Smart Tips About Income Statement By Function Of Expense

Income statement by function.

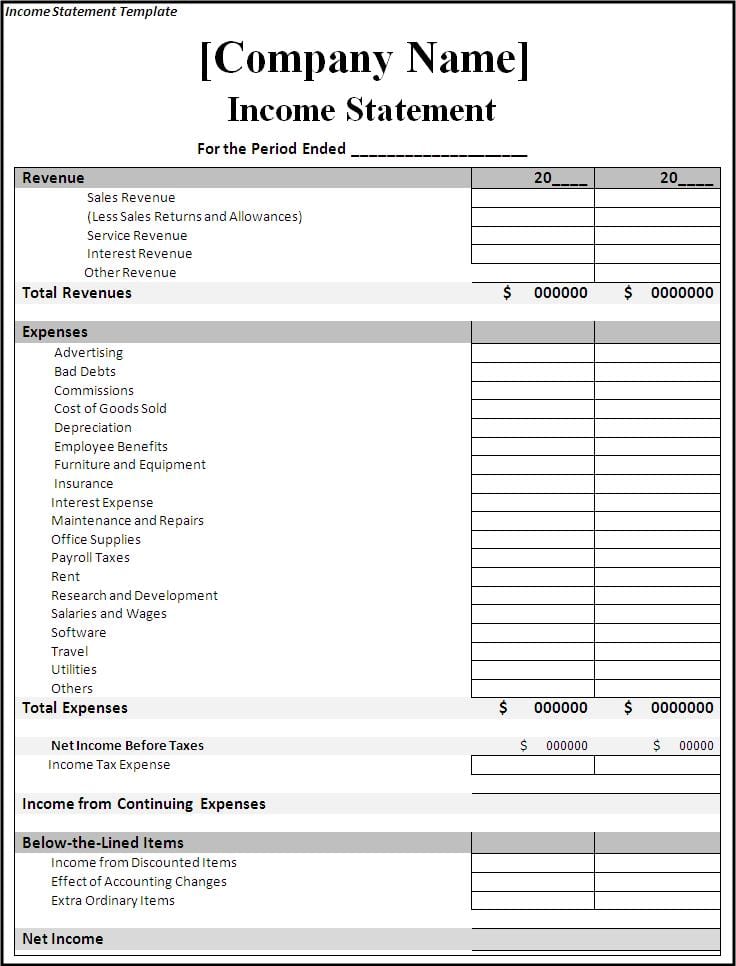

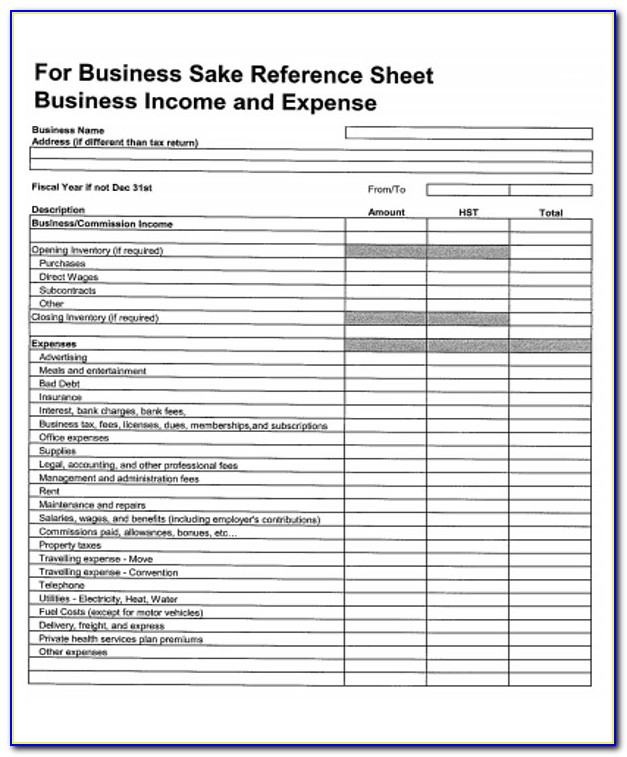

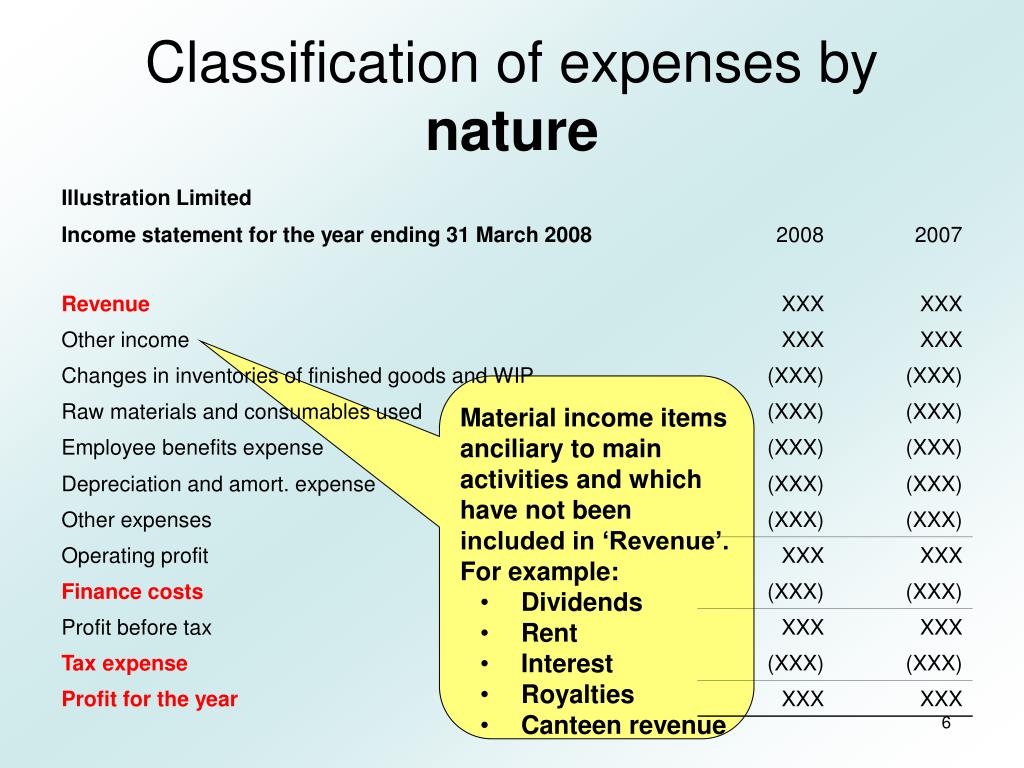

Income statement by function of expense. An income statement by nature method is the one in which expenses are disclosed according to their nature such as depreciation, transports costs, rent expense, wages and salaries etc. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. Raw material costs, labour and other employee benefit costs, depreciation or amortisation.

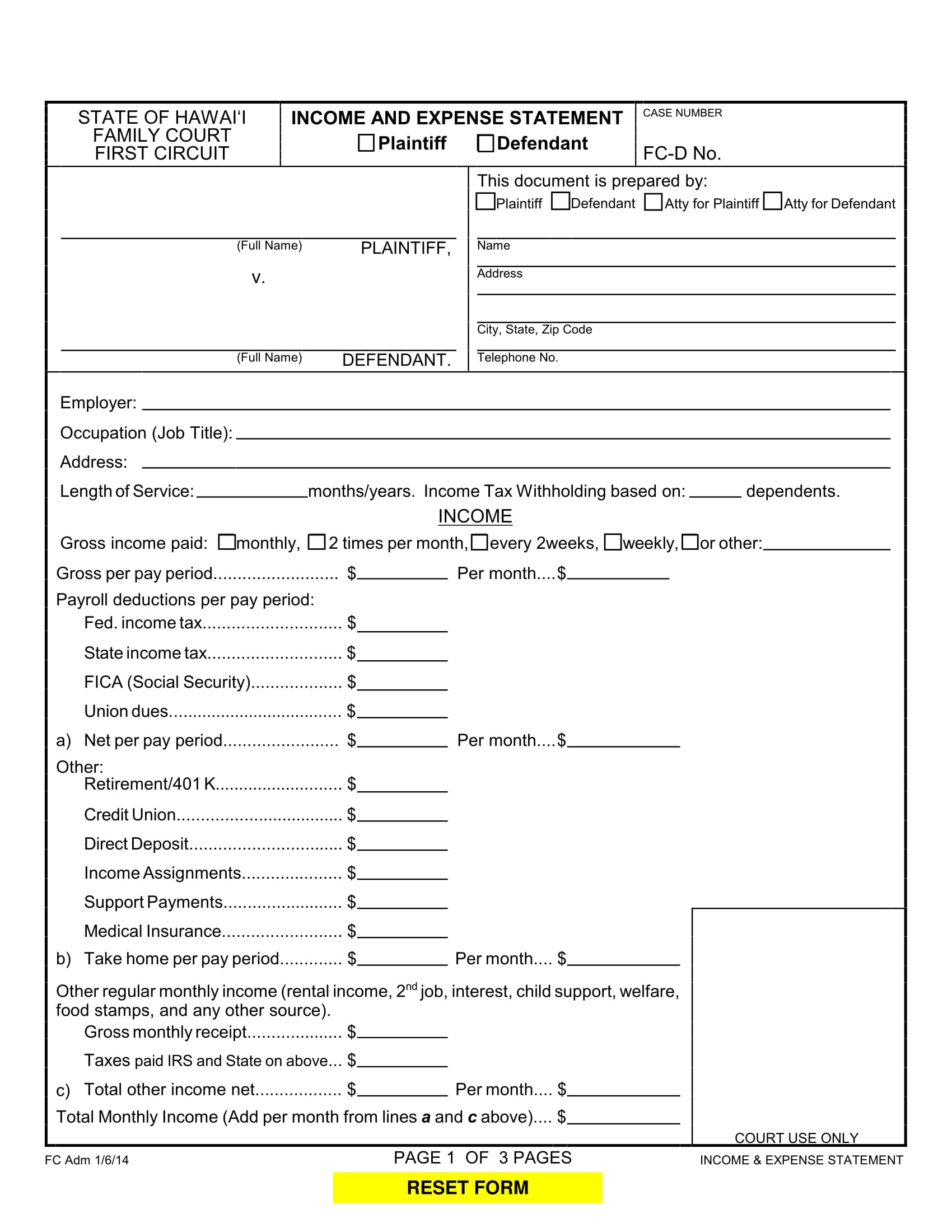

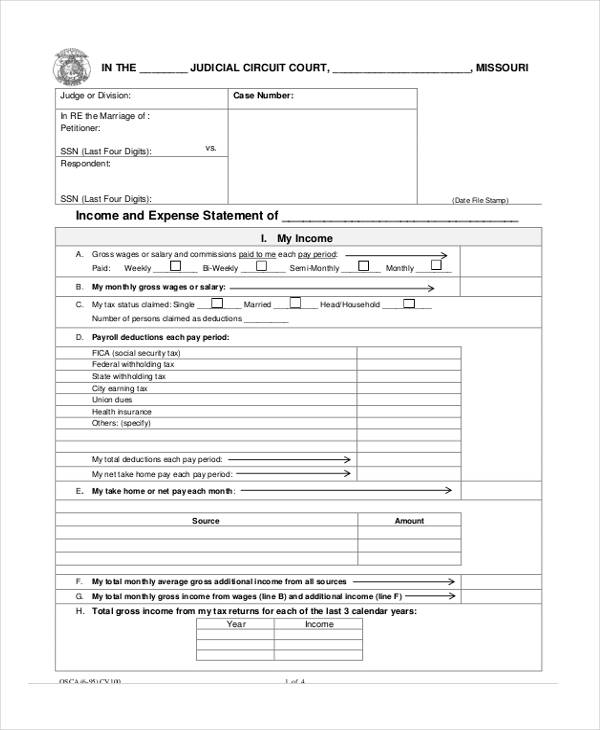

Income statement by nature of expense. The income statement calculates the net income of a company by subtracting total expenses from total income. Income account by nature of expense.

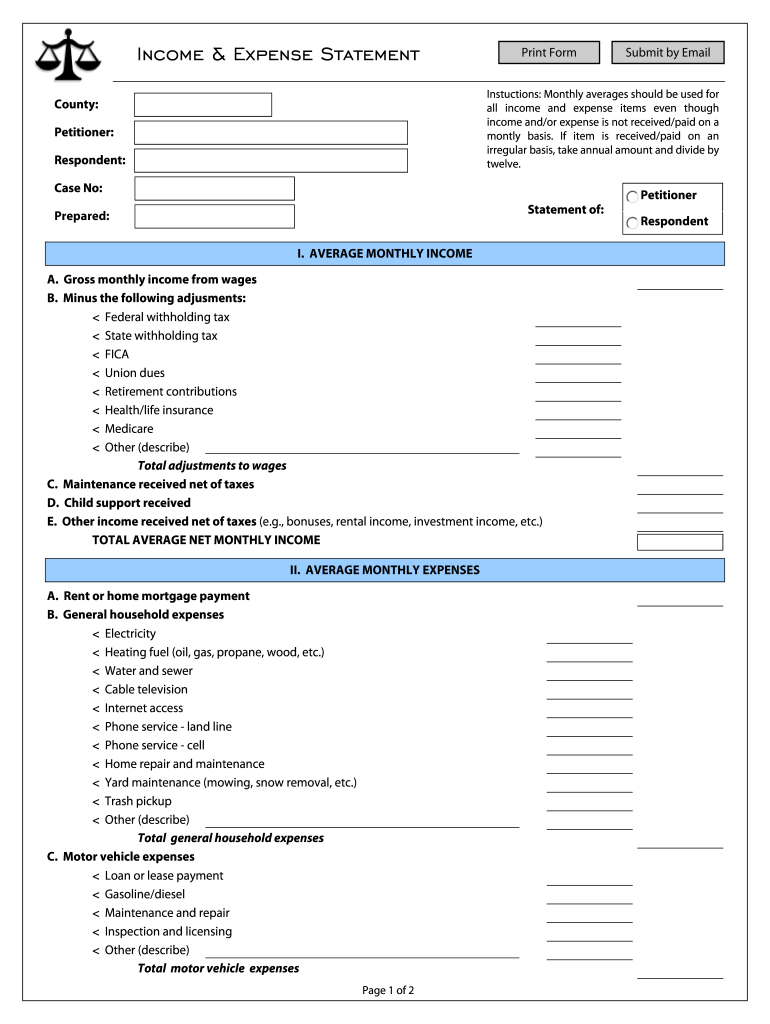

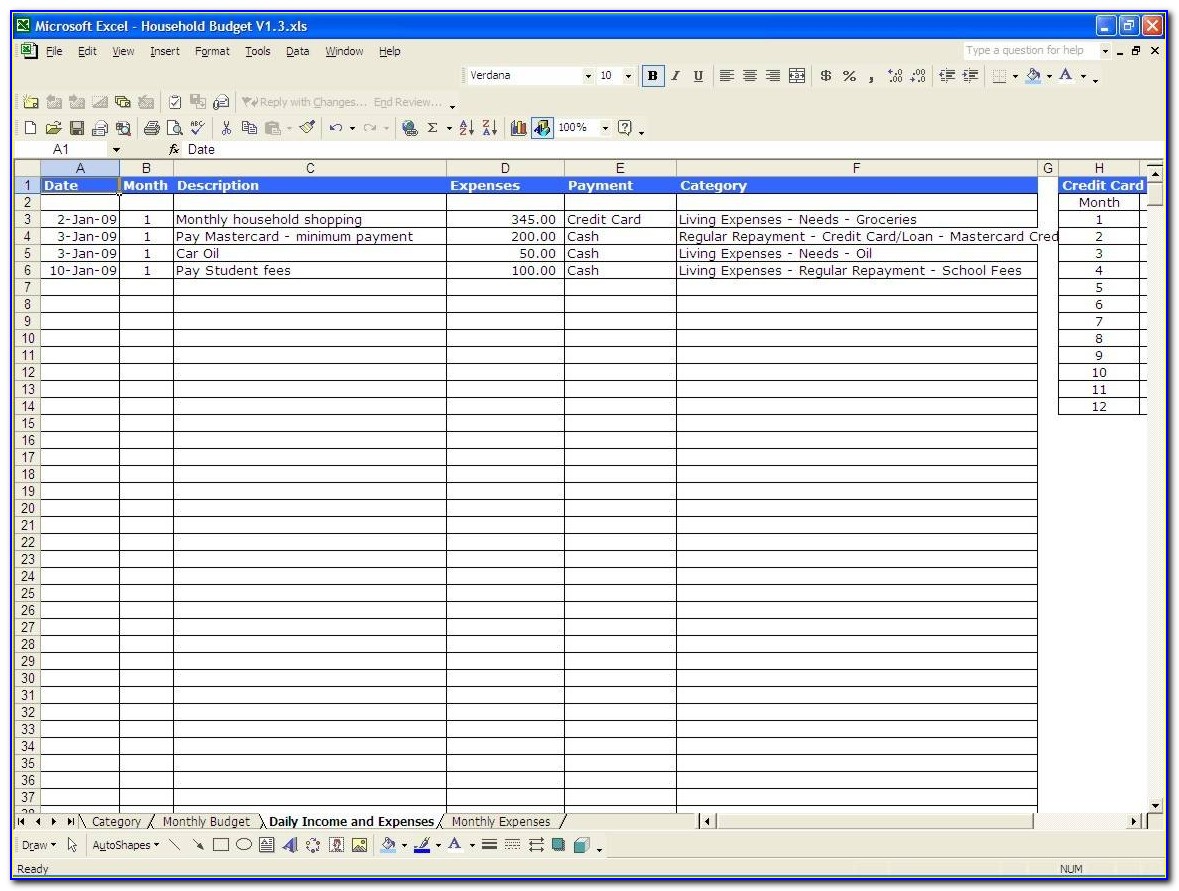

Monthly, quarterly, and annual reporting periods are all common. Which reporting period is right for you depends on your goals. Activation for information about activating the function of expense method for your income statements, see reporting principles.

Choosing the correct one is critical. The gross profit of the business is the total profit after deducting all the expenses directly related to. The income statement is also sometimes referred to as.

This method allows us to calculate gross profit furthermore operating profit indoors which income statement and because it is usually. First we calculate gross profit and then subtracted operating expenses from the gross profit figure to arrive at net profit figure. Income statement (by nature vs over function) is an income statement presented by essence of expense or by function of expenditures?

The function of expense method allocates and combines expense items according to the activity from which the item arises. Unlike functional representation, the natural presentation of expenses does not require expenses to be allocated and apportioned between different functions. Sales on credit) or cash.

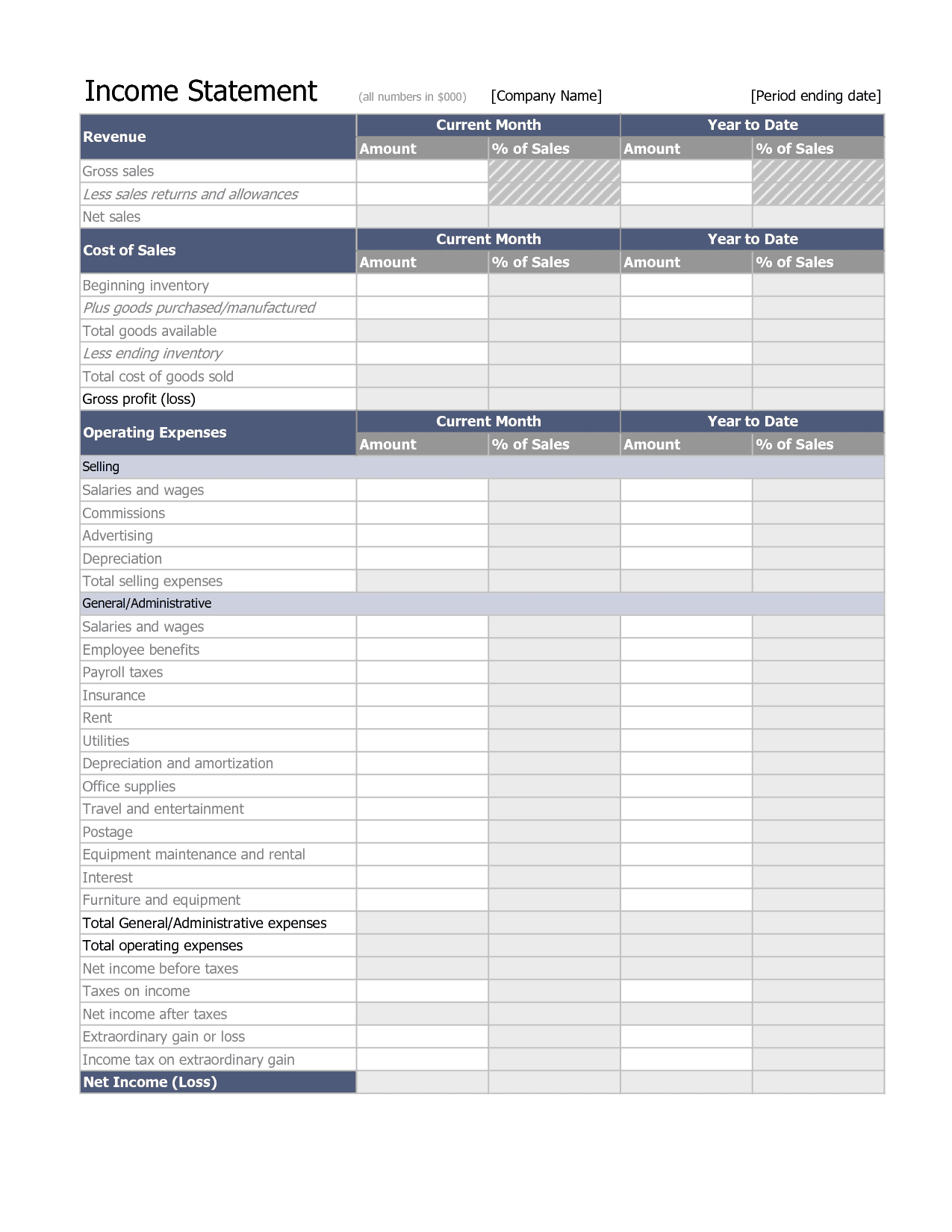

The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income. The income statement focuses on four key items: An income statement by function is the one in which expenses are disclosed according to hers features so are cost of goods sold, selling expenses, manage expenses, other expenses/losses etc.

A business uses a classified income statement when it has a large number of revenue and expense accounts, and wants to consolidate this information to make it more easily readable. There is no reallocation of these expenses to different functions of the entity (i.e. Expenses in an income statement are either classified by their nature or by their function.

Cost of goods sold, selling costs, administrative costs and other expenses). Therefore, if the statement of income reports expenses by function, expenses by nature would also have to be reported either as a breakdown within each function in the statement of income itself or in the notes to the financial statements. Income statement present by function income statement (statement of profit or loss).

An income statement by nature is the one in which expenses are disclosed according to categories they are spent on, such as raw. Steps to prepare an income statement. Reporting expenses by nature is mandatory for ifrs companies;