Perfect Tips About Interest Revenue Financial Statement

They state that ifrs 7.b5 (e) requires an entity to disclose whether net gains or net losses on financial instruments measured at fvpl include interest or dividend.

Interest revenue financial statement. Earnings before interest & taxes (ebit) is an indicator of a company's profitability, calculated as revenue minus. Address financing gaps for medicare and social security, both of which are supported by trust funds that will be depleted within 10 years. To determine the appropriate interest income recognition model, a reporting entity must first consider the nature of the financial instrument, any.

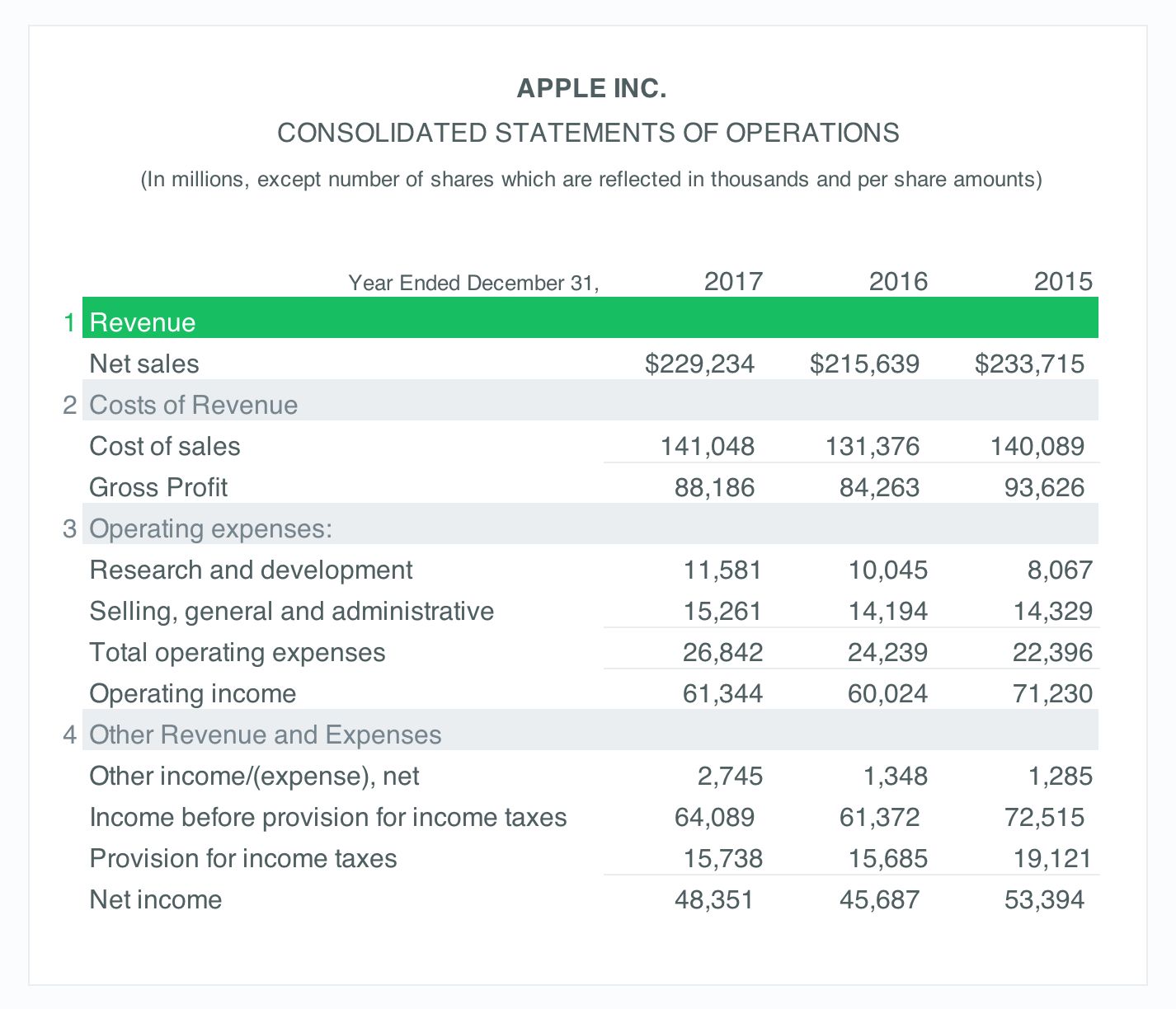

Interest revenue is the interest income an entity earns through the loaning out of money, through investments, or through receiving interest from deposited money. For financial institutions, interest revenues represent the interest payments. Total interest earned was $57.5 billion for the bank from loans, all.

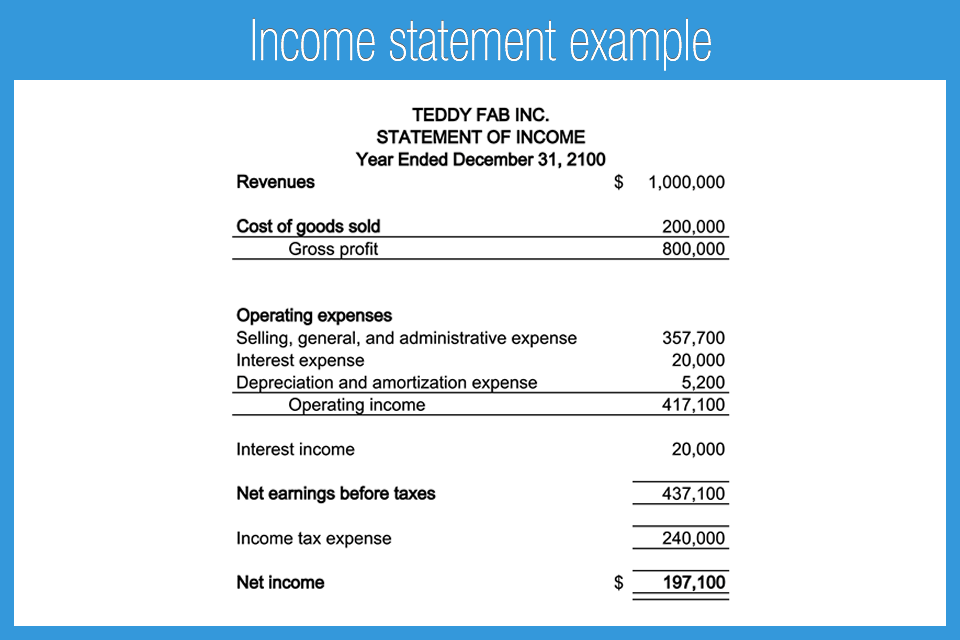

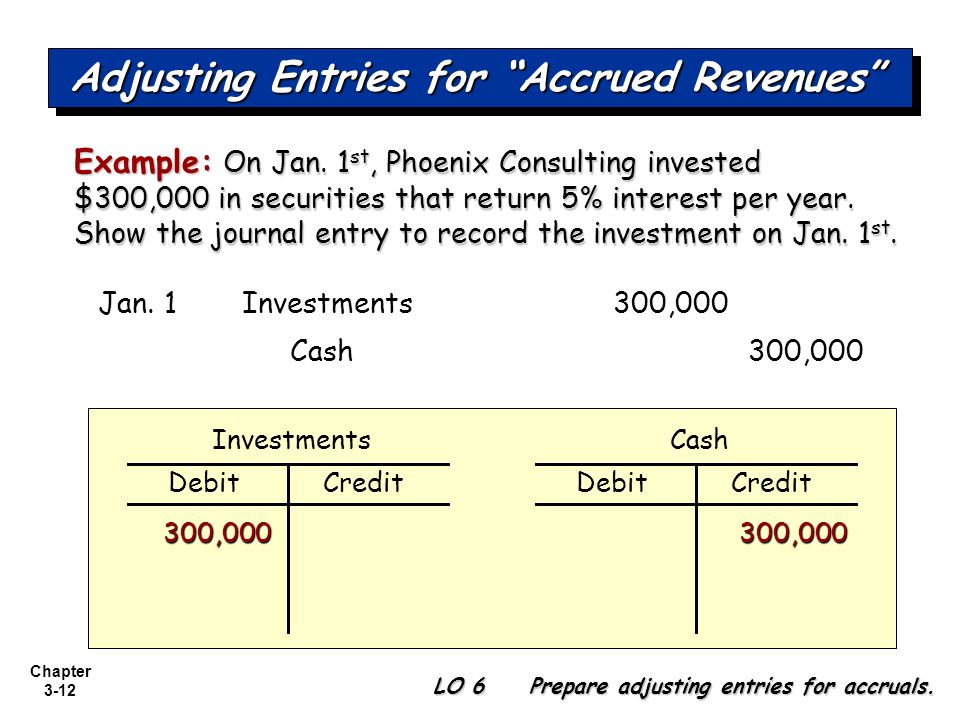

Net interest income is defined as the difference between interest revenues and interest expenses. Interest income is usually taxable income and is presented in the income statement for the simple reason that it is an income account. Secondly, the interest is a finance cost in the statement of profit or loss ($8,000), the accrued interest ($4,000) is a current liability and the loan notes ($100,000) are a non.

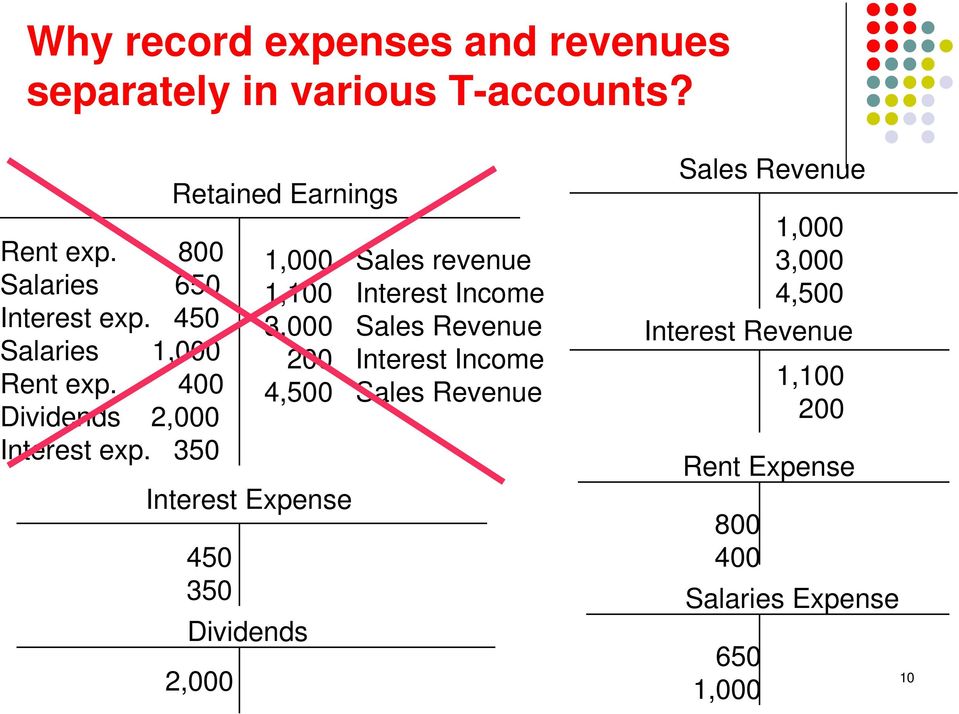

The statement of profit or loss, interest revenue calculated using the eim. Interest revenues are nonoperating revenues or income for companies not in the business of lending money. Usually, the two categories in the income.

Basis of preparation this consolidated financial. 6.2 interest income overview. You can learn about the health of a business—up and down,.

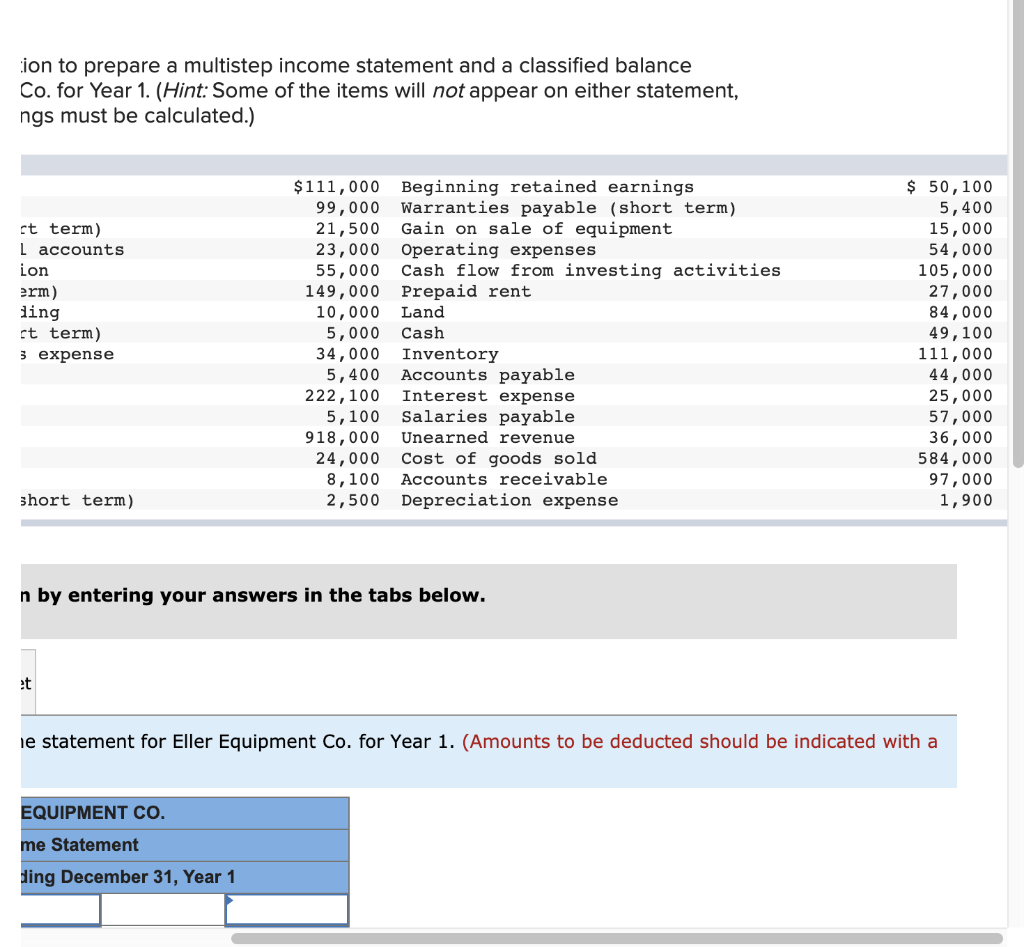

The civil fraud ruling on donald trump, annotated. Interest revenue is the amount of money a company earned from interest during a set period. Add up all your revenue and gains.

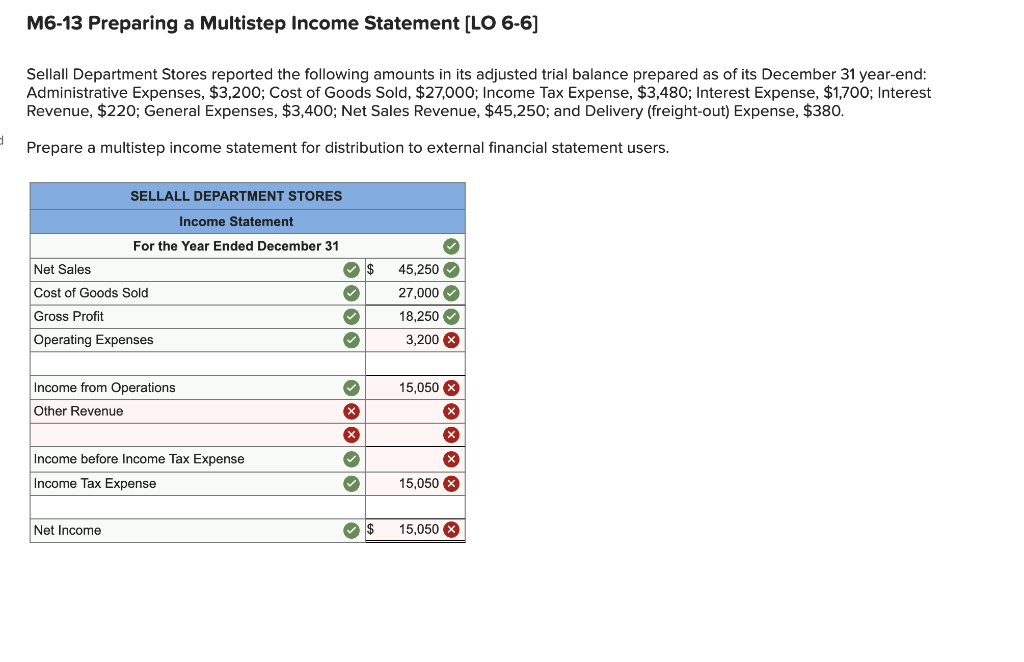

For companies in the business of lending money, interest. It is a metric often used to measure and assess a financial. An income statement compares revenue to expenses to determine profit or loss.

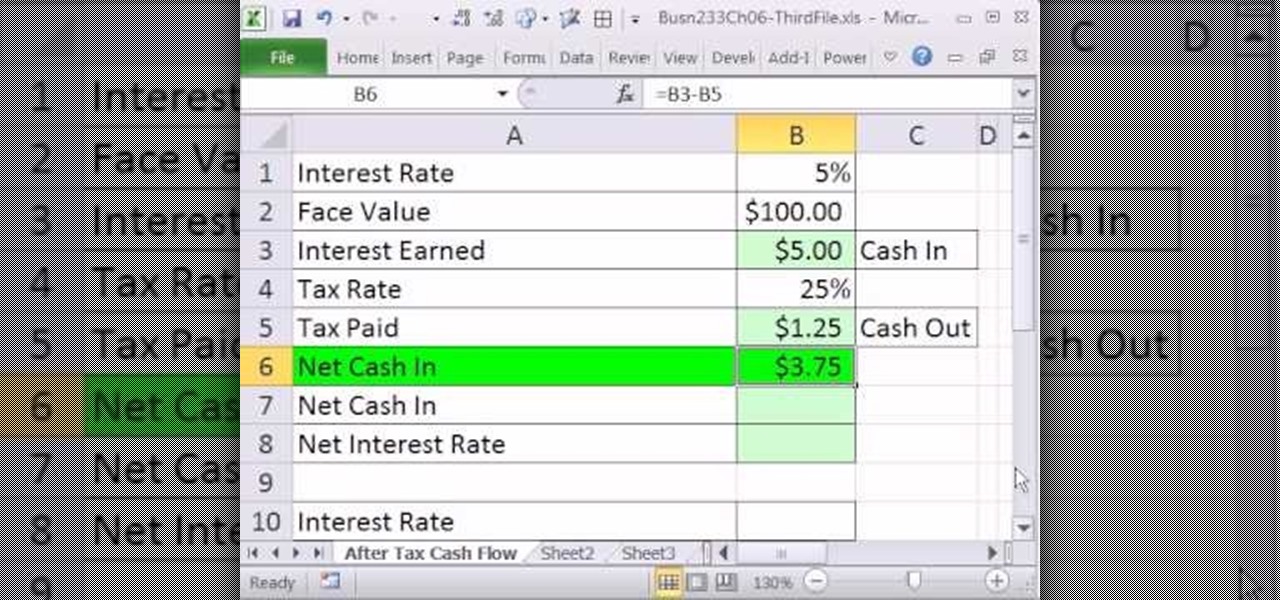

Others combine them and report them under either interest income. Our quarterly statement on monetary policy sets out the rba’s assessment of current economic and financial conditions as well as the outlook that the reserve bank board. A business that employs the accrual method of accounting purchases bonds and earns 3% interest on them, earning $400 at the end of the.

There are various ways to earn through interest, such as the. It is presented on the organization’s income statement, showing the interest earned for the reporting period in. The financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential.

An example of bank of america's income statement is shown below with the following highlights: Interest payable, and $14.3 trillion of federal employee and veteran benefits payable) yields a negative net position of $37.5 trillion. Ifrs 9 and ias 1│presentation of interest revenue for particular financial instruments page 3 of 15.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)