Unique Info About Interest Receivable In Balance Sheet

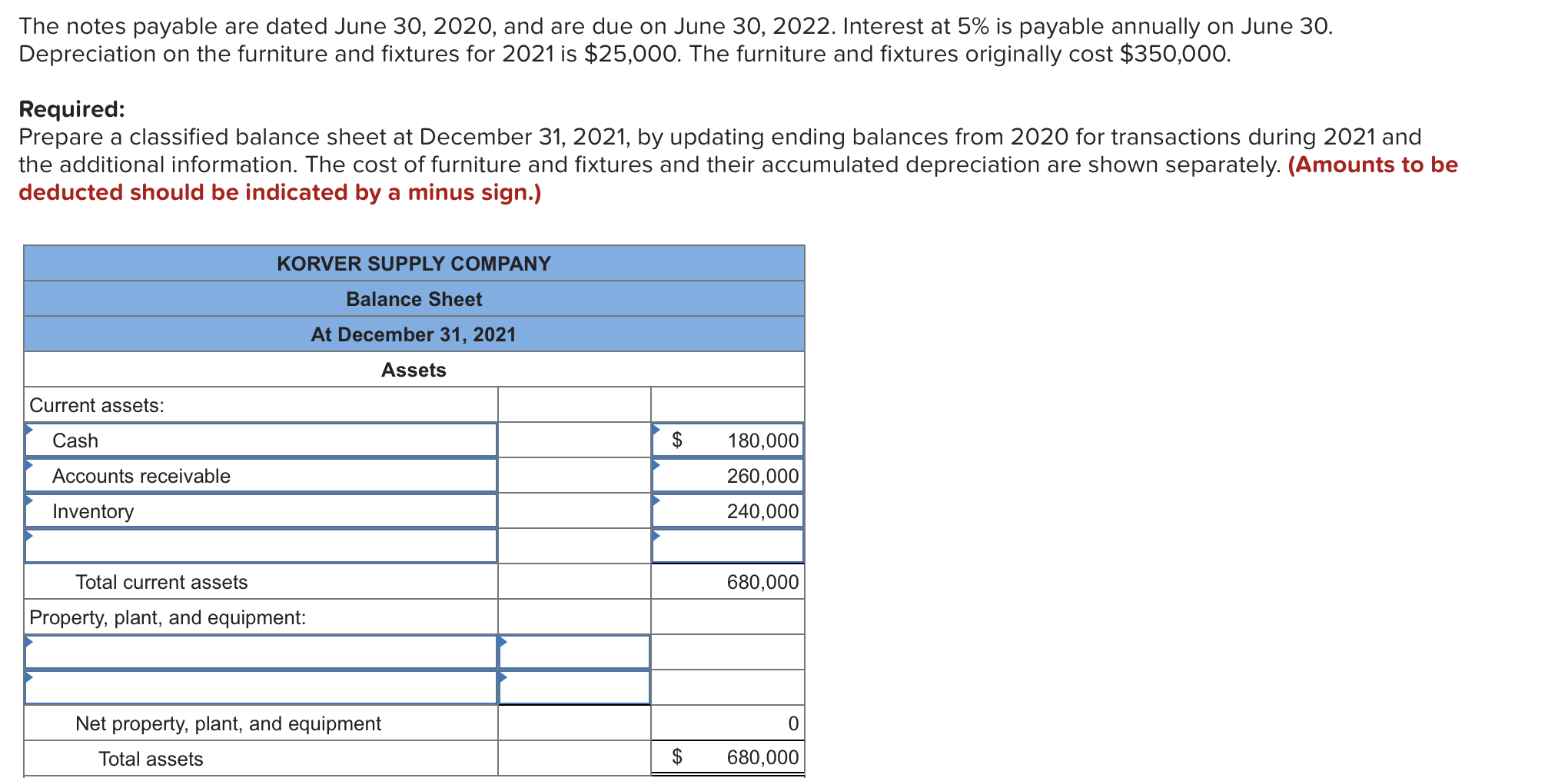

As fixed assets age, they begin to lose their value.

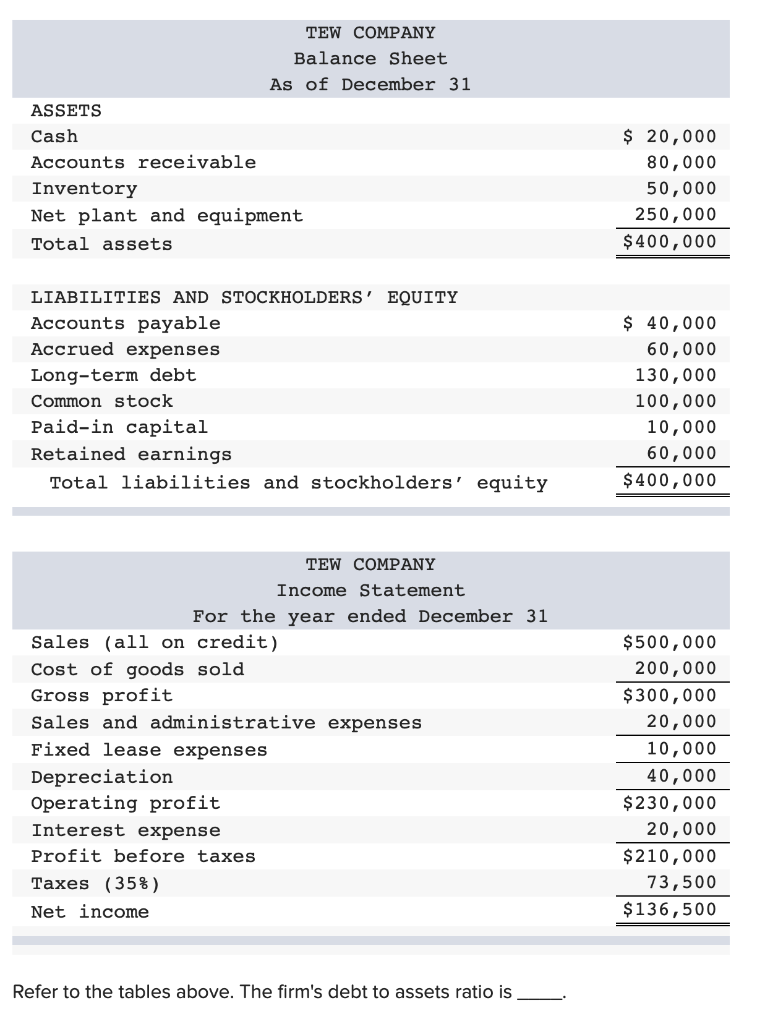

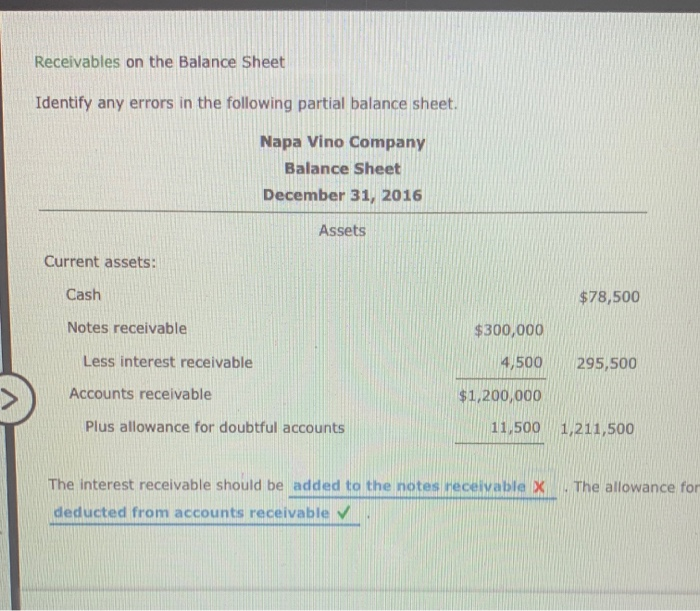

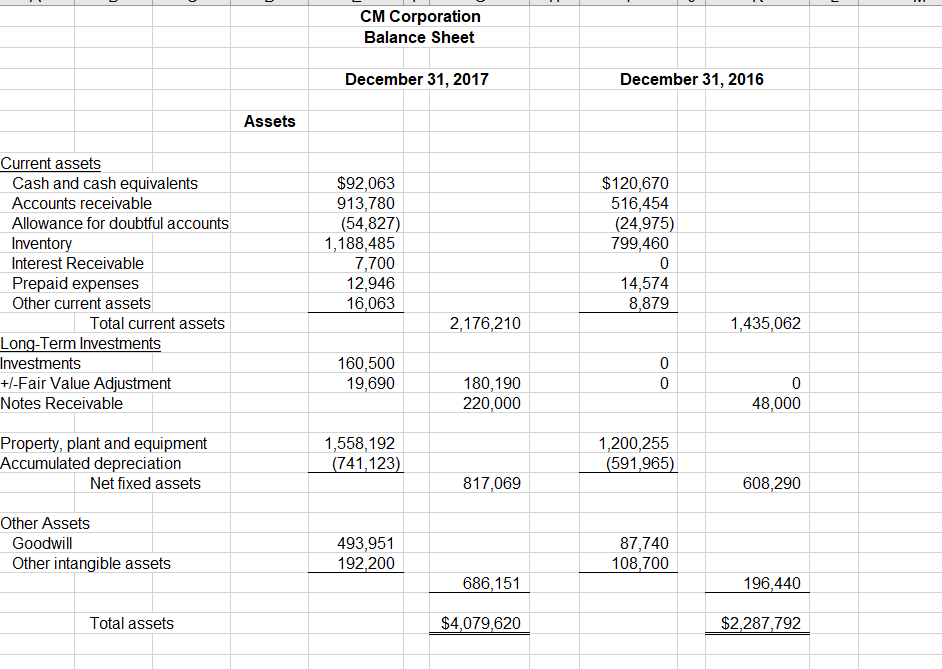

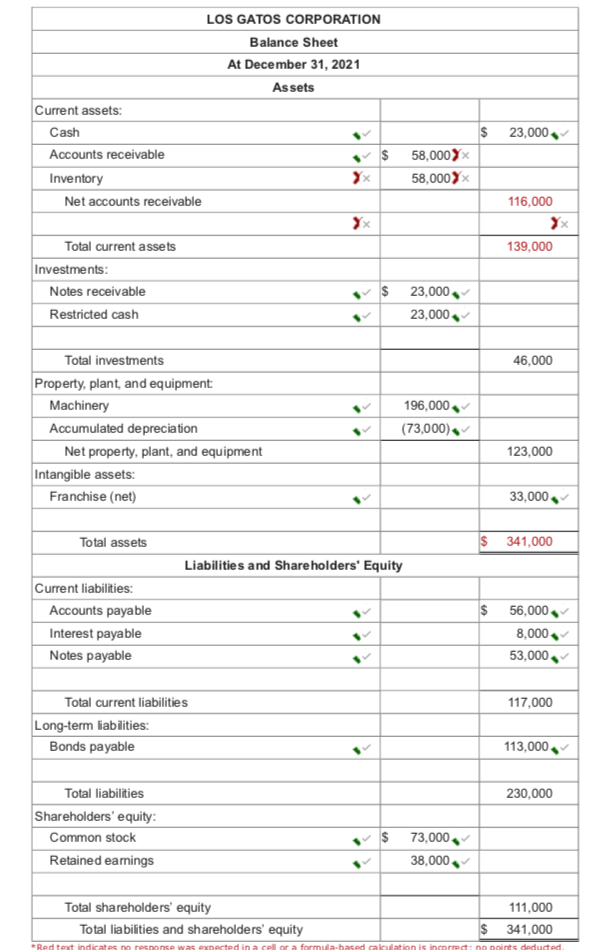

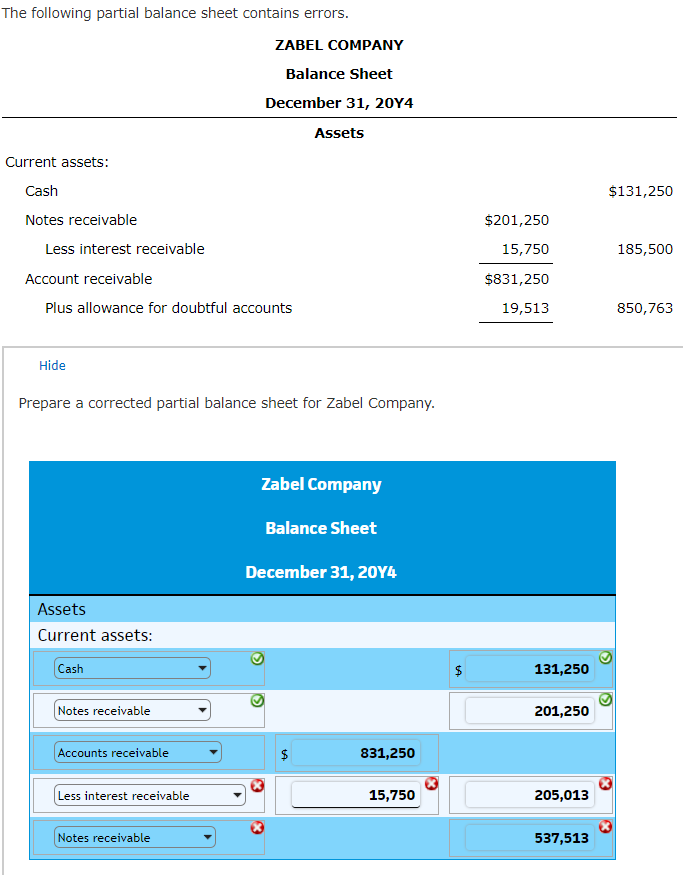

Interest receivable in balance sheet. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. Accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet.

Interest receivable is an asset account in the balance sheet that records any interest income due to a company from its debtors. The balance sheet is one of the three core financial. Current forecasts for 2024, before taking into account future balance sheet initiatives, indicate that first quantum could breach the prevailing net debt to ebitda ratio.

If you extend credit to your customers beyond the standard invoice terms, record the balance owed as a note receivable. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Interest receivable is a journal entry that appear on the balance sheet.

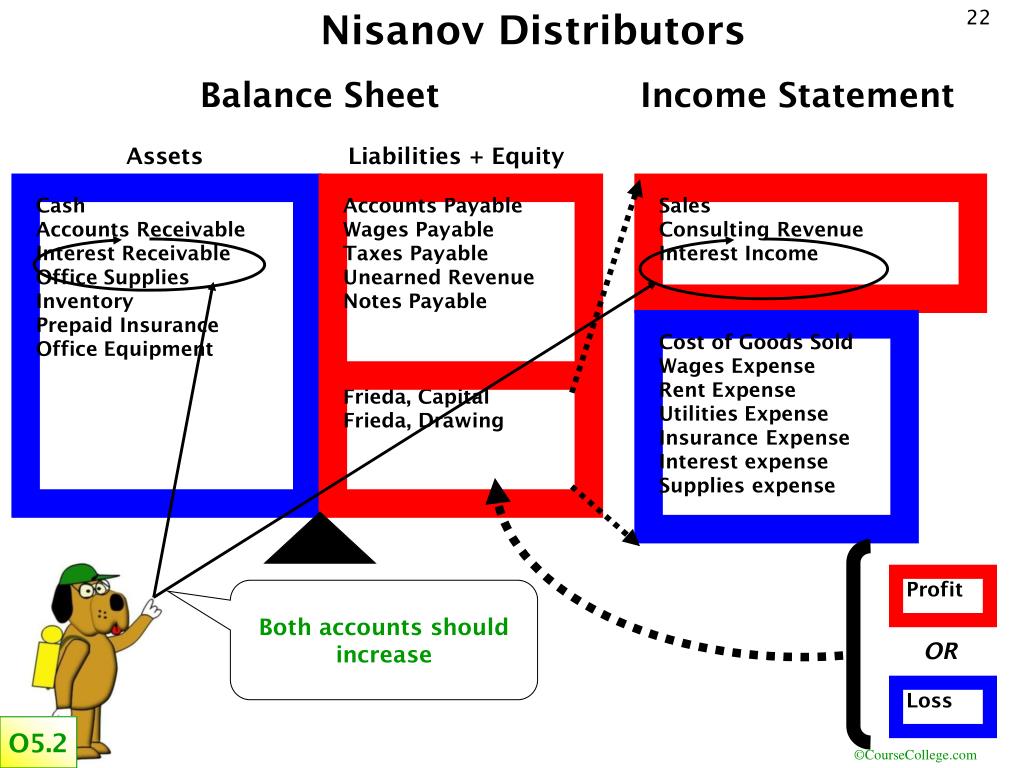

The interest receivable is an asset account on the balance sheet while the interest revenue is an income. Investors should interpret accounts receivable information on a company's balance sheet as money that the. Entities accumulate interest earned but not yet collected on financial assets as an accrued interest receivable.

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. It reflects the interest income a business has earned but for which a customer or debtor. Based on this information, the entity should record an interest income amount of 60,000usd in its income statement, and the remaining amount of 30,000 usd should be.

How to find accounts receivable on the balance sheet? The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near. Interest receivable definition the current asset that represents the amount of interest revenue that was reported as earned, but has not yet been received.

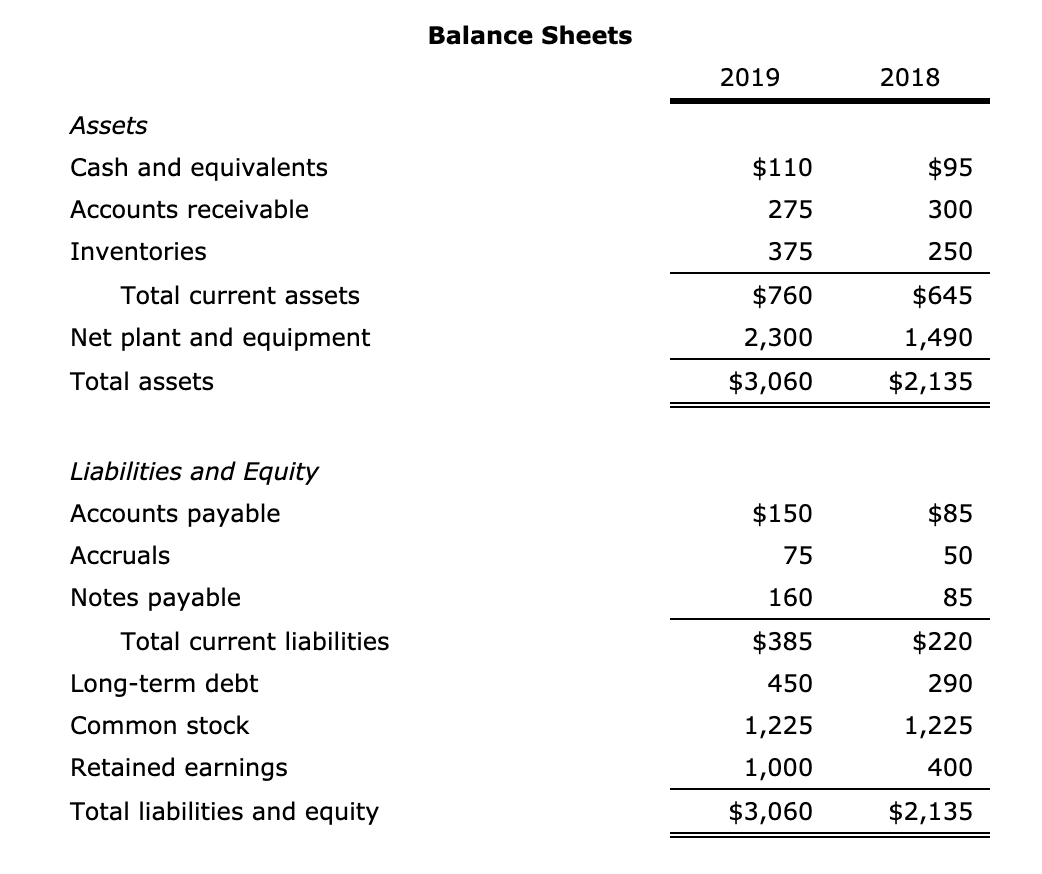

A company (the asset originator) with receivables (e.g., auto loans, credit card debt), identifies the receivables (assets) it wants to sell and remove from its balance. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The interest receivable account balance will be reported on the company's balance sheet as a current asset such as accrued interest receivable or interest receivable.

Tips multiply the interest rate by the amount of notes receivable and then divide by 12 to capture the monthly rate to calculate interest receivable and interest. Updated march 28, 2022. As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet.

Since the payment of accrued. Notes and interest receivable. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet.

The interest receivable account is usually classified as a current asset on the balance sheet, unless there is no expectation to receive payment from the borrower within one year.