Who Else Wants Tips About Treatment Of Prepaid Expenses In Profit And Loss Account

Expenses in the profit and loss account should represent the total benefit derived from the service.

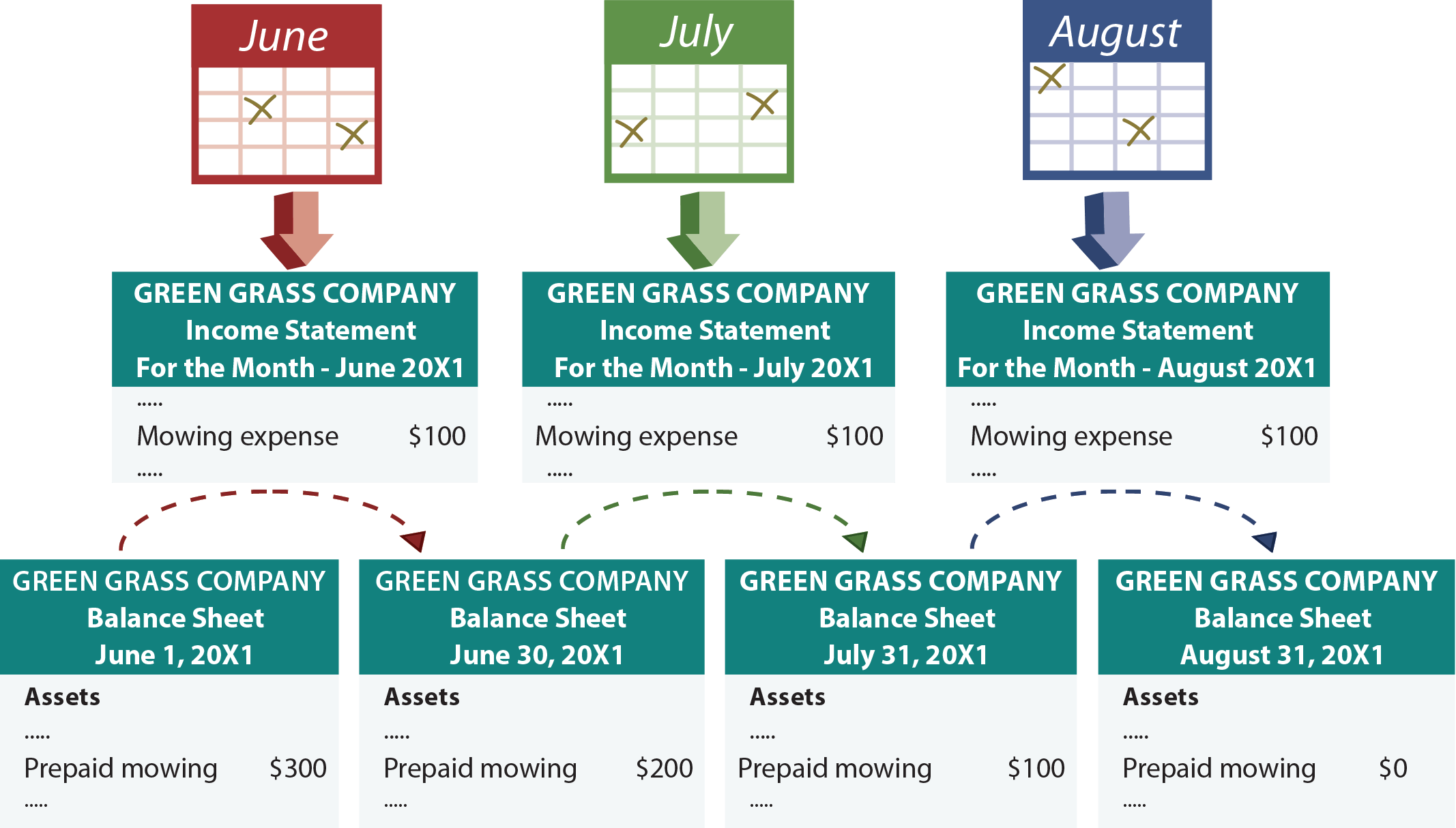

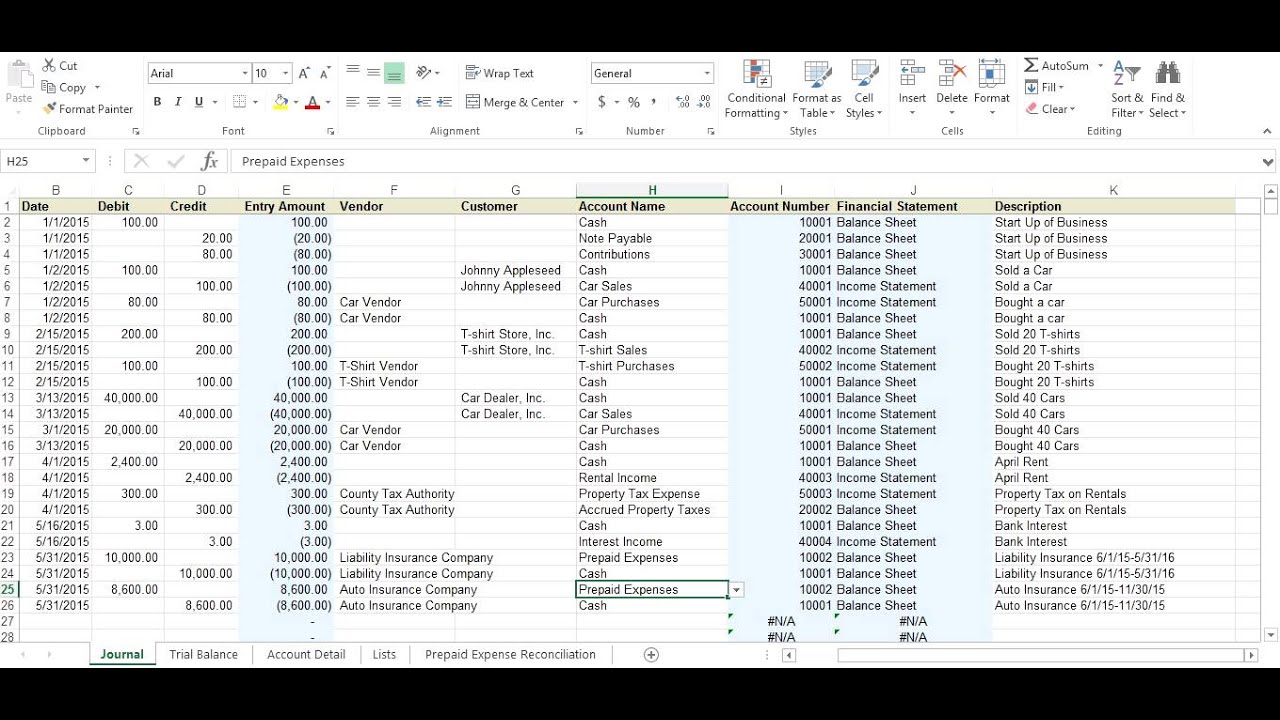

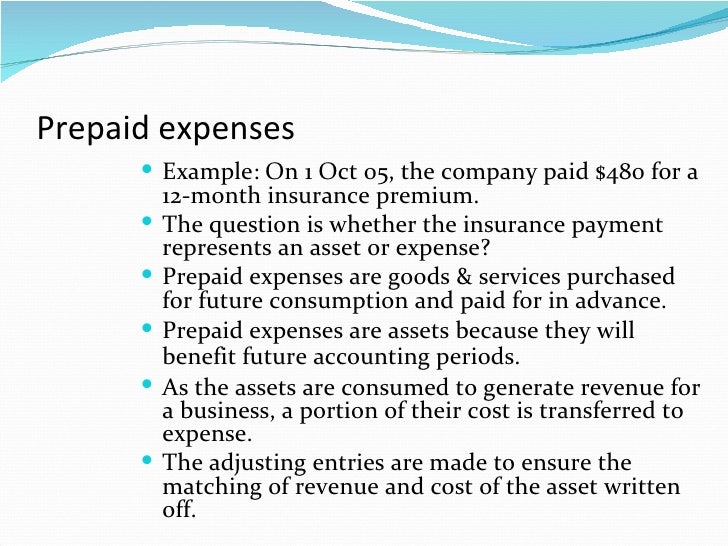

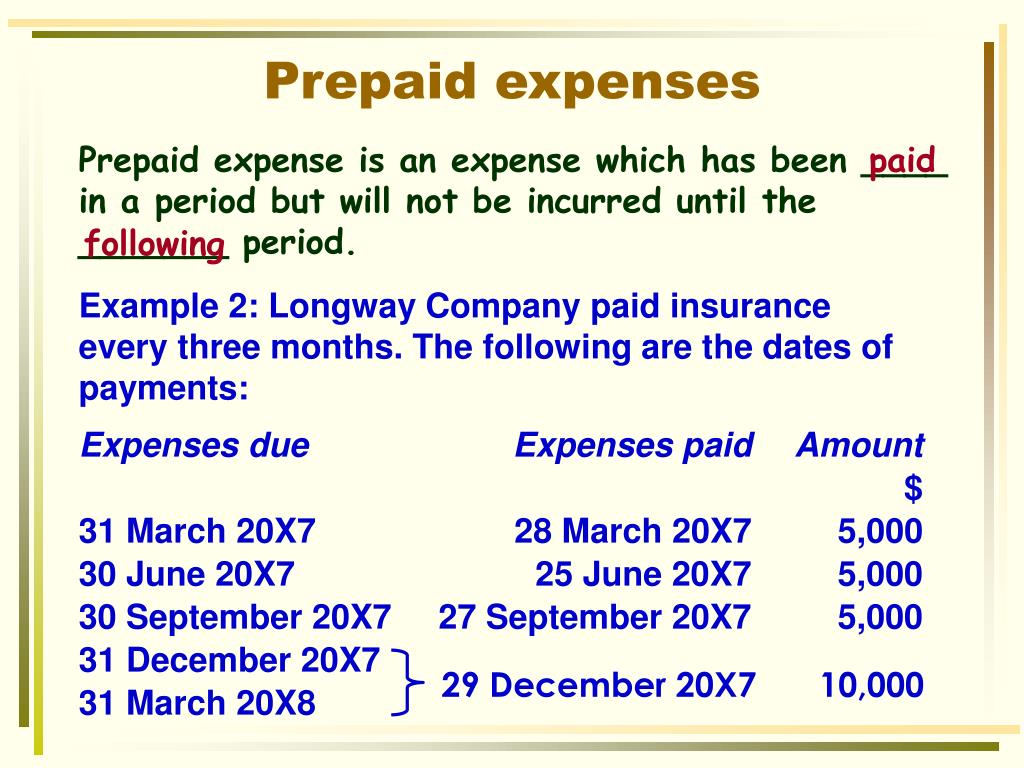

Treatment of prepaid expenses in profit and loss account. Payments payments may be made towards the current period expenditure or for clearing the dues. Prepaid expenses refer to those expenses which are paid in advance by the firm but the benefit of which are availed in the next accounting period. Prepaid expense a company prepaying for an expense is to be recorded as a prepaid asset on the balance sheet and is termed as ‘prepaid expense’.

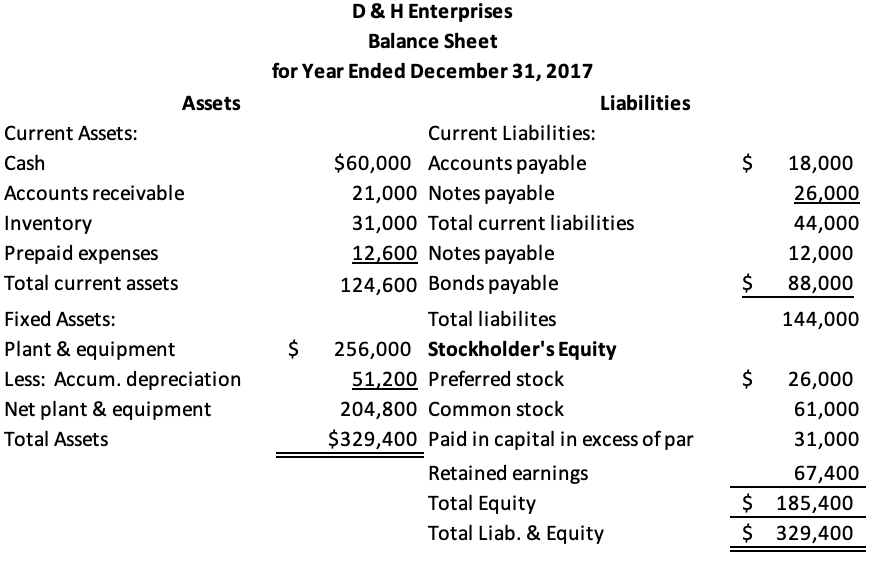

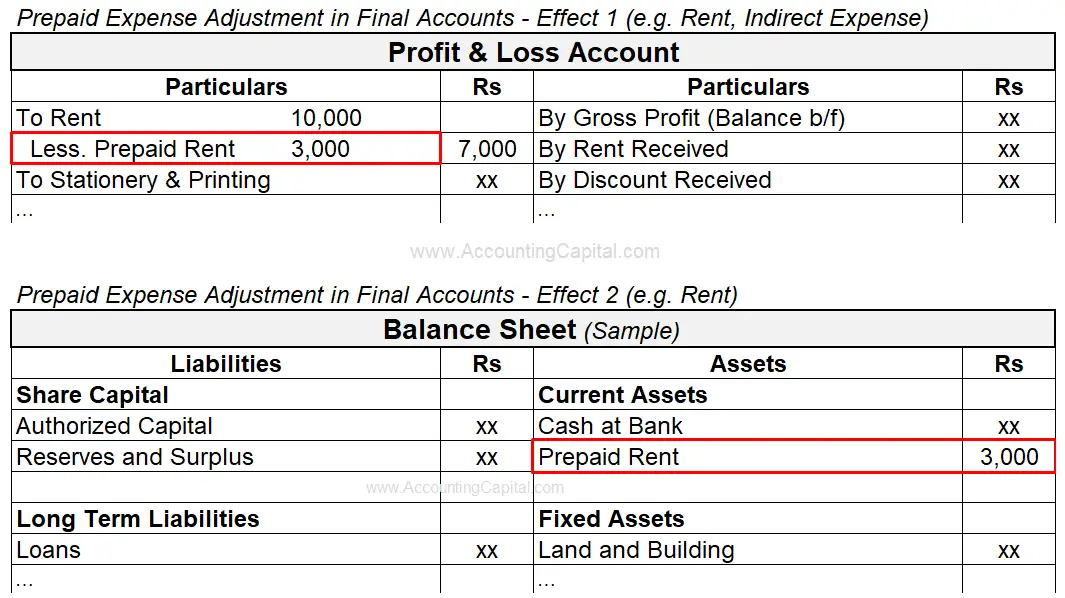

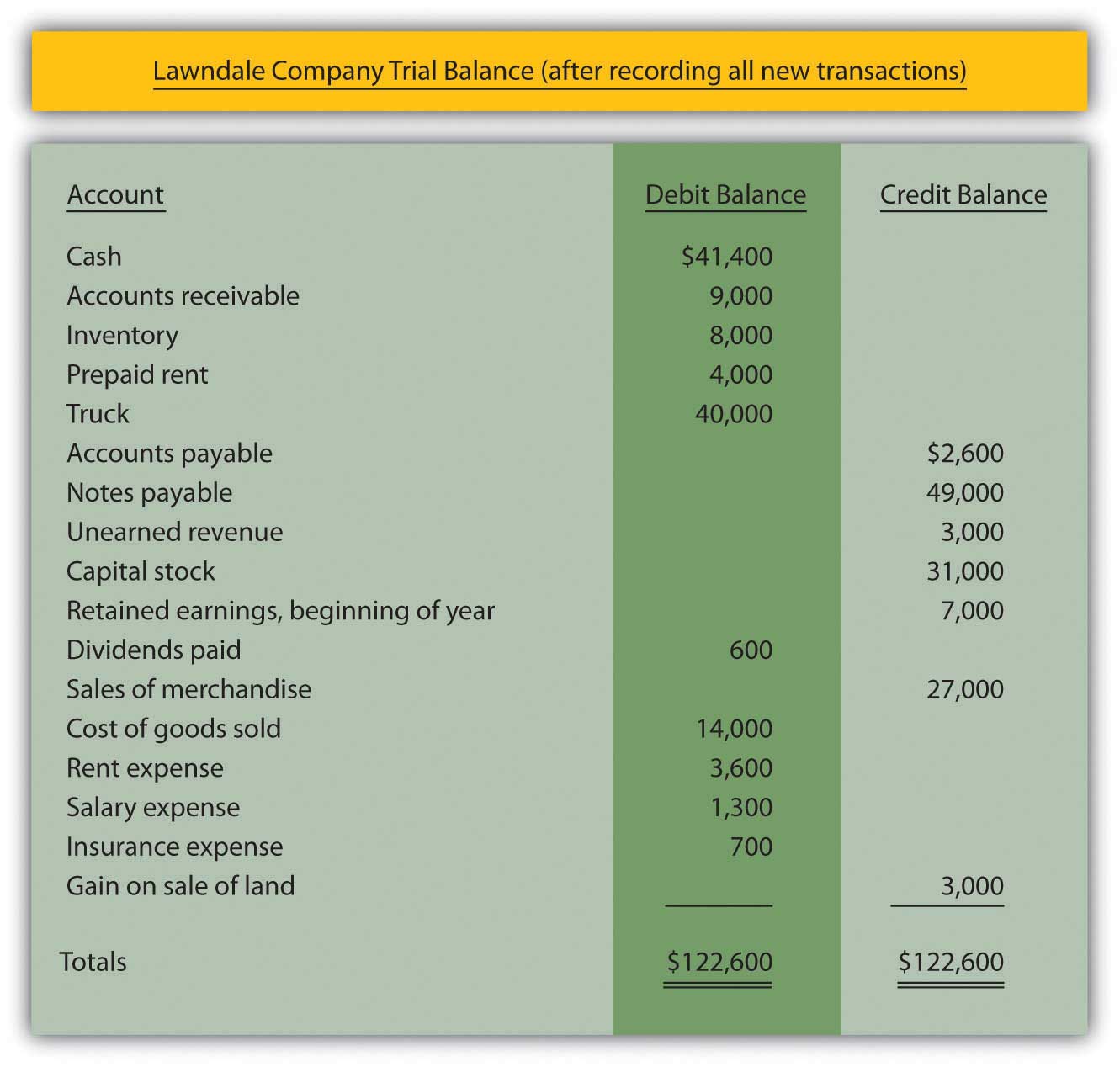

The prepaid expense is shown on the assets side of the balance sheet under the head “current assets”. Types of adjusting entries are outstanding expenses, prepaid expenses, accrued income, unearned income, inventory. Key takeaways prepaid expenses are incurred for assets that will be received at a later time.

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Amounts paid towards the dues are considered to be payment for clearing the. The various prepayment expenses disbursed by a firm.

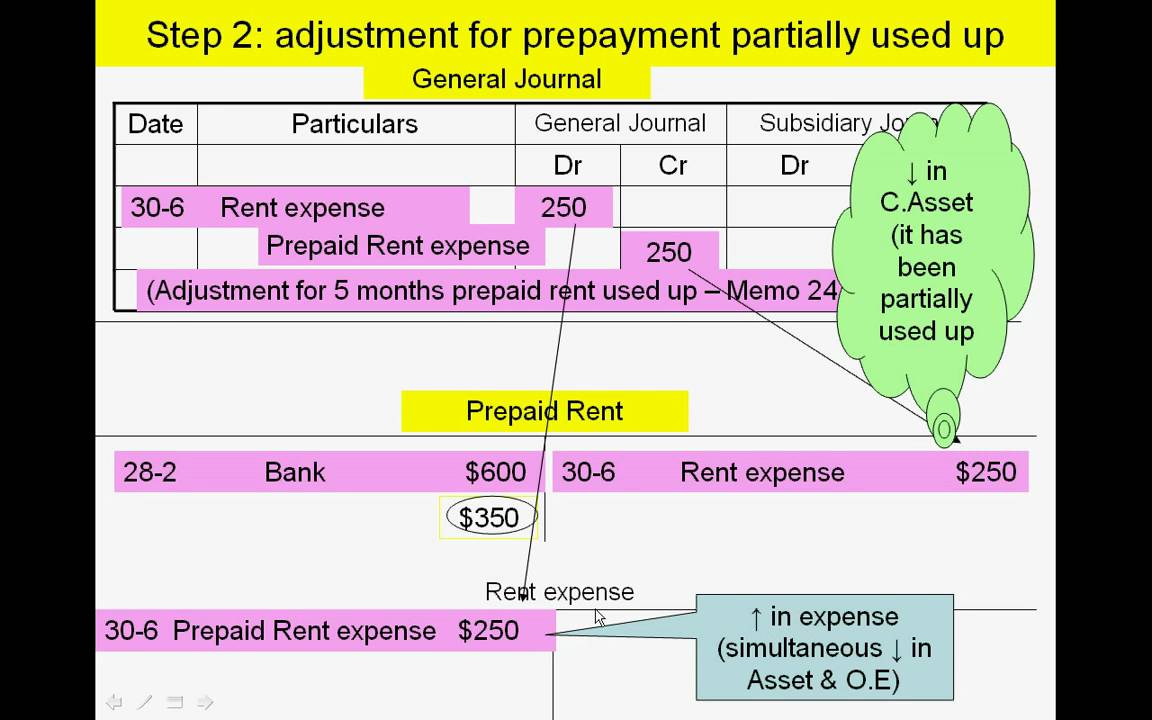

Dr prepayment (balance sheet asset) cr expenses (profit & loss account) mar 04 2014 12:57 am. Prepayments are current assets if they pertain to a. As the benefits of the expenses are recognized, the.

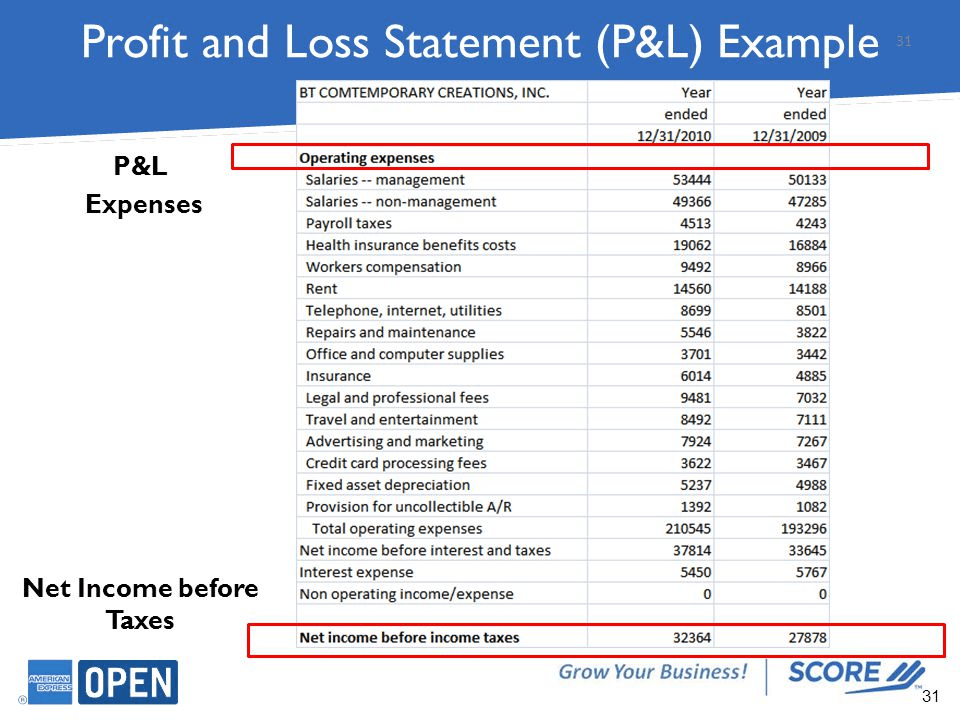

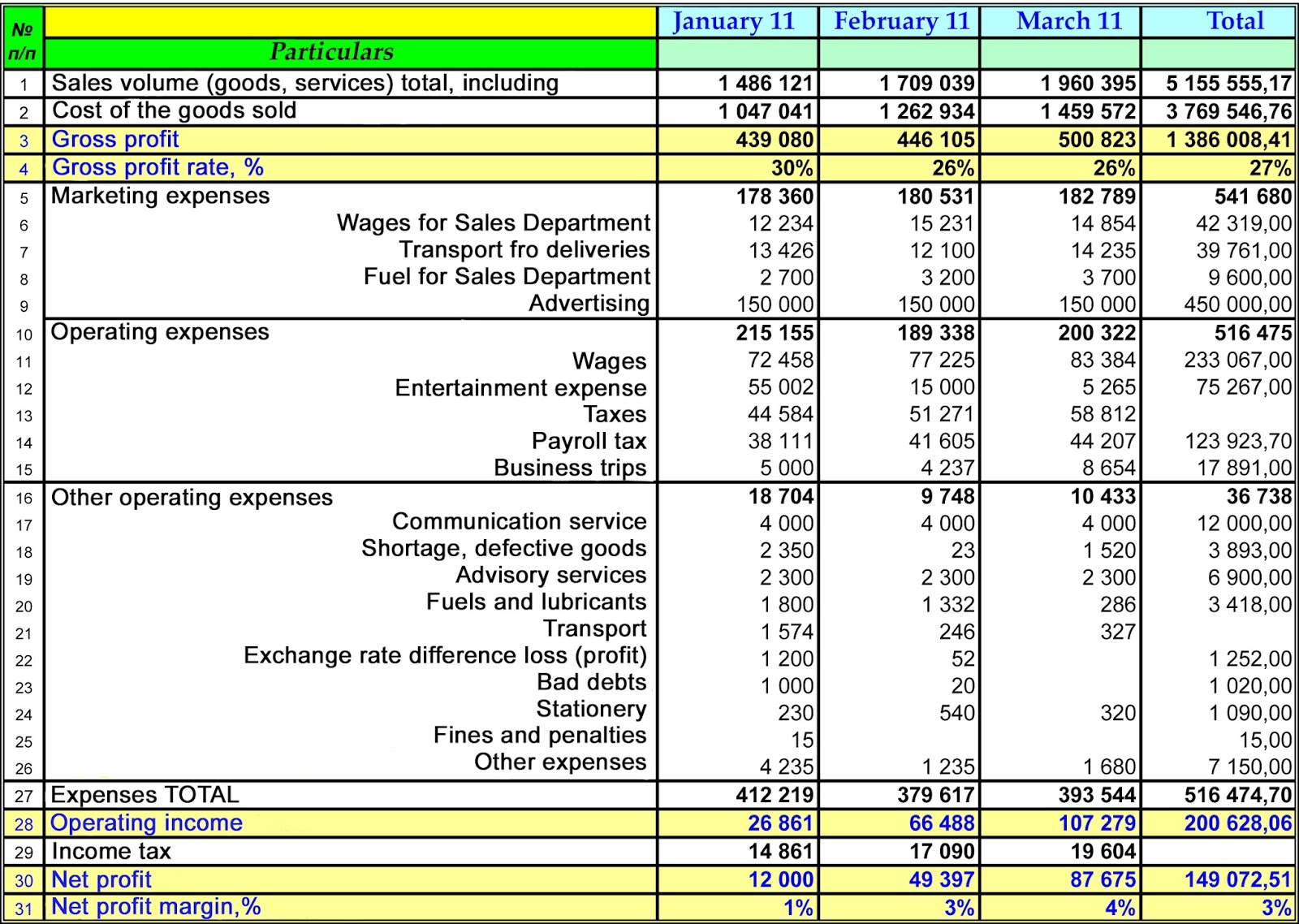

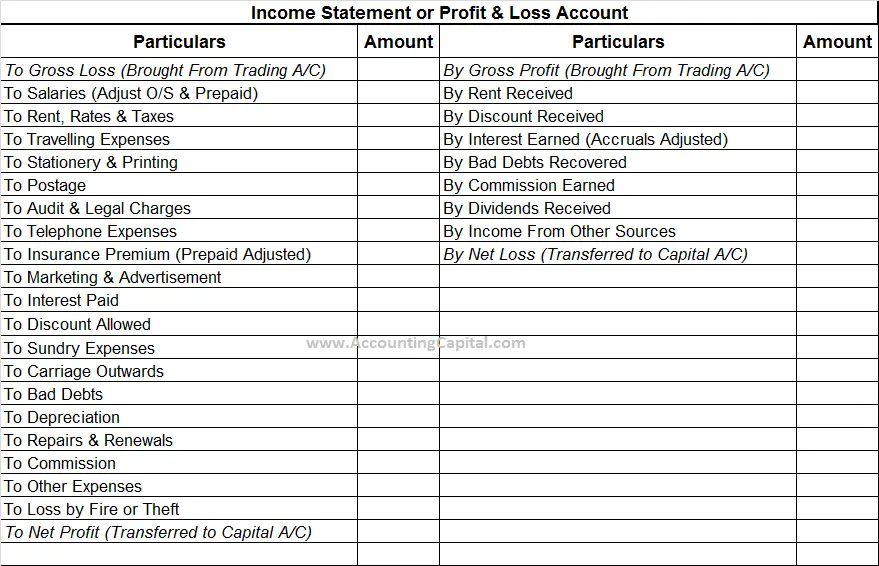

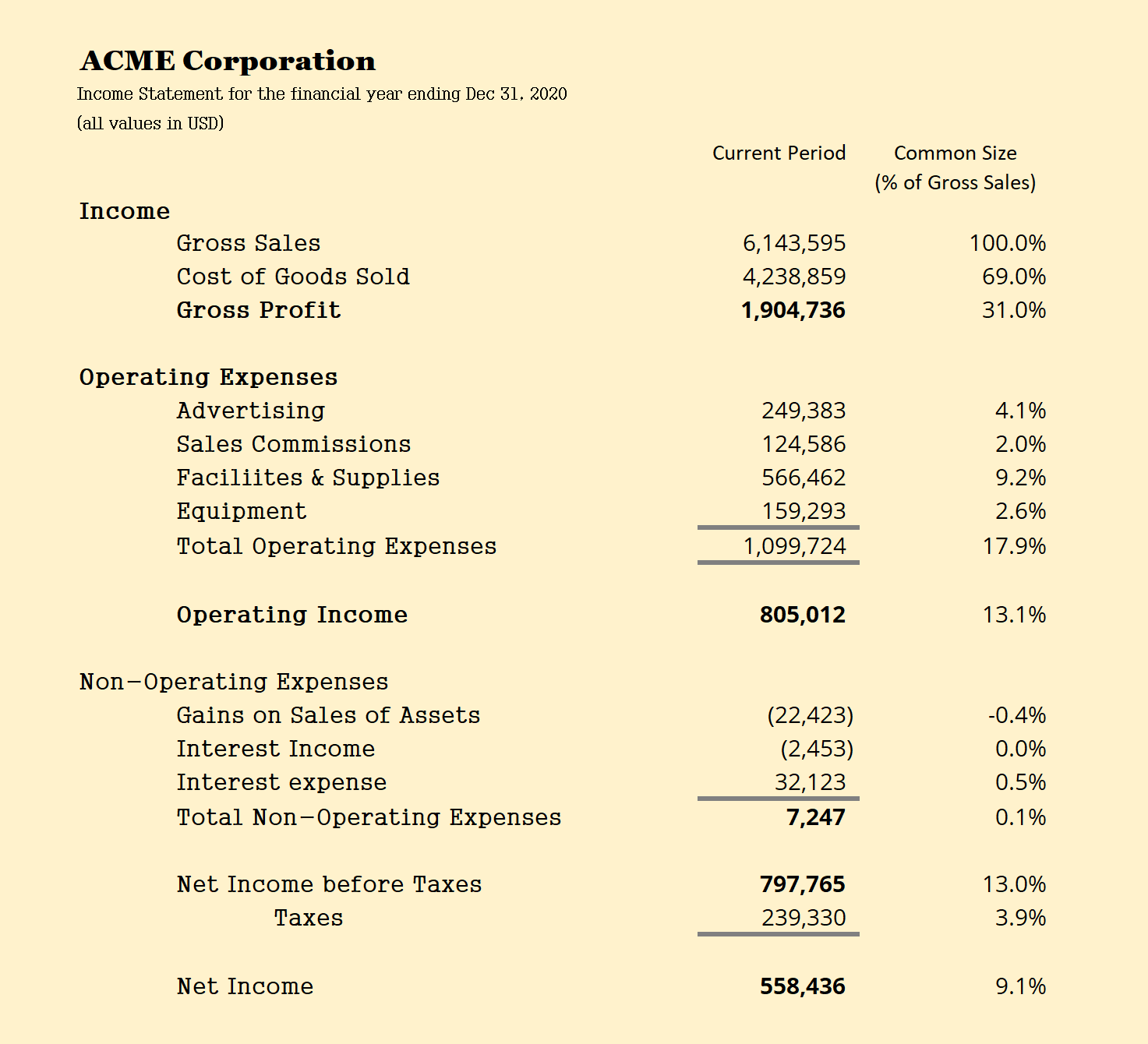

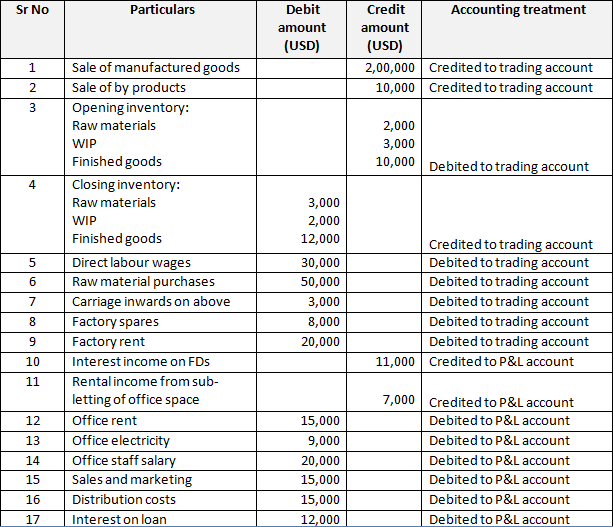

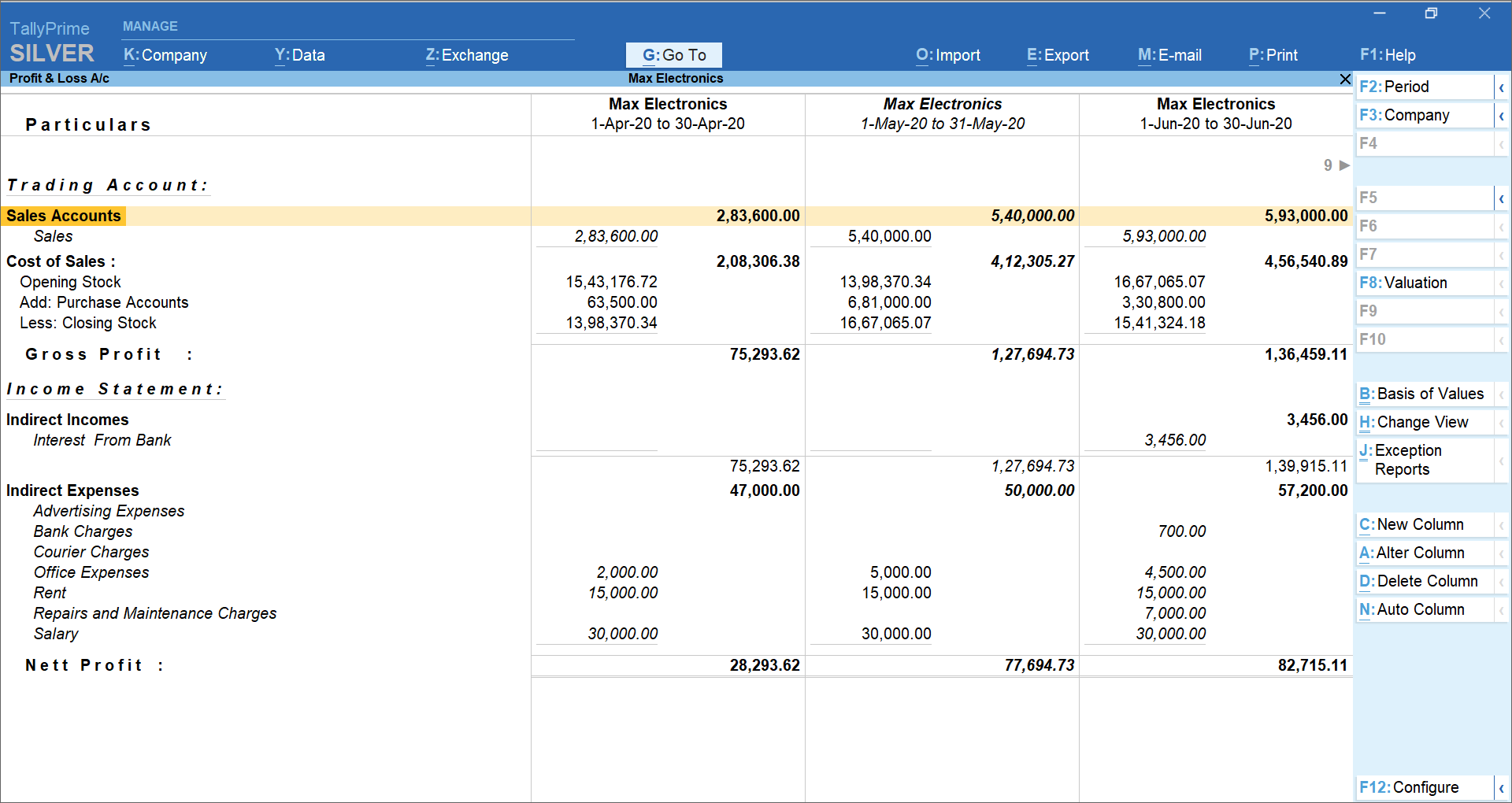

What are direct and indirect expenses? The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a. Full year 2023 financial results.

The accounting treatment is similar to that for. A prepaid expense is an amount paid in advance for the goods or benefits that are to be received in the upcoming period. Upon the initial recordation of a supplier invoice in the accounting system, verify that the item.

Prepaid expenses are first recorded in the prepaid asset. Treatment of prepaid expenses in final accounts (or) financial statements. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a.

The prepaid portion of the expense (unexpired) is reduced from the total expense in the profit & loss account. Adjustment of prepaid expenses or unexpired expenses adjustment of accrued income or outstanding income adjustment of income received in advance adjustment of. What is the profit and loss statement (p&l)?

How to show prepaid expense inside trial balance? In this article, we will learn about adjusting. Can you share a list of direct and indirect expenses?.

The interest expense generally accrues over a period of time and it is irrespective of company’s operational productivity during a given period of. Adjusted ebitda loss in the fourth quarter of 2023 was $8.4 million compared to $9.8 million for the same period in 2022.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)