Out Of This World Info About Depreciation In Statement Of Profit And Loss

The value of depreciation is deducted from assets value, the result gives us the netbook.

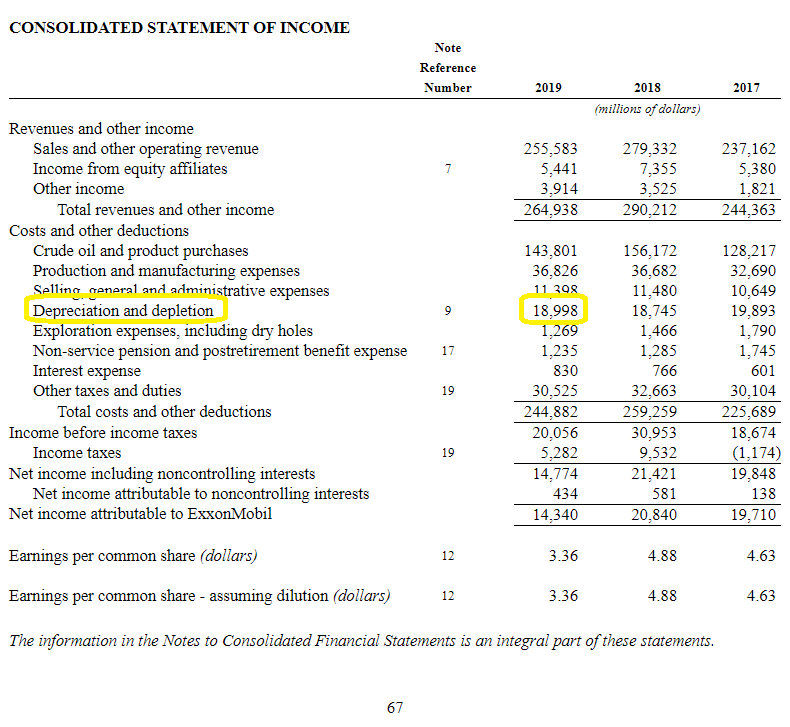

Depreciation in statement of profit and loss. Corporate finance accounting are depreciation and amortization included in gross profit? The balance in depreciation expense account is transferred to the profit and loss account at the end of the year. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts.

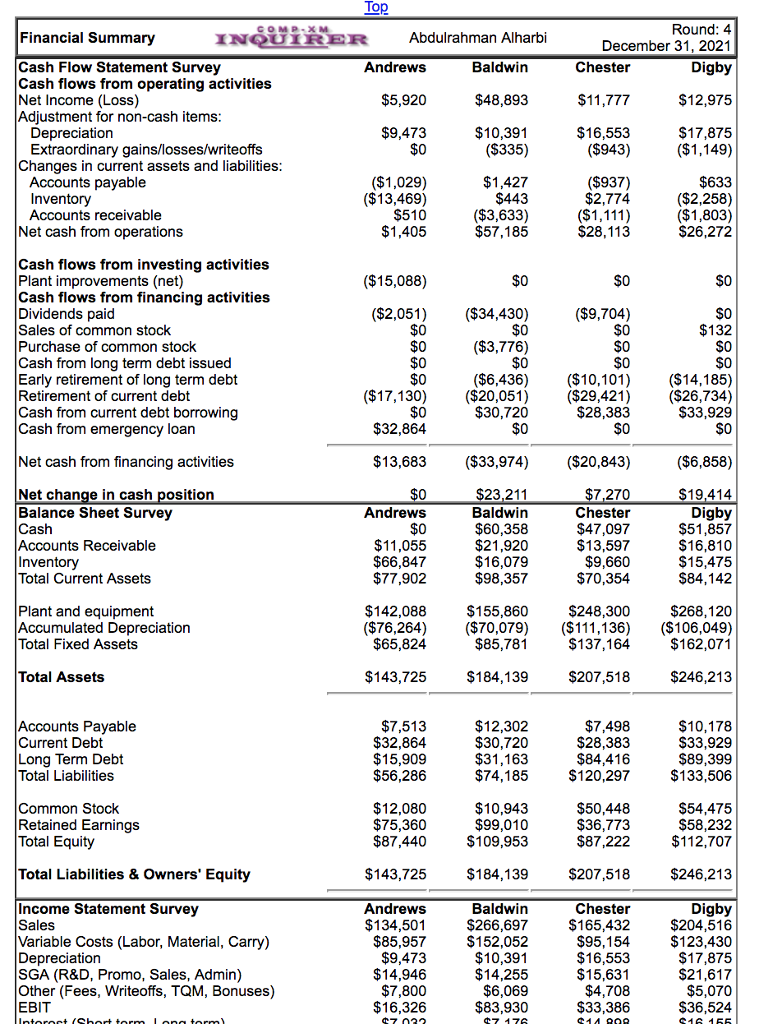

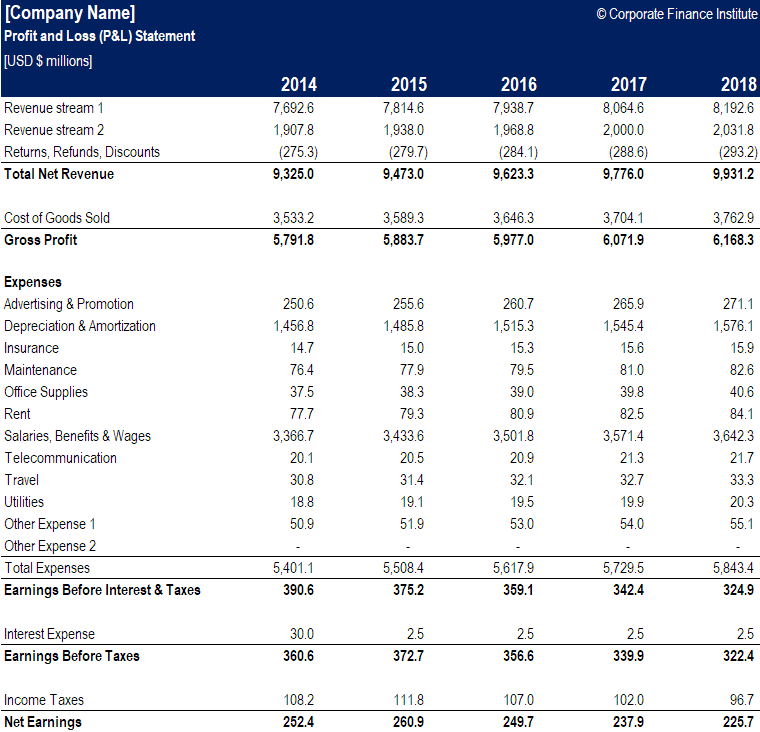

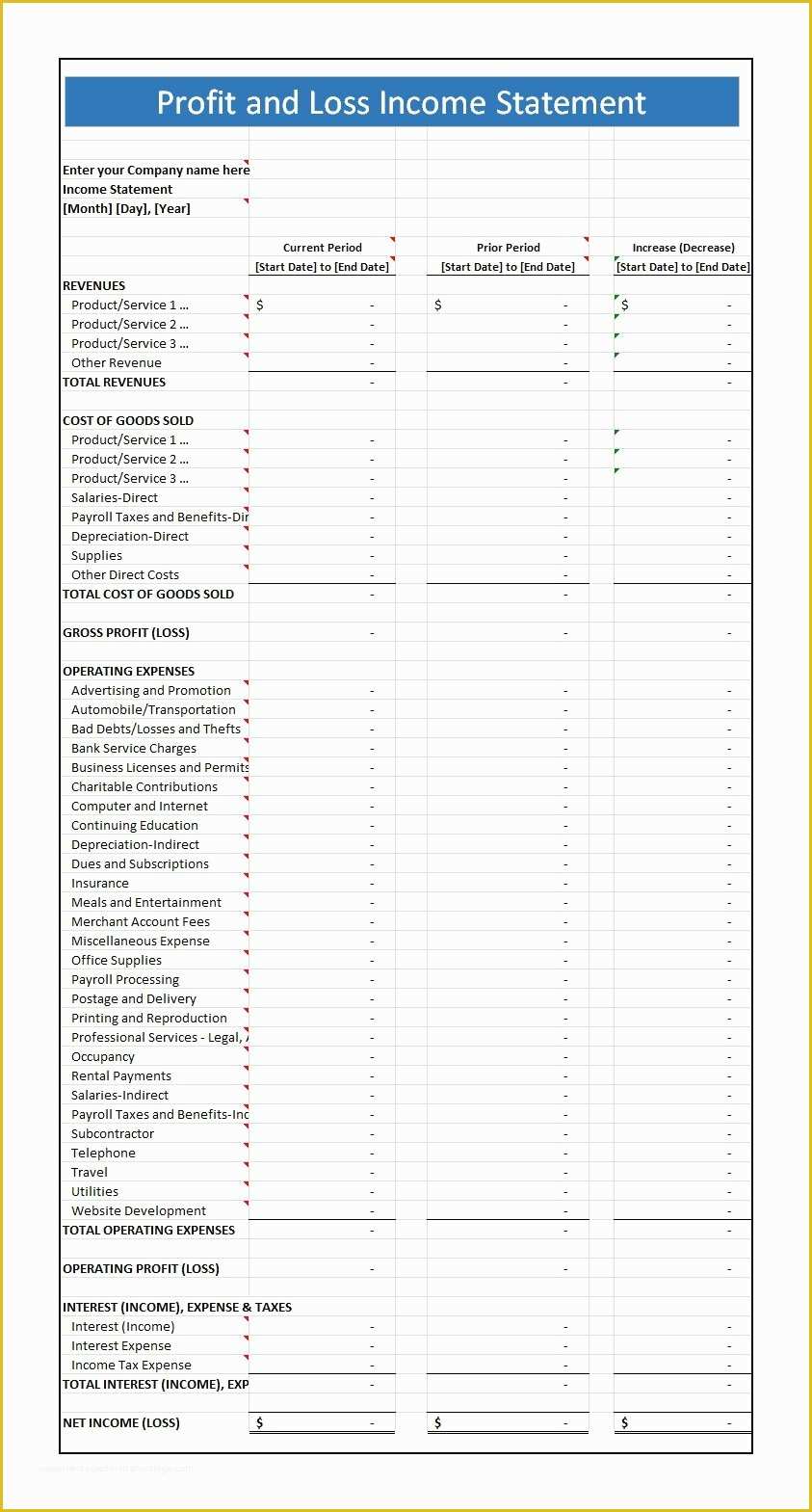

For example, elaborate p&l statements can benefit companies looking to cut their general expenses, like amortization and depreciation costs, when they conduct a profit and. The other two are the balance sheet and the cash. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a.

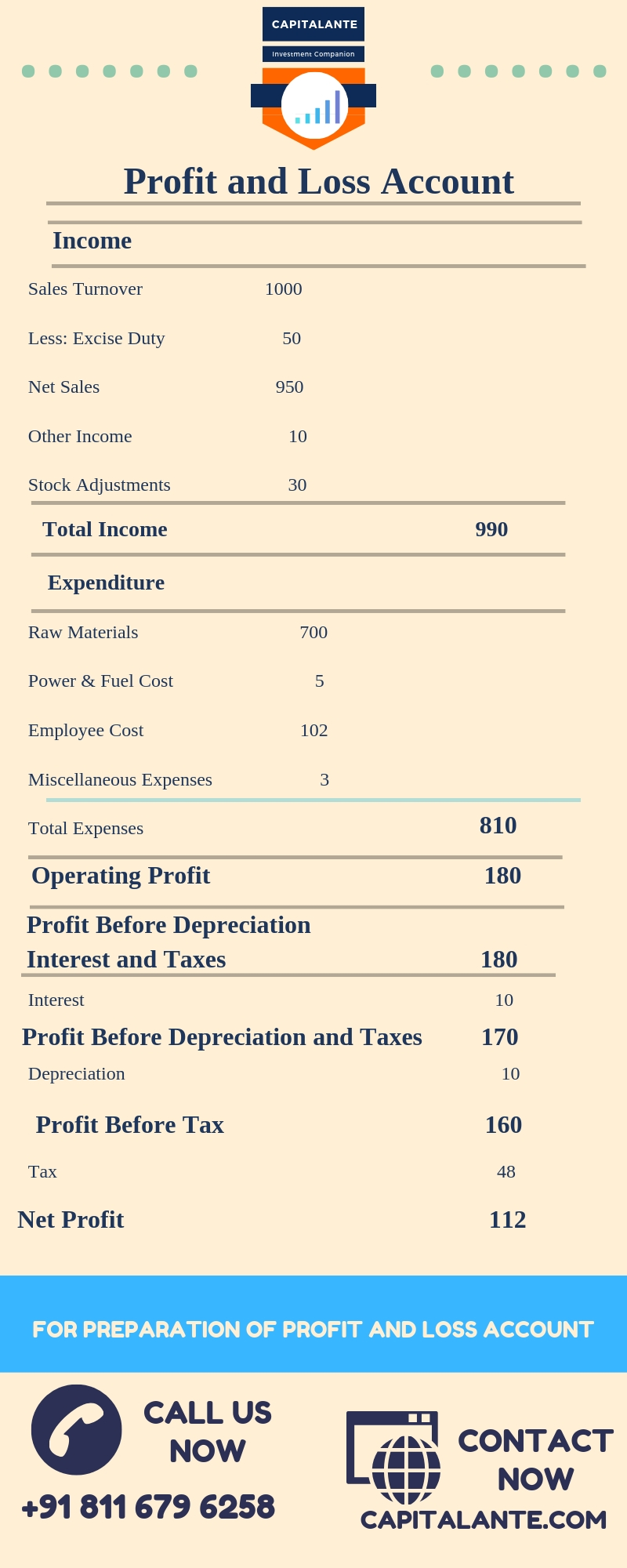

The $39,000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. More advanced profit and loss statements also include. Depreciation is an accounting concept that applies to a business’ fixed assets, such as buildings, furniture and equipment.

What is depreciation on an income statement? Depreciation is an amount that reflects the loss in value of a company's fixed asset. Entry 4 the balance of the provision for.

It is accounted for when companies record the loss in value of their fixed assets through depreciation. Murphy updated july 23, 2021 reviewed by margaret james. Depreciation expenseis an income statement item.

Physical assets, such as machines, equipment, or vehicles, degrade over time and reduce in value incrementally. Revenue, expenses, and net income. A profit and loss statement contains three basic elements:

That number needs to be listed on your profit and loss statement, and subtracted. Explain what basic condition are to. It is identical to profit/loss for the period attributable to equity owners of the parent as defined by ifrs rules.

Profit is simply all of a company's sales revenue and any other gains minus its expenses and any losses. In depreciation, assets are depreciated to show the true or original value of assets. Explain its effect on profit and loss account as well as balance sheet.

Depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of. The depreciation term is found on both the income statement and the balance sheet.on the income statement, it is listed as depreciation expense, and refers. A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies.

Elucidate the factors that affect depreciation. It spreads the cost of the fixed asset. A $3,000 depreciation expense, then, has the effect of.

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)