Can’t-Miss Takeaways Of Tips About Provision For Doubtful Debts Account

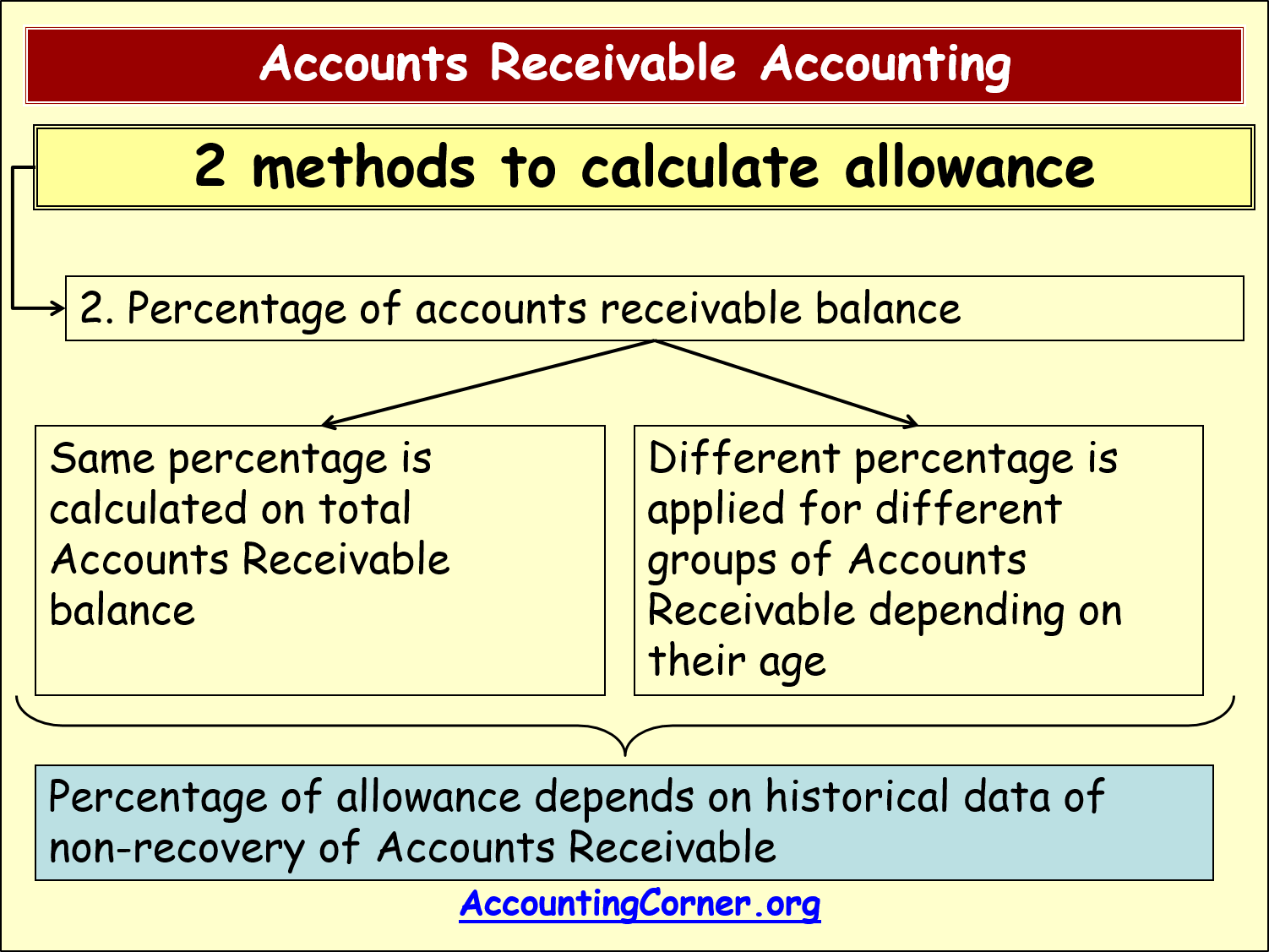

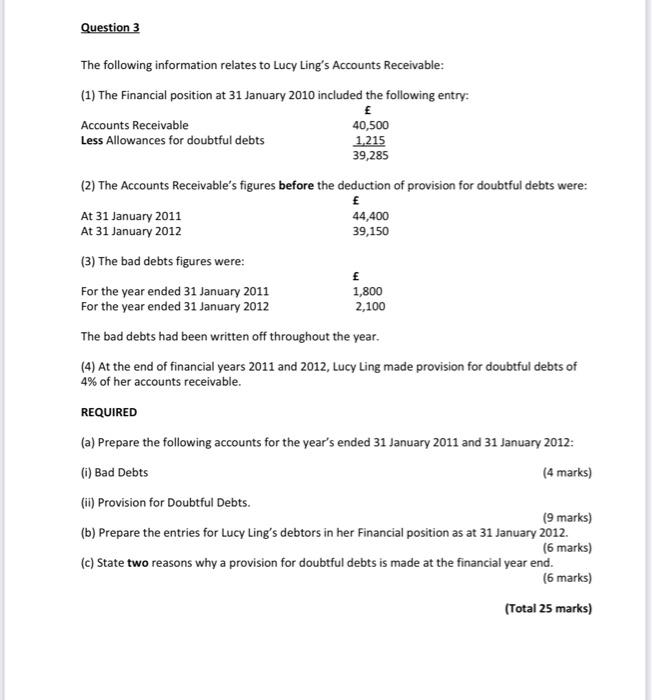

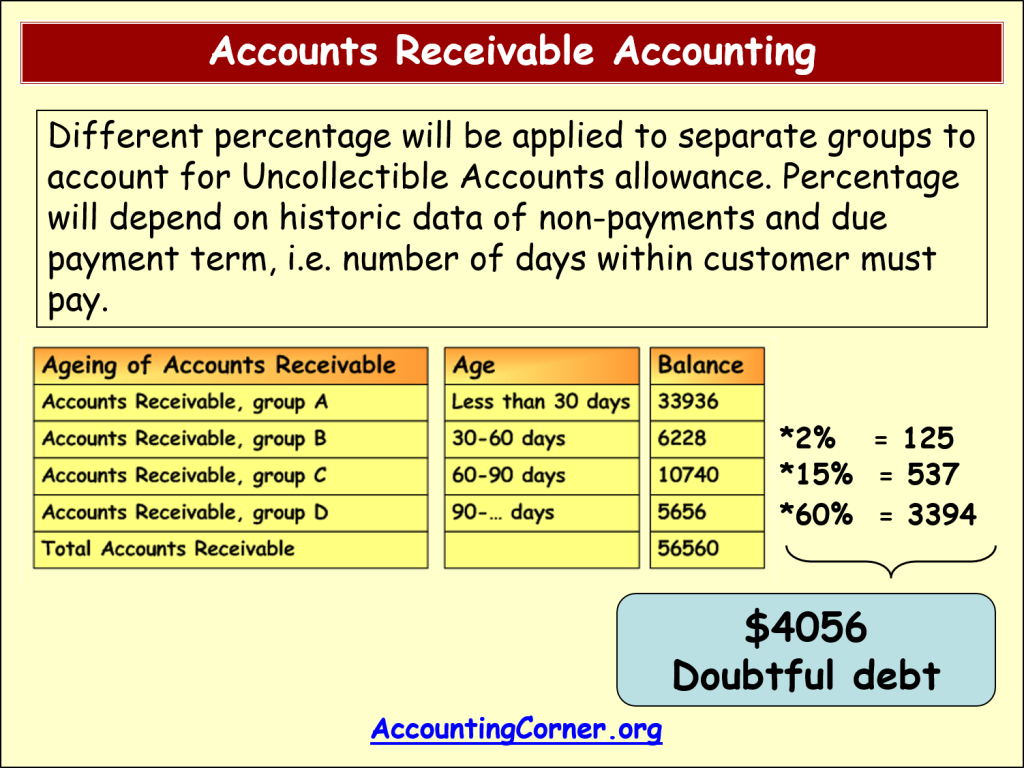

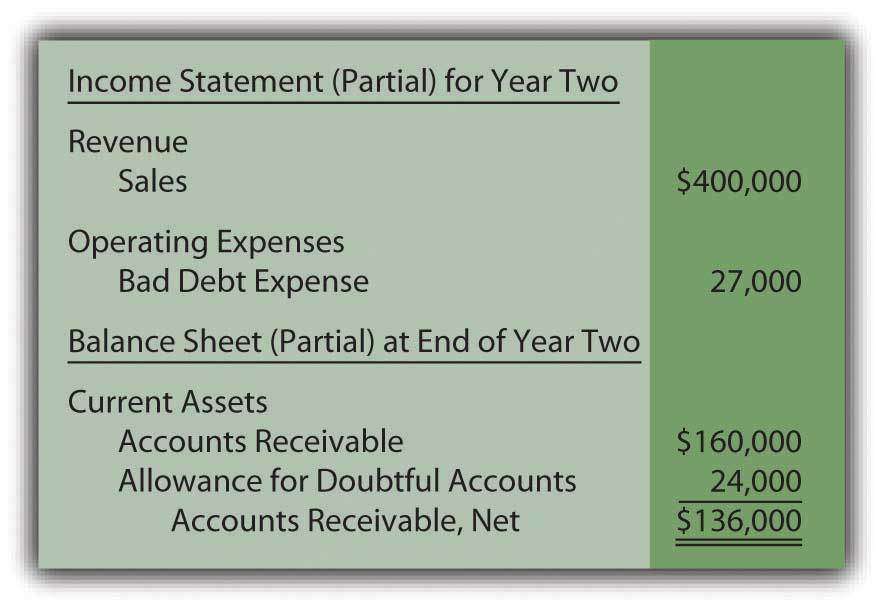

This estimate is called the bad debt provision or bad debt allowance and is recorded in a contra asset account to the balance sheet called the allowance for credit.

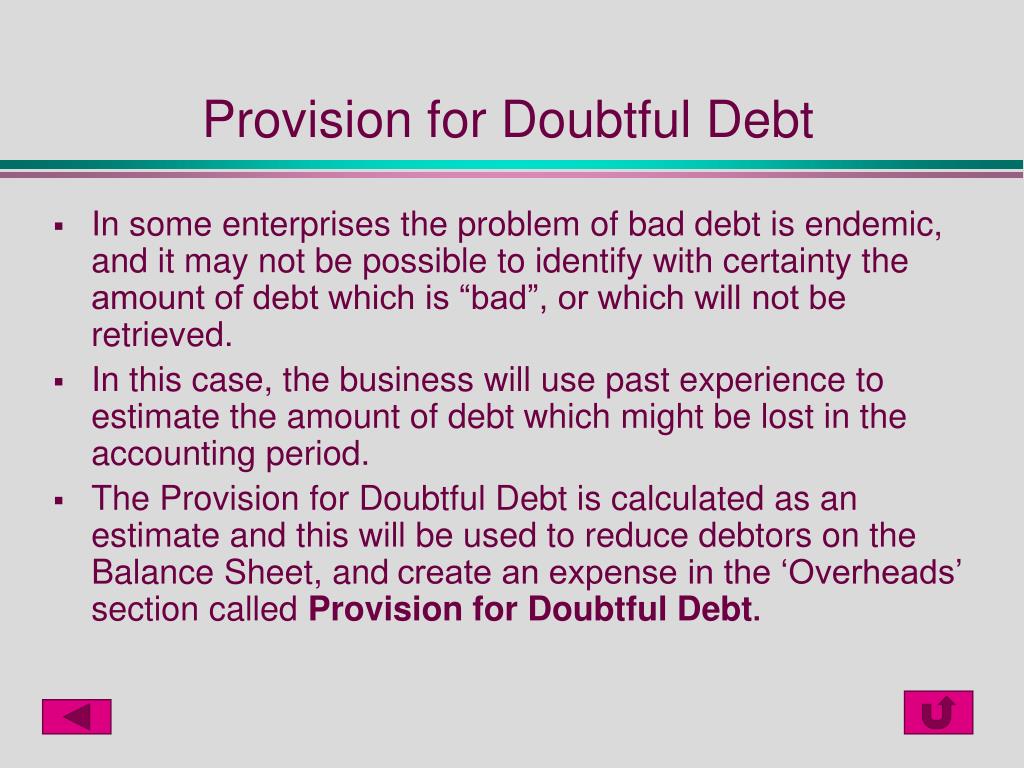

Provision for doubtful debts account. The following guidance does not apply to bad money debts of companies which are dealt. Adjustment of provision for bad and doubtful debts in final accounts (financial statements) read. Recoverability of some receivables may be doubtful although not definitely irrecoverable.

A provision for doubtful debts is the estimated amount of bad. At the same time, the credit to the provision. Learn how to account for doubtful debts in accounting, a process of estimating and writing off the receivables that are expected to default.

A doubtful debt is an account receivable that might become a bad debt at some point in the future. Provision for doubtful debts: See the accounting entry, balance sheet.

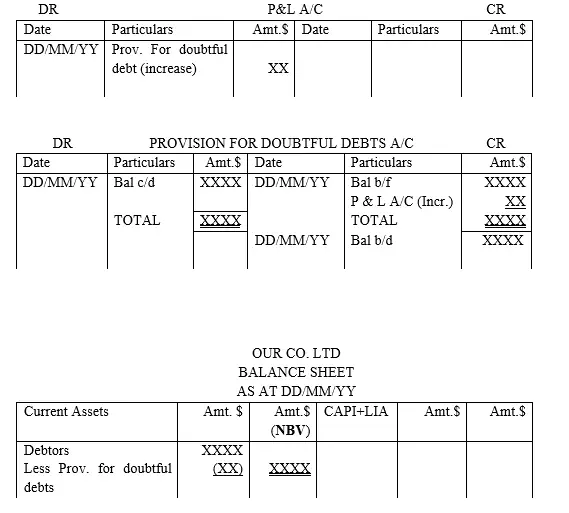

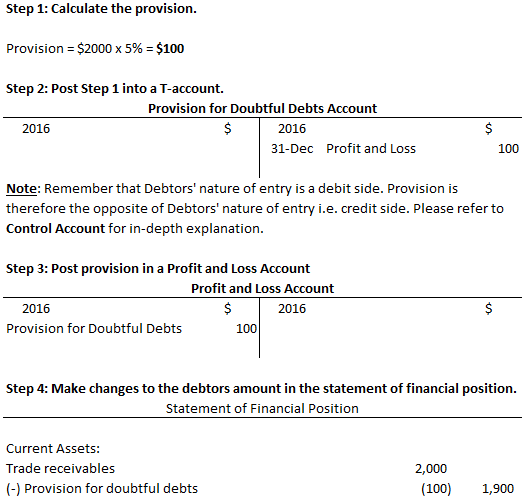

Provision for doubtful debts, on the one hand, is shown on the debit side of the profit and loss account, and on the other hand, is also shown as a deduction from debtors on the. The following journal entry is made to record a reduction in provisions for bad or doubtful debts: 3) decrease in provision of doubtful debts.

A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in. 1) increase in provision of doubtful debts. Accounting for doubtful debts.

The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for. How to calculate bad debt provision under ifrs 9 by silvia financial instruments 256 last update: The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt expense account.

Learn how to create, increase, decrease and recover a provision for doubtful debts account in double entry accounting. You may not even be able to specifically identify which open. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been.

The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the. 2) no change in provision of doubtful debts. Provision is created out of profits of the current.

If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an. Provision for bad debts account cr: The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of.

The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. 2023 if you have a large portfolio of trade receivables, then you face the same.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)