Simple Info About Accounting Income Statement Format

These amounts are then totaled to show net income or loss.

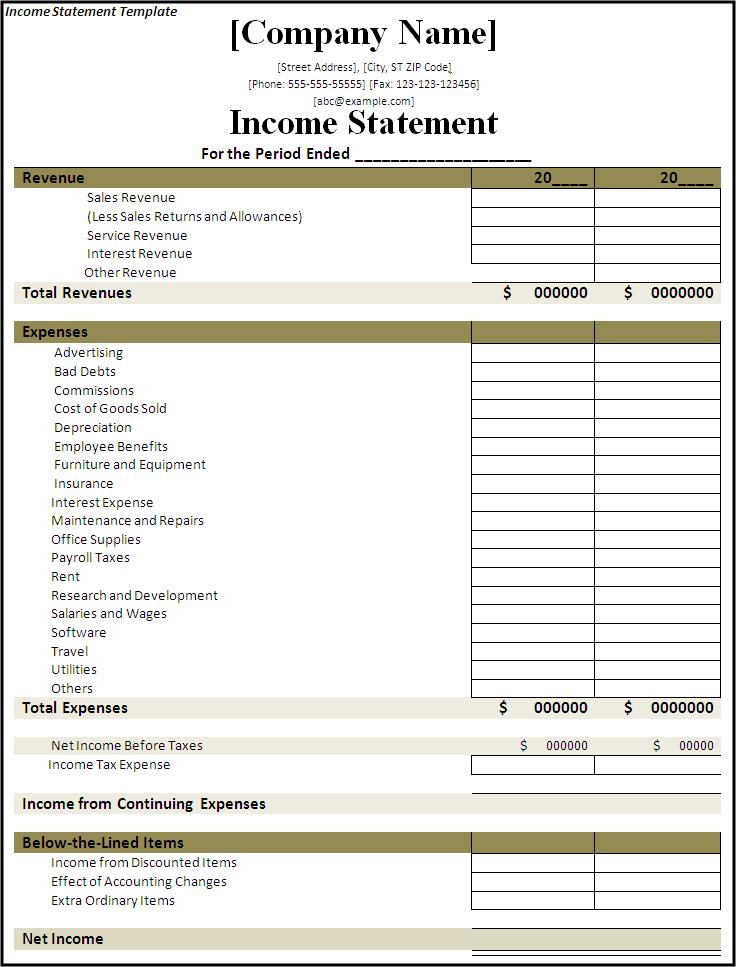

Accounting income statement format. Chapter contents the income statement is a financial statement that summarizes a company's revenues, expenses, and the resulting net income. Table of contents what are income statement examples? Download a free blank excel template of income statement.

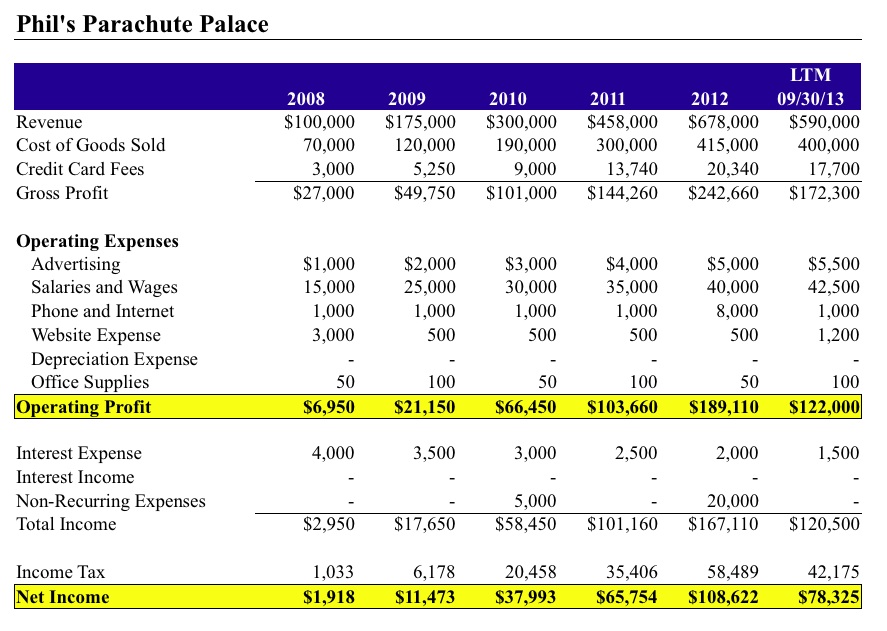

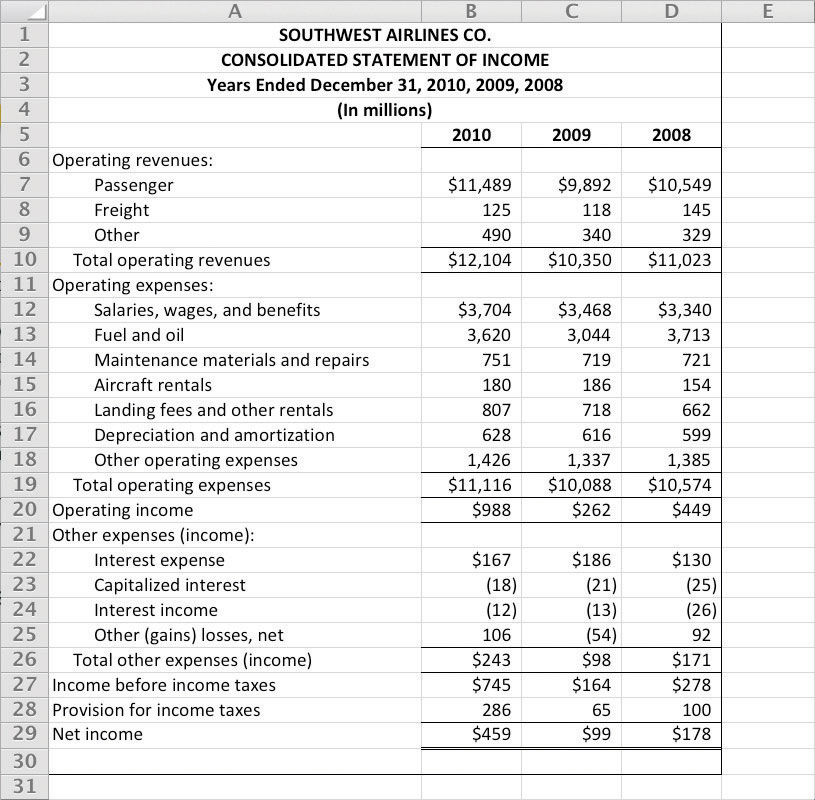

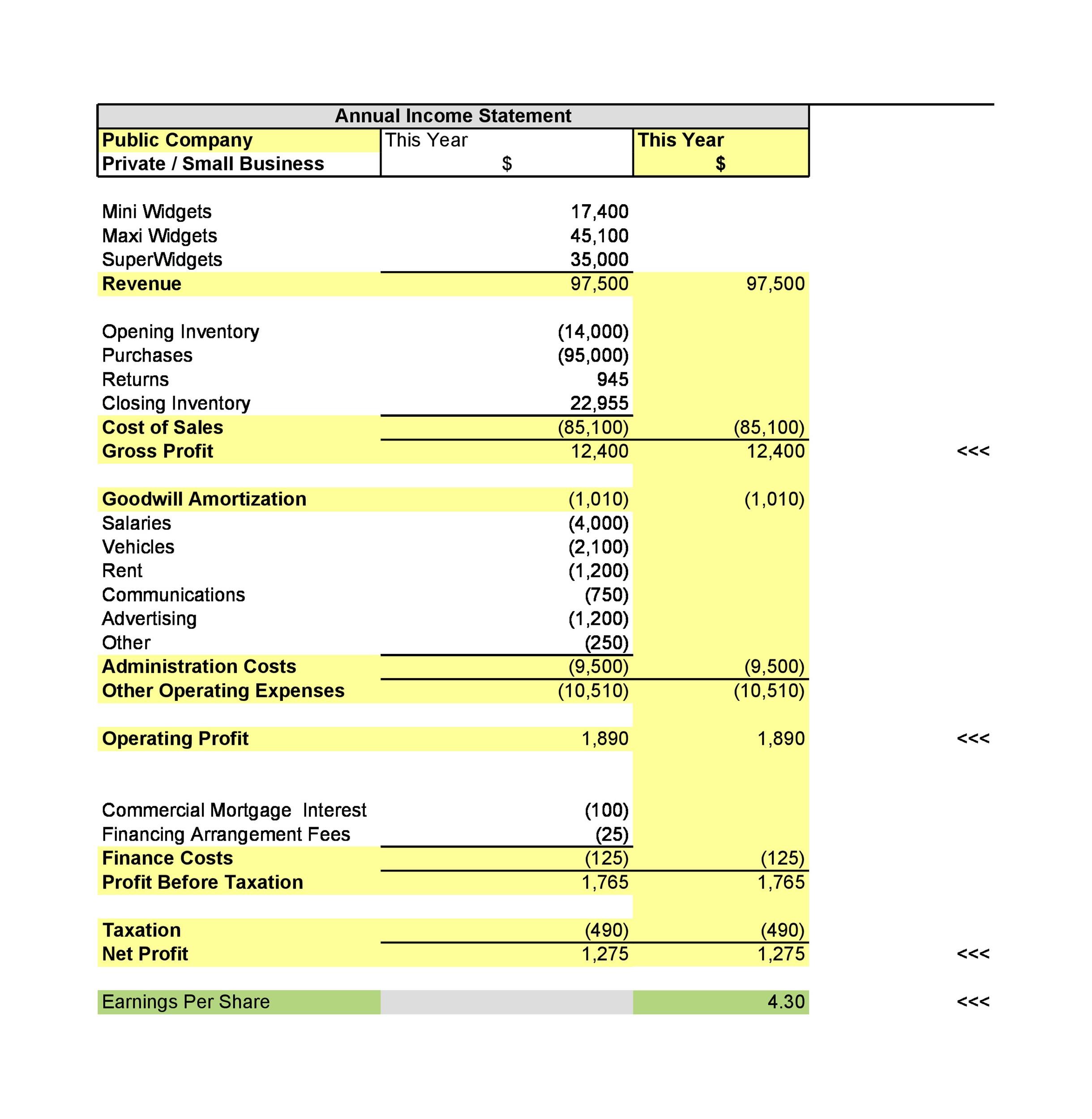

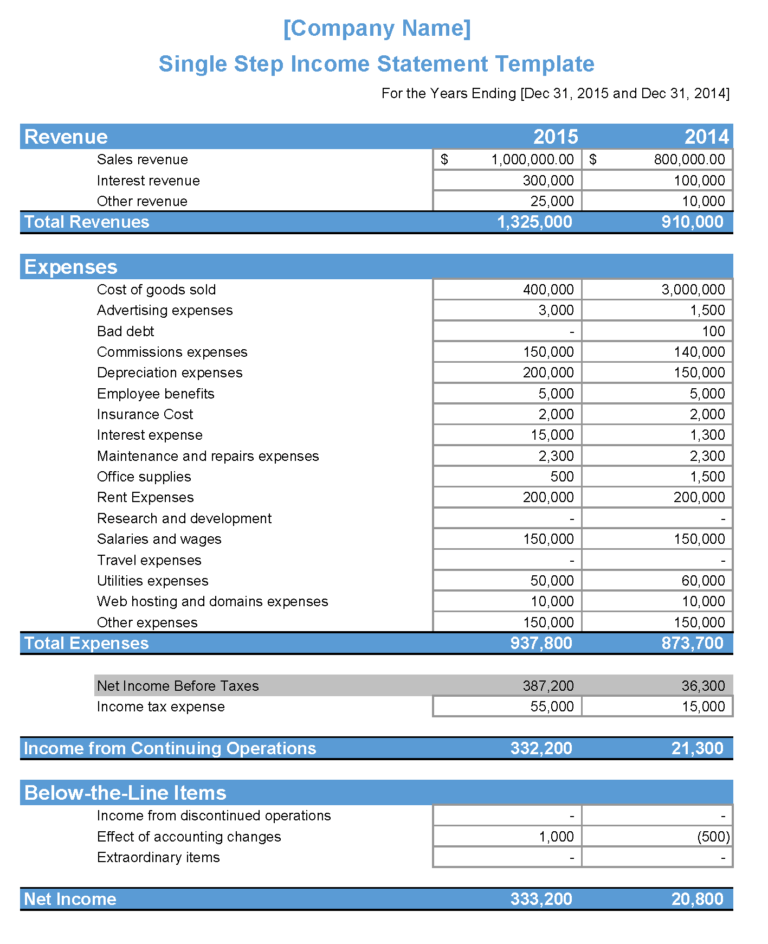

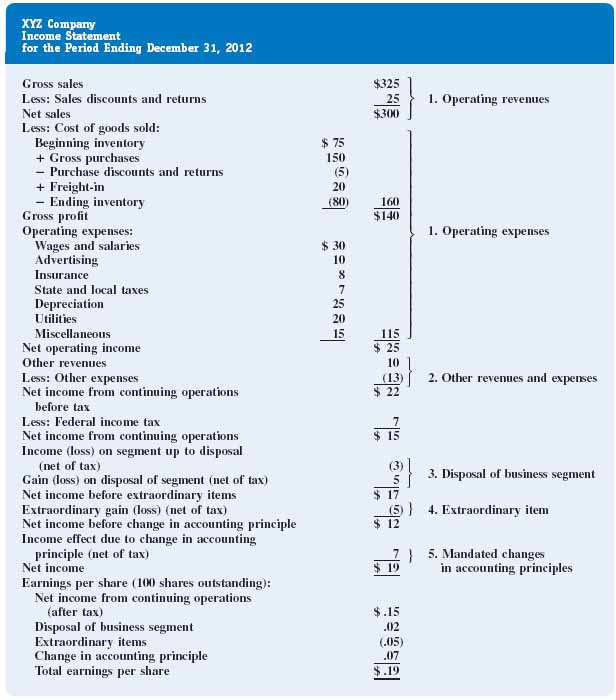

The income statement can either be prepared in report format or account format. For example, the income statement of a large corporation with sales of $8,349,792,354.78 will report $8,349.8 and a notation such as ( in millions, except earnings per share ). It also shows whether a company is making profit or loss for a given period.

You can look at an income. An income statement is a financial statement that shows you the company’s income and expenditures. There are two ways of presenting an income statement.

After that, all the business expenses are deducted from the total amount of revenue and other income generated and finally we ge. Also sometimes called a “net income statement” or a “statement of earnings,” the income statement is one of the three most important financial statements in financial accounting, along with the balance sheet and the cash flow statement (or statement of cash flows). The income statement is a useful way to see how a company makes money and how it spends it.

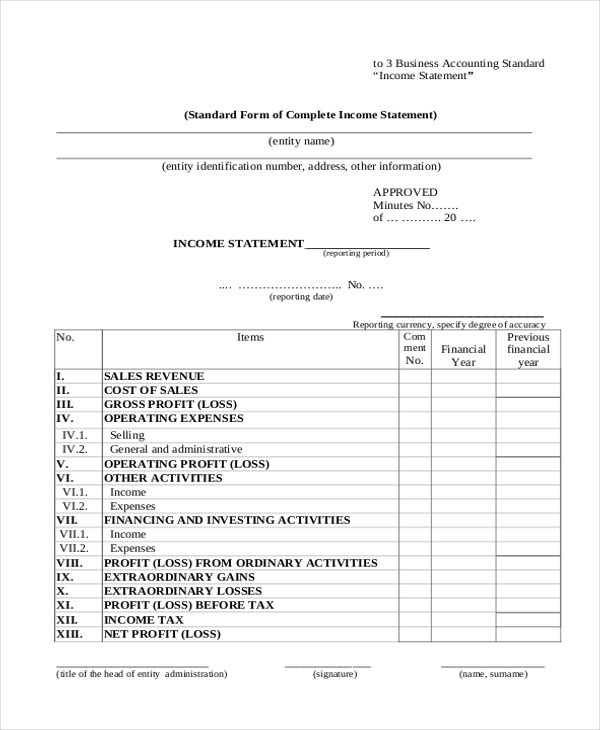

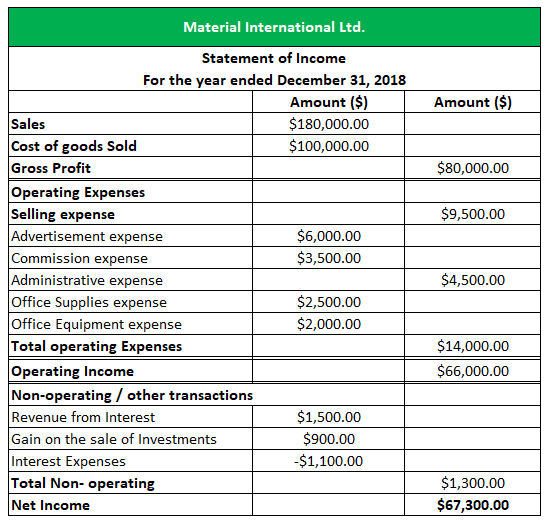

A business engaged in services usually prepares an income statement instead of profit & loss a/c. In the income statement, there is a standard format that is used while preparing the income statement of the company, which reports the sales revenue figure of the business at the start, then adds other income into it; Income statement, also known as profit & loss account, is a report of income, expenses and the resulting profit or loss earned during an accounting period.

Let's take a look at how each would look like. The accounting period can be any length but is usually a month or a year. While a balance sheet provides the snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year, and.

An income statement might use the cash basis or the accrual basis. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Income statement expenses can also be presented by the nature or function of.

The statement shows the profitability of a business over an accounting period. A typical income statement is in report form. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees.

In this tutorial we'll learn the purpose of this key accounting report and go over a simple income statement example to learn its format and components. An income statement is another name for a profit and loss statement (p&l). The income statement is a company’s one of the most important financial statement that indicates profit and loss for an accounting year.

Learn about these formats that are widely used in actual business practice. The header is followed by revenue and cost of goods sold and calculation of gross profit. There are two common formats of the income statement: