Fun Tips About Negative Equity Balance Sheet Reconciliation Excel

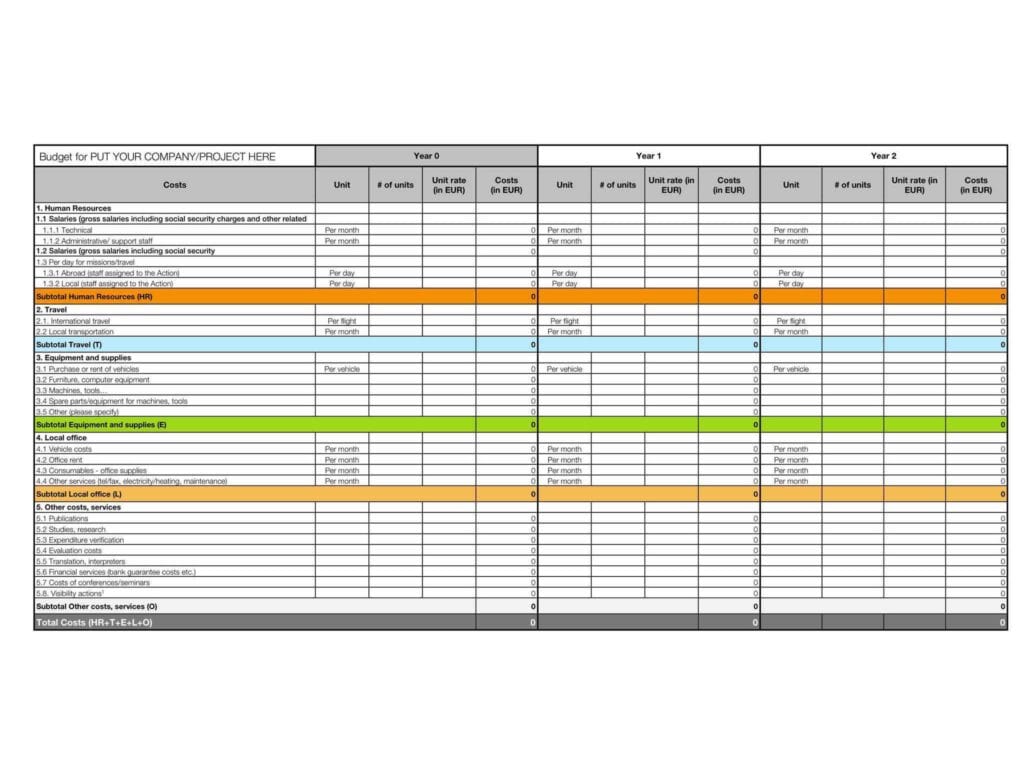

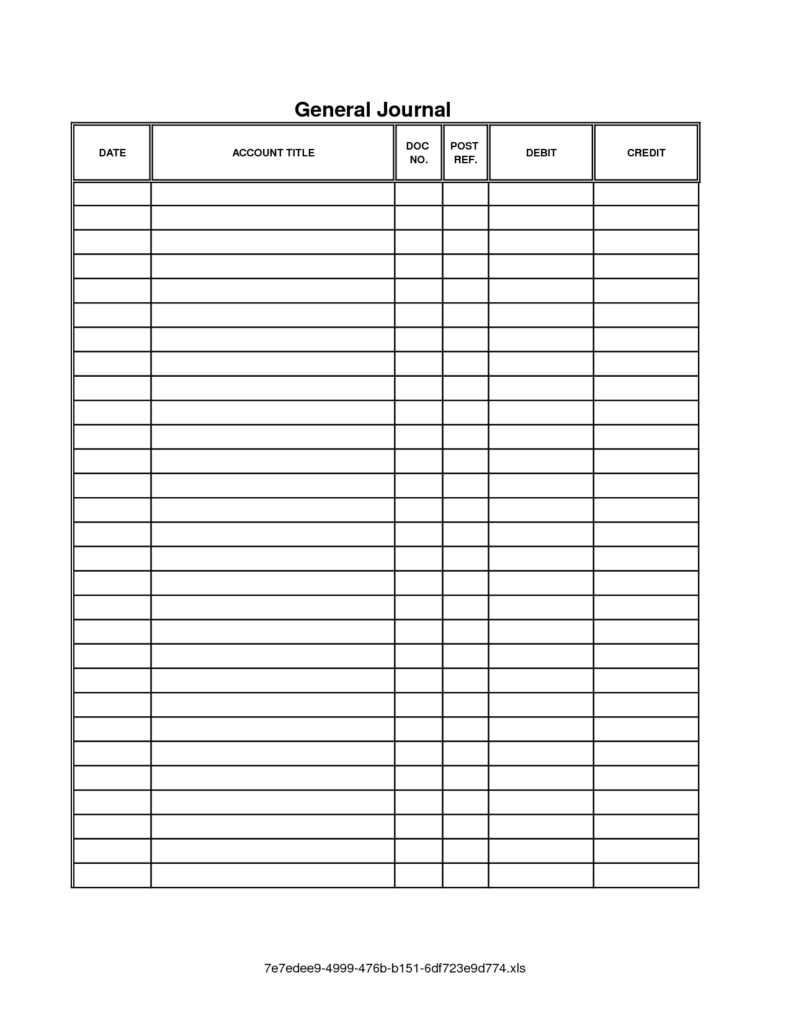

Here, we’ll insert dates in column b, transaction descriptions in column c and transaction amounts in column d respectively.

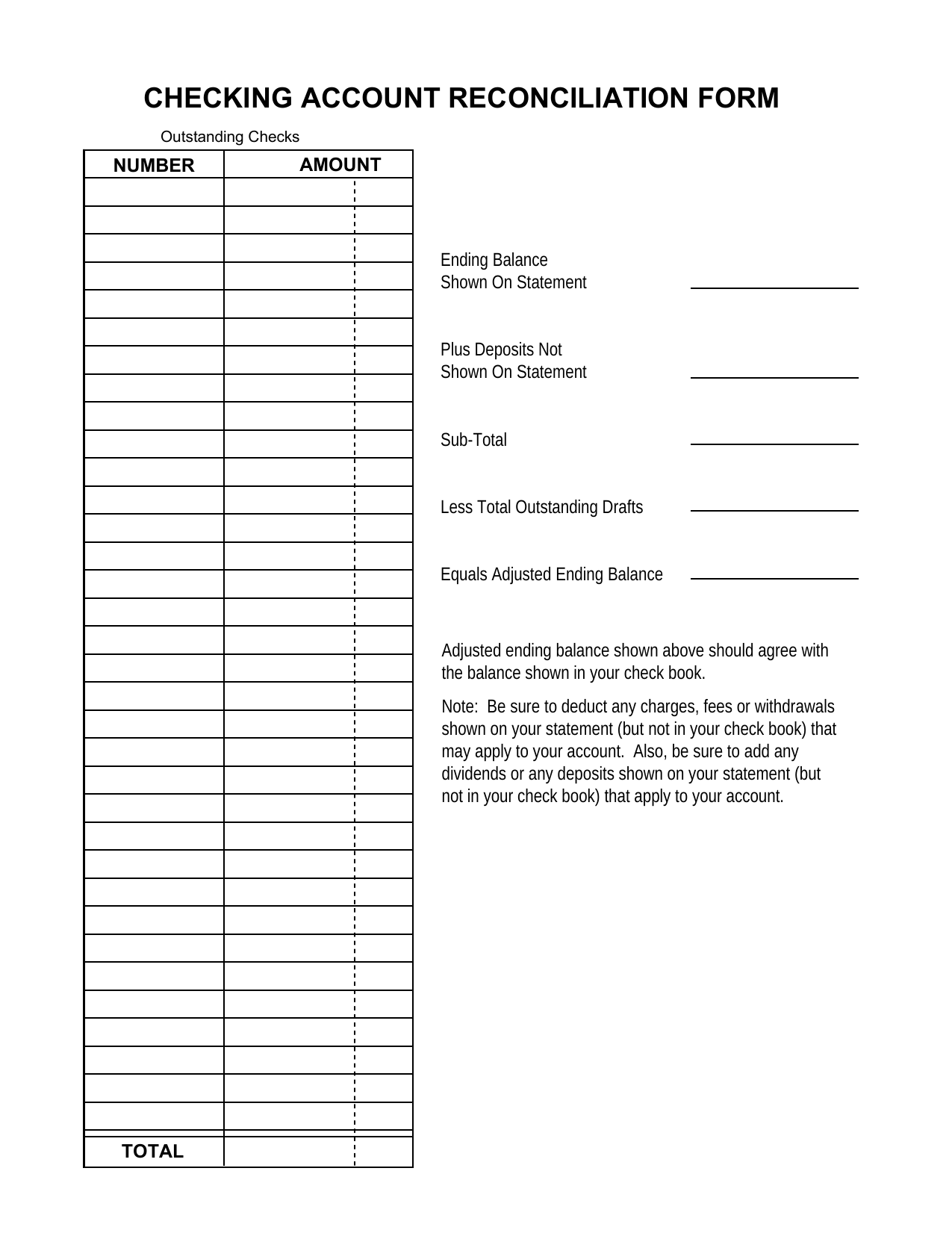

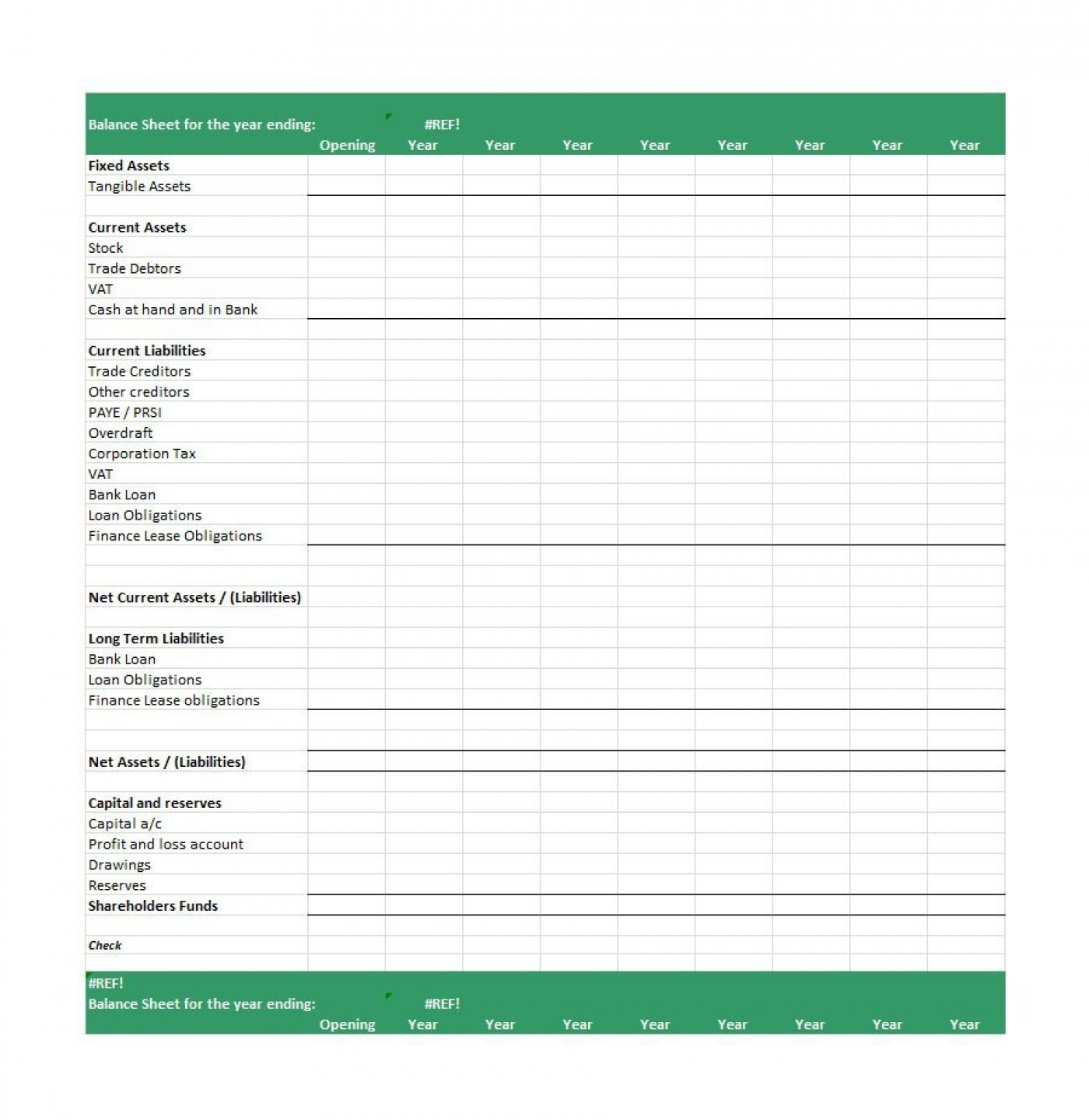

Negative equity balance sheet balance sheet reconciliation excel. The workbook has two worksheets. Definition of equity section of the balance sheet the equity section of the balance sheet is known as: It is designed to work with the tiller foundation template, and references the transactions and accounts sheets.

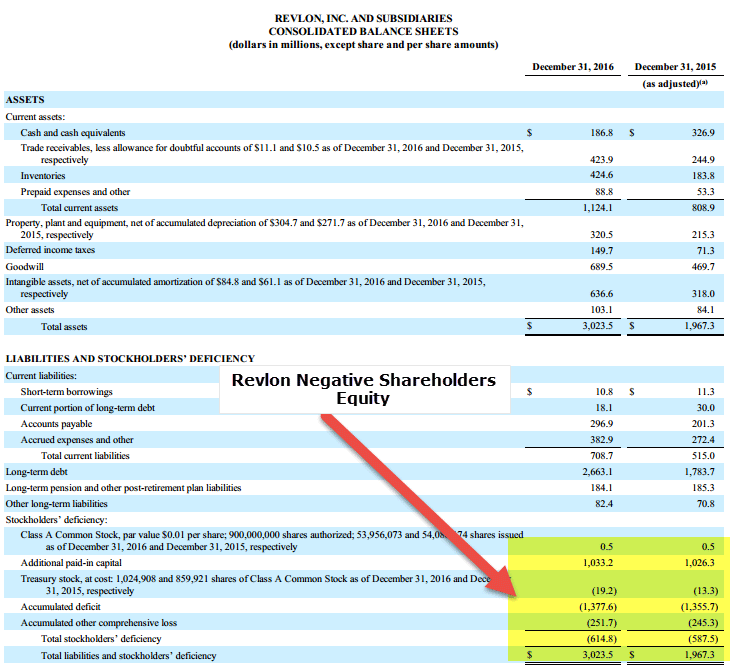

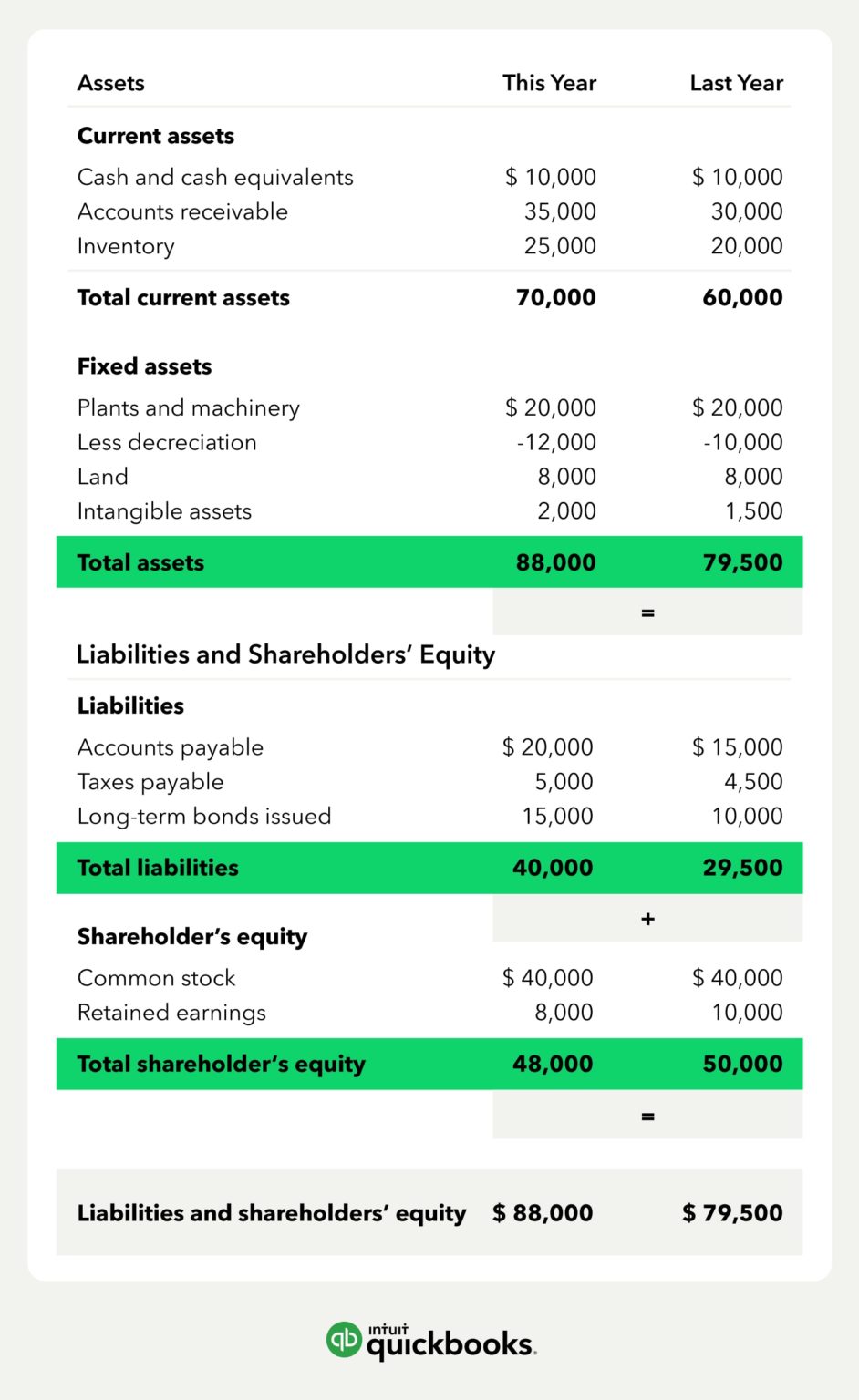

Is it okay to have negative amounts in the equity section of the balance sheet? Here are some common reasons for negative shareholders' equity:. It helps identify errors, omissions, and discrepancies in financial records, preventing inaccuracies in.

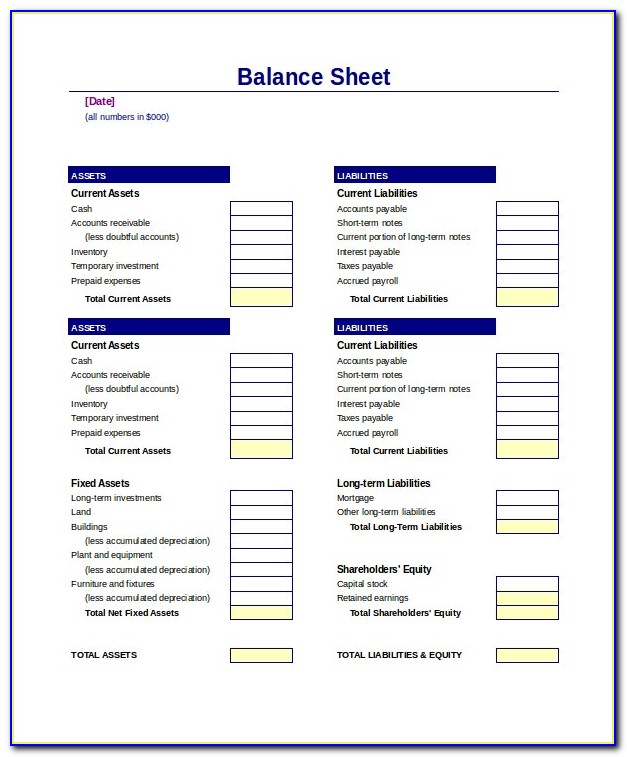

Using this template, you can add and remove line items under each of the buckets according to the business: This comprehensive template includes everything you need to reconcile your balance sheet and is compatible with both excel and numbers. The template includes lines for assets such as cash, accounts receivable, inventory, and investments, along with liabilities, including accounts payable, loans, and payroll.

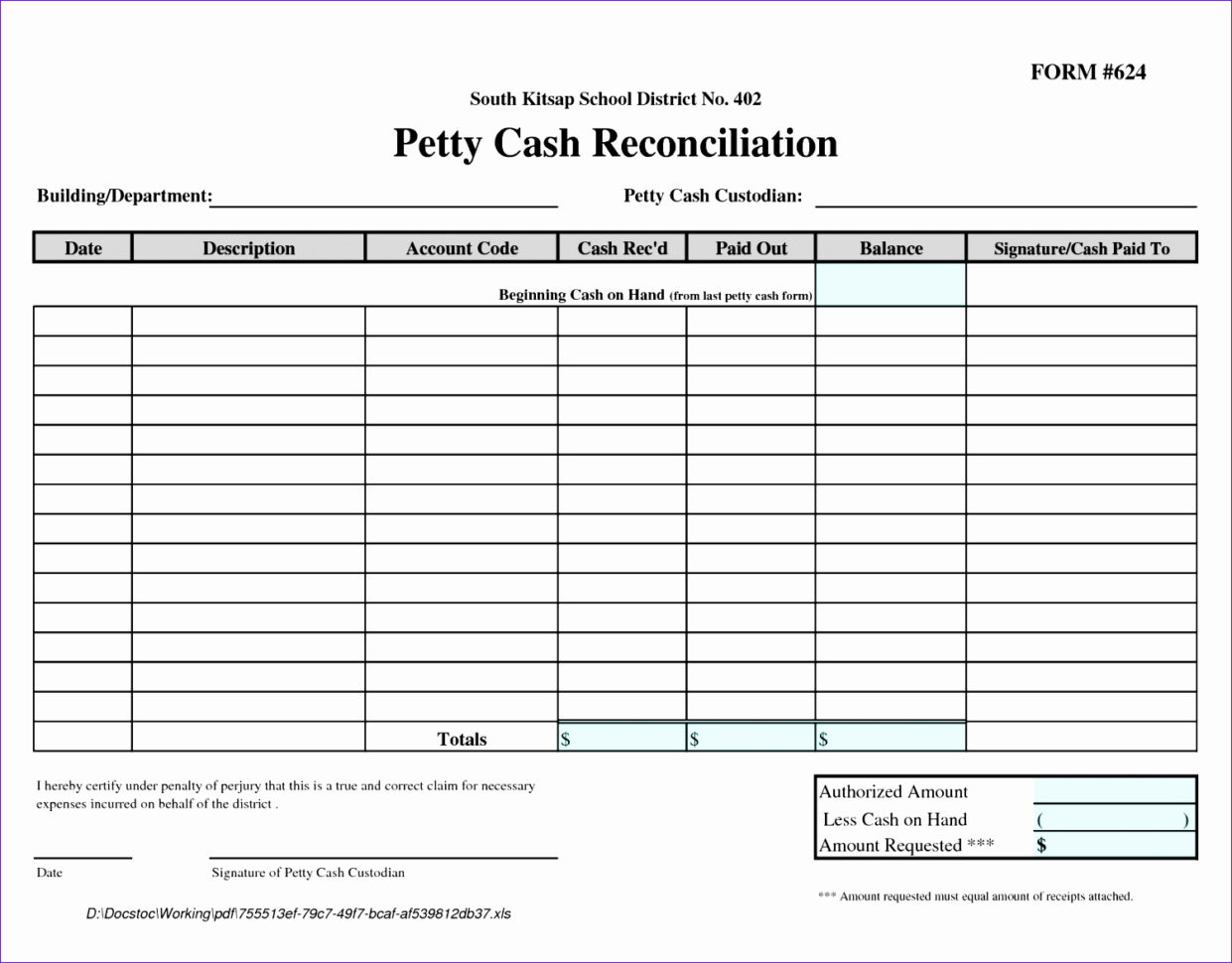

That’s why it’s useful to follow these simple best practices during the reconciliation process: Put in [company name] balance sheet at cell a1 for easy identification. Balance sheet reconciliation is essential for verifying the accuracy of financial data and ensuring that a company’s assets, liabilities, and equity are correctly stated.

Balance sheet reconciliation checklist: Review the balance sheets closely. An excel workbook template aids one in forming a wonderful equity reconciliation report.

Balance sheet template. Instead of having a positive value, equity is shown as a negative figure, indicating that the company’s liabilities outweigh its assets. During the financial close, one of the most common and necessary steps is completing thorough balance sheet reconciliations.

Assets = liabilities + equity. However, the company may be able to operate if its cash inflows are greater and sooner than the cash outflows necessary for. Owner's equity if it is a sole proprietorship.

Here are three major issues with using spreadsheets for account reconciliations to verify balance sheet data, and their corresponding solution. Open up a new file on microsoft excel. This is done by businesses to ensure that the company closing balances are classified and recorded properly in a balance sheet.

The vital value concerned with stock balance can be listed at the start of the period. In the first worksheet, the equity analysis will be shown. Provide tools to troubleshoot transaction balances that don’t match your account statements.

Calculate the balance of a company’s assets, liabilities, and equity to get a snapshot of its financial position at any given time. Negative equity is reflected in the equity section of the balance sheet. When reconciling balance sheet accounts, look at things like your business’s current and fixed assets, current and noncurrent liabilities, and owner’s equity.