Sensational Tips About 12ba Form Income Tax

Form 12b is an income tax form that must be submitted as per the guidelines of rule 26a.

12ba form income tax. Do you know the details of the perks and allowances your. Go to gateway of tally >. The cbdt has amended form no.

Form 12ba is to be issued only when the salary paid or payable to the employee exceeds rs 1,50,000. Cbdt revises form no. Meaning, format, importance, and applicability have you received perks from your employer?

The employer is required to issue form 12ba along with form 16. Both form 12b and 12ba come under the same master circular of rule 26. View plans form 12ba:

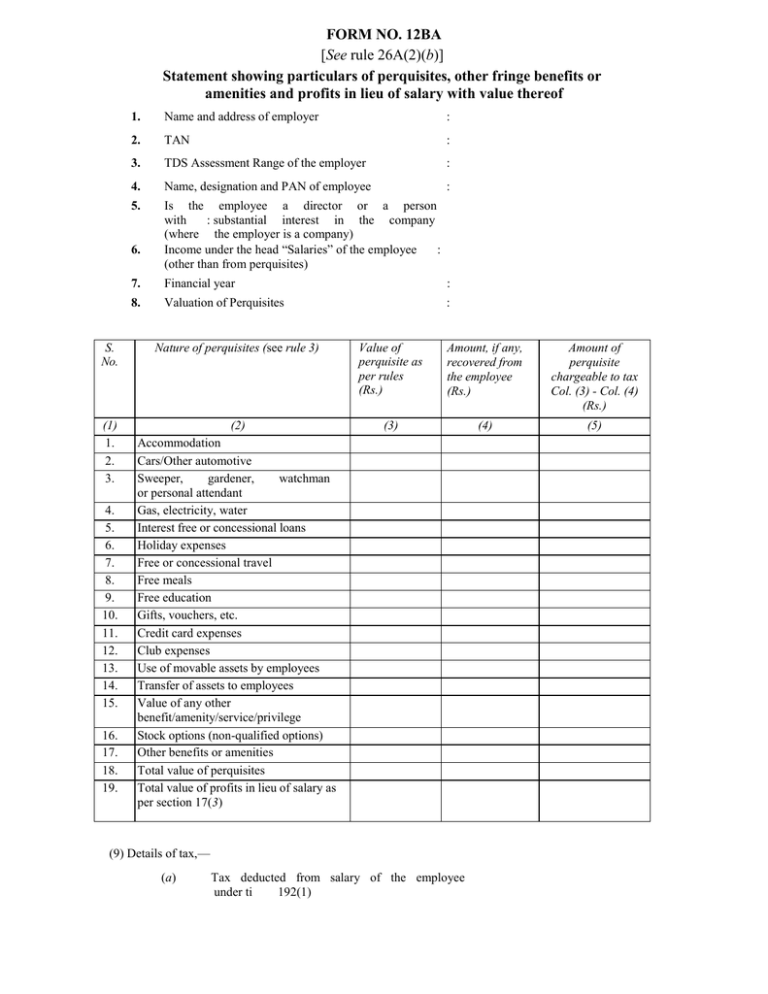

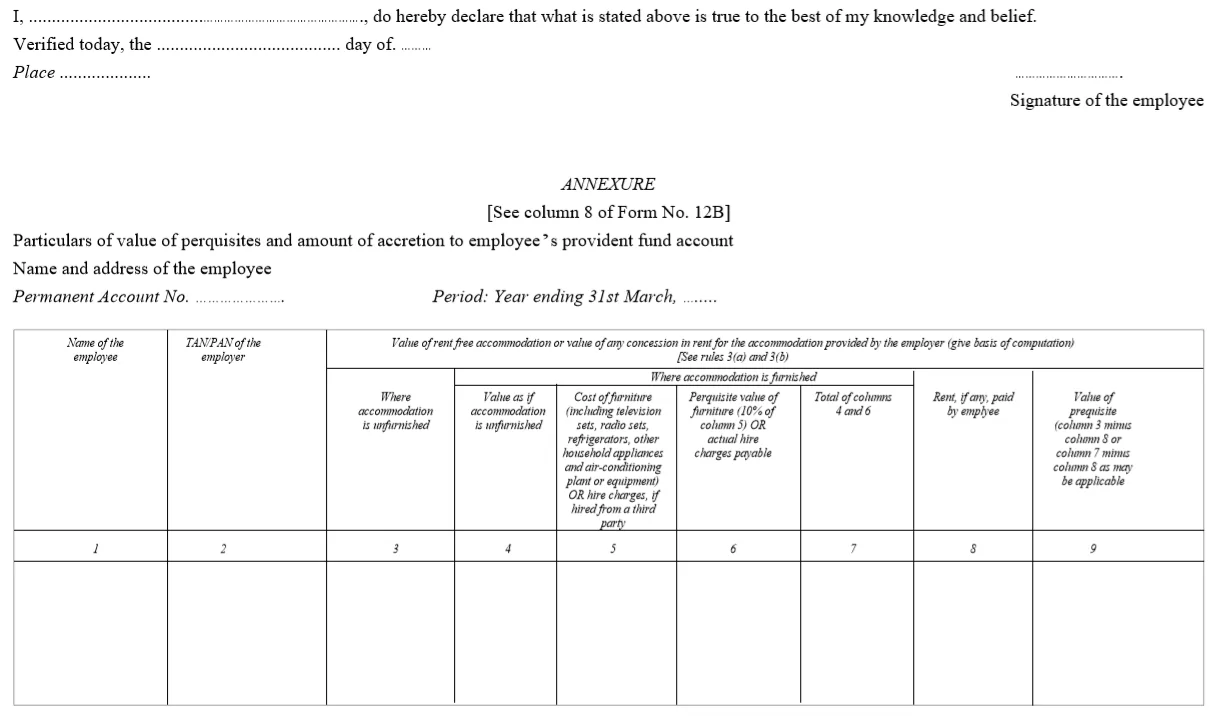

It is submitted by employees who move from one company to. According to rule 26a, an individual who joins a new organization or corporation in the middle of the year must submit form 12b, an income tax form. Form 12ba is the statement displaying the particulars of perquisites, other benefits or amenities and profits in lieu of salary with value thereof.

Gateway of tally > display. Form 12ba is a statement which needs to be issued by the employer to the employee if the amount of salary paid or payable to the employee is more than one lakh. 12ba (statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value.

12ba [see rule 26a(2)(b)] statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof name and. For form 12ba, you can. Home / income tax / form 12ba form 12ba form 12ba is a statement that details regarding the perquisites and other fringe benefits along with profits in lieu of an.

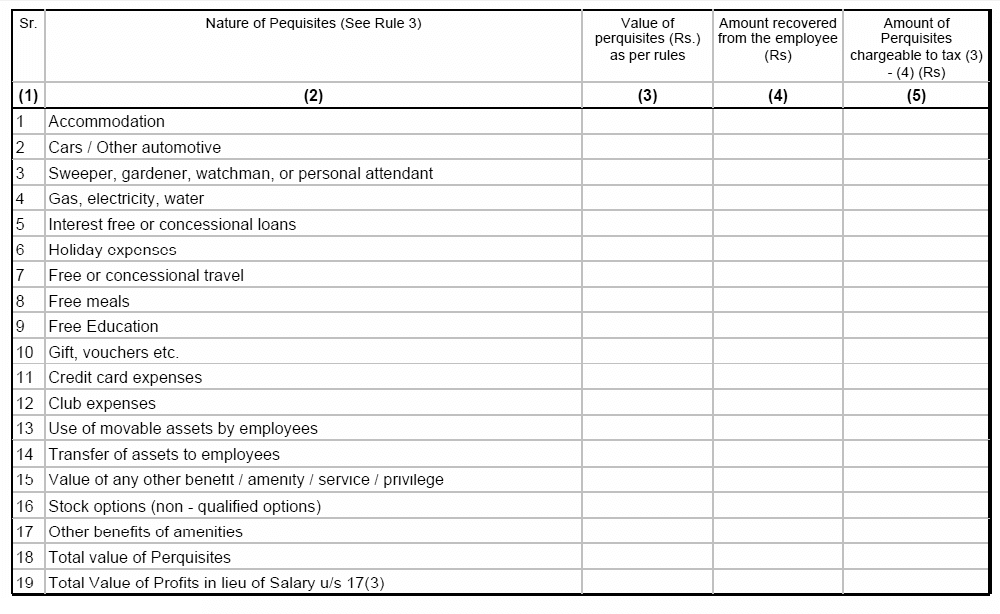

Form 12ba is the statement displaying the particulars of perquisites, other benefits or amenities and profits in lieu of salary with value thereof. Form 12ba is a detailed statement showing particulars of perquisites, other fringe benefits, and profits in place of salary. 12ba (statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof), part b.

Form 12ba is an income tax statement which gives all the details of the perquisites, amenities and other fringe benefits provided by the employer, and profits in. Form 12b is a document that contains information about the income and tax deducted from the previous employer. The value of the aforementioned payments and the.

If salary does not exceed rs 1,50,000, details of perquisites which already forms part of ‘part b’ of form 16 itself would suffice and there is no requirement of separate statement in the form of ‘form 12ba’. It is mandatory for employees who have changed. Form 12ba is required to be issued only.