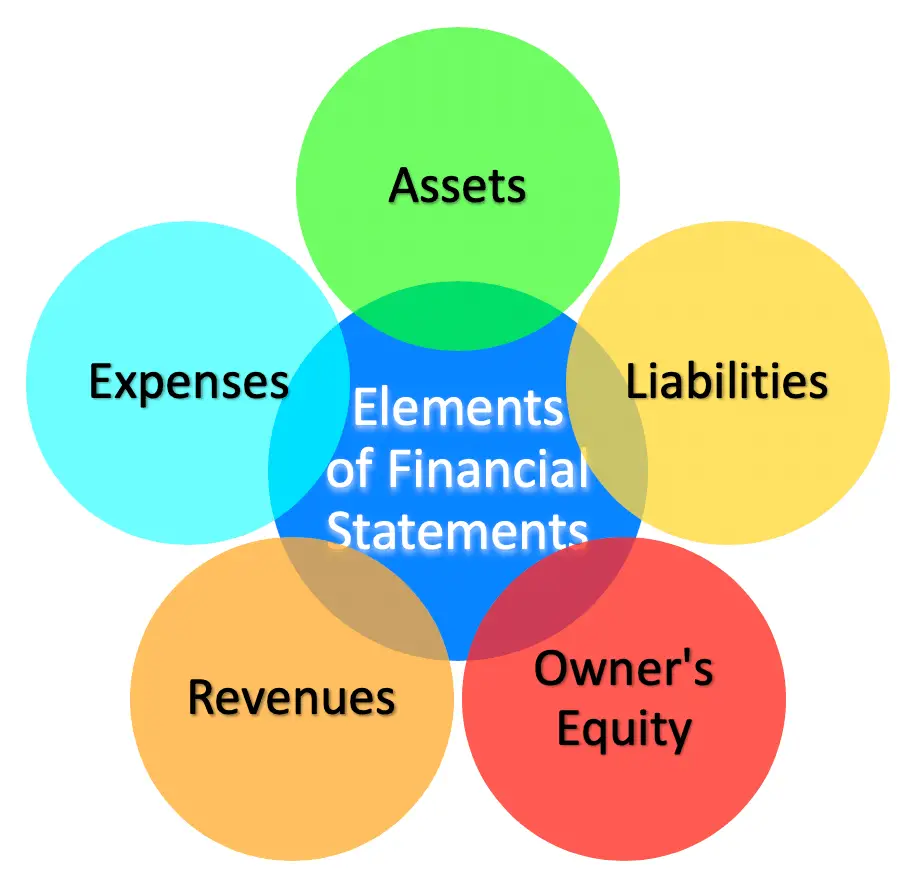

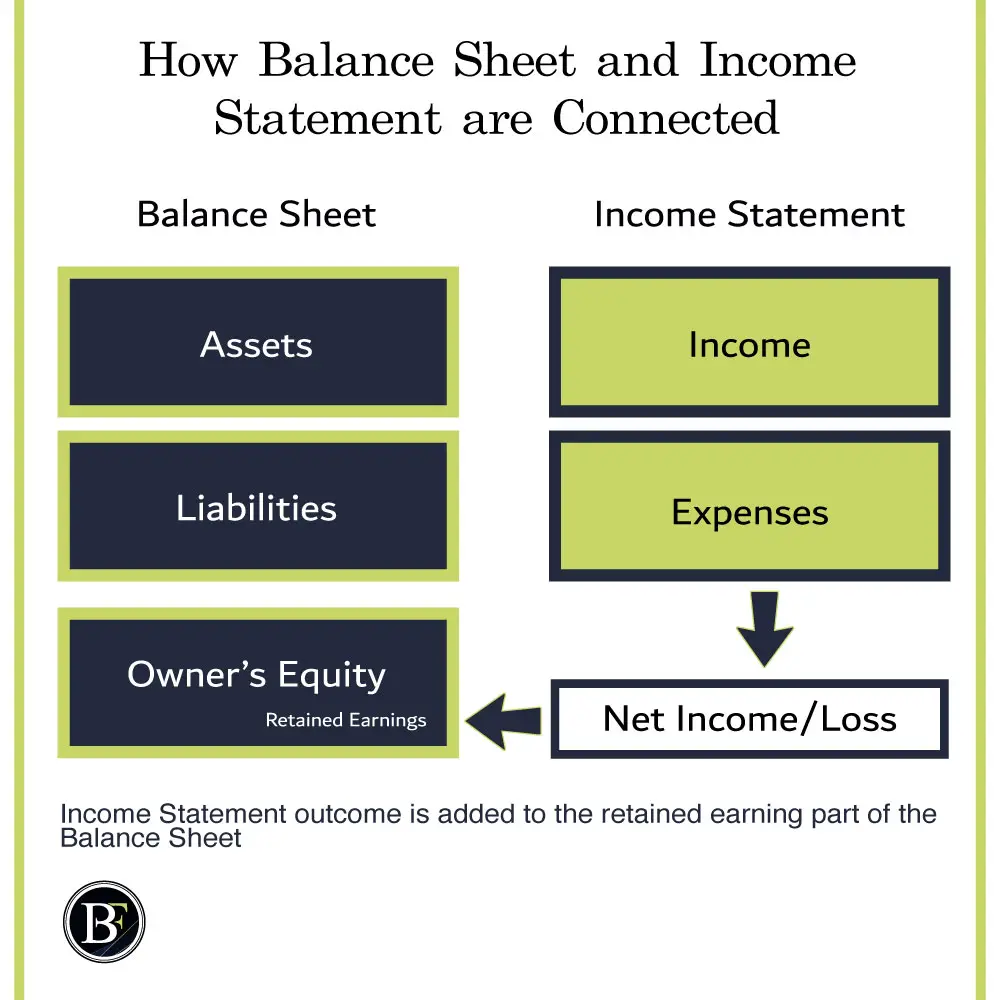

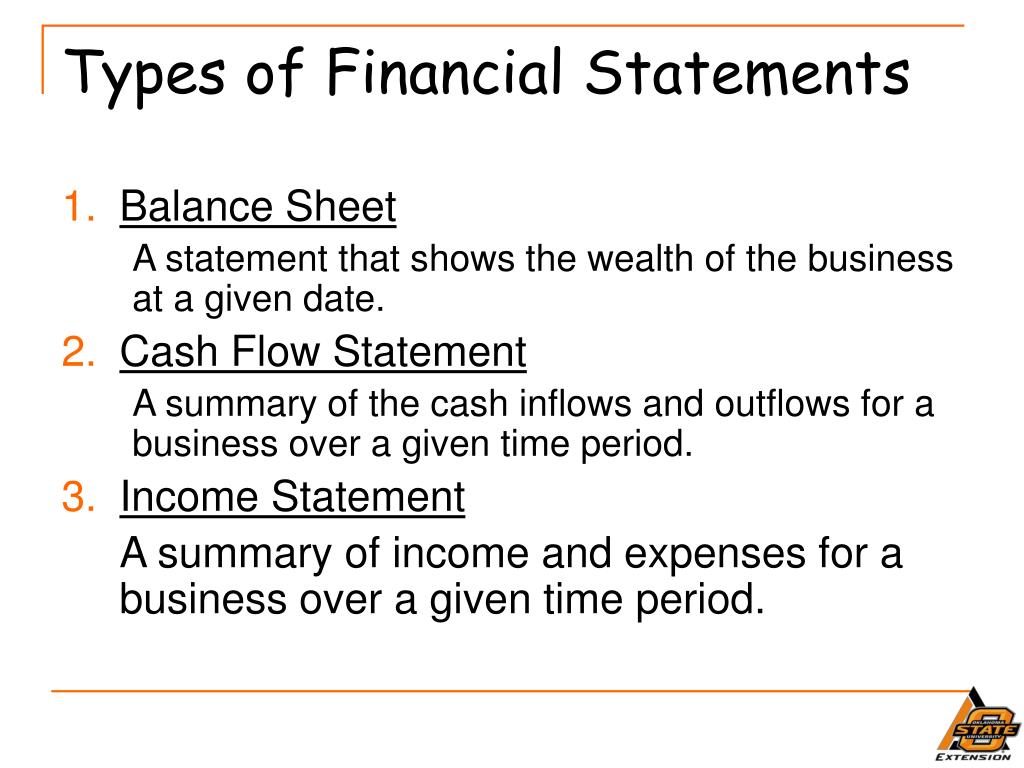

Different types of financial statements. Types of financial statements companies use the balance sheet, income statement, and cash flow statement to manage the operations of their business and to provide transparency to their. There are two types of financial analysis: Let us discuss these statements in detail now 1.

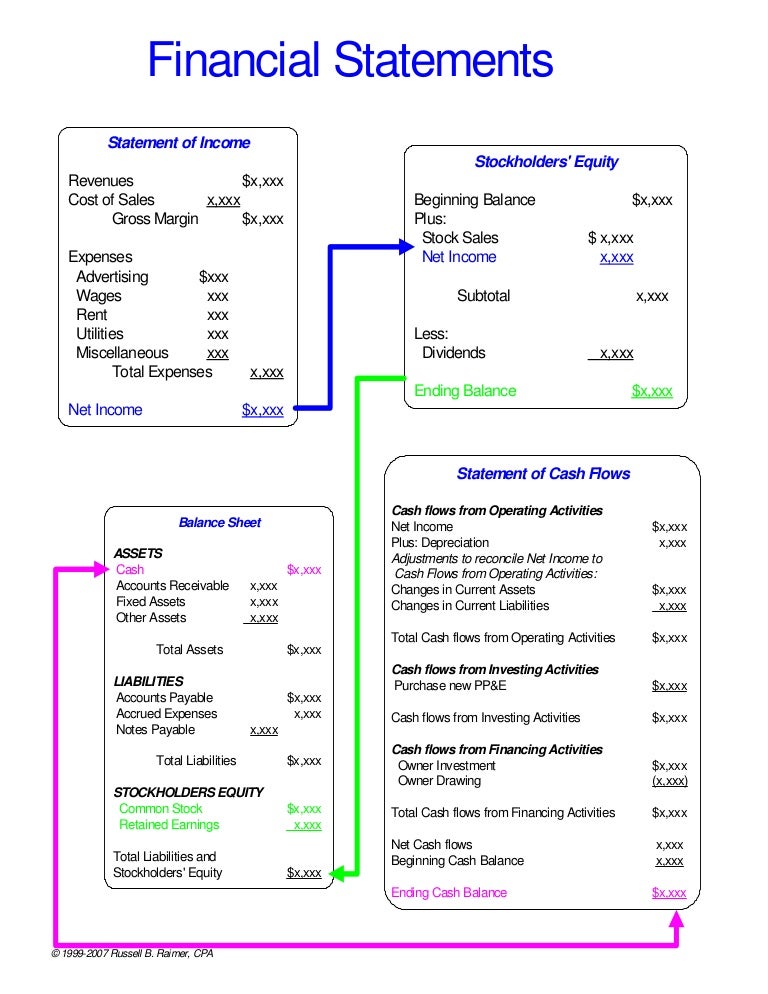

Balance sheets, income statements, and cash flow statements. Income statement arguably the most important. Statement of financial position statement of financial position, also known as the balance sheet, presents the financial position of an entity at a given date.

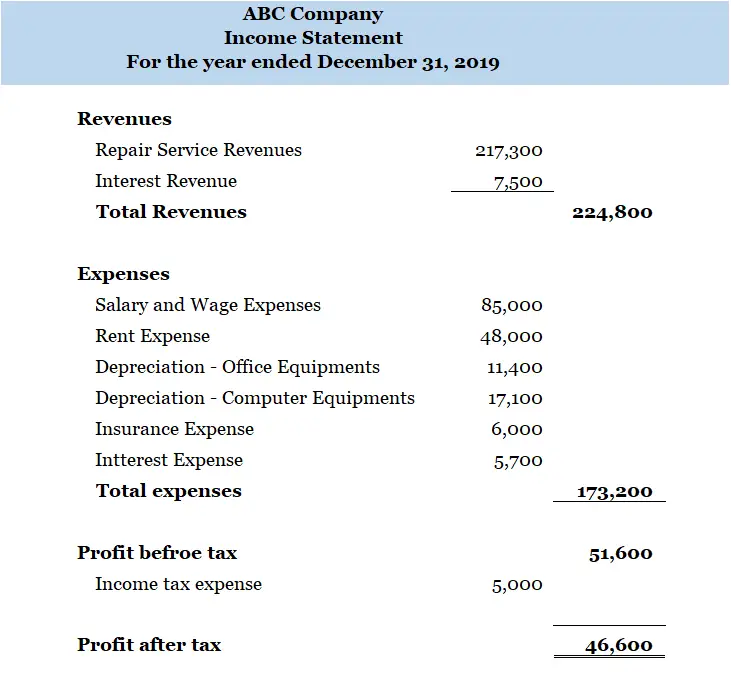

Types of financial statements 1. A business needs to keep a very close eye on profit and money coming in, and that’s precisely what an income statement does. An income statement may also be known as a profit and loss statement, showing your businesses income and outgoings over a set period.

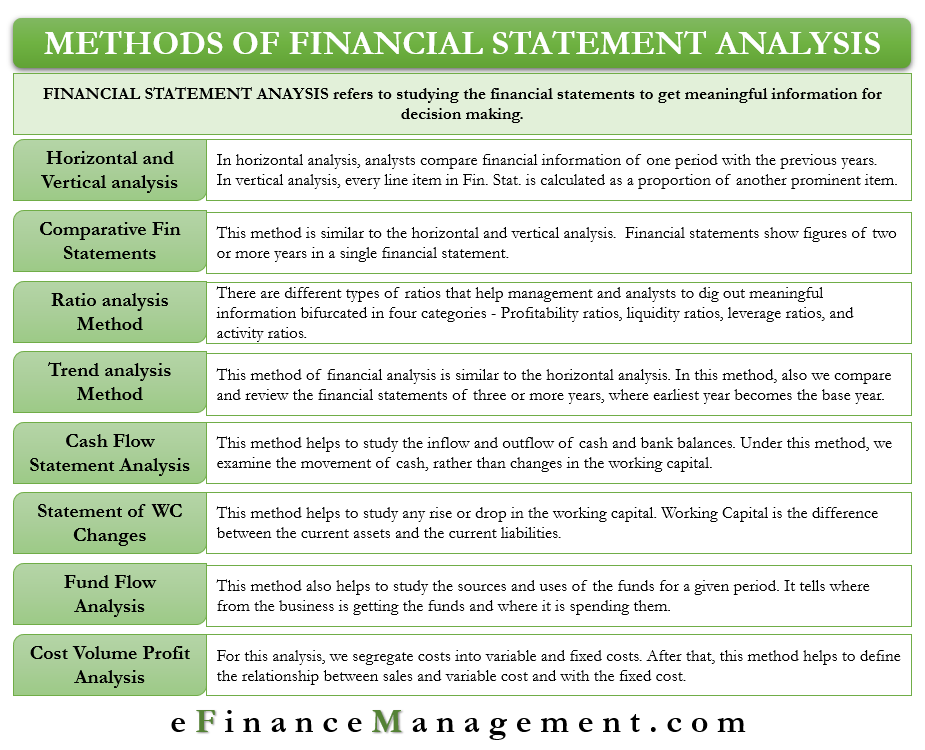

The different types of preparing financial statements are as follows: There are three main types of financial statements: Fundamental analysis and technical analysis.

The balance sheet normally prepared and presented is on as on date. There are four (4) types of financial statements that are required to be prepared by an entity. Financial ratio analysis is often broken into six different types:

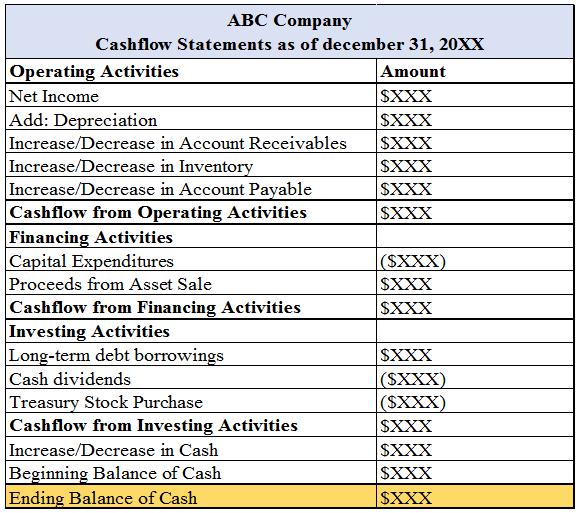

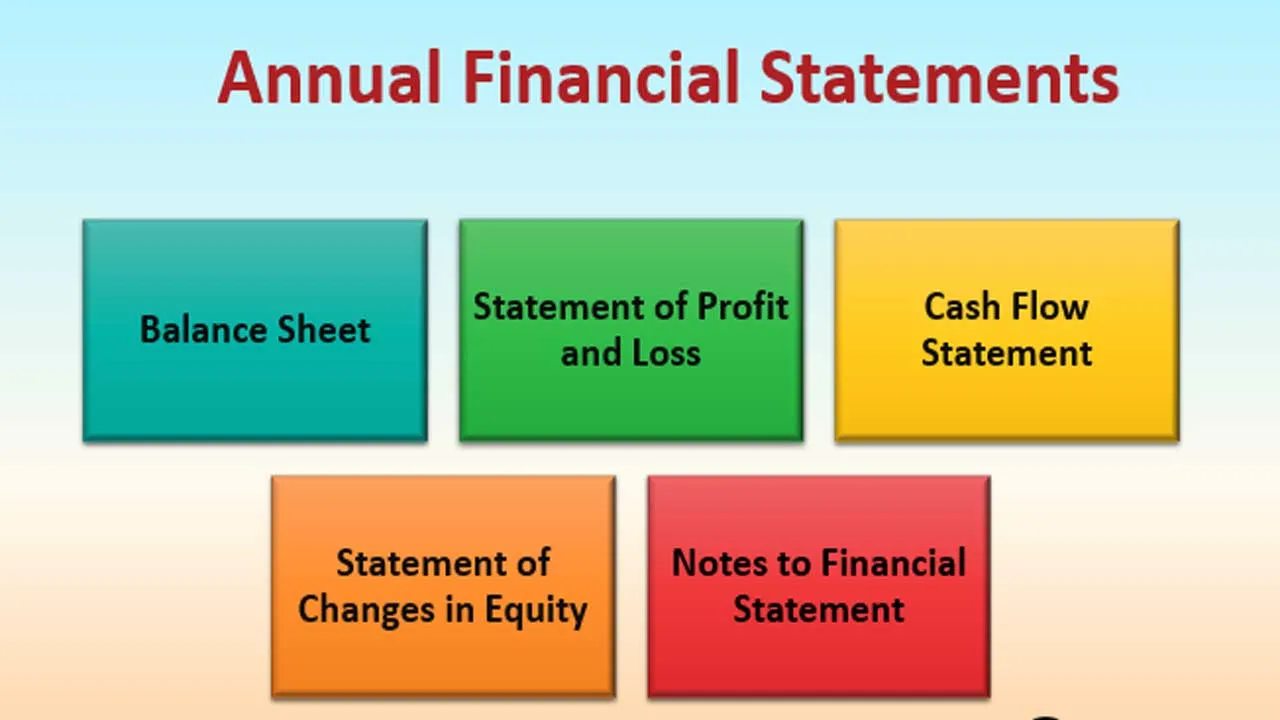

In general, there are five types of financial statements the income statement, statement of financial position, statement of change in equity, cash flow statement, and the noted (disclosure) to financial statements. The balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. Balance sheet income statement cash flow statement part of the world considers the statement of stockholders equity as another financial statement.

Profitability, solvency, liquidity, turnover, coverage, and market prospects ratios. In the true sense, explanatory notes in the annual reports should also be called financial statements. It is also commonly referred to as the profit and loss statement.

The three financial statements are: The balance sheet describes the financial position of the business and it delivers critical and. That is prepared by an entity monthly, quarterly, annually, or for the period required by management.

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. What they are and why they’re important 1. The advantages of preparing financial statements are as follows:

It is comprised of the following three elements: (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Read on to explore each one and the information it conveys.

/96251863-57a250083df78c327615ea44.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)